Mascot/Digital Vision via Getty Images

In the previous evaluation, the Stevanart Group’s (New York Stock Exchange:Star TV) is rated “Inventory reduction and valuation risk.‘ As a precaution, keep in mind that Stevanart’s peers have lower sales growth forecasts for 2024, with some expecting a decline. Start-up costs and unfavorable exchange rate effects reduced EBITDA and net profit, but the company was well-valued in our view.

Easier said than done. After analyzing FY2023, Stevanart’s share price fell by nearly 30%. That said, we still have a positive assessment of the company, and here’s why: 1) Worldly Favor Demand for biologics, 2) Recent Free Float Extension a price of $26 per share (which will support the liquidity of the stock and the company’s capital expenditure plans), and 3) expanding profit margins supported by an economic moat.

First Quarter Results and changes in guidance

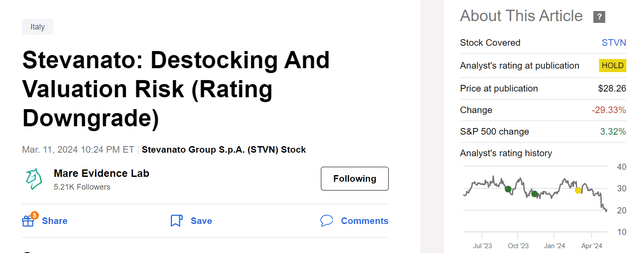

The company decided to revise its estimates after the first quarter fell short of expectations. Looking at the figures, Stevanart’s sales were 236 million, minus 1% between January and March 2023. Looking at the income statement, the company’s EBITDA and net income were minus 18% and minus 33.5%, reaching 62.2 million and 18.8 million euros, respectively. This resulted in an EPS of 7 cents per share in the first quarter. Due to the decline in orders and the worsening performance in the first quarter, the company adjusted its guidance for 2024. In terms of operations, sales are down mainly due to lower vial volumes, but the company believes this is temporary.

Stevanart first quarter results

Figure 1

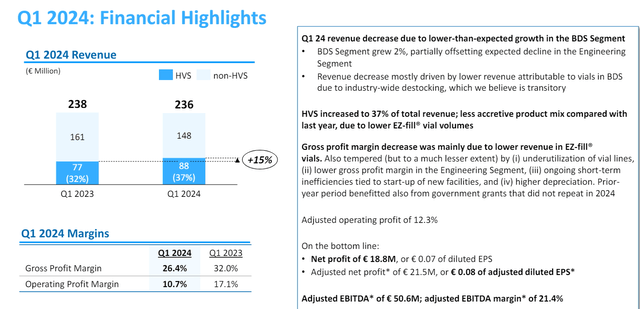

As a reminder, Stevanato had forecast “2024 sales of €1.18-1.21 billion, adjusted EBITDA of €314.1-329.5 million, and adjusted EPS of €0.62-0.66.” Sales are now expected to be €1.12-1.15 billion, with an EBITDA range of €278-292 million. Finally, with the job cuts, the company’s EPS will be in the range of €0.51-0.55 per share.

Stevanato announces new guidelines for 2024

Figure 2

Why are we being positive now?

Several factors need to be considered. Let’s start with the CEO: stated“Industry-wide vial de-stocking was more pronounced than previously expected, especially for EZ-fill vials, which have a higher growth rate.” Orders are expected to pick up momentum and gradually recover in 2024. In addition, he highlighted how the deferral of large customer orders has impacted Stevanato and that it is taking a more cautious approach to sales in 2024. Stevanato is supported by favorable long-term tailwinds of rising demand for biologics. Growth in the second quarter may continue to be affected by the headwinds of de-stocking. As a result, in the lab, we assume that growth in the BDS segment will be in the mid-to-high single digits. Looking at margins, and taking into account the de-stocking of EZ-fill vials, the company will see a lower gross margin mix and a negative impact on EBITDA overall. In the engineering division, extended lead times for electronic components appear to be resolved, but margin risks remain. Looking back, guidance was flat, but we now assume that the division’s sales will be in the mid-single digits of decline. We also believe that the company’s CAPEX plans have led to increased start-up costs for new facilities and increased D&A. Putting aside the CEO’s reassuring words and the current one-off negative factors, the company could benefit from the following going forward:

- Improving profit margins through the High Value Solutions (HVS) division

- EBITDA MIX improved due to a decrease in customer inventory adjustment activities.

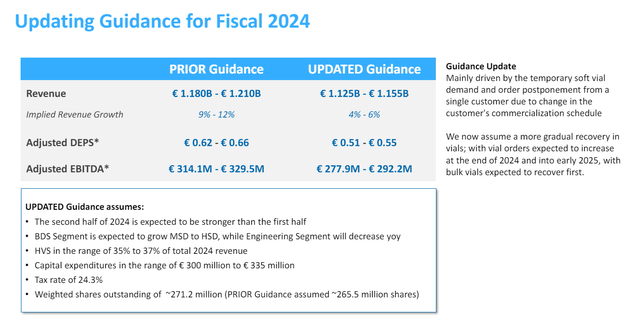

- Expanded capacity at Fisher and Latina will improve product mix and should help boost sales over the long term.

In detail, efforts are underway to expand production capacities as Stevanato continues to validate new lines. As for the Italian addition, commercial syringe production began last quarter. These lines will serve as a transition from bulk to sterile cartridges for one customer. As for the Indiana facility, the company plans to start commercial production in the second half of 2024. This capacity will support biologics-related demand and GLP-1. There was no news on an expansion in China; however, it could become a contract manufacturing capacity for large customers in 2026.

In addition, Stevanato injected around €170 million into the company’s capital through a capital increase, reducing its debt to €186.9 million from €324 million at the end of December.

Stevanate production capacity expansion

Figure 3

Changes in revenue and valuation

Following the first quarter performance and Stevanato’s guidance change, we updated our EBITDA forecasts for 2024 and 2025 to €275 million and €310 million, respectively. Single-digit growth rates impact the company, and we have lowered our 2024 sales forecast from €1.12 billion, which is in line with Stevanato’s new outlook. Taking into account the equity injection, we lowered interest payments to €8 million per year and our technical guidance on corporate taxes remained unchanged, resulting in net profit of €135 million and EPS of €0.49 per share.

In terms of valuation, our 12-month forward price target is derived by applying the EV/EBITDA multiple to our base case TTM EBITDA. Applying our 24x EV/EBITDA multiple, which is in line with Stevanato’s peers, and using projected debt and cash levels, we lower our price target to $23.75 per share. With respect to Stevanato’s peers, the company is no longer trading at a premium. We used the average EV/EBITDA valuation of Schott Pharma AG, Gerresheimer AG, and West Pharmaceutical Services Inc. On the balance sheet side, taking into account capital injections and CAPEX plans, our net debt is €207 million at year end.

risk

Downside risks to Stevanato’s target price include 1) slowing demand for biologics, 2) increased competition from Chinese companies, 3) asset exchange risk, 4) failure to make significant new capital investments that could impact top-line performance, 5) lower sector multiple valuation, 6) regulatory change, and 7) US-China relations regarding drug supply agreements. Additionally, the company is exposed to currency risk.

Conclusion

Last time, we reported that “industry-wide destocking activity should subside.” Despite the company’s 2027 financial targets being confirmed, we were more cautious. With the release of the first quarter and this reset, we see favorable tailwinds for the future. For this reason, we now have a buy recommendation on Stevanato with a price target of $23.75 per share.