In Q1 2024, fintech venture capital (VC) funding experienced a notable decline, dropping by 16% compared to the previous quarter, new data released by market intelligence platform CB Insights show. The total funding amounted to US$7.3 billion, marking the lowest quarterly level since 2017.

Quarterly fintech equity funding and deals, Source: State of Fintech Q1 2024, CB Insights, Apr 2024

The data, presented in the “State of Fintech Q1 2024” report, illustrates the continued downward trajectory in fintech funding this year as investors continue to opt for smaller investments. In Q1 2024, the average deal size stood at US$11.1 million, down 19% from 2023. Moreover, the number of mega-rounds worth US$100 million and over declined substantially, totaling a mere 12 rounds in Q1 2024. These rounds represented just 26% of total fintech VC funding during the quarter, the lowest share since Q2 2023.

Quarterly fintech funding and deals from mega-rounds, Source: State of Fintech Q1 2024, CB Insights, Apr 2024

In terms of geographical distribution, the US maintained its position as the global leader in fintech funding, amassing a total of US$3.3 billion through 393 deals in Q1 2024. Following the US are Europe with US$2.2 billion and 203 deals, and Asia with US$1 billion raised across 210 rounds.

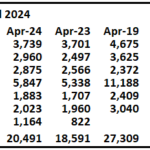

Fintech funding and deals by global region in Q1 2024, Source: State of Fintech Q1 2024, CB Insights, Apr 2024

The CB Insights report also provides insights into the largest VC funding rounds secured during the past quarter.

Today, we look at the biggest rounds of VC capital secured by Asian fintech startups in Q1 2024, delving into these companies’ product offerings, recent achievements and growth strategies.

HashKey Group – US$100 million, Series A

HashKey Group, a cryptocurrency firm headquartered in Hong Kong, said in January that it had raised nearly US$100 million after the completion of a Series A financing round. The funding resulted in a pre-money valuation exceeding US$1.2 billion.

Established in 2018, HashKey Group is a leading end-to-end digital asset financial services group. Headquartered in Hong Kong and with operations in Singapore and Tokyo, the company has a wide range of businesses that provide retail investors, large institutions, family offices, funds, and professional and accredited investors with innovative investment opportunities and end-to-end solutions in the fields of digital assets and the Web3 ecosystem.

HashKey Group’s core businesses include HashKey Exchange, a licensed virtual asset exchange regulated by the Securities and Futures Commission of Hong Kong; HashKey Capital, a global asset manager investing exclusively in blockchain technology and digital assets; HashKey Cloud, a blockchain node validation service provider; HashKey Tokenisation, a tokenization services provider; and HashKey NFT, a Web3 incubation and community operation service provider, among others.

HashKey Group said that it would use the proceeds from its US$100 million round to strengthen its Web3 ecosystem, enhance product diversification of its licensed business in Hong Kong and support its global development.

In August 2023, HashKey Group achieved a significant milestone when it became the first licensed crypto trading exchange in Hong Kong to extend its services to retail users. This expansion broadened its market reach from solely catering to professional investors to include retail users as well.

Perfios – US$80 million, Series D

Perfios, a business-to-business (B2B) software-as-a-service (SaaS) provider from India, announced in March a US$80 million Series D funding round. The startup said it would use the proceeds to continue its international expansion to Southeast Asia, the Middle East, and Africa, and strengthen its global footprint. It will also continue to invest in its comprehensive tech stack to power the end-to-end customer journeys across banking, insurance, and embedded commerce.

Founded in 2008, Perfios is a B2B SaaS company serving the banking, financial services and insurance industry in 18 countries, empowering 1,000+ financial institutions. Through its software platforms and products, Perfios helps financial institutions take big leaps by shaping their origination, onboarding, decisioning, underwriting and monitoring processes at scale and speed. It does so by delivering 8.2 billion data points to banks and financial institutions every year to facilitate faster decisioning, and processing 1.7 billion transactions a year with assets under management (AUM) of US$36 billion.

Perfios is headquartered in Bangalore, with offices worldwide and with 75+ products and platforms, and over 500+ APIs. The startup has raised US$443 million in debt and equity funding so far, according to CB Insights.

Perfios said it would use the proceeds from its Series D to continue its international expansion to Southeast Asia, the Middle East, and Africa, and strengthen its global footprint. It will also continue to invest in its comprehensive tech stack to power the end-to-end customer journeys across banking, insurance, and embedded commerce.

Uzum – US$52 million, Series A

Uzum, a digital services ecosystem in Uzbekistan, secured in March more than US$100 million in funding hrough a combination of a Series A and debt financing. More than US$50 million was secured in equity funding. According to the startup, the round made Uzum the first tech company in Uzbekistan to achieve unicorn status with a post-money valuation of over US$1 billion.

Uzum’s digital ecosystem seamlessly integrates e-commerce, fintech, and banking services, catering to both individuals and small to medium-sized enterprises (SMEs). With offerings including a marketplace, express delivery service, traditional and digital banks, automotive marketplace, and entrepreneur app, Uzum is streamlining digital transactions and empowering businesses across the country.

By the end of 2023, Uzum claimed 10 million monthly average users and nearly US$100 million in net profit, with its retail banking, fintech, and e-commerce businesses leading the market in terms of profitability and user engagement.

Uzum said it would use the proceeds from its Series A to advance “develop the country’s IT and logistics infrastructure”, as well as to fund its own buy now, pay later (BNPL) service.

Looking ahead, Uzum plans to raise additional financing of approximately US$200 million in a Series B funding round in 2024. The startup also wants to launch a large logistics complex for e-commerce in the country, which is expected to increase e-commerce turnover on its platform by more than 150% during the year. It also plans to launch a number of ecosystem products for unsecured lending to individuals as well as SMEs.

Qoala – US$47 million, Series C

Qoala, an Indonesian omnichannel insurtech startup, announced in March the completion of its Series C funding round, raising US$47 million led by PayPal Ventures and MassMutual Ventures. The funding brought the startup’s total funding raised to US$130 million.

Since its Series B fundraise in 2022, the insurtech startup has recorded a 2.5x growth in gross written premiums and currently processes up to 60% of total claims in-house, while delivering market-leading customer satisfaction. Notably, the impressive growth is predominantly attributed to their diversified partnership channels, which saw a significant expansion in business partners.

In 2023, Qoala processed over 115,000 claims and reached 45,000 new customers. Its diverse product portfolio and motivated 60,000+ marketers network further contribute to safeguarding its customers’ financial well-being. Through nationwide presence and impactful initiatives, the platform simplifies insurance and empowers individuals across Indonesia, making a significant societal impact.

Qoala said it would use the new capital from its Series C to propel the expansion of its embedded insurance business throughout Southeast Asia, bolster its tech-driven initiatives, and integrate artificial intelligence (AI) across all channels to enhance customer, agent, and partner experiences. Furthermore, the startup aims to diversify its product offerings and distribution channels for its agent platform, while also pursuing strategic acquisitions and partnerships across various verticals to accelerate growth and solidify its leading market position in the region.

Annapurna Finance – US$36 million, Corporate Minority

In January, Annapurna Finance, a non-banking financial company (NBFC) from India, raised about US$36 million in equity financing from Piramal Alternatives Trust (PAT), a wholly-owned subsidiary of Piramal Enterprises.

Established in 2009, Annapurna Finance is a NBFC headquartered in Odisha. The company is one of the top 10 MFIs in India, with AUM of more than US$1 billion as of September 2023.

Annapurna Finance has more than 1,275 branches and a customer base of over 2.5 million spread across 20 states. The company’s diversified product offerings range from microfinance, constituting 86% of AUM, to secured and unsecured loans catering to SMEs (14% of AUM).

The partnership between PAT and Annapurna Finance signifies a strategic alignment aimed at fostering further growth and innovation in the NBFC sector. With PAT’s backing and Annapurna Finance’s proven track record, the collaboration is poised to unlock new opportunities and enhance financial inclusion initiatives.

Annapurna Finance’s AUM has surged at a compound annual growth rate (CAGR) of 29% over the past three years, reaching US$188 million in fiscal year 2023, a substantial leap from US$480 million in fiscal year 2020.

AwanTunai – US$27.5 million, Series B

Indonesian fintech startup AwanTunai closed in March a US$27.5 million Series B funding round. The Jakarta-based company, known for its point-of-sale (POS) financing solutions, has surpassed its initial target of US$25 million due to heightened investor interest.

Established in 2017, AwanTunai is a POS solution aimed at digitizing Indonesia’s vast cash economy. The startup builds digital distribution to thousands of micro-retail merchants who can then access working capital as well as accept payment from AwanTunai consumer credit. The startup also issues mobile-based consumer credit, serving the 100 million Indonesians unable to access banking products. Currently, AwanTunai has over 80,000 active micro, small and medium-sized enterprises (MSMEs) on its platform.

The company plans to utilize the capital from its Series B to enhance its equity base, facilitating the expansion of lending capital facilities. The startup’s goal is to support over US$2 billion of annualized inventory purchase financing by the end of 2024. It’s also looking to further expand its geographical footprint in Indonesia and to increase its supplier and merchant outreach.

Xcelerate – US$25 million, Growth Equity

Xcelerate, a governance, risk and compliance platform headquartered in Singapore, raised over US$25 million in an equity funding round in February.

Founded in 2021, Xcelerate offers comprehensive solutions to corporates to help them maintain the highest levels of governance standards, manage risk and ensure compliance with various statutes, laws, and regulations, both internal and external.

The company aims to create a regional platform offering software solutions and services catering to the governance risk and compliance (GRC) and environmental, social and governance (ESG) requirements of organisations operating across Asia-Pacific (APAC) and other regions. It strives to bring global solutions, tools and technologies together and build highly qualified and experienced teams through a roll-up strategy of acquisitions and partnerships to create comprehensive solutions.

Xcelerate said it would use the proceeds from its funding round to pursue strategic acquisition opportunities and invest in its operations, team and technology.

Oobit – US$25 million, Series A

Mobile payment app Oobit concluded in February its Series A funding round, raising US$25 million to advance the adoption of cryptocurrencies as a means of payment.

Founded in 2007, Oobit provides the gateway to spending crypto in traditional commerce settings. Consumers pay with their crypto, but merchants receive fiat money, exactly like a typical credit card transaction. While consumers and merchants experience a simple Tap and Pay solution, numerous critical processes and transactions occur behind the scenes in near-real-time, allowing for complete seamlessness.

In the near future, Oobit intends to extend its capabilities to external third-party wallets, creating a bridge between Web3 and spending. This strategic move will transition Oobit into a non-custodial crypto payments app, allowing external wallets to Tap and Pay with crypto anytime, anywhere, just by connecting via the Oobit app.

Featured image credit: edited from freepik