Eve is here. It is worth pointing out that the bond and stock markets have diverged over President Trump’s victory. Indeed, part of the stock market’s massive rally can be attributed to the fact that the popular vote difference means Democrats won’t engage in a major transition. As many have pointed out, this can have very devastating effects. Given that Team Blue couldn’t secure their own resources (let’s start primarily with big city bases and places where food is produced) or acquire weapons, a “civil war” would be That was an exaggeration. But the U.S. avoided major chaos because Trump’s opponents rather subdued the show of personal trauma, including hysteria and what Aurelian calls epic sulking.

Rising bond yields typically push stock prices down. This is why, for example, the stock market crashed during the 2014 “taper tantrum” when Bernanke threatened to force the Fed to begin exiting ultra-low interest rates, and more recently, the prospect of rising interest rates caused stock prices to plummet. The Federal Reserve lowered interest rates even as interest rates rose.

These movements are a result of Treasury yields acting as the basis for valuing financial assets. These provide risk-free rates to which analysts add a premium to reflect the risk of a particular investment. The expected future cash flows are then discounted by this rate. Therefore, higher interest rates mean that your expected future income is worth less in today’s monetary terms.

Some may wonder about this noticeable difference in readings. Investors are probably hoping for further tax cuts. It’s not clear how many more gimmies Trump can pull off, as he appears to be well along this path. President Trump has also threatened to cut federal spending, reducing consumer and business spending and hurting business revenues and profits.

If President Trump can keep the budget deficit under the Biden administration to a yawning level or below, the economy will continue to be at a high level by many indicators (I won’t go into too much detail, but many As one person explains, it’s the wealthy (who are actually benefiting) and not so much the ordinary people (whose dissatisfaction produced Trump’s victory). Inflation would also tend to rise, so the Fed might need to keep interest rates high, or lower them and then raise them soon.

In other words, bond investors seem to have a good understanding of the impact of the current economic situation and that Trump is unlikely to easily escape Biden’s massive deficits. But, as Keynes famously said, markets can remain irrational for longer than they can remain solvent.

Wolf Richter, editor wolf streett.First published in wolf street

In addition to their first rise since September’s interest rate cut, long-term Treasury yields soared this morning. A sharp rise in yields means a sharp fall in prices, which is a disaster for bondholders.

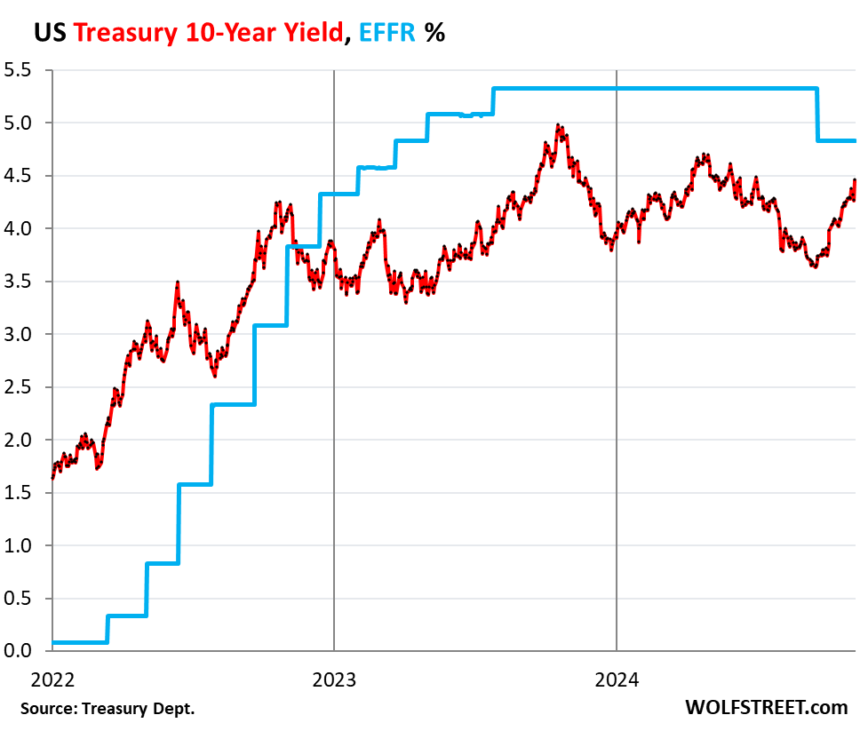

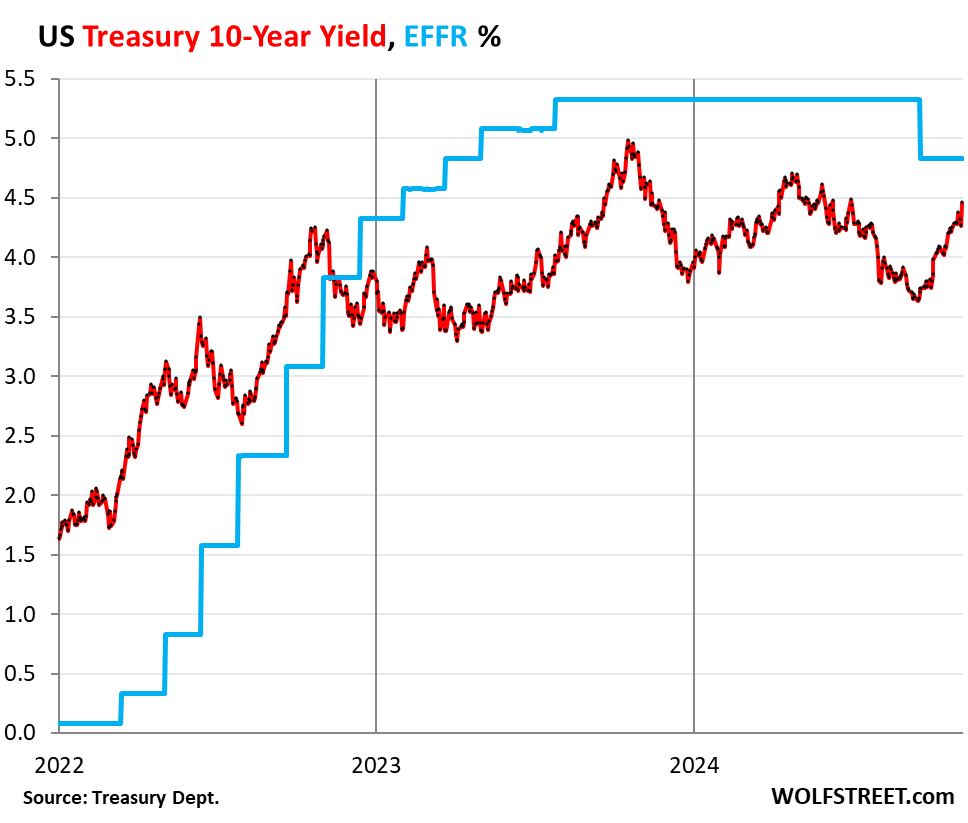

10 year government bond yield It rose 20 basis points this morning and is now at 4.46%, its highest level since June 10th. The 10-year Treasury yield has risen 81 basis points since the Fed cut rates on September 18th. Did it come to 5%?

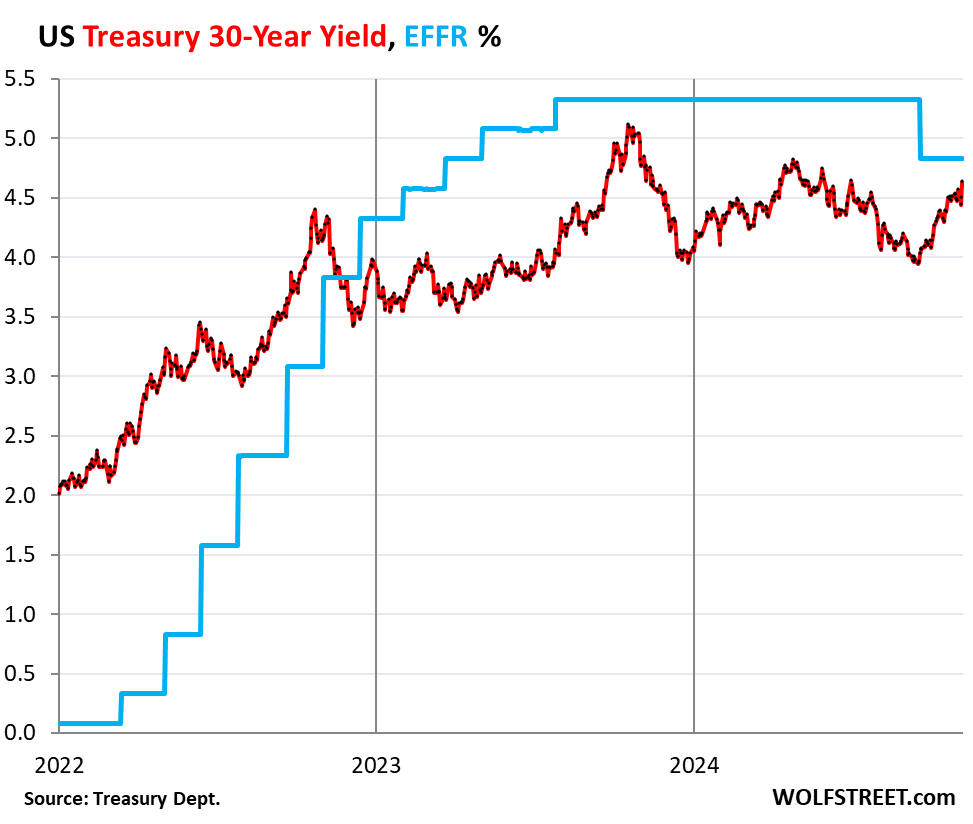

30 year government bond yield It rose 20 basis points this morning to 4.64%, its highest level since May 31st. Since the Fed’s September 18 rate cut, it has jumped 68 basis points.

So all we need to further scare the bond market is another rate cut?

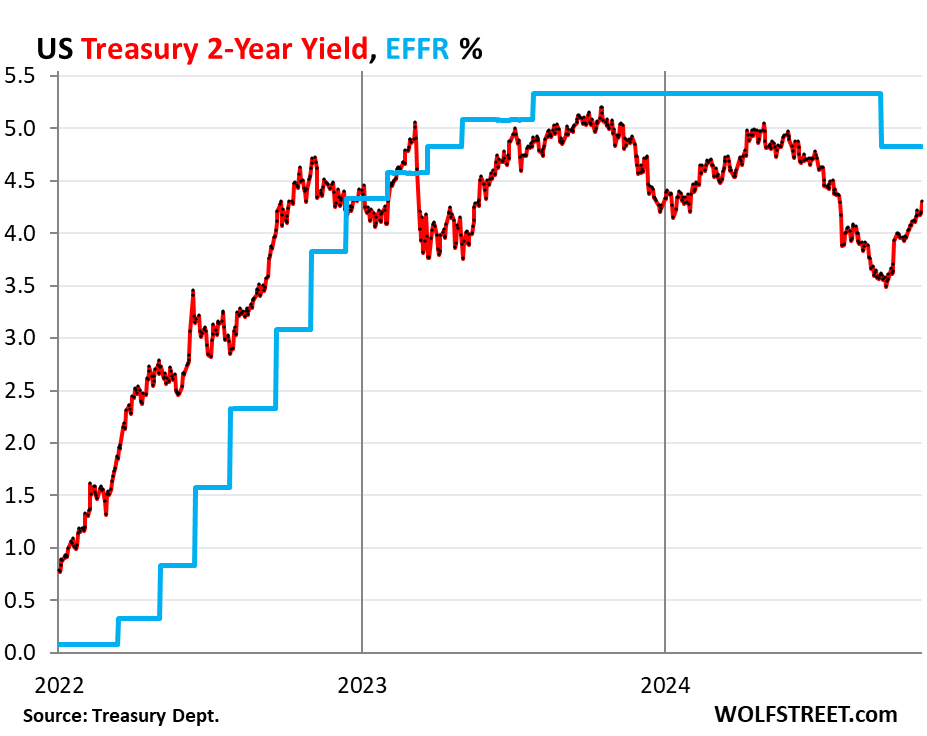

2 year government bond yield This morning it rose 10 basis points to 4.29%, its highest level since July 31st. Since the rate cut, it has increased by 69 basis points.

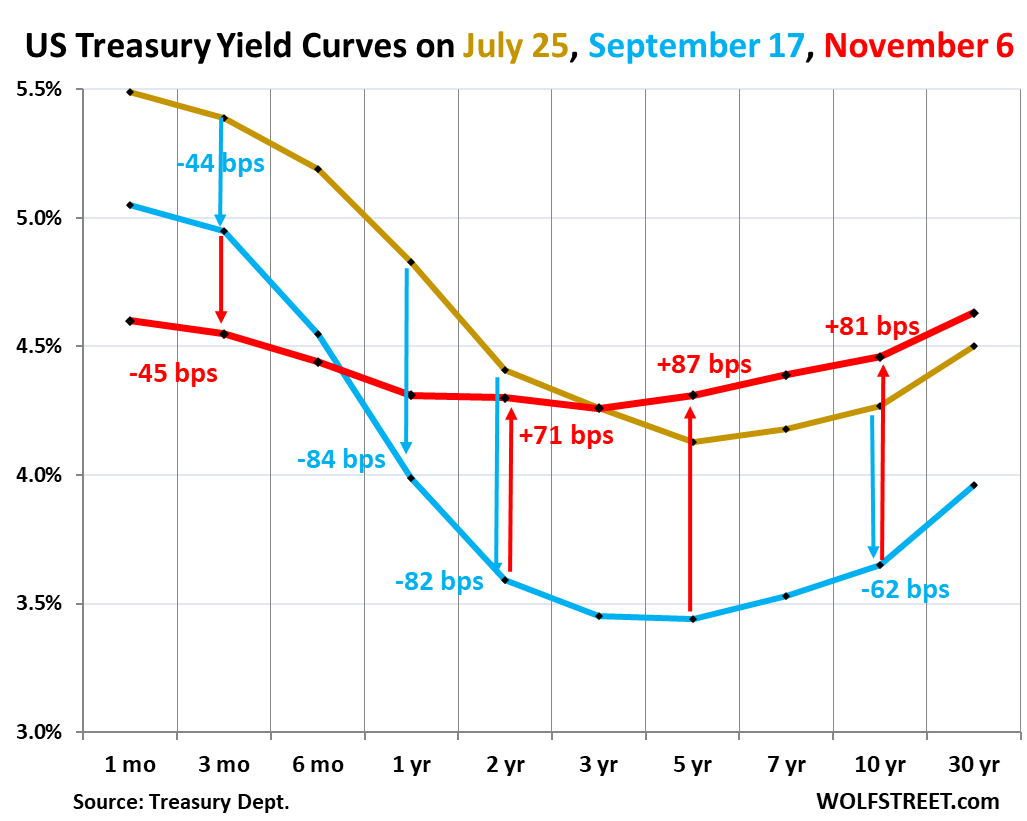

“Yield Curve” The de-inversion process continues, driven by a sharp rise in long-term yields and a decline in short-term yields, with another significant jump today.

The normal state of the yield curve is for long-term government bond yields to be higher than short-term yields. When long-term yields are lower than short-term yields, the yield curve is considered to be “inverted.” This started in July 2022, when the Fed raised interest rates, short-term Treasury yields rose, and long-term yields rose, but more slowly and thereby lagging behind. The yield curve is currently in the process of normalizing, with long-term yields rising sharply and outpacing short-term yields.

The chart below shows the “yield curve” showing yields on U.S. Treasuries with maturities ranging from one month to 30 years at three important dates.

- Fri: July 25, 2024, before the labor market data turned into a downturn, which has now been corrected.

- Blue: September 17, 2024, the day before the Fed’s major rate cut.

- Red: This morning, November 6, 2024, after the election results.

The 30-year Treasury yield is currently higher than all other yields and has not fully reversed. The 10-year Treasury yield is just a few basis points away from a complete reversal.

Notice how much long-term yields have risen since the September rate cut (blue line). Yields on three-year to 10-year notes have soared more than 80 basis points since September’s rate cut, falling in two months and rising even more rapidly in seven weeks in a screeching U-turn. Volatility in the government bond market.

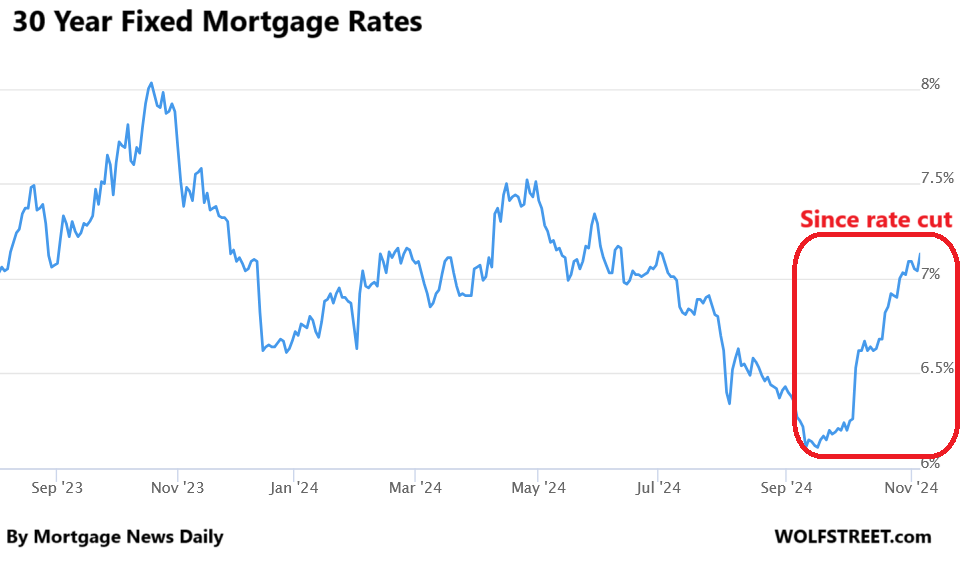

Mortgage interest rates too. These are about the same as the 10-year Treasury yield, which jumped 7.13% today, according to daily measurements. daily mortgage news.

Mortgage application numbers for the latest reporting week (not including the past two days) have already fallen further from previous freezing levels, further depressing demand for existing homes. This year, it is on track to fall to its lowest level since 1995..

This U-turn was a blow to both the housing industry and home sellers. At this rate, the yield curve will soon return to normal, but in the opposite direction from what the real estate industry was hoping for. The expectation was that the Fed would quickly reduce short-term yields to ultra-low levels, which would push long-term yields down and mortgage rates to follow suit.

However, mortgage interest rates have already plummeted from nearly 8% in November of last year to 6.1% by mid-September of this year, and with no rate cuts, just prayers and wishes, all sorts of rate cuts are already priced in. Ta. And since the rate cut, much of the wing-and-prayer sell-off in long-term rates has reversed, and that’s really all that happened.

The real estate industry was expecting 5.x% mortgages by now, with mid-September already ending with 6.1% mortgages, and some even pushing 4.x% mortgages in time for the spring sales season. We were talking about mortgages and today they are looking at a 7.13% mortgage.