smrm1977

preface

As a supplement to this article, please note the following: Motley Foolthe source of this latest list, and reliable dividend Both update their lists regularly.

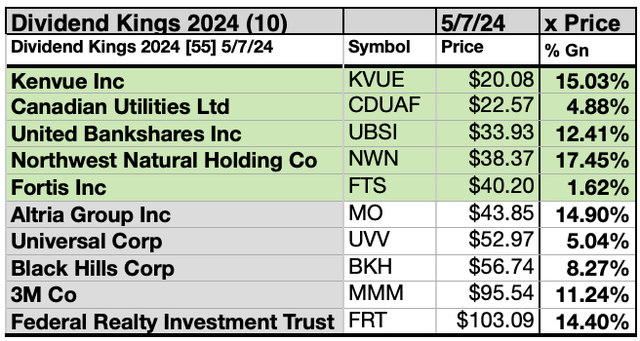

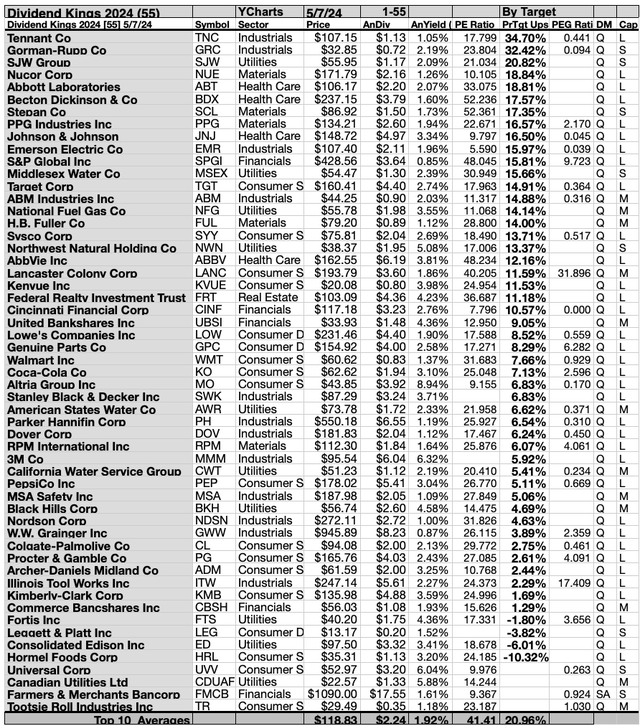

Although most of the May collection of 55 kings is too expensive to justify; Dividends are low, with 7 of the top 10 companies by yield and one more outside of that 10 fulfilling the ideal of providing an annual dividend (from a $1,000 investment) that exceeds the single stock price, and this month There are eight more companies. to look.

In the current market adjustment, these eight companies, Altria Group, Inc. (M.O.), Universal Corporation (UVV), Canadian Utilities Ltd. (OTCPK:CDUAF), Northwest Natural Holdings Co., Ltd. (northwest north), Fortis Co., Ltd. (FTS), United Bankshares Inc. (UBSI), Kenview Co., Ltd. (KVUE) (7 in the top 10), and Leggett & Platt Inc. (leg), (one outsider) maintains a fair value with an annual yield (from $1,000 invested) that matches or exceeds the single share price.

The eight companies to watch are: Hormel Foods Corp. (HRL); Black Hills Co., Ltd. (BKH); 3M Company (Hmm); Federal Realty Investment Trust (FRT); coca cola (K.O.); Archer Daniels Midland (ADM); Middlesex Water Company (MSEX); California Water Services Group (C.W.T.).

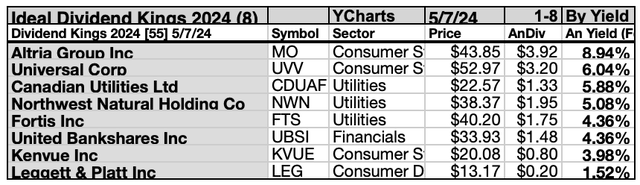

BKH is overvalued by $5.77, HRL is overvalued by $3.11, MMM is overvalued by $17.83, and FRT needs to fall by $37.05 to enter the ideal 8.

Four years after the Ides of March crash in 2020, it may be time to bring back the remaining eight highest-yielding king dogs… unless another big bear market looms. (The strategy then is to add to the position with any of the positions you hold.) Which of these kings (if any) exhibits a more “safer” dividend (covering the dividend To make sure you have enough cash, check the last bullet point at the top of the post May 15th.

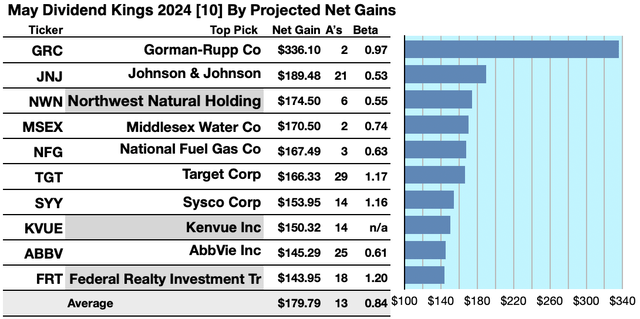

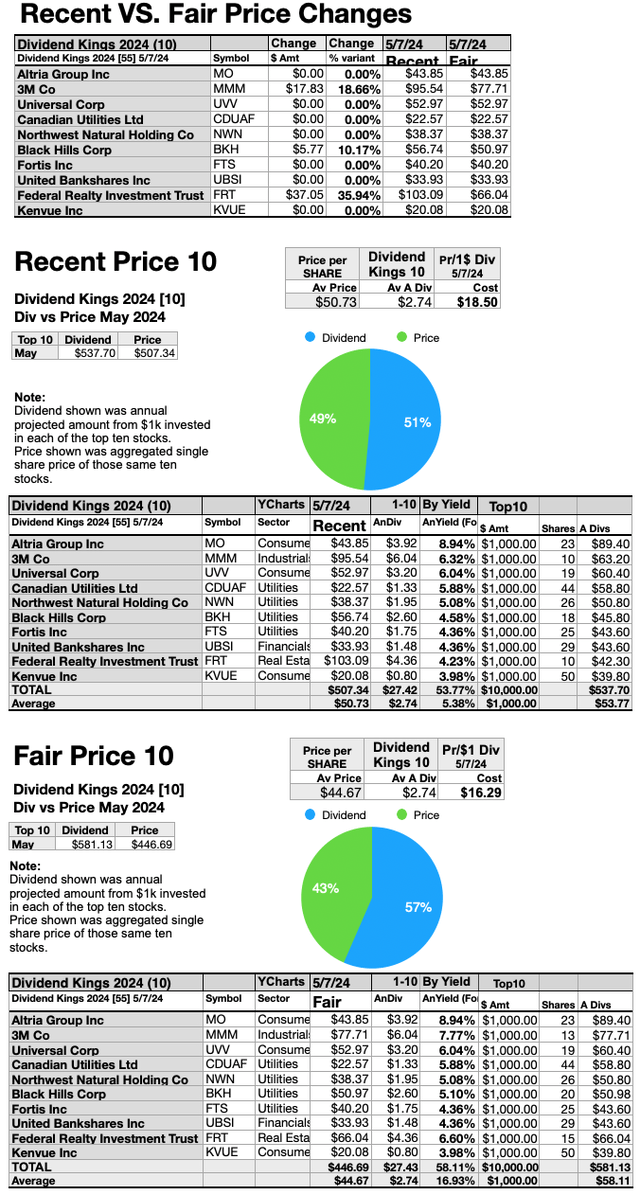

Practical Conclusion (1-10): Analysts predict Kingly’s Top 10 Net Margin to range from 14.53% to 33.61% by May 2025

Based on analysts’ one-year price targets, three of the top 10 yielding king stocks are among the top 10 gainers next year. (Colored gray in the graph below). Therefore, his April 10 prediction (as rated by his broker) based on this yield was 30% accurate.

YCharts reports the expected dividend yield for a $1,000 investment in each of these highest-yielding stocks, combined with their analysts’ one-year median price targets, for the following 2024-25 data points: was obtained. (Note: Single analyst price targets are not used.) Here are the 10 trades with the potential to generate projected profits by May 2025.

Gorman Rupp (G.R.C.) was expected to net $336.10, the median price target of two analysts plus dividends and broker commissions. The beta value shows that this estimate assumes a risk/volatility below his 3% of the overall market.

Johnson & Johnson (JNJ) was projected to net $189.48 based on the dividend plus the median price target of 21 analysts, less broker commissions. The beta value indicated that this estimate assumes 47% lower risk/volatility than the overall market.

Northwest Natural Holding’s net income was expected to be $174.50, less dividends and broker fees, based on the median target estimate of six analysts. The beta value indicated that this estimate assumes 45% lower risk/volatility than the overall market.

Middlesex Water Co.’s net income was expected to be $170.50, including dividends, the median price target of two analysts, and broker commissions. The beta value indicated that this estimate assumes 26% lower risk/volatility than the overall market.

National Fuel and Gas Company (NFG) was projected to net $167.49 based on the dividend plus the median price target of three analysts, less broker commissions. The beta value indicated that this estimate assumes 37% lower risk/volatility than the overall market.

Target Co., Ltd. (target) was projected to net $166.33 based on the dividend plus the median price target forecast of 29 analysts, less broker commissions. The beta value indicates that this estimate takes into account the 17% risk/volatility of the overall market.

Cisco Co., Ltd. (SYY) was expected to net $153.95 after 14 analyst price targets plus annual dividends and broker commissions. The beta value showed that this estimate is subject to 16% more risk/volatility than the overall market.

Kenview’s net income, calculated by subtracting dividends and broker commissions from the median price target of 14 analysts, was expected to be $150.32. KVUE’s beta number was not available.

AbbVie Inc. (ABV) Based on the median price target of 25 analysts, net income was $145.29, or dividends less broker commissions. The beta value showed that this risk/volatility-adjusted estimate was 39% lower than the overall market.

Federal Realty Investment Trust’s net income was expected to be $143.95, based on the median price target of 18 analysts, plus the annual dividend estimate and broker commissions. The beta value indicates that this estimate assumes 20% more risk/volatility than the overall market.

If you invested $10,000 as $1,000 in each of these 10 stocks, the average net return on dividends and price was estimated to be 17.98%. The average beta ranking indicated that these estimates were subject to risk/volatility 16% below the overall market.

Source: Open Source Dog Art (from divideddogcatcher.com)

Dividend Dog Law

Stocks earned the nickname “dogs” by exhibiting three characteristics: (1) they pay reliable, recurring dividends, (2) their prices decline, and (3) their yields (dividends/price) are in line with their peers. Higher than other companies. Therefore, the highest-yielding stocks in any collection became known as “dogs.” More precisely, even though they are “kings”, they are actually best described as “weakers”.

Top 50 Dividend Kings by Broker Target

Source: motleyfool.com/YCharts.com

This scale of broker-estimated price upside (or downside) provides a measure of market popularity. Note: No broker coverage or single broker coverage resulted in a score of 0 on the above scale. These broker quotes can be considered an emotional component (as opposed to the strictly monetary and objective dividend/price yield based reports below). As mentioned above, these scores may also be considered contrarian.

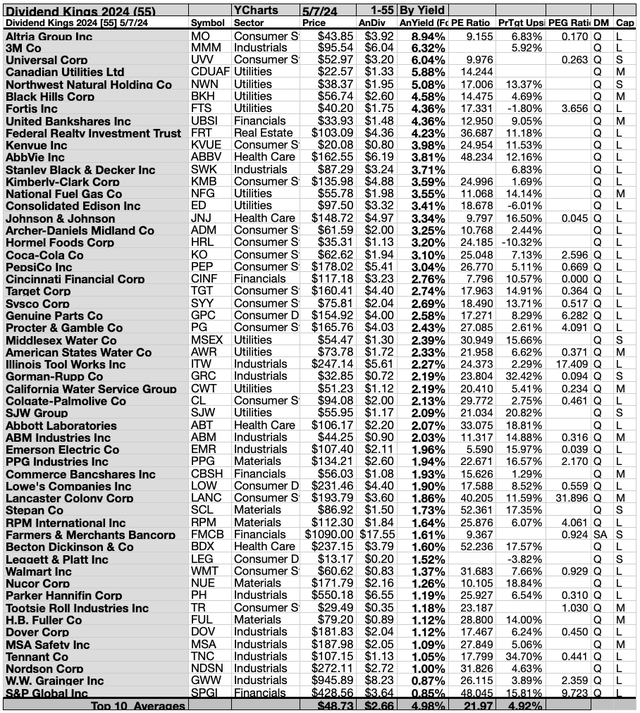

Dividend King Top 55 (by yield)

Source: motleyfool.com/YCharts.com

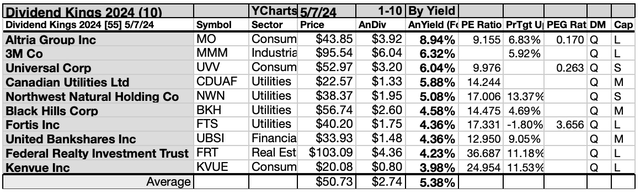

Practical Conclusions (11-20): Top 10 Stocks by yield are Dividend King May Dog

The top 10 King Dogs selected by yield on 5/7/24 accounted for 5 of 11 Morningstar categories.

first of three consumer defense The number one representative was Altria Group, Inc. (second place). His other companies ranked 3rd and 10th were Universal Corp. (3 listings) and Kenvue Inc. (10 listings).

2nd place was solo industrial 3M Co Sector Representative (2).

There were 4 people from 4th to 7th place. public worksCanadian Utilities Ltd (4), Northwest Natural Holding Co. (5), Black Hills Corp. (6), Fortis Inc. (7).

In the end, he won 8th place alone. Financial operations Sector member United Bankshares Inc. (8), alone in 9th place real estate Representative Federal Realty Investment Trust (9th place) completed the top 10 kings for May in terms of yield.

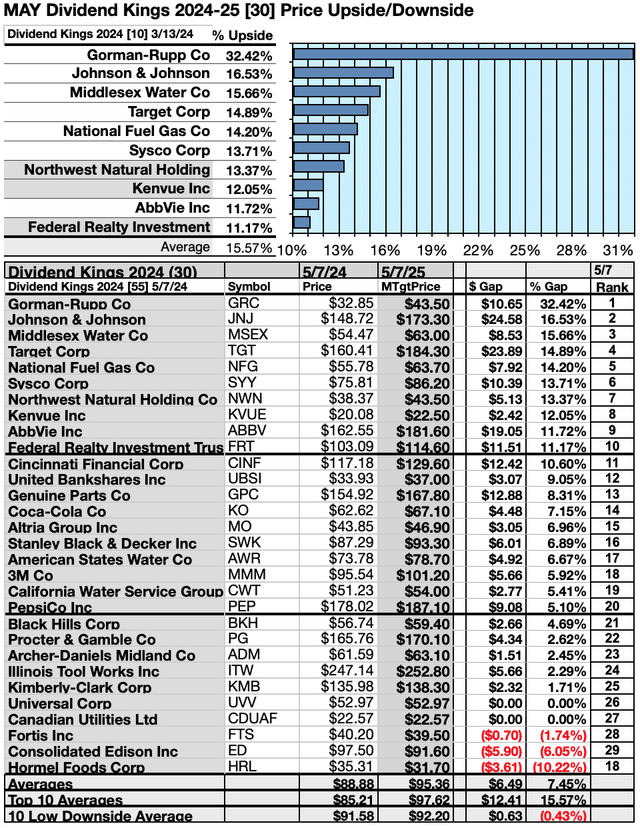

Practical conclusion: (21-30) The top 10 kings showed an increase of 11.17% to 32.42% by May 2024. (31) 3 -1.74% to -10.22% downside factors tagged

To quantify the highest yield rankings, we created a measure of “market sentiment” that uses the median price target forecast of analysts to measure upside potential. In addition to simple high-yield indicators, the median price target forecast by analysts has also become a tool for finding bargains.

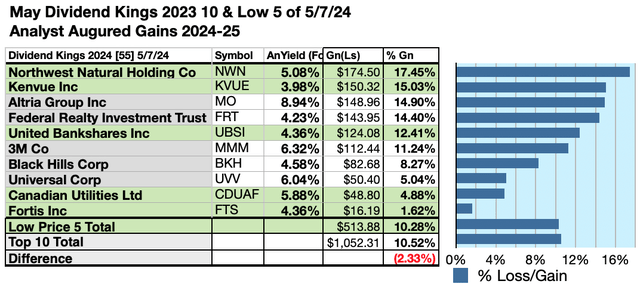

Analysts expect a 2.33% disadvantage on the five highest-yielding and lowest-priced Top 10 Dividend Kings by May 2025

The top 10 kings were chosen by monthly update yield. We have ranked the yield (dividend/price) results verified by YCharts.

As mentioned above, the top 10 kings with the highest dividend yield, picking 4/10/24, represented 6 of the 11 companies in the Morningstar Sector Scheme.

Actionable conclusion: Analysts have estimated the 5 lowest prices out of 10 highest yield Dividend King (32) is 10.28% vs. (33) 10.52% Net income by Allten By May 2025

The analyst’s one-year target is if you invest $5,000 at $1,000 each in the five lowest-priced stocks in the top 10 Dividend King rankings by yield, or if you invest $5,000 at $0.5,000 in all 10 stocks. It was predicted that the company would earn 2.33% less than the previous year. The fourth-lowest-priced and high-yielding King stock, Northwest Natural Holdings, was expected to deliver the highest net return of 17.45%.

As of May 7, the top five Dividend Kings with the lowest prices are: Canadian Utilities Limited; United Bancshares Ltd.; Northwest Natural Holding Company; Fortis Inc., prices between $20.08 and $40.20

As of April 10, the five highest-yielding dividend kings in the high price range were: Universal Inc.; Black Hills Inc.; 3M Co, Federal Realty’s price range was $43.85 to $103.09.

This distinction between the five low-priced dividend dogs and the ten general areas reflects Michael B. O’Higgins’ “Fundamental Method” for beating the Dow. The size of expected gains based on analyst targets has added a unique element of “market sentiment” to gauge upside potential. This gave him the here and now equivalent of waiting a year to see what would happen in the market. However, caution is advised, as analysts have historically only had 15% to 85% accuracy on the direction of change, and 0% to 15% accuracy on the extent of change.

Afterword

If you missed the 8 stock suggestions at the beginning of the article, we’ll restate the list at the end.

The following eight companies (as of May 7, 2024) have achieved the ideal of providing annual dividends greater than a single stock price from a $1,000 investment. Seven of the top 10 companies by yield and one of the top 10 companies are: While the ideal would be to offer more annual dividends (from a $1,000 investment) than a single stock price, there are eight more stocks to keep an eye on.

The eight companies to watch are Hormel Foods Corp., Black Hills Inc.; 3M Company; and Federal Realty Investment Trust. Coca-Cola; Archer Daniels Midland; Middlesex Water Company; California Water Services Group;

BKH is overvalued by $5.77, HRL is overvalued by $2.11, MMM is overvalued by $17.83, and FRT needs to fall by $37.05 to join the eight stocks.

Four years after the Ides of March crash in 2020, it’s almost time to bring back the remaining eight highest-yielding king dogs… unless another big bear market looms. (The strategy then is to add a position with one of the positions you currently hold.)

A fall in price or an increase in dividends could bring all of the top 10 Dividend Kings back to ‘fair value’ interest rates for investors.

The chart above shows the dollar and percentage difference because 7 of Dividend King’s top 10 stocks have a price lower than the annual dividend paid on a $1,000 investment. Note that the other three are within $5.77 to $37.05 of that. The middle chart compares seven ideals to three at recent prices. Fair pricing (if all top 10 horses fit the ideal) is shown in the chart below.

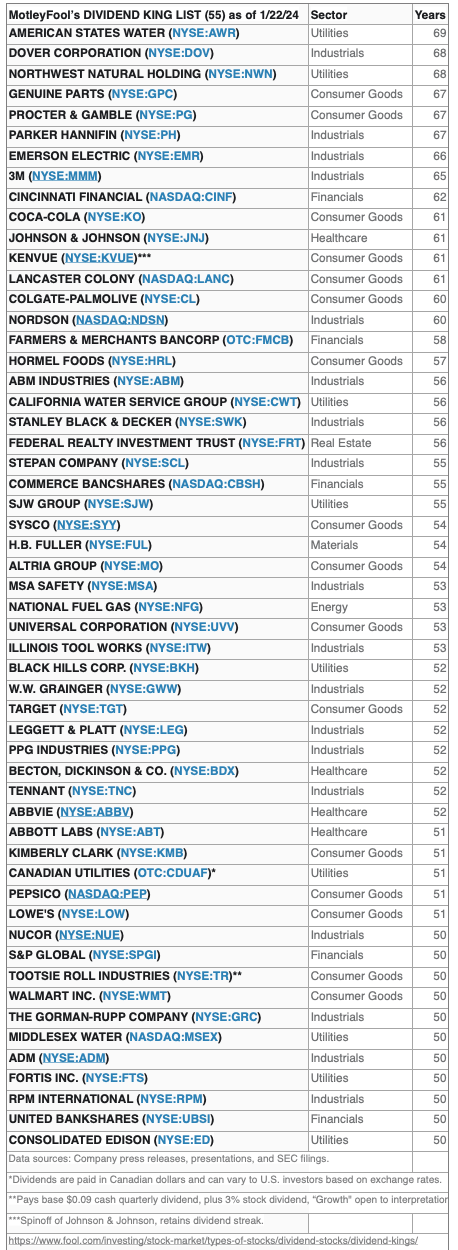

May Dividend King Increased dividend every year

Source: Motleyfool.com

The profit or loss estimates above do not take into account any foreign or domestic tax issues arising from the distribution. Please consult your tax advisor regarding the source and consequences of “dividends” from your investments.

The stocks listed above are suggested only as a possible reference in your research process to buy or sell Dividend King Dog stocks. These were not recommendations.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.