douglas rising

The Fed has been implementing quantitative tightening for more than two years.

During this time, since March 16, 2022, the Federal Reserve’s securities portfolio has been reduced by more than $1.6 trillion. Amount through Wednesday, May 15, 2024 is $1,628.1 a billion.

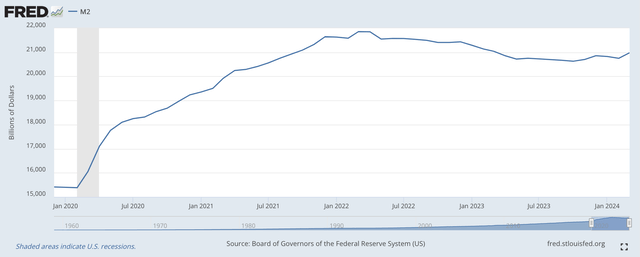

However, looking at the growth rate of the M2 index of money stock from March 2020 to March 2024, we see that the M2 money stock has increased from $16,051.5 trillion to $20,981.9 trillion.

This increase in the M2 money stock is compounded at an annual rate of 6.9%.

Historically, this is a fairly high expansion rate for a four-year period.

Of course, most of the expansion took place in the first part of this period, but the funds are still in the system.

This is the chart.

M2 Money Stock (Federal Reserve System)

So when calculating the 6.9 percent figure, we’re looking at a four-year chart from March 2020 to March 2024.

This financial growth is what the Federal Reserve is talking about when it claims there is still plenty of money in the banking system, even as it reduces the size of its securities portfolio.

Financial economist Milton Friedman argued that inflation at any time and place is the result of financial expansion occurring in a country.

The M2 money stock’s compound growth rate of 6.9 percent certainly far exceeds the growth rate of the U.S. real economy.

Should we be surprised that price inflation has become a problem in recent years?

Yes, the Federal Reserve is reducing the size of its securities portfolio, but the growth in the money stock is still excessive.

There is a lot of money circulating in the system.

An open question remains… will the Fed’s efforts to reduce the size of its securities portfolio actually be enough to reduce U.S. inflation to the level the Fed is aiming for?

And, sure, the growth rate of the M2 money stock has been negative for the past two years, but you can ask the same question about this behavior. Has the movement in the M2 money stock over the past two years really been enough to slow US inflation?

If you look at the performance of the U.S. stock market, the answer to these questions is…some would say no.

On Friday, all three major stock indexes hit new intraday record highs. On Friday, the Dow Jones Industrial Average closed at a new all-time high, while the S&P 500 index, like the Nasdaq, closed just below its new record.

This is not the kind of economy where the investment community believes that central bank monetary policy is restrictive.

The Fed continues to reduce the size of its securities portfolio.

According to the Federal Reserve’s latest H.4.1 statistical release, May 15, 2024, the Federal Reserve’s securities portfolio decreased by an additional $30.7 billion in the latest banking week.

This will reduce the size of the reduction to $1.6281 trillion.

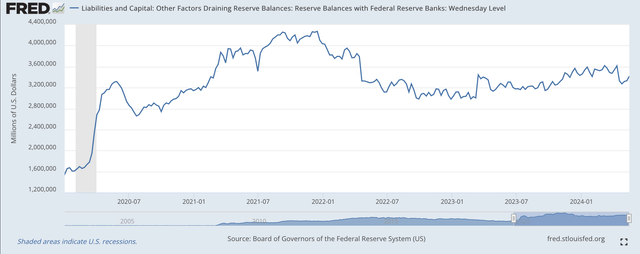

However, it should be noted that the banking system’s “excess reserves” increased to more than $3.4 trillion last week. This comes from the Federal Reserve H.4.1 Statistical Release under the heading “Reserve Balances with Federal Reserve Banks.”

Looking at the Federal Reserve’s H.8 statistical release “Assets and Liabilities of the U.S. Banking System,” as of May 1, 2024, U.S. commercial banks held $3.3 trillion in “cash assets.” Recognize.

This is a huge number.

There is a huge amount of cash sitting in the commercial banking system.

Yes, the size of the Fed’s securities has shrunk.

Still, the commercial banking system is highly liquid.

This is the “excess reserve” situation of commercial banks going back to January 2020.

Federal Reserve Bank Reserve Balance

Excess reserves expanded rapidly as the Federal Reserve battled the effects of the coronavirus pandemic. It reached its peak at the end of 2021.

Excess reserves declined when the Fed began quantitative tightening, but began to increase when commercial banks failed in 2023.

Note that even as the Fed continues to reduce the size of its securities portfolio, it continues to manage commercial banks’ reserves and has increased this measure starting in March 2023.

All of this is happening as Fed Chairman Jerome Powell and the central bank continue to debate whether to lower the Fed’s policy rates.

I think one of the reasons Mr. Powell is so cautious about starting to lower Fed rates is because the commercial banking system continues to be sitting on so much cash.

With so much cash on hand, inflation remains a major threat.

Recall that over the past four years, the M2 money stock has grown at a compound rate of just under 7.0 percent.

The threat of excessive inflation remains.

Mr. Powell doesn’t want to face the possibility that inflation will stay at current levels or even rise higher as a result of the Fed lowering interest rates.

Investor?

Investors are finding that they have excess cash on hand. This cash becomes the source of the stock price rise.

This cash is also a source of confidence in the continued growth of the U.S. economy.

Mr. Powell is truly addressing the issue of “balance.”

When will interest rate reductions start?

How long will you keep interest rates at their current levels?

And the presidential election is coming up in six months…

The last thing the Fed Chairman oversees is the Fed doing anything that would disrupt markets or the economy in a way that would affect the outcome of an election.

Mr. Powell will be very cautious about what he and the Fed do over the next six months.

If the Fed acts to keep financial markets peaceful throughout the election, investors should feel like financial markets are functioning well. In other words, if the Federal Reserve is able to maintain financial market stability, the stock market could rise further and reach new “new” historic highs.