Hi, I’m Yves. I don’t watch ponies much, as many analysts and commentators do, but I would like to remind my readers that a stock market crash does not cause a widespread financial crisis unless many of the positions are financed with debt. In the US, post-crash reforms limited margin lending, although there have been some attempts to get around these rules, including with equity derivatives like total return swaps that caused Archegos to collapse.

Unfortunately, Greenspan was the man who gave the Fed the idea that its job was to protect stock investors. As The Wall Street Journal exposed in 2000, Greenspan was obsessed with the factors that determine stock price levels. He noted in 1996, in the early days of the dot-com bubble, that the market seemed to be suffering from irrational exuberance. When the Dow plummeted, he quickly retreated and persuaded the market to rise again.

In ECONNED, we noted that Greenspan’s obsession with the stock market played a role in fueling the financial crisis. After the dot-com bubble burst, Greenspan was convinced it would have serious repercussions on the real economy, but the 1987 crash showed the opposite. Greenspan cut policy rates to negative real interest rates and kept them there for nine quarters. The Fed’s previous practice had been to cut rates to that level for just one quarter during a recession. As a result, investors flooded into high-yielding products. We explained at length how that spurred demand for products such as asset-backed CDOs, which primarily contained the riskiest tranches of subprime mortgage securities.

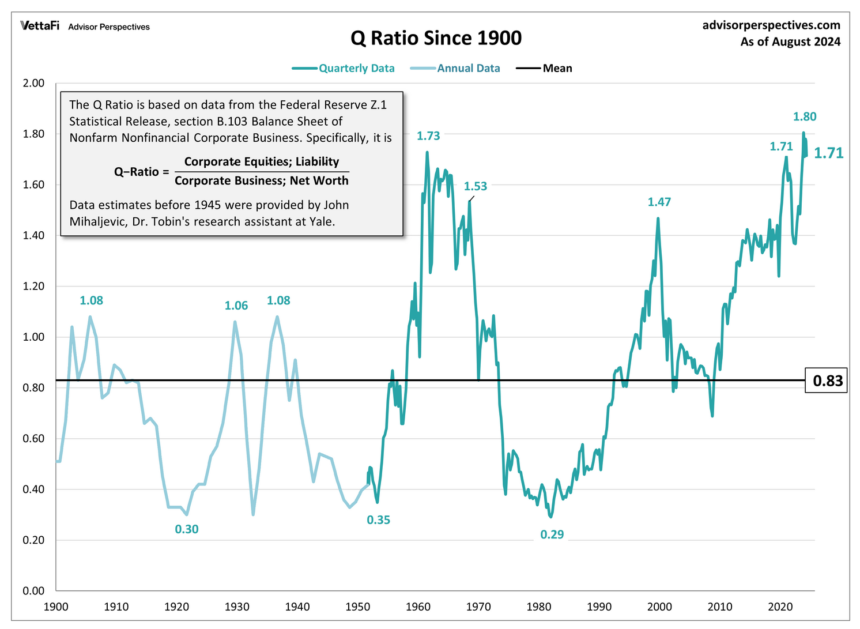

As Wolf (and the Wall Street Journal noted yesterday), investor enthusiasm for stocks doesn’t seem to be waning. One problem is that the average is overly influenced by the high performance of mega-cap tech stocks like Apple, Meta, Google, and Microsoft. That said, stocks overall seem pretty overvalued based on the Tobin’s Q ratio.

Finally, it’s worth remembering that while the dot-com bubble seemed to be dragging on, it had a dramatic explosion phase before it turned around, triggered by an unexpectedly weak earnings report from benchmark Cisco.

Written by Wolf Richter, Editor of Wolf Street. Originally Wolf Street

Nvidia, a poster child for the stock market mania around AI and semiconductors, plunged 9.5% in regular trading. It fell another 2.6% to $105.40 a share in after-hours trading, for a total decline of 11.7%. The after-hours decline was driven by Bloomberg The Department of Justice reportedly sent a subpoena to Nvidia as part of an expanded ongoing antitrust investigation.

“Antitrust regulators are concerned that Nvidia is making it harder for companies to switch to other suppliers, penalizing buyers that don’t have exclusive access to its artificial intelligence chips,” Bloomberg reported, citing people familiar with the matter.

Nvidia’s market capitalization, which matters because of its size, fell by $279 billion in regular trading, the largest single-day loss ever recorded by a single company, and by $342 billion including after-hours trading, equivalent to half the value of Tesla’s stock.

But that’s not a big deal, because easy come, easy go: Nvidia had a similar one-day move during the rally: The company’s shares are now down 20% from their July 10 peak. And Nvidia isn’t the only one to fall.

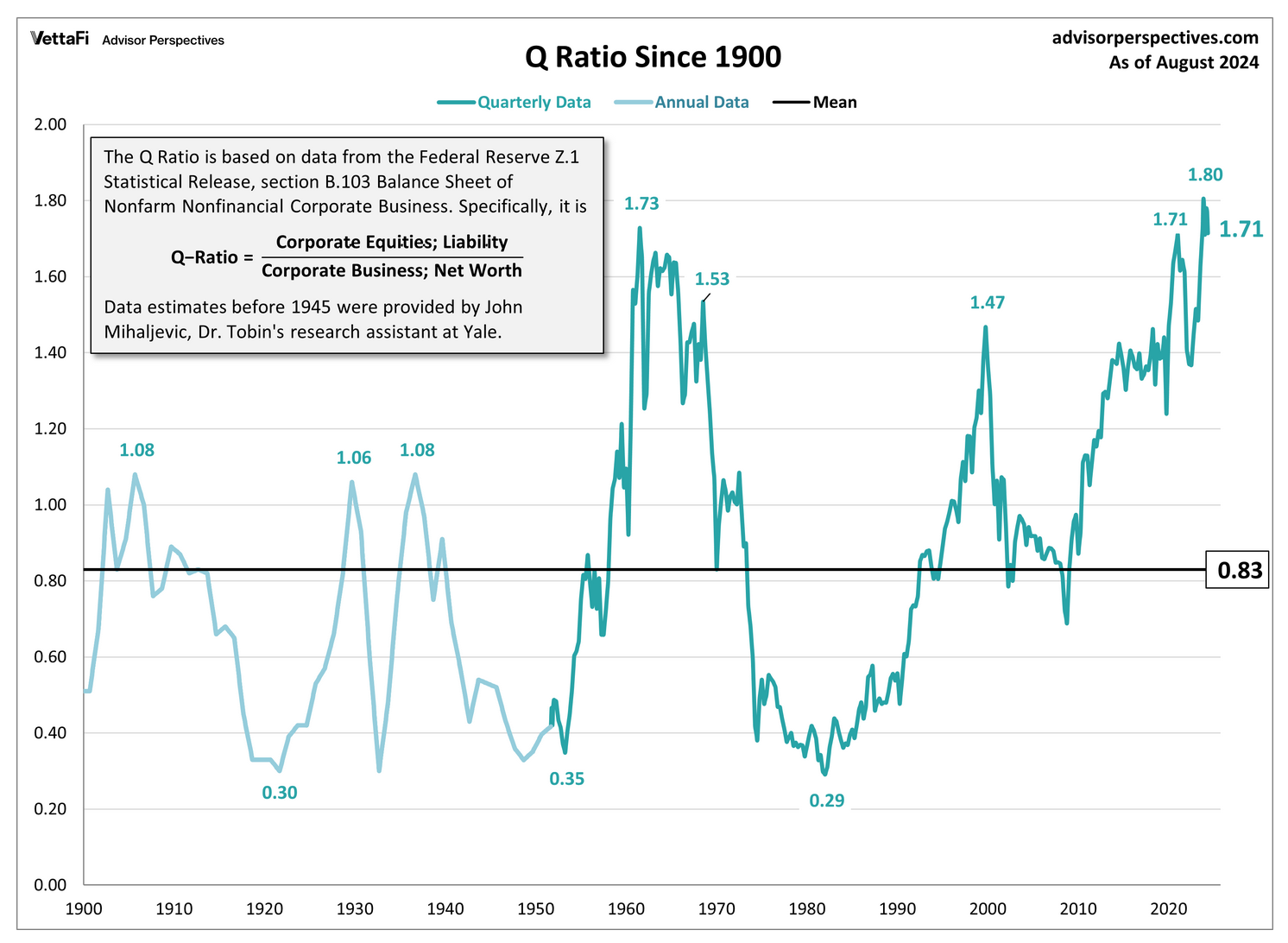

Semiconductor bloodletting during normal hours includes:

- NVIDIA (NVDA): -9.5%

- Intel (International Trade Commission): -8.8%

- Marvel Technology (MRVR): -8.2%

- Broadcom (AVGO): -6.2%

- AMD (Am): -7.8%

- Qualcomm (QCOM): -6.9%

- Texas Instruments (TI): -5.8%

- Analog Devices (Analog Devices): -6.5%

- ASML (ASML): -6.5%

- Applied Materials (Amato): -7.0%

- Micron Technology (M): -8.0%

- NPX Semiconductors (NXPI): -7.9%

- KLA (crack): -9.5%

The VanEck Semiconductor ETF (SMH) plunged 7.5%, its biggest one-day drop since the March 2020 crash. The Philadelphia Semiconductor Index (SOX) plunged 7.8%. The first trading day of September has been a sizable one-day trade.

It wasn’t the economic news that sent semiconductor stocks down, like a sudden Labor Day consumer downturn, or three big banks going bankrupt on Friday night, or an AI predicting the world is going to end. And it sent broader stocks down, too, with the S&P 500 down 2.1% today and the Nasdaq Composite down 3.3%. Far from being down, consumers are doing just fine, They returned to the punch bowl for refills..

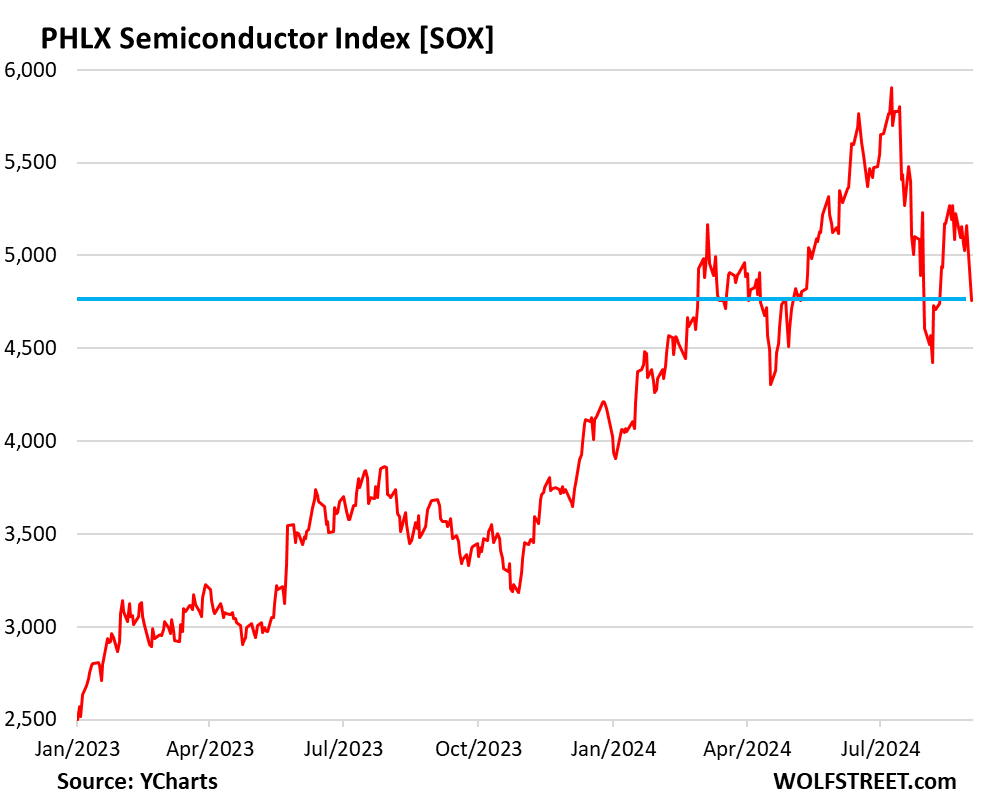

As a result, the Nasdaq Composite Index fell 3.3% today to 17,136, down 8.1% from its all-time high hit on July 10th.

A further decline of 6.7% would put them back to levels they first fell to in November 2021, but with a massive sell-off and a generational rally in between. Treasuries have fared better since November 2021, but without the fun and drama.

The movement since the peak on July 10th has not been very encouraging.

But after years of soaring stock prices, Americans are more bullish than ever on stocks, with stocks accounting for a record 42% of household financial assets in the second quarter, comfortably beating the previous record of 37% set in the second quarter of 2000, according to JPMorgan estimates cited by The Wall Street Journal.

Q2 2000 was, of course, when stocks began to experience the dot-com bubble burst, and over the next two and a half years the S&P 500 fell 50% and the Nasdaq Composite fell 78%. It would take 13 years, including QE and the 0% years, for the Nasdaq to surpass the dot-com bubble highs.

But investors think this is irrelevant now. It will never happen again. Stocks will always go up. The Fed will restart QE every time stocks go down a little, etc. Investors are so overinvested in stocks, especially the hottest stocks with ridiculous valuations like NVIDIA, that they are overconfident that stocks will always go up, so when something moves and selling pressure spikes, no one will dare buy at this ridiculous price, and the next tier of buyers, the bargain-buyers, will have to be lured in by even cheaper prices. But things have been tough lately.