Lambert says: I don’t know why there is no air quote for “engineering” in “financial engineering”.

Written by Wolf Richter, editor of Wolf Street. First appearance: Wolf Street.

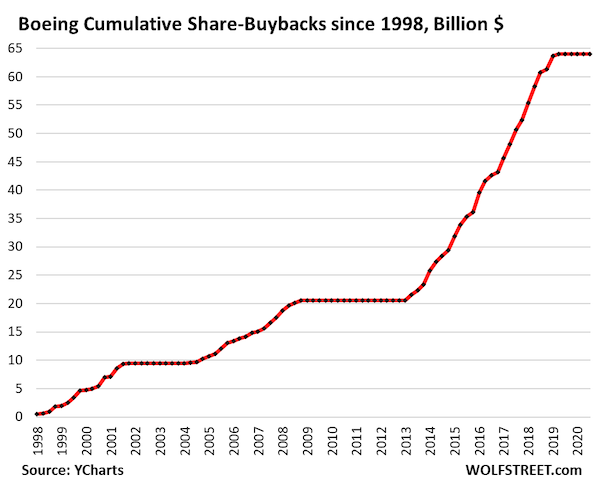

Boeing has posted net losses totaling nearly $32 billion each year since 2019, and after years of heavy borrowing, short-term and long-term debt has reached $58 billion, and shareholders’ equity is now negative. It has become. After wasting and burning $64 billion in cash on share buybacks to buy $23.6 billion more stock, it’s in dire need of lots of cash to burn.

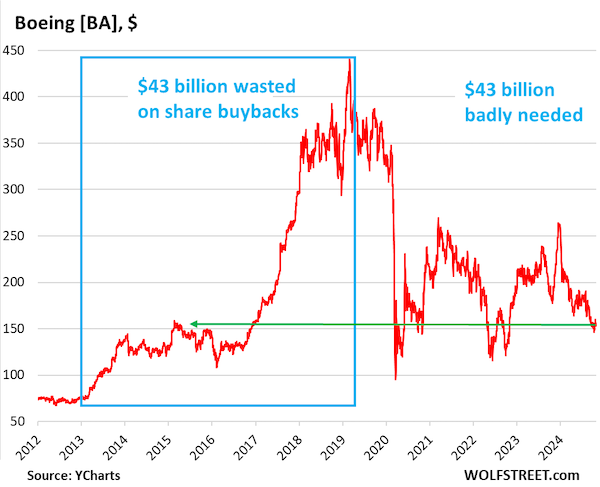

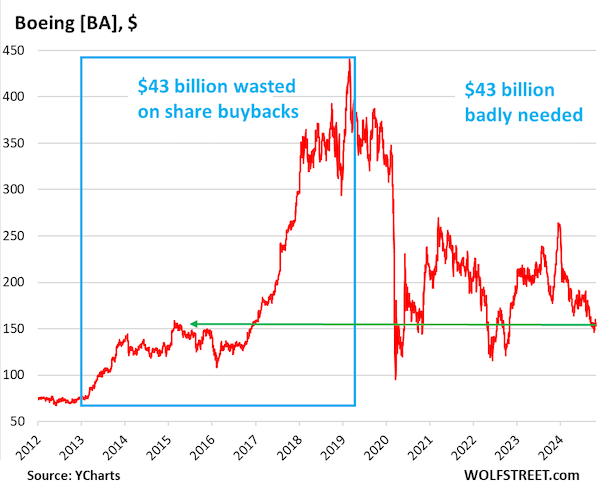

The company’s infamous shift from aerospace engineering to financial engineering to please Wall Street turned into a catastrophic mess, including for shareholders. Wall Street cheered the stock at the time, and the stock price soared 500% between 2013 and its peak in early 2019. But since then, the stock has plummeted, giving up much of its gains and returning to its starting level in 11 years. before.

So today, after days of rumors about a stock offering, Boeing announced announced It’s a huge stock issuance that would undo some of the devastation the share buyback caused to its balance sheet, and would dilute returns from current shareholders.

The company will sell 90 million shares of common stock (approximately $14 billion at current stock prices) and $5 billion of mandatory convertible preferred stock, which will qualify as stock for credit rating purposes. That’s about $19 billion. The company also granted the underwriters an option for an additional 13.5 million shares, valued at $2.1 billion at current prices. And according to the term sheet he saw: Reuterscould increase mandated convertibles by $750 million.

All together, the total capital raised increases to $22 billion.

The Mandatory Convertible Preferred Stock is sold to investors at a dividend of 6.0% to 6.5% and a premium of 17.5% to 22.5% to Friday’s closing price of $155.01, and is sold to investors at a dividend of 6.0% to 6.5% and a premium of 17.5% to 22.5% to Friday’s closing stock price of $155.01. Applicable when converting. According to Reuters, the maturity date is October 15, 2027.

The offering will provide the company with much-needed equity capital, which it recklessly burned through share buybacks prior to 2019. And it will almost fill the huge hole of $23.6 billion in negative equity.

If Boeing actually raises the full $22 billion, it would undo about half of the balance sheet destruction caused by the $43 billion wave of stock buybacks from 2013 to 2019. This wave of share buybacks caused the stock to soar 500% in early 2019, rising from $75 to $450.

Its current price is around $153, which first rose in price in February 2015, and is down about 66% from its peak, just short of qualifying for a pedestal in our Hall of Fame. implosion stock (Data via YCharts).

The dilution of existing shareholders due to the stock offering will be significant. There are 618 million shares outstanding, and the addition of the 90 million shares to be offered today will dilute existing shareholders by approximately 15%. This is before the conversion of the mandatory convertible notes and the option of an additional 13.5 million shares granted to the underwriters. So if Boeing were to actually become profitable again, its earnings per share would be diluted by at least 15%.

Boeing canceled stock buybacks in 2019 after two of its mistakenly created 737 Max 8 planes crashed, causing serious financial difficulties. Instead of wasting and burning $64 billion, including $43 billion in stock buybacks from 2013 to 2019 and $20 billion in the decade before the financial crisis, the company should develop a brand new airplane to replace the 737. It was. Fired financial engineers and hired several aircraft engineers (data via) Y chart).

Boeing’s corporate credit ratings are currently one notch above junk at Moody’s (Baa3), S&P (BBB-), and Fitch (BBB-). There are concerns that financing problems, production and quality problems, large debts and an ongoing strike by 33,000 workers, which halted much of production in September, could lead to a downgrade to junk status. There was. Corporate credit rating by rating agency).

If the credit rating goes junk, it will be more difficult and costly for Boeing to raise the funds needed to cover the huge outflow and repay the $12 billion in debt due in 2025 and 2026. It will cost.

With the capital increase outlined today, the company has limited financial headroom and is likely to avoid a downgrade to junk status in the near term, so it will take it one day at a time. . But it won’t solve the decades of damage inflicted on the company by production and quality issues surrounding its aircraft, labor issues and top-down financial engineers.