SerrNovik/iStock (via Getty Images)

Last month, the Government Audit Office (GAO) 401(k) Retirement Planning: Department of Labor needs to update guidance on target date funding In response to Requests for May 2021 From Senator Patty Murray (D-Wash.), Health, Education, and Labor Committee Chair: Rep. Bobby Scott (D-VA), Chairman of the Pensions (HELP) Committee, and the House Education and Labor Committee.

GAO’s report was three years in the making. At $4 trillion and growing, the TDF is extremely important. The GAO report has the potential to improve the industry.

Senators Murray and Scott wrote:

“…we request in writing that the General Accounting Office (GAO) conduct a review of target date funds (TDFs). We need to deliver services effectively and we are concerned that certain aspects of the TDF may lead to failures.” They are at risk.

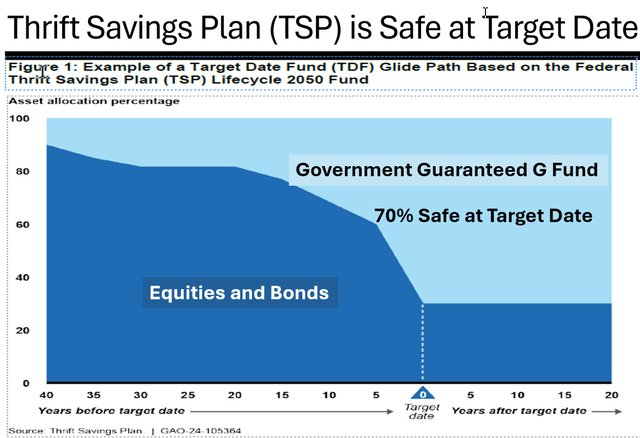

…according to new york times, “For example, many of the major target date funds designed for people retiring in 2020 invest 50 to 55 percent of their investments in equity funds, whereas the Thrifty Savings Plan 2020 Lifecycle Fund 60 percent or more in G funds (short-term U.S. Treasury securities) for the two years prior to discontinuation.

They are, federal government The Thrift Savings Plan (TSP) is an example of a plan that has performed well during market turmoil. With 6 million beneficiaries and $800 billion in assets, the TSP The world’s largest defined contribution plan.

And as a federal program, Congress should at least consider a TSP target date fund, called the “L fund.” Importantly, GAO employees are participants in the TSP.

GAO recommends that the DOL strengthen its oversight of the TDF by:

GAO recommends that DOL update (1) the 2013 Guidance for Plan Sponsors and (2) the 2010 Guidance for Plan Participants on TDF Selection. The DOL disagreed with both recommendations. As discussed in the report, GAO continues to believe that both are justified.

Below are five criticisms of the GAO report and specific recommendations for all TDF regulators, including the DOL.

1) The risk around the target date is much higher than it should be.

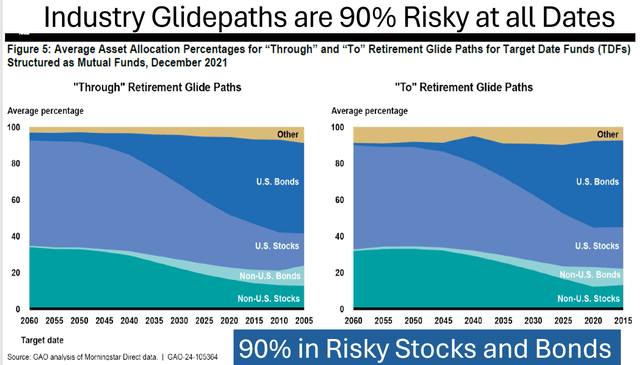

Upon request, GAO contrasted the TSP risks with the TDF industry risks, as shown in the following two graphs. TDF says it will comply Academic lifetime investment theorybut most do not follow the theory described in . This article.Although the theory is 80% risk-free as of the target date, the industry 90% dangerous It targets riskier stocks and long-term bonds (for all age groups).

TSP follows theory. The risk-free G Fund is 70% guaranteed against losses by the US government, making it extremely safe on your target date.

Regulators should realize that academic theory is very safe for people nearing retirement, and they should confront the industry that lied about following theory. Deviations from this theory have paid off over the past 15 years, as U.S. stocks have enjoyed the longest bull market in history, but things will change. Those who are high risk will suffer big losses in the next stock market crash. That’s the nature of risk.

Representatives Murray and Scott expressed concern about the level of risk associated with TDF. This study accepts without questioning why the industry’s risks are greater than TSP or academic theory. Don’t miss this important opportunity to improve your TDF.

2) There is a more meaningful distinction than “To” and “Through.”

The GAO report uses the distinction between “To” and “Through” throughout. Although this is a common approach, it doesn’t make a difference. As explained in , safety and risk at target dates are much more meaningful. Selecting a target date fund that is more meaningful than “deadline” or “deadline”.

3) Collective investment trust TDFs should be scrutinized

GAO’s report focuses on mutual fund TDFs, but opines that CIT TDFs may not be as well understood as they should be. The GAO report states:

“In the absence of guidance for reviewing TDF disclosures for collective investment trusts, including written plan documents and collective investment trust fact sheets, plan sponsors should review the applicable You may not be able to understand the disclosures made by collective investment trusts.

Also, Explanation: Fiduciary risk of target date funds, Chris Tobe warns:

There is a general assumption that CITs are regulated by the Federal Office of the Comptroller of the Currency. Some CITs are regulated by the OCC, but most used in 401(k)s are regulated by one of the 50 state banking regulators. This allows CITs to choose their own state regulators, which may or may not have lax oversight. SEC and mutual fund regulations are not perfect, but they manage many risks and provide ample transparency.

Trustees should review CIT TDF reports and understand the details – these are not regulated by the SEC – for example, they should investigate and evaluate the reported expenses of the underlying funds.

4) Only one workforce demographic really matters

GAO reports that while advisors focus on workforce demographics in the selection process, the only demographic common to all defaulting participants is a lack of financial sophistication; Demographics have made them more like dependent children, he said. A duty of care is like our responsibility to protect young children from avoidable harm. Defaulting participants are entitled to and need protection.

5) The interests of the participants do not match those of those interviewed for the study.

GAO interviewed management companies and advisors. Both are happy with the status quo, but as outlined below, the current structure is not optimal for participants. DOL’s final fiduciary rule could resolve conflicts of interest in target-date funds.

GAO did not interview participants. Other studies that have interviewed participants have reported that they want to be protected for retirement, and most believe they are protected. Default participant does not select her TDF. Their trustees choose for them. Also, remember that GAO employees are participants in her TSP, and her TDF in the TSP actually follows and protects academic theory.

TDF has three interest groups. Investment managers create TDFs for profit, that’s their business. The trustee probably chooses her TDF for the benefit of the participants, but that is not what is actually happening. Beneficiaries want to be protected, especially in retirement, but in reality they are exposed to great risks.

conclusion

78 million baby boomers will spend this decade in the retirement risk zone, a loss that could be devastating for the rest of their lives.Much has been and will continue to be invested in his $4 trillion TDF industry. Great damage has been caused by the market crash over the past 10 years..

Recommendations to strengthen surveillance should be taken seriously and implemented immediately.