As disruption continues, insurers are being asked to reinvent themselves. To transform at the operational level, insurance companies need to move from complexity to simplicity. This alone is a daunting task. Composable architecture helps insurers simplify this complexity at every stage of the insurance value chain using the processes they already have at their disposal. Here are five practical use cases for composable architectures.

1. Policy Management – From complex organizational structures to agile, integrated ecosystems

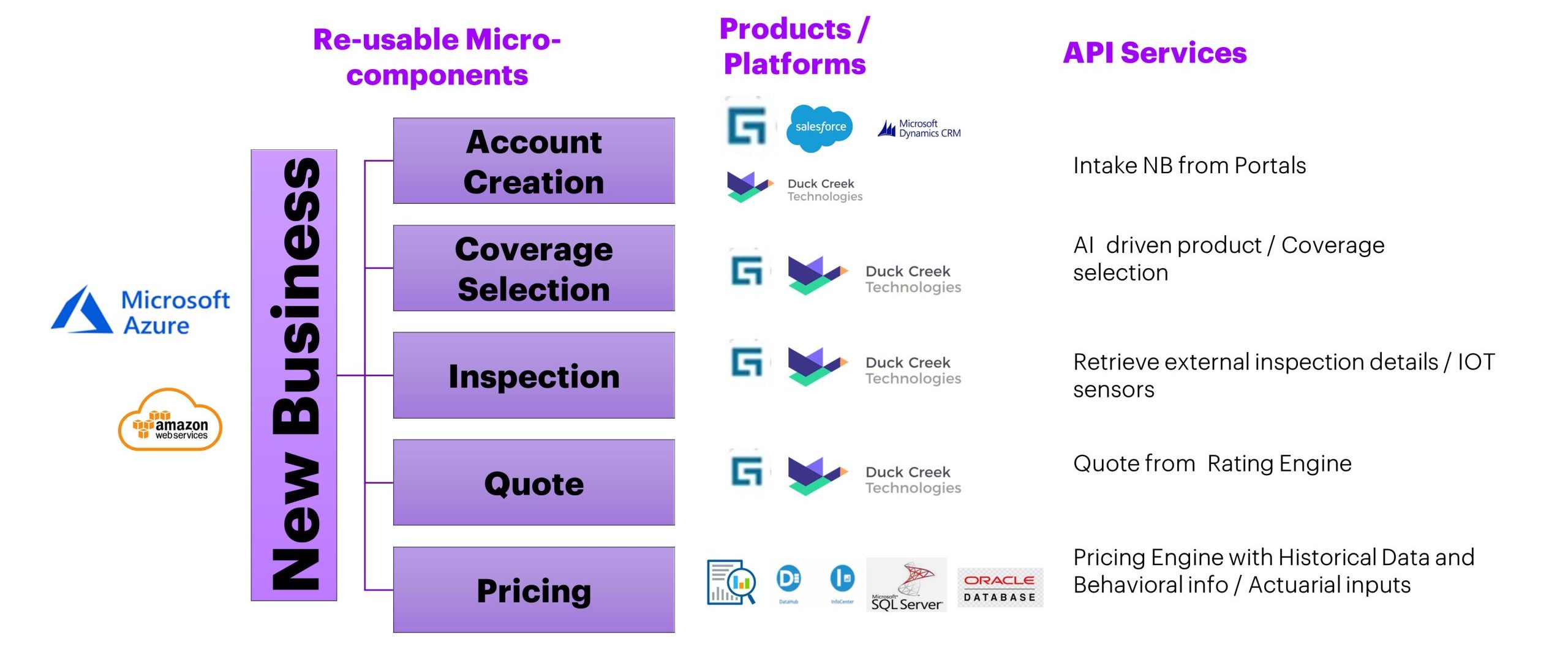

Many of the services for applying for new insurance coverage can be bundled. This will enable insurers to capture applications from digital portals and AI-based product/coverage selection engines. It establishes a pre-qualification engine based on data from various vendors, including distance to shore, CLUE reports, risk inspections using IoT sensors (surveillance systems, smart appliances, smart meters, etc.), and externalized assessments. It also helps. and a pricing engine. This allows you to distribute development, integration, and testing efforts and incorporate new business policy applications at a faster pace. Splitting a process into multiple subprocesses allows users to interact with the process at different points in the insurance contract transaction timeline, such as when creating or renewing a financial endorsement.

2. Billing management – from manual to automated individual invoicing

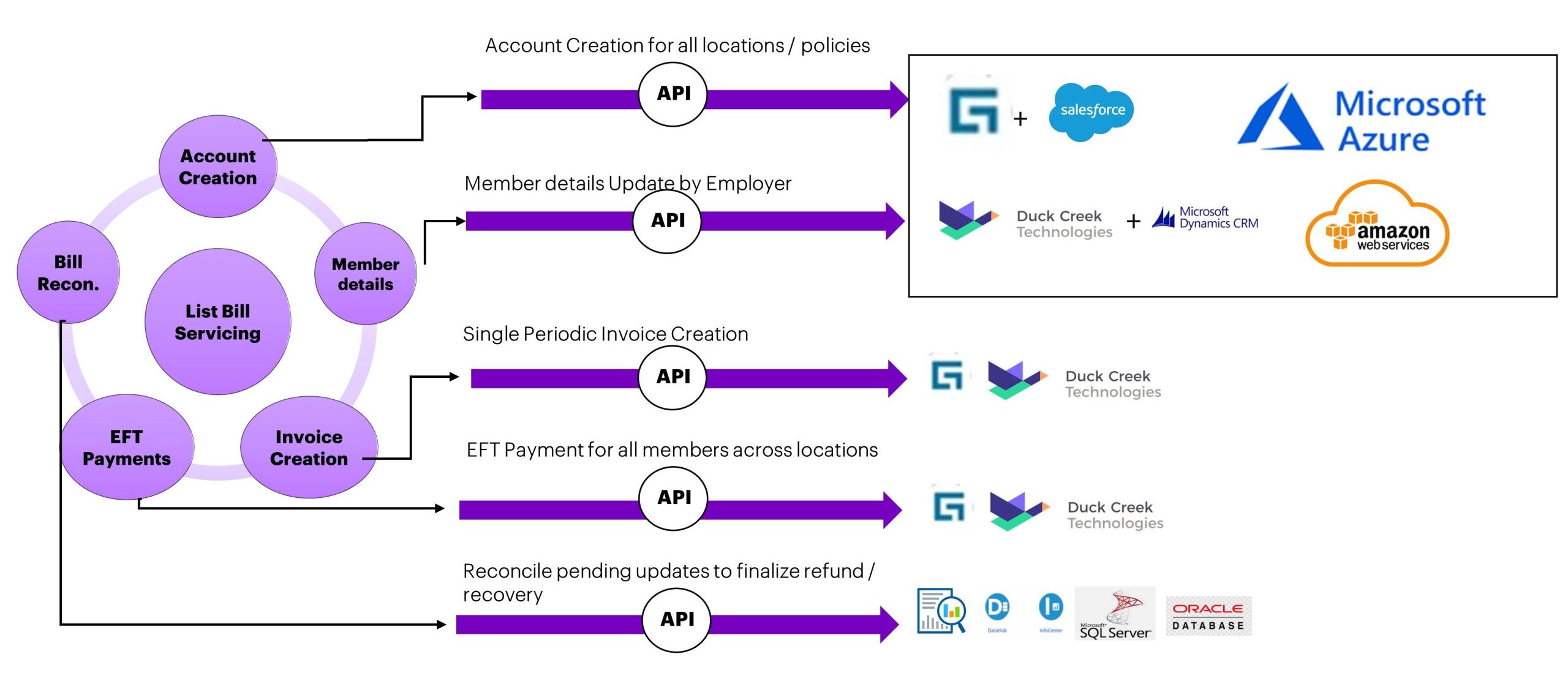

For billing management, a list of billing service breakdowns can be used to build reusable functionality such as account creation and member details updates. Invoices are generated for transactions across multiple policyholders or agents at a specific frequency to complete his EFT payments to various policyholders across locations. Collection and refund transactions can be triggered based on audit tasks completed at the end of the policy year. Many of these individual services can also be reused for regular audits of commercial lines.

3. Transforming claims with configurability – from a rigid claims solution to a dynamic claims solution

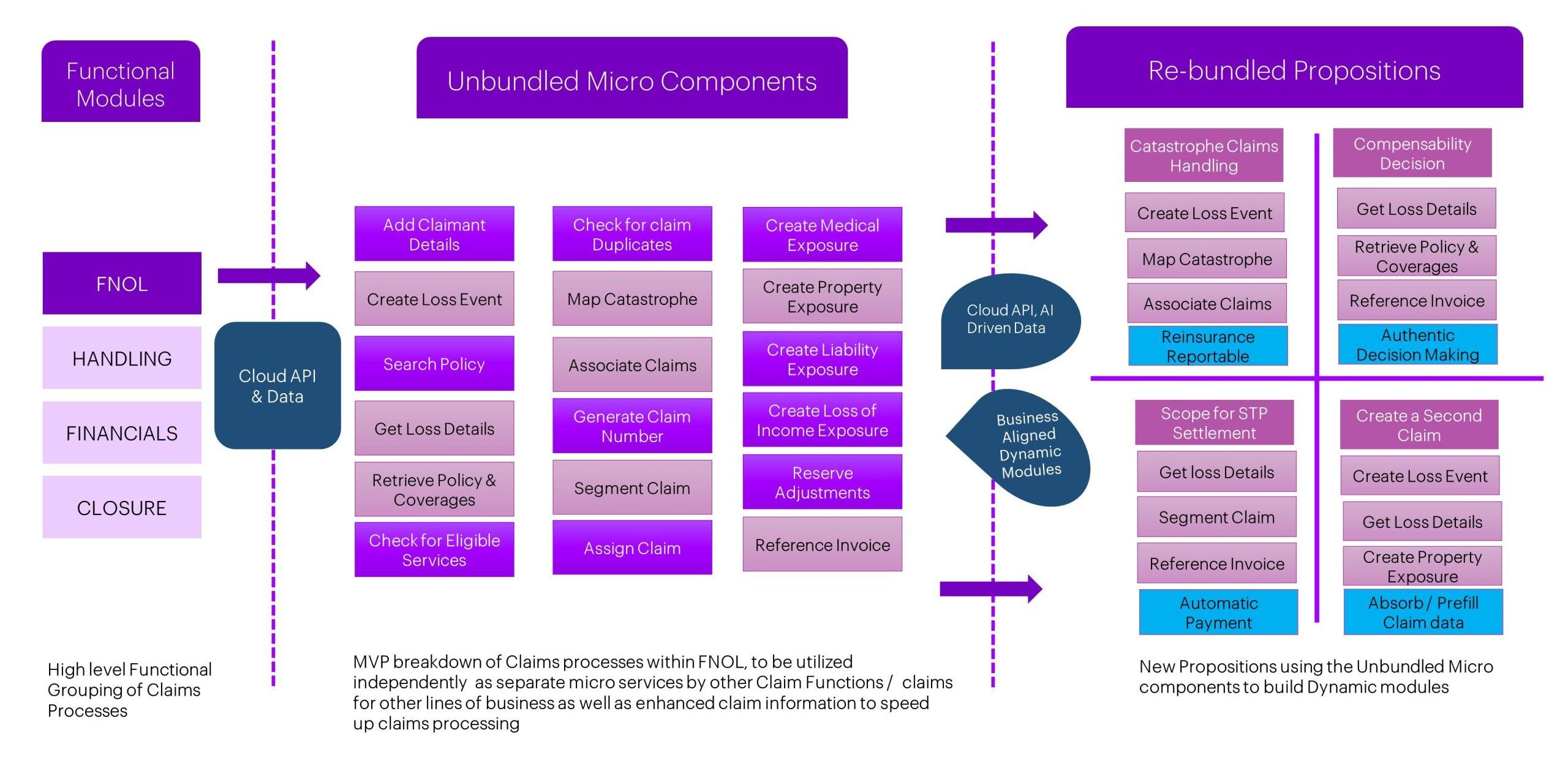

Claims processing has four high-level modules: First Notification of Loss (FNOL), Processing, Financials, and Claims Closing. The FNOL process has micro-level services that can be bundled as separate application programming interface (API) services to internal and external systems and are listed as unbundled micro-components. The composability business model allows you to rebundle these unbundled components to build dynamic modules.

4. Straight-through processing (STP) in claims – from lengthy review processes to API-driven automated approvals

Straight-through processing (STP) claims are high-volume, low-value claims that can be paid immediately without a detailed adjudication process. In this case, different APIs are used in the following processes, starting from the base of receipt acceptance. Search and retrieve policies. Attach invoices by automatically pushing invoices with vehicle number or invoice number. Check the scope of specific details on your invoice. Check if the claim amount is less than the STP threshold defined by your insurance company (for example, $350). Based on the results of all these API processes, the claim payment is automatically approved and the amount is immediately disbursed to the insured. These can be used for auto “glass only” claims and low-cost medical injury claims.

5. Monolith Simplification – From large legacy infrastructure to a modular, agile approach

In our current conversations with clients, we recommend simplifying the monolith structure to effectively implement composable architectures. This refers to the process of gradually dismantling the current infrastructure and rebuilding it in a more efficient manner. Monolith simplification helps clients minimize risk when they have an active monolith application that supports their business and is constantly undergoing enhancements.

Once you decide that composable design is a good fit, approach it in three steps: understand the challenge, evaluate the necessary actions, and implement the solution. Following this first approach, you can create additional component checklists to categorize your monolith experience.

Contact us to find out how you can use this to streamline and grow your insurance business. Reinventing the entire enterprise.