by calculated risk 5/08/2024 02:53:00 Afternoon

From Dodge Data Analytics: Dodge Momentum Index rose 6% in April

The Dodge Momentum Index (DMI), published by Dodge Construction Network, rose 6.1% to 173.9 (2000 = 100) in April from the March revised value of 164.0. Over the month, commercial plans improved by 12.6%, while institutional plans decreased by 6.3%.

“The Dodge Momentum Index (DMI) showed positive development in April, A large number of data center projects have entered the planning stage.said Sarah Martin, associate director of forecasting at Dodge Construction Network. “Outsized demand for building cloud and AI infrastructure is supporting above-average activity in the sector. However, growth in most other categories slowed during the month. Across these industries , owners and developers are grappling with uncertainty around interest rates and labor shortages, which could delay decisions to put projects in the planning queue if interest rates start to fall in late 2024. There should also be further substantial growth in planning activities.”

DMI’s commercial segment saw solid growth in April with a slew of data center projects entering planning. Traditional office and hotel projects continue to trend toward slower momentum. Warehouse planning remained basically unchanged. On the institutional side, activity in education and health programs retreated again, partly due to another month of weak activity in life sciences and research and development laboratories. On a year-over-year basis, DMI fell by 1% compared to his April 2023. The commercial sector increased by 6% year-on-year, while the institutional sector decreased by 15% over the same period.

…

The DMI measures the value of planned nonresidential construction projects each month and is shown to lead nonresidential construction spending over a one-year period.

Emphasis added

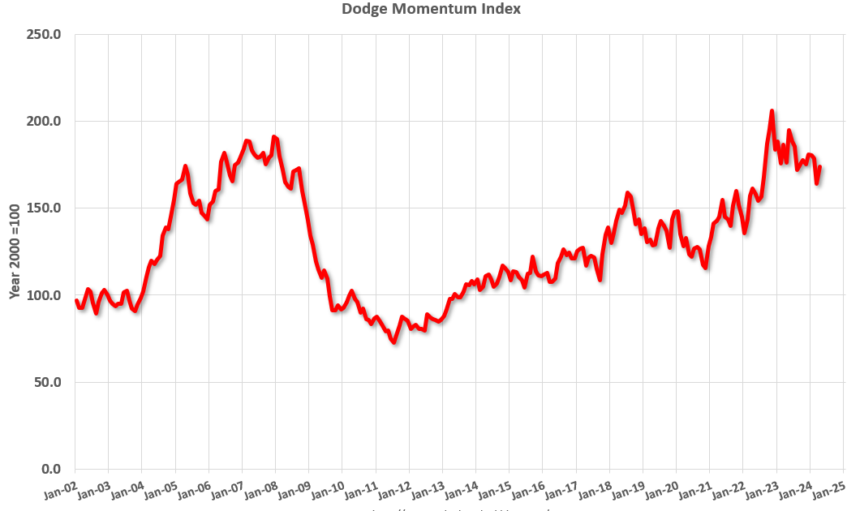

This graph shows the Dodge Momentum Index since 2002. The index for April was 173.9, up from 164.0 the previous month.

According to Dodge, the index “leads nonresidential building construction spending for the year.” This index suggests an economic slowdown in 2024.

Commercial construction is typically a lagging economic indicator.