PM image

Written by Nick Ackerman, co-produced with Stanford chemists.

Calamos Strategic Total Return Fund (Nasdaq:CSQ) has been performing very well since then. last update This fund provides investors with diversified exposure. It is primarily a pool of equity positions, but also includes convertible bonds and high-yield securities. Given that this fund utilizes leverage and the overall market performed well through 2024, it’s not too surprising that CSQ performed slightly better on a total return basis.

CSQ performance since last update (In search of alpha)

Despite some recent volatility, CSQ continues to trade at a small discount. This fund’s shallow discount is not uncommon over the past five years or so, but it means you should still be patient before adding too aggressively. Instead, continue to Holding seems like a good plan, but it’s also possible to make small additions through a dollar-cost averaging approach.

CSQ basics

- 1-year Z-score: -0.41

- Discount: -2.28%

- Dividend yield: 7.76%

- Expense ratio: 1.57%

- Leverage: 30.56%

- Assets under management: $3,874 million

- Structure: Permanent

CSQ objective The goal is to pursue “total return through a combination of capital appreciation and ordinary income.” They simply try to achieve this by something like: “Invest in a diversified portfolio of stocks, convertible bonds, and high-yield corporate bonds.”

The Fund has the ability to invest where it believes the best opportunities exist. Part of the appeal of active management is its flexibility to adapt to different situations. However, it is important to note that the fund must “hold at least 50% of the shares.”

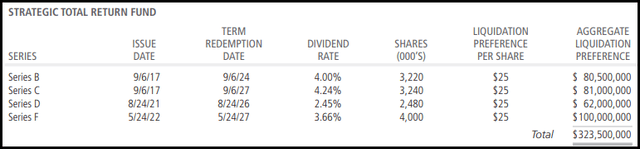

This is a leveraged fund, and the fund’s total expense ratio, including leverage expenses, is 4.09%. As interest rates rose, the fund’s expense ratio increased significantly.At the end of the year, it was 2.50%. October 31, 2022. Fortunately, some of this leverage is utilized through preferred issues with fixed-rate dividends. These help reduce leverage costs to some extent.

CSQ Preferred Leverage (Calamos)

However, the fund still remains exposed to a floating rate of OBFR plus 0.80% on a large portion of the leverage pie. At the end of fiscal year 2023, the fund had borrowings of $801 million, which it recently raised to $860.5 million as the market rose during that period. As the underlying asset increases in value, the leverage ratio naturally decreases, giving you more room to add more debt. Under our latest credit agreement, we can borrow up to $1.13 billion.

Performance – stubbornly narrow discounts

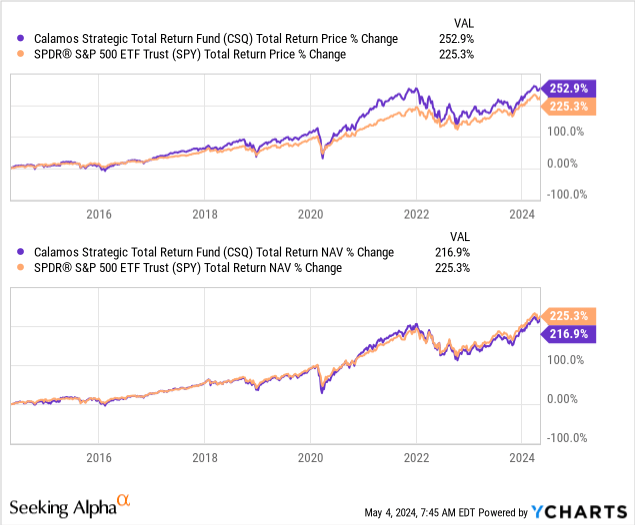

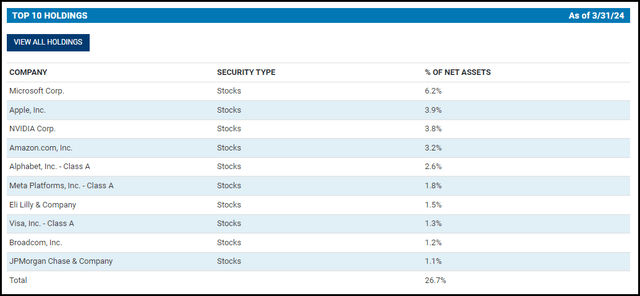

Although this fund offers good diversification, the fund has performed incredibly well thanks to its strong tilt towards top holdings towards exposure like the S&P 500 index. The fund holds nearly all of the top 7 Mag stocks, excluding Tesla (TSLA), most people accept that they were kicked out of the club.

S&P 500 Index (spy) The fund contains a significant sleeve of convertible and high-yield bonds, so it may not be the best benchmark for CSQ, but its performance is still competitive. The graph below compares CSQ and SPY over the past 10 years, and his CSQ actually outperformed on a stock price basis. The fund lagged slightly on a total NAV return basis.

Y chart

Looking at CSQ’s annual results, we of course see some solid results as well.

CSQ annual performance (Calamos)

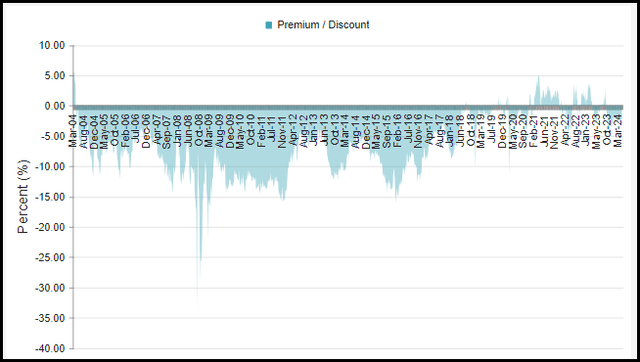

That said, the fund’s discount rate remains narrow and has continued to command a premium since around 2018, and the fund remains a “hold” today. Past performance has been strong, but that doesn’t mean you should ignore valuation. Personally, I believe valuation is a better measure of whether it’s worth buying today.

What is very strange is that this fund has historically traded at a discount of around 5-10% for most of its life. It wasn’t until around 2018 that this started to change, and in 2022/2023 he realized that even though discounts across the CEF space had widened to historic broad levels, CSQ I have never experienced such a situation. They were able to buck that trend and continue to flirt with premium. The fund’s average discount rate over the past five years has been a modest -0.40%.

CSQ discount/premium history (CEF Connect)

In addition to considering CEF discounts/premiums, another consideration is that if there is a more severe market correction, it may be time to consider more aggressive purchases. I don’t think the recent market decline actually presents the biggest opportunity. Further volatility, such as a market-wide correction, could further destabilize this fund’s valuation.

Distribution – appears stable

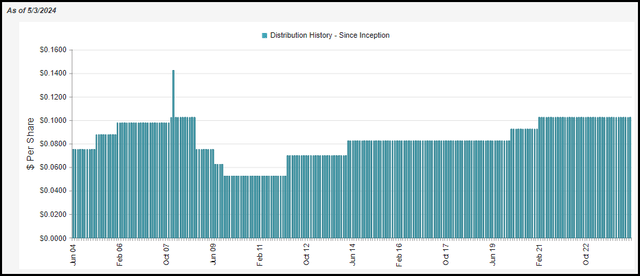

The fund pays monthly distributions and currently has an interest rate of 7.76%. Based on NAV, it would be a similar 7.58% with only a small discount.

CSQ distribution history (CEF Connect)

In our last update, we mentioned that the current distribution appears to be very sustainable as it is currently at a reasonable NAV rate. In fact, the NAV rate has gone down a bit thanks to the ratings since the last update.

So there isn’t much to update on this front. If we believe the market can continue to perform well, CSQ should be able to continue supporting its distribution. Given that the market is depressed and will remain depressed for an extended period of time, CSQ distribution may struggle as well.

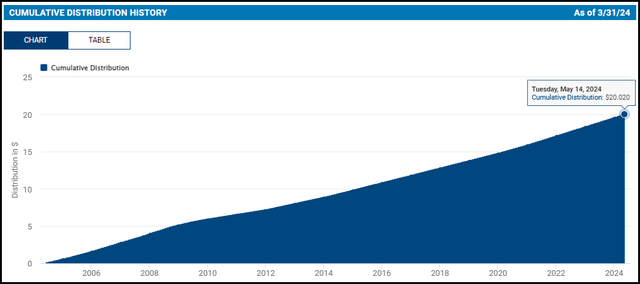

One last thing to note. Since its inception, the fund has accumulated over $20 worth of distributions. This is quite remarkable since this fund started with a NAV of around $15 and its current NAV is higher than when it started. Indeed, it took a long time for the fund to recover to this level after the global financial crisis. Still, this is a pretty impressive feat.

CSQ cumulative distribution number (Calamos)

CSQ portfolio

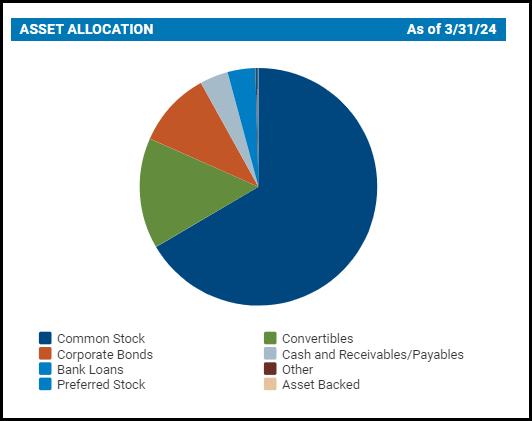

Consistent with the fund’s strategy, the portfolio remains heavily focused on equities. This accounts for his 66.57%, with 15.08% in convertible bonds, 10.30% in debentures, and the rest held in various other smaller sleeves.

CSQ Asset Allocation (Calamos)

I didn’t see much change since the last time I looked at the fund, but that was the breakdown as of the end of November 2023. The fund’s turnover rate was 29% last year and 24% this year. Since it’s 2022, they’re not the most active, but they’ve still made some changes over the years.

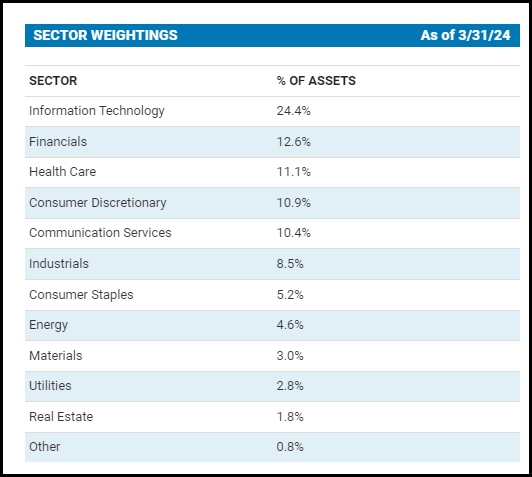

We see that the sector allocation, as well as the overall fund asset allocation, has not changed as dramatically.

Information technology was the largest sector at 24.4%, up from 23.6% previously. This is significantly higher than his 12.6% weight in the second sector, Finance. Previously, the financial sector accounted for his 12% and was the third largest sector, while the consumer sector accounted for his 12.3%.

At the same time, the S&P 500 index itself has recently started to feature around 30% of the tech sector. Therefore, if anything, CSQ appears to be more diversified in terms of sector allocation.

CSQ sector weighting (Calamos)

The decline in some consumer discretionary exposures from an overall portfolio weighting perspective may be at least partially related to TSLA. As I mentioned at the beginning, TSLA is not considered a top 10 holding, but it used to be.

CSQ Top Ten Holdings (Calamos)

According to the fund’s list of total holdings (which unfortunately does not match the March 31, 2024 period of the top 10 stocks), TSLA was its 17th largest holding as of February 29, 2024.

Overall, the fund’s actual holdings decline quite dramatically after the first few stocks. As such, the fund is incredibly diversified, with 824 holdings, according to CEFConnect.

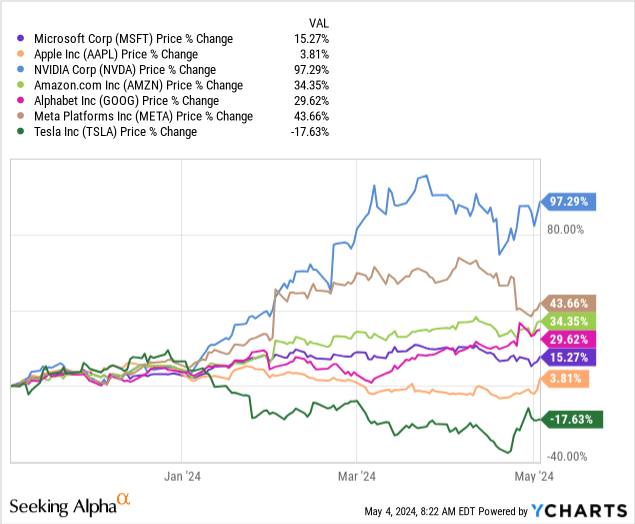

Therefore, TSLA’s terrible performance is less of a problem for CSQ. Here, we will look at the price changes over the past 6 months for just the name “Mag 7”. Some now call it “Mag 6” to the exclusion of TSLA. On the other hand, Apple (AAPL) also did not perform particularly well, but its stock price soared thanks to the company’s announcement of a massive $110 billion share buyback along with the proceeds.

Y chart

conclusion

CSQ has historically offered a solid performance track record, but given the fund’s shallow discount, now may not be the best time to consider adding too aggressively. The fund’s flirtation with narrow discounts and even premiums above its base price has continued over the past five years. However, more patient investors may wait for his occasional 5%+ discount level to add up more meaningfully. The overall market correction could also make it a more interesting time to consider this fund, and its discount could soften a bit more.