Bill Oxford/iStock Unreleased via Getty Images

introduction

Let’s talk about one of the biggest compounding stocks in the stock market.

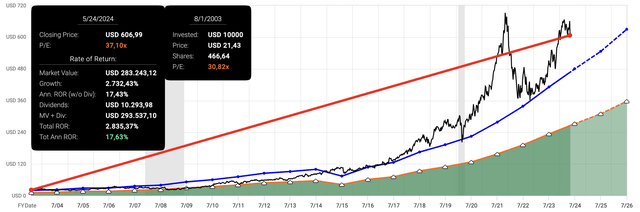

Intuit Inc.Nasdaq:Into) As the chart below proves, since August 2003, it has returned 17.6% per year.

If you grow your money at 17.6% compounded annually, your $10,000 investment will grow to $256,000 within 20 years.

My recent article The comment on the stock was made on July 17, 2023, when I named the company “A tech investor’s dream.“

Since then, the stock has risen 24%, considerably outperforming the S&P 500’s impressive 17% return.

Unfortunately, past results are no guarantee of future results, which is why I am writing this article.

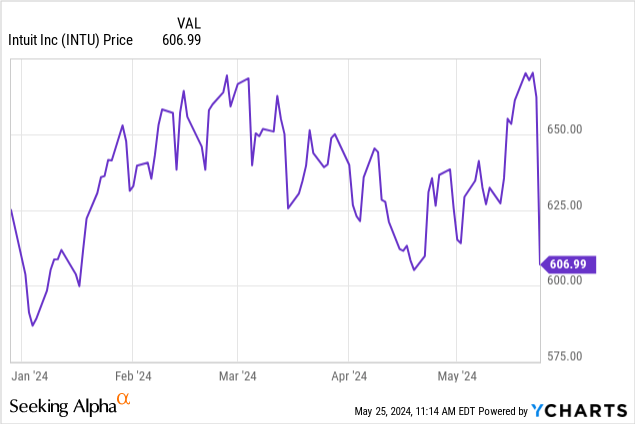

The company reported its third-quarter results on May 23, and its shares fell 8%, its worst one-day drop in two years.

In this article I explain why the drop occurred, why I remain bullish, and how to manage the risks and rewards at current levels.

Now let’s take a look at the details.

What happened to the stock price?

An 8% drop is not something to ignore, especially for a company like Intuit that typically has a very favorable volatility profile.

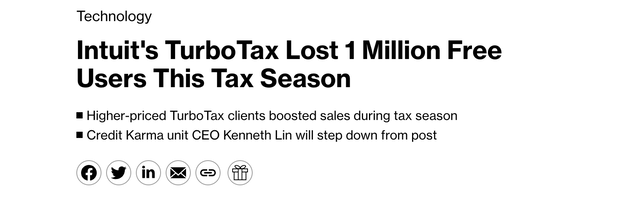

We think the headline below perfectly sums up why fear has put pressure on the company’s stock price:

Reports say BloombergInvestors were not pleased that the company’s TurboTax service lost 1 million free customers, dropping the total number of free users to 10 million.

Investors are generally somewhat concerned about competitive risk, so this has understandably caused some anxiety.

Two very common fears are:

- The US government could introduce some kind of free tool to help people file their taxes quickly (I’m Dutch and my government has a very simple tool). According to a Bloomberg article, the US government is running a pilot program with a limited number of users in each state.

- A new entrant could build its own affordable alternative to TurboTax, but the risk of this is very low and the company generally operates a “wide moat” business due to its large customer base and high switching costs, especially for businesses.

Furthermore, the report states (emphasis added):

Despite the decline in free customers, Intuit’s investments are paying off. The average TurboTax user spends 10% more This year’s filing showed a decrease compared to last year, the company said. Third quarter revenue up 12% $6.74 billion Beats average analyst estimate of $6.64 billion.

In other words, despite this “loss,” the company beat expectations because it isn’t worried about a decline in free users.

Between Earnings ReportThe company clarified that these people are “flipping between platforms and just looking for free tax software.”

The company isn’t interested in acquiring these customers, and rightly so, since its main focus is on businesses and consumers with high purchasing power.

While a growing base of “free users” is obviously a good thing because it provides upselling opportunities, it doesn’t make sense for any business to throw money at a potential customer base that isn’t going to bring in much revenue anyway.

Additionally, The Wall Street Journal tested the free software and was not impressed.

The IRS’ new tax-filing site is much better than wrestling with paper tax returns — and it’s free for users. But the government’s first foray into electronic tax filing still doesn’t beat TurboTax. The Wall Street Journal

Still, it’s still important to keep an eye on these developments, as the 8% drop in the stock price suggests investors are growing increasingly nervous about the threat.

More features than TurboTax

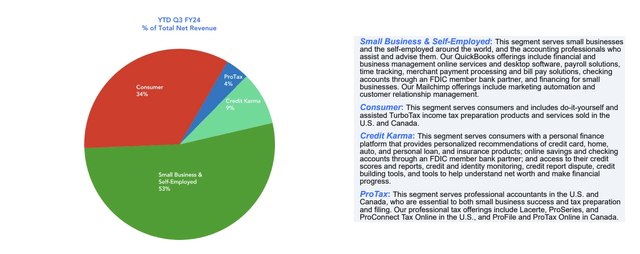

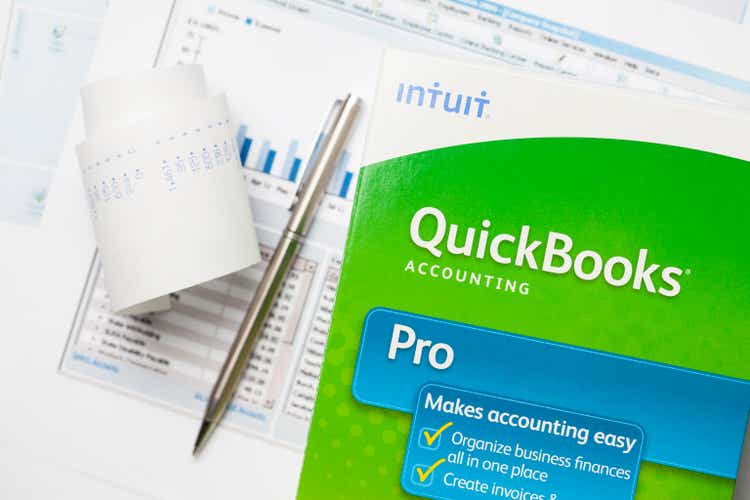

Intuit is a $170 billion company, and there’s a lot more at play than just potential competition from TurboTax and the government.

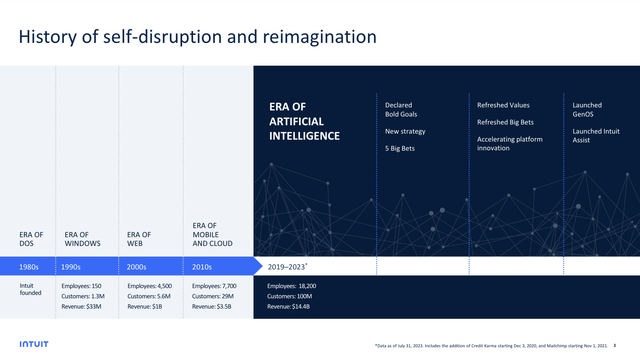

As already mentioned in the Bloomberg quote earlier in this article, the company’s total revenue grew 12% due to its strategy to become a global, AI-driven expert platform, which marks the next big era for Intuit after the mobile and cloud computing dominated 2010s.

While it may have had challenges with low-quality free TurboTax subscribers, the company performed well in the small business space, posting 18% growth in the small business and self-employed group and 9% growth in the consumer group.

Credit Karma revenue grew 8% as it benefited from product integration with TurboTax, a great example of synergy building.

Against this backdrop, the company continues to “revolutionize” the tax preparation market, a total addressable market (“TAM”) valued at $35 billion in the United States alone.

This approach involves leveraging data, AI and Intuit’s virtual expert platform to enter the assisted tax preparation market.

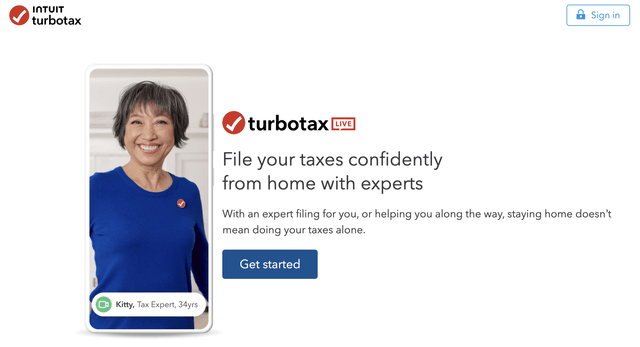

For example, the company’s assistance service, TurboTax Live, is expected to grow its customer base by 12% and revenue by 17% in fiscal 2024, making it a $1.4 billion product.

In fact, the full-service TurboTax Live has been so successful that the company expects to double its customer base and triple its new customer acquisition. High customer satisfaction will benefit Intuit, allowing it to focus on increasing its average revenue per return (ARPR) per high-end customer.

As we mentioned briefly already, this strategy is far better than throwing money at retaining low-quality customers.

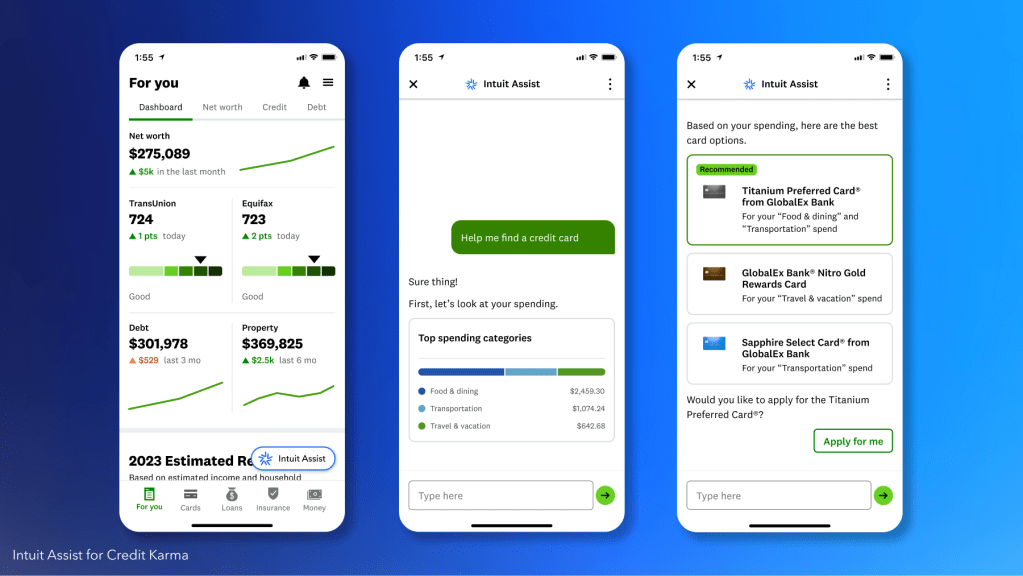

In general, it seems the company’s efforts are paying off: Intuit Assist, its generative AI-powered financial assistant, is already used by more than 24 million customers.

Intuit

Plus, as we mentioned briefly above, the Credit Karma integration with TurboTax was a boon for the company, leading to a 76% increase in customers filing through the built-in Credit Karma service and a 28% increase in tax refunds deposited into Credit Karma accounts.

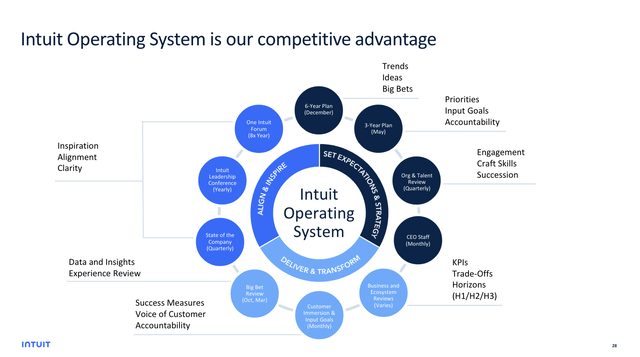

Speaking of AI, Intuit believes it is “one of the most important technology shifts of our lifetimes,” explaining in its Q3 2024 earnings call that it is driving “five big bets” using AI to pursue its biggest customer problems and growth drivers for the company.

These include Big Bet 1, gen AI delivers experiences on your behalf with Intuit Assist. Big Bet 2, TurboTax go-to-market investments Live and QuickBooks Live, Incorporating AI-based experts into SME servicesBig Bet 4, our money solution Digitizing end-to-end consumer and small business experiencesFrom quotes to issuing invoices, receiving payments and paying invoices. Big Bet 5, Doubles focus on mid-market with additional investment in platform and go-to-market activities. And finally, Accelerating International Growth with Mailchimp and QuickBooks– INTU Third Quarter 2024 Earnings Release (emphasis added)

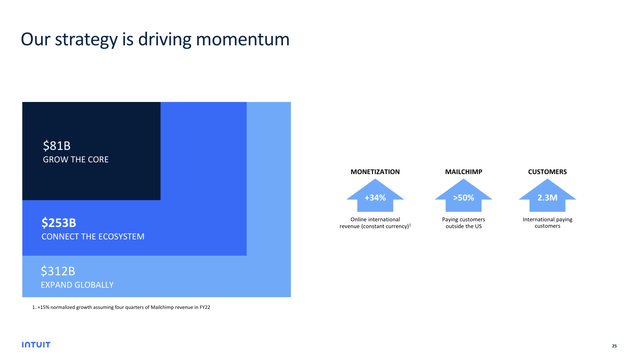

The international part is particularly interesting: the company believes it can tap into a $312 billion market if it expands aggressively beyond U.S. borders. As of now, 100% of the company’s revenue is U.S.-based.

So what does this mean for shareholders?

Better guidance and consistent dividend growth

The company raised its full-year earnings outlook and expressed optimism about the future.

- The company now expects total revenue to grow 13%, up from 11-12% previously.

- GAAP operating income is expected to increase by at least 21%, while adjusted operating income is expected to increase by 16%.

- GAAP EPS is expected to increase 28% to 29% year over year, and adjusted EPS is expected to increase 17%.

And going back to TurboTax, as I mentioned briefly earlier, TurboTax Live revenues are expected to grow 17%, which will increase TurboTax Live’s weighting to 30% of the Consumer Group’s total revenues.

ARPR is expected to increase by 10%.

The company has strong growth expectations as well as a healthy balance sheet, so all of this bodes well for shareholders.

Intuit ended the quarter with $4.7 billion in cash and investments and about $6 billion in debt.

this year, Analysts predict The company plans to reduce net debt to less than $500 million, or less than 0.08x EBITDA, which is very healthy. The company has an A- credit rating.

Next year, the company is expected to have $3.9 billion in net cash (cash over total debt).

This makes sense, as analysts expect the company’s free cash flow to grow from $5.1 billion in 2024 to $6.1 billion in 2025. This implies a free cash flow yield of 3.6%.

This is favorable for dividend growth.

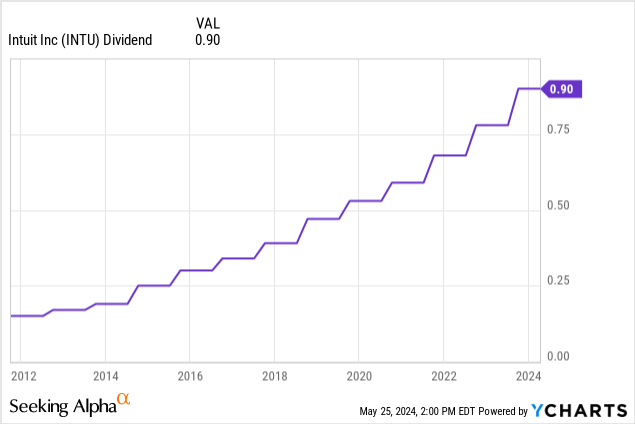

Intuit yields just 0.6%, but its dividend payout ratio is 5% (I believe this is the lowest ratio I’ve mentioned in my articles this year) and it has a five-year CAGR of 14.1%.

The company raised its dividend by 15% in the fourth quarter of the 2023 calendar year.

In other words, low yields are bad news for income-oriented investors looking for exposure, but this is not the “fault” of the companies, but the fault of investors who never allowed yields to reach high levels.

As mentioned at the beginning of this article, the company is one of the strongest compounders in the stock market, and there was no room for the dividend yield to grow because capital gains offset the dividend growth.

That being said, there is one problem.

evaluation

I believe the main reason INTU was sold off after the earnings announcement was because investors found an “excuse” to take profits.

After being sold off, INTU is still trading at a blended P/E ratio of 37.1x, well above its long-term normalized P/E ratio of 28.6x.

There is no room for error in these assessments.

While analysts expect annual EPS growth to average 15% through at least 2026 (using FactSet data in the chart above), I would argue that a multiple of 37x is too high, especially given new risks such as government competition.

While I have little doubt that INTU’s growth is sustainable and that diversification can withstand new risks, I’d like to see the share price fall further before buying.

That being said, even using a 28.7x multiple, based on projected 2026 EPS of $22.04, the fair value stock price comes to $632, 4% higher than the current price.

When I think of great ways to grow a business, I think of buy evaluation.

However, I would not initiate a full position at these prices as I believe a gradual investment is the best approach when dealing with a very favorable long-term growth story and short-term valuation headwinds.

remove

Despite concerns about TurboTax’s decline in free users, Intuit remains an attractive long-term investment.

The company’s strong financial performance, impressive revenue growth, strategic focus on high-value customers and AI-driven solutions underpin its resilience and future growth potential.

However, current valuations are high, suggesting a cautious, phased approach to investment may be advisable.

I have placed INTU on my watchlist, which means I will be including it in more articles going forward as I am considering making it a holding in my dividend growth portfolio.

Pros and Cons

Strong Points:

- Strong FinancialThe company reported that its third-quarter 2024 revenue rose 12%, beating expectations, despite losing some free users.

- Strategic FocusBy leveraging AI and focusing on high-value customers, Intuit is positioning itself for future growth.

- Healthy balance sheet: With large cash reserves and low debt, Intuit is financially stable, which is great news for future M&A and dividend growth.

- Global expansionWe are actively working on expanding overseas.

- Wide moatAlthough it faces competition in certain areas, its vast installed base and technical expertise make it very difficult for new entrants to compete and for customers to switch.

Cons:

- Highly ratedIntuit’s stock price, trading at 37.1 times earnings, isn’t cheap. Its favorable growth outlook helps offset that, but it doesn’t have much room for error.

- Government Competition: New risks arising from potential government tax preparation tools could negatively impact TurboTax’s user base.

- Low dividend yieldWith a yield of just 0.6%, income-focused investors may be able to find better opportunities elsewhere.

- economic growthA weak economy could hurt small and medium-sized businesses and weigh on INTU’s revenue growth.