Although artificial intelligence has been around since the 1950s, the business potential of AI has expanded dramatically over the past few years. We currently live in a world where big data and powerful computing capabilities allow AI to flourish. Companies, including insurance companies, are investing in establishing data lakes. Optimizing Cloud-based Operations Activates AI for target analysis.

Insurance companies are seeing concrete results from current AI initiatives. Our AI maturation studies show The share of cost-reducing carriers generated through AI more than doubled between 2018 and 2021. Furthermore, it expects its share to triple by 2024. Furthermore, insurance companies are quite pleased with the profits of their AI investments. 52% of insurers said that AI initiative returns exceeded expectations, while only 3% said returns did not meet expectations.

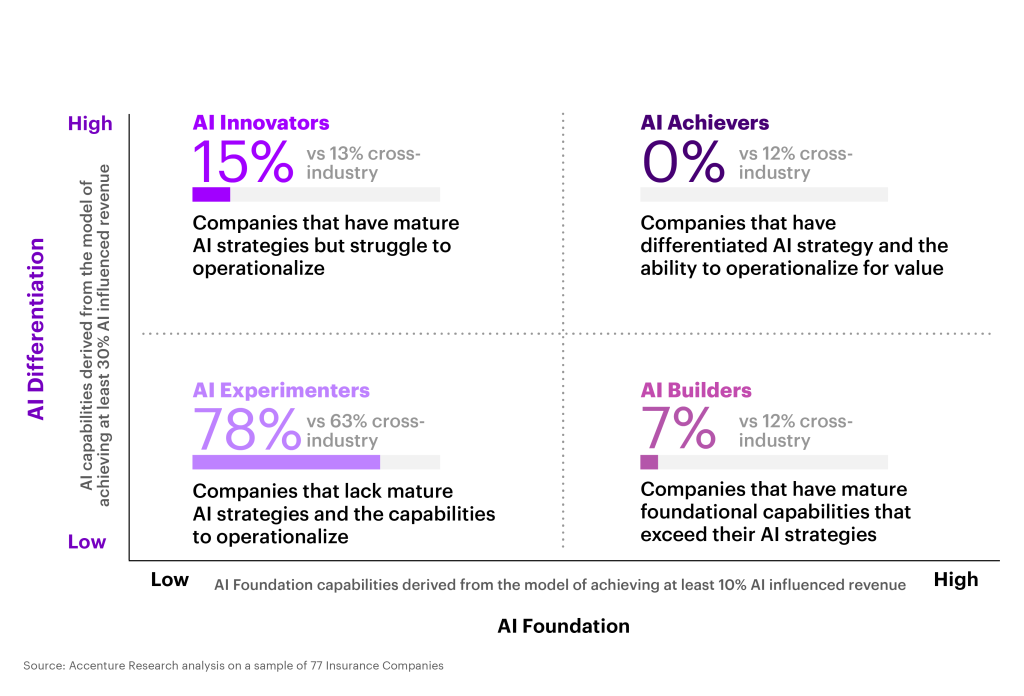

However, insurance companies leave value on the table. An analysis of 77 insurance companies found that none of them are AI achievements. It defines it as a company that differentiates AI strategies and operates AI and implements it. In fact, most insurers fall under the AI experimenter category, representing those with the least AI strategies and lacking the ability to operate AI.

By leveraging AI to leverage full enterprise reinvention, insurers can move into the achievement category and achieve greater value. This includes employing AI for decision-making across the organization and integrating AI into every part of the business, from optimizing business processes to delivering rethinked products, services and experiences to customers.

Careers who want to gain momentum through AI investments can find opportunities in the front office and build their next stage of growth. Our research examined three major front office use cases to dive in this post. Customer experience, product and service development, sales and marketing.

Customer Experience Intelligence and Journey Automation

When it comes to optimizing customer experiences, insurance companies are beginning to make progress compared to other industries.

Many insurers have invested in developing a single customer opinion and have been able to understand what products they own if they recently charged or received a quote for other products.

While some insurers are beginning to understand their interactions with specific customers better, most insurers struggle to connect their clients’ journeys across multiple channels and touchpoints. These insights can be used to understand and systematically address breakpoints in their experience.

While many insurers invest in customer relationship management (CRM) platforms to share customer insights across the enterprise, few have layered AI and used these insights to coordinate highly personalized customer experiences across marketing, sales, services and billing. Leading CRM vendors integrate AI capabilities into their platforms, making it easier to embed ready-to-use AI models in any workflow. Choosing such technologies is a great opportunity to create an omnichannel experience and build a truly holistic view of each customer.

When it comes to automating part of the customer journey, conversational AI is a largely untapped opportunity for the insurance industry as a whole. People creating self-contained conversational experiences that meet the needs of their customers are not merely answering FAQs or pointing to whether they can get help from their customers, but are creating high levels of satisfaction with significant savings in customer service costs and reducing trust in the challenging labor market.

New Products and Service Development

Recently Accenture found it 88% of executives I think customer needs are changing faster than the business can keep up. Factors such as climate change and economic uncertainty force customers to adapt to situations out of their control and move around territory as they try to make decisions that are best for them. Our study highlighted the need for businesses to move from focusing on their customers as consumers to developing subtle understandings of customers as multifaceted people with complex and often contradictory desires.

This shift is a shift from customer-centric to the approach we created. “Life-centered” Carriers are particularly relevant when developing products. AI helps carriers broaden their understanding of customer behavior and use data insights to navigate outside Cookie-Cutter’s customer profile. As you progress through your life, it can help you build services that allow you to seamlessly recommend or upgrade your personal products to accommodate events such as the purchase of a new home, or provide coverage as climate change reshapes natural disaster risks.

There are plenty of opportunities for insurers to use AI to create new products and services that deliver more value and enhanced experiences. We already offer a policy where many airlines implementing AI in their car insurance products evaluate driver behavior and drive as a paycheck.

As IoT and wearable technologies improve, carriers can use AI to gain a deeper understanding of customer behavior, meet their needs, and predict what their future needs are. A deeper understanding of customers allows carriers to build products at a personalized level at scale.

My colleague Jim Brumblett I explored several ways AI can provide another layer of protection For customers while gathering data about risk profiles and needs. One example he discusses is on the floor of an IoT connected factory where AI stops and workers pass the machine, notifies team members of the parts needed to be maintained, and displays potential dangers through AR glasses.

Sales and Marketing Intelligence, Recommendations, and Process Automation

Finally, careers can leverage AI to improve sales and marketing performance. Throughout the marketing and sales funnel, carriers can implement AI to express the most relevant recommendations to their customers and address questions at the moment. For example, a UK business insurance company Tapoli Using AI at all customer touchpoints, we offer commercial line insurance products tailored to the target market for microsooms and freelancers. It also uses AI to optimize pricing and risk assessments based on customer data.

AI can streamline when customers want to talk directly to the living people Human-to-human experience And it increases the likelihood that customers will achieve the results they are looking for. Agents can benefit from more data and insights at their fingertips. This means that you can seize the opportunity to cross-sell with Upsell at this point. Agents can rely on AI assistants to express the most relevant information in real time and create recommendations when talking to prospects.

Sanpo We are also partnering with AI CRM company Vymo to build AI-enabled proactive sales coaching technology to improve the services our teams provide. Ping An has been developed Similar solutions Provides relevant customer data and real-time coaching assistance to improve agent performance.

How insurance companies become AI achievements

Our recent report shows that The Art of Maturity of AIwe have identified five important areas where businesses need to invest if they want to maximize their AI potential and seize value that is at stake.

- Make sure that Leadership Champion AI is a champion as a strategic priority across the organization. When it comes to transformation, everyone is a stakeholder. Leaders need to ensure that teams understand the value AI brings to everyday tasks and comprehensive business goals.

- Invest a lot in talent and get more from AI investments. Innovation comes from employing diverse groups of people to solve problems in a unique and meaningful way.

- Industrialize AI tools and teams to create “AI cores.” To expand AI, careers need to create repeatable processes that create a strong foundation for increasing innovation over time.

- Use AI responsibly from the start. AI Ethics and Governance As a career scale, you need to be at the heart of every AI initiative. Today, only 35% of consumers trust how AI is implemented by organizations. To retain customers, carriers need to be transparent and minimize bias.

- Plan long-term and short-term investments. There is no finish line when it comes to AI strategy and innovation. Just like AI capabilities, customer needs continue to evolve. Those who plan ahead will move on as their need to adapt increases.

The possibilities of AI in insurance are not fully realized, but careers taking initiatives to build today’s powerful AI programs will likely bring strong returns from those investments. Don’t hesitate as I want to explain how to make better use of front office AI Please contact me.

AI: When applied in collaboration with humans, AI claim transformation and underwriting has emerged as a key differentiator in the insurance industry.

Get the latest insurance industry insights, news and research straight to your inbox.