Richard Drury

Housing is one of the most interest rate sensitive sectors of the economy. It is also one of the most cyclical and important inputs to the business cycle. Based on this, we can reasonably expect interest rates to rise sharply beyond this period. The past two years would have shattered the trend in home prices. While the effects have been around for a while, the dramatic decline in year-over-year changes in U.S. home prices is once again accelerating. Reflation has been slow so far, at least compared to 2021-2022. But it’s notable that after the Federal Reserve’s most aggressive tightening policy in decades, and before the rate cut materialized, home prices were showing resilience again.

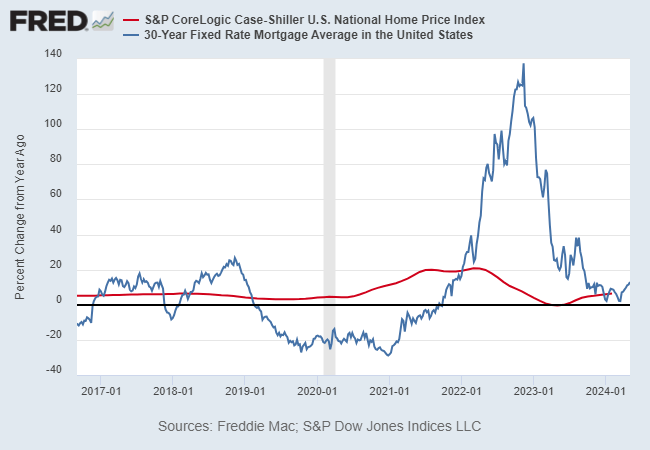

Recent history speaks for itself. After the Fed began rapidly raising rates in early 2022, 30-year mortgage rates rose sharply and by late 2022 were more than double what they were then. Last year’s level. The strong year-on-year increase in home prices at the time quickly took a hit, with annual increases of around 20% in the second half of 2022 to flattening in 2023. But in recent months, home prices have rebounded and are even higher than before. 6% per annum based on the S&P CoreLogic U.S. National Home Price Index.

The resurgence of strong housing price trends is notable for several reasons. First, it comes before the Fed starts cutting rates. In fact, market expectations for interest rate cuts have been pushed back further, which tends to delay housing relief in the form of lower borrowing costs.

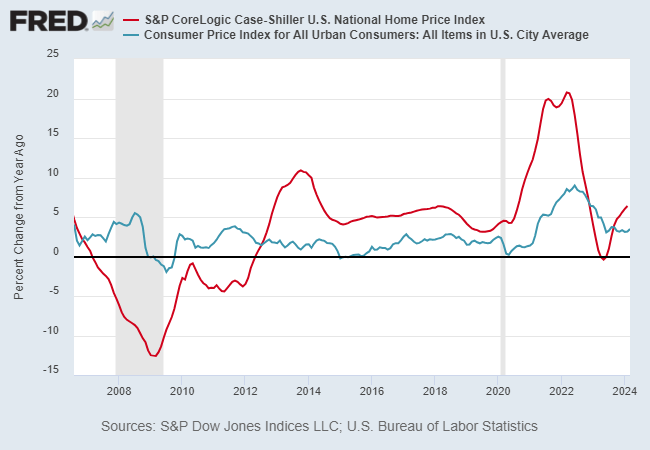

Meanwhile, year-on-year housing prices are once again rising faster than consumer inflation. This suggests that housing is a contributing factor to the thorny inflation problem the Fed is grappling with this year.

Another implication is that once the Fed begins cutting rates, it could begin as early as September. federal funds futures, Policy easing could further strengthen the recent resurgence in housing inflation, which could lead to a prolonged period of inflation.

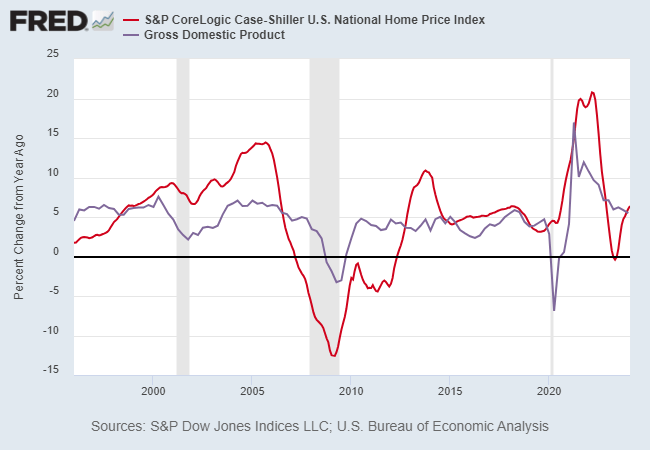

Reflation in housing prices is also noticeable, and they are once again rising at a pace that exceeds the year-on-year economic growth rate on a nominal GDP basis. U.S. production rose 5.4% in the first quarter from a year earlier, slower than the rate of home price growth.

“The housing market is proving more resilient to tightening policy than it has been in the past,” said Neel Kashkari, president of the Federal Reserve Bank of Minneapolis. essay It was released on Tuesday (May 7th). As a result, to support a rate cut, “we need to see multiple positive inflation measures that suggest the process of deflation is on track.” He said At yesterday’s conference.

The challenge for central banks is to set policy at a time when economic growth is slowing and house prices remain resilient. One of the main reasons why disinflationary momentum has stalled seems to be due to the resurgence of housing inflation.

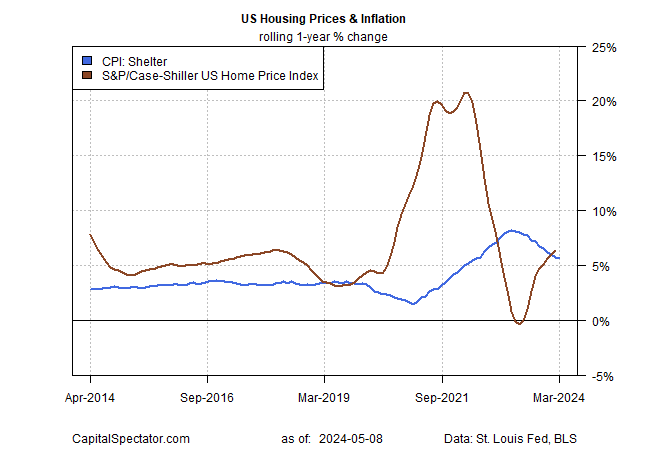

One possible warning sign is that home prices in the Consumer Price Index are again rising faster than home prices on a year-over-year basis.

This challenge is further exacerbated by the imbalance between housing demand and supply. “Housing is a serious problem in the United States, due in part to a significant shortage of affordable housing and high interest rates,” Treasury Secretary Janet Yellen said in a statement. To tell Bloomberg News. “That being said, I strongly believe, and I think it’s very likely, that the shelter costs that have been driving up inflation will come down.”

So far, there is no sign that Yellen’s beliefs will translate into hard numbers.

Editor’s note: The summary bullet points in this article were selected by Seeking Alpha editors.