Emmanuel M. Schwermer

Understanding the difference between good short-term and long-term investing is important for most people. Some people want to trade as well as invest, but most people allocate funds to retirement accounts with long-term goals.

There Few commodities are more volatile than base metals such as copper. Base metals tend to be highly volatile, although price fluctuations in energy and bulk metal markets can be even more exaggerated. Freeport-McMoRan (New York Stock Exchange:FCX) it is maximum It is the world’s leading copper producer, recently surpassing Chile’s Codelco.free trade port Obtained Almost 80% of the company’s revenue comes from copper, and it also produces gold, molybdenum, and other minerals.

Major copper producers performed exceptionally well as demand surged from the pandemic, but the red metal remained in short supply.

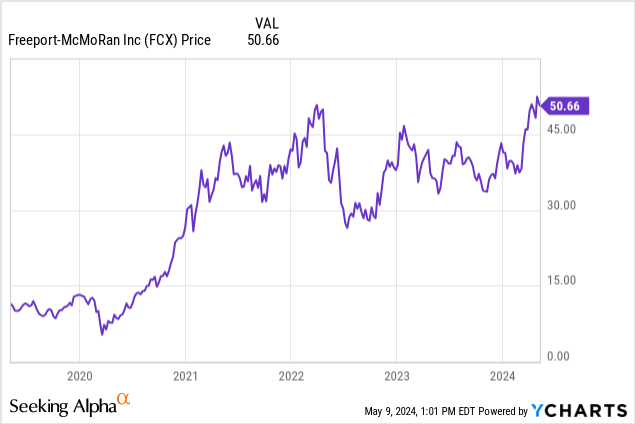

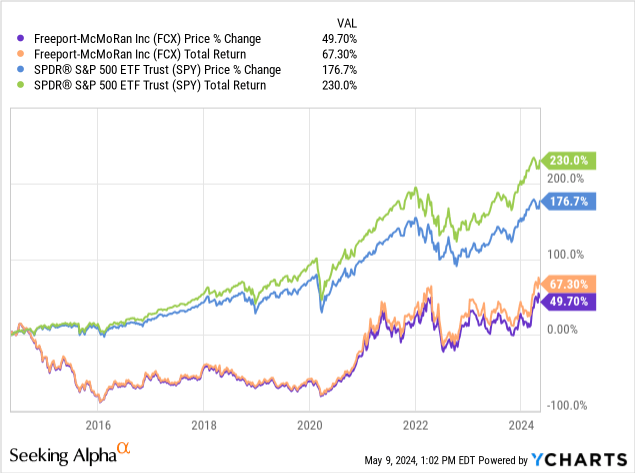

However, in stock It hasn’t grown anywhere over the past decade, and Freeport has also consistently underperformed the S&P 500 by a wide margin (spy) by a large margin.

Freeport has provided investors with a total return of 60.67% since 2014 while the S&P 500 has provided investors with a total return of 176.26% during the same period.

Today I will lower the company’s rating.i am the last I have written When I heard about Freeport in February 2023, I rated the company a Sell. Today I’m downgrading the company to Strong Sell. Copper prices have risen so far this year mainly due to supply concerns, but China’s growth outlook remains weak and the world’s second-largest economy is still grappling with significant overbuilding in its property and real estate sector. . China’s debt level also remains at a level of concern. Freeport has struggled to increase production for several years, and the company’s capital expenditures continue to rise, so a small increase in copper prices would provide minimal benefit to the company.

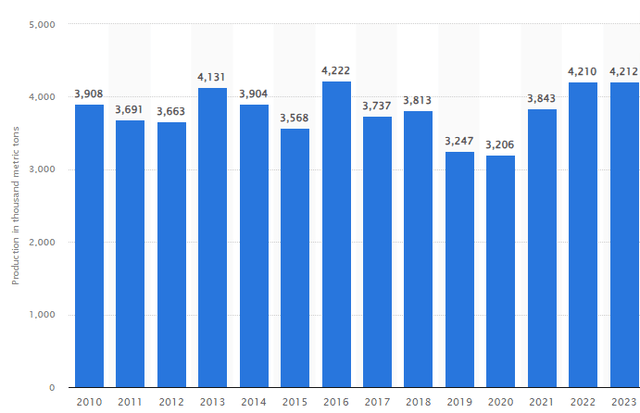

Freeport’s copper production has been flat since 2013, making Freeport highly susceptible to copper spot prices.

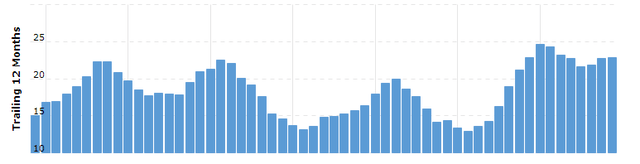

Freeport copper production data (macro trend)

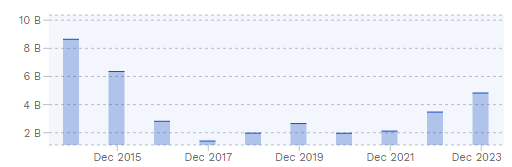

The world’s largest copper producer has increased its capital expenditures over the past three years, even though management expects capital expenditures to reach nearly $4.5 billion in 2024. It has been unable to meaningfully increase production for more than a decade. The company recently announced that it plans to make capital investments of $4.6 billion in 2024. Major copper producers continue to increase spending even though overall production levels have remained roughly the same over the past decade, including when compared to 2023 data.

Freeport capital investment (fin box)

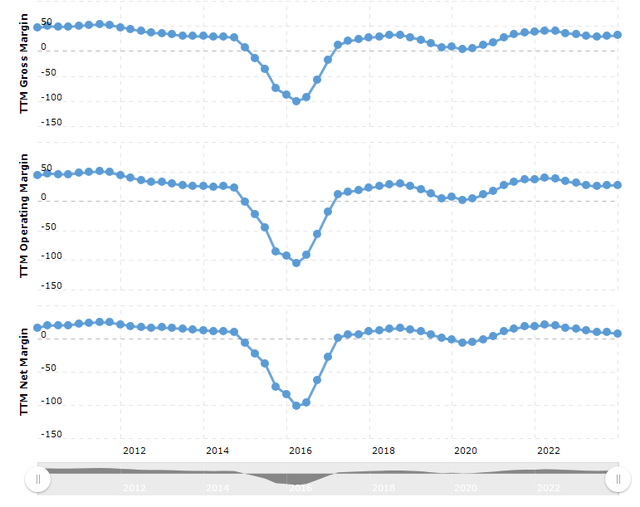

Freeport’s revenue has also been largely stagnant since 2011, when the company earned nearly $20.8 billion, but the copper producer earned $22.8 billion in 2023.

While the company is a well-run, low-cost producer, Freeport’s profit margins have not improved significantly over the past decade.

total copper producers margin Generally hovering consistently between 30-34% over the past four years, Freeport experienced cost increases last year due to: increased Shipping and Site Costs.

The recent rise in copper prices may also be unsustainable for multiple reasons. Analysts say this comes despite supply shortages caused largely by the closure of Panama’s largest copper mine ahead of recent elections, causing prices for the red metal to soar in the first four months of this year. Most of them showed a growth rate. Outlook The US and China are still in the doldrums, and China’s real estate and real estate sector is still in the doldrums. weak. Evergrande, one of China’s largest real estate development companies, declared Bankruptcy, and more recently Fitch. demoted Outlook for China’s housing industry.

Data on China’s real estate sector (National Bureau of Statistics)

IMF too Expect it China’s growth rate is expected to slow to 4.5% in 2024, with recent economic data from the world’s second-largest economy showing that retail sales and This indicates a slowdown in industrial production. strong In the country. Debt levels remain very high in China as well.This country’s debt to GDP ratio reach In 2023, it will reach a record level of 287.8%. The world’s second largest economy is bigIt is the world’s largest importer of copper, accounting for almost 60% of the world’s copper demand.

Copper prices have risen sharply this year, nearing the fastest rate in a decade. treble, but this move is probably not sustainable.Chinese smelters have made short-term production cuts; do not have This trend is likely to continue in the long term, with production at Panama’s largest copper mine expected to return to normal production levels once Panama’s president takes office. election finished. Panama’s Supreme Court ruled that the government’s labor contract with Canadian company First Quantum was unconstitutional, and Panama suspended production at the Cobre Panama mine shortly after the ruling. The mine accounts for nearly 5% of Panama’s economy and 1.5% of global copper production, and the government is likely to restart production at the site this year.

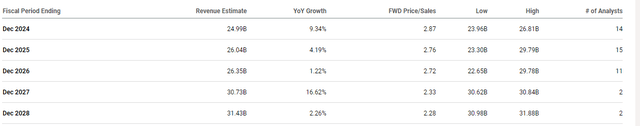

Freeport also appears to be significantly overvalued when looking at some metrics.major copper producer transaction Expected future GAAP earnings are 31.56x, expected future book value is 3.94x, and expected future cash flow is 10.43x. Freeport’s five-year average valuation is three times its expected future book value and 8.58 times its expected future cash flow. The average forward P/E using his GAAP earnings for this sector is also 18 times projected future earnings. Analysts also predict that copper producers’ earnings will only grow by 5% to 7% over the next four years.

Freeport earnings expectations grid (In search of alpha)

A cyclical company like Freeport, with modest revenue growth, is unlikely to trade at more than 12 to 14 times forward GAAP earnings estimates. Copper producers have also been reluctant to buy back large shares in the past, and as management spends more and more on production development, Freeport will reduce its existing $3 billion share buyback plan. It is unlikely that the company will return significant amounts of cash to shareholders. announced In 2021.

Freeport is a well-run company, and the copper producer has consistently had industry-leading profit margins for some time. Still, the world’s largest copper producers have not been able to significantly grow profits or increase production over the past decade, and copper prices will come under pressure as new supply begins in the second half of this year. likely to be exposed.