by calculated risk 2024/11/06 07:00:00 AM

From MBA: Mortgage applications drop in latest MBA weekly survey

Mortgage applications fell 10.8% from the previous week, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending November 1, 2024.

The market composite index, which measures the number of mortgage loan applications, decreased by 10.8% from a week ago, seasonally adjusted. On an unadjusted basis, the index was down 12% compared to the previous week. The refinance index was down 19% from the previous week and up 48% compared to the same week last year. The seasonally adjusted purchasing index was down 5% compared to a week ago. The unadjusted purchasing index decreased by 7% compared to the previous week; 2% increase compared to the same week one year ago.

“The 10-year Treasury rate remains volatile, continuing to put upward pressure on mortgage rates. Last week, the 30-year fixed rate rose to 6.81%, the highest level since July.” said Joel Kang, provost and principal deputy economist. “The number of applications decreased for the sixth consecutive week,

Purchasing activity falls to lowest level since mid-August Refinance activity fell to its lowest level since May. The average loan amount for refinance applications has fallen below $300,000. This is because borrowers with larger loans tend to be more sensitive to changes in mortgage rates. ”

…

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased from 0.69 to 0.68 percentage points for 80% lenders (including origination fees) and increased from 6.73% to 6.81%. . Loan to Value (LTV).

Emphasis added

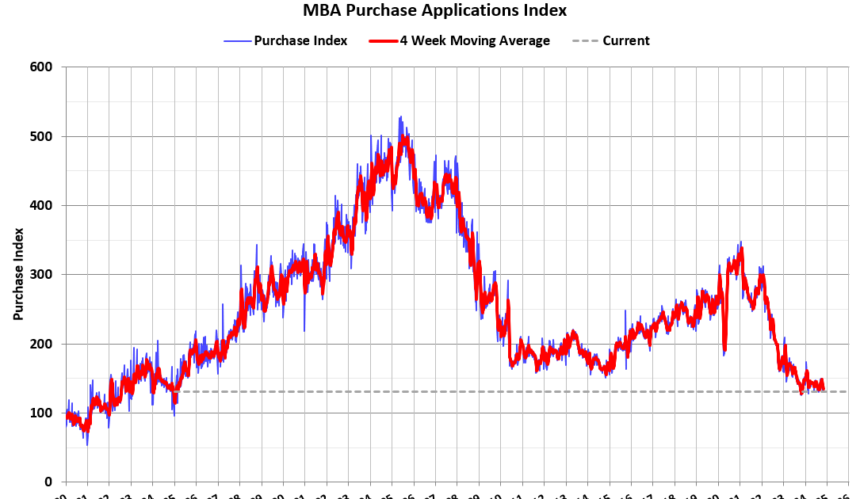

The first graph shows the MBA Mortgage Purchase Index.

According to M.B.A. Purchasing activity increased by 2% YoY Unadjusted.

Red is the 4-week average (blue is weekly).

Purchase application activity is up about 4% from its low in late October 2023, but is still about 13% below its lowest level during the housing crisis.

Due to rising mortgage rates, the refinance index rose significantly in September as mortgage rates fell, but has declined over the past six weeks as interest rates have risen again.