bet noir

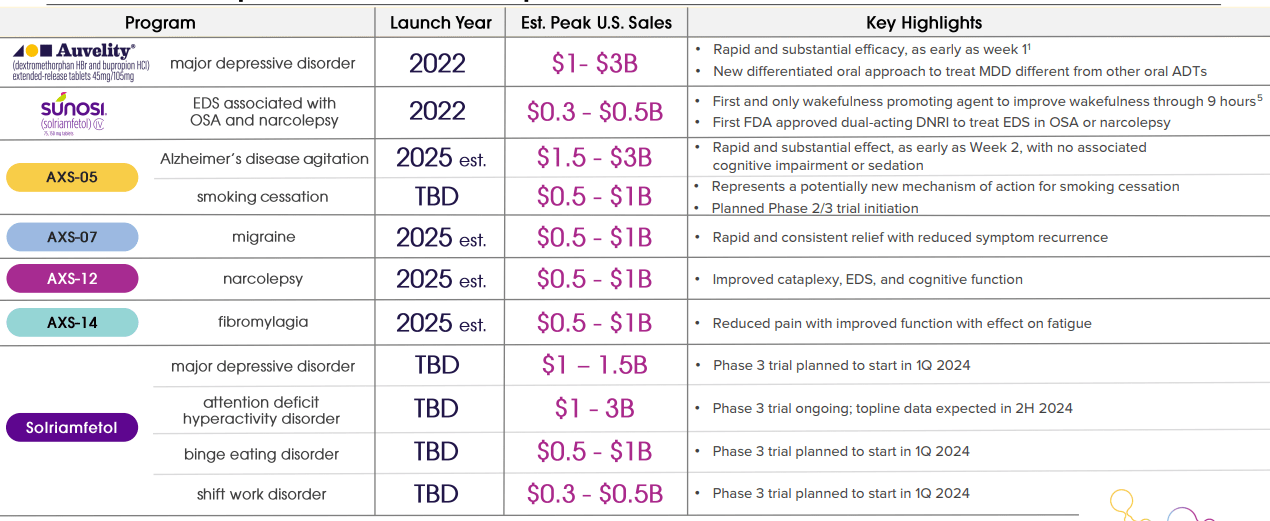

Axum Therapeutics (Nasdaq:AXSM) is developing new treatments for central nervous system (CNS) conditions. The company has two commercially available products. One is Auvelity, launched in 2022 for major depressive disorder, and the other is Sunosi, launched in the same year for sleep disorders related to narcolepsy and obstructive sleep. Apnea.

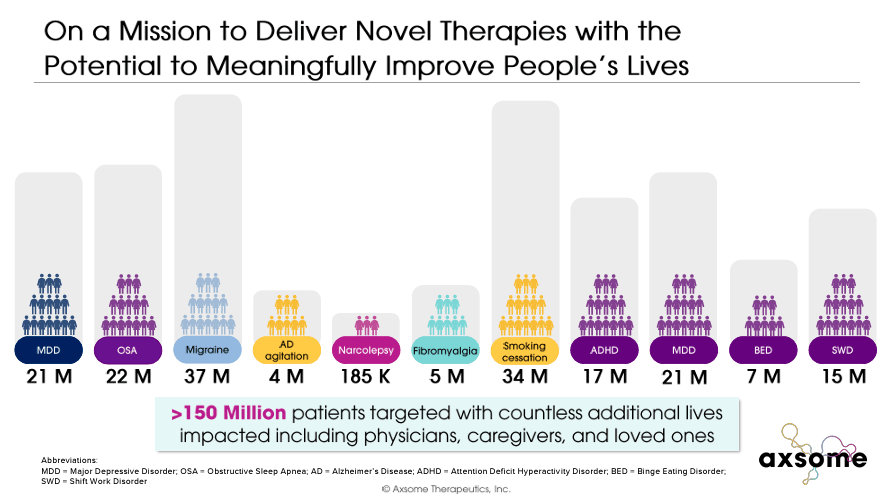

AXSM is also a late-stage candidate for diseases such as Alzheimer’s agitation, smoking cessation, migraines, narcolepsy, fibromyalgia, bulimia, attention-deficit/hyperactivity disorder (ADHD), and shift work disorder. We are developing a diverse portfolio that includes: This diverse portfolio addresses the medical needs of more than 150 million people suffering from these mental and neurological disorders. I believe AXSM is a good buy at these prices because the return potential and likelihood of achieving it outweigh the typical biotech risks.

Peak Sales in the Billions of Dollars: Business Overview

Axsome Therapeutics is a biopharmaceutical company founded in 2012. Based in New York City, the company focuses on developing treatments for central nervous system (CNS) disorders. Its main value driver is Auvelity, which was approved for major depressive disorder (MDD) in 2022. Executives expect peak sales for this particular drug to be between $1 billion and $3 billion. Additionally, AXSM has commercialized his Sunosi and is developing other drug candidates that could be important value drivers, but they are mostly inventory catalysts pending FDA approval.

Source: Corporate Presentation, February 2024.

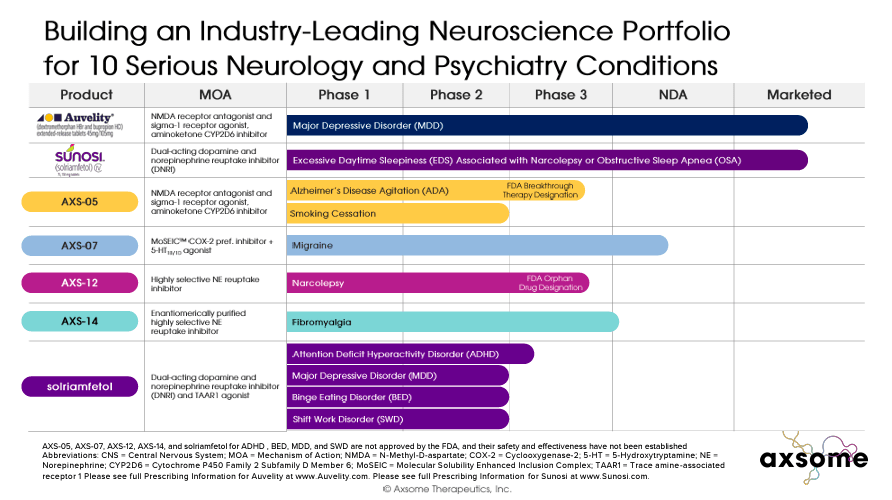

The company offers two commercial products: Auvelity and Sunosi. Auvelity was released in 2022. It is a combination of dextromethorphan and bupropion that addresses multiple pathways to treat MDD and aims to provide better efficacy than traditional antidepressants, which typically target only the serotonin system. Masu. Auvelity reduces depressive symptoms by targeting glutamatergic and catecholaminergic systems with dextromethorphan, which regulates glutamate levels that influence mood and emotional responses, and bupropion, which improves norepinephrine and dopamine neurotransmission. to maintain the effect.

Meanwhile, AXSM’s Sunosi (solriamfetol) was also launched in 2022. It is indicated for excessive daytime sleepiness (EDS) associated with narcolepsy and obstructive sleep apnea. Solriamfetol regulates sleep-wake states by inhibiting the reuptake of dopamine and norepinephrine and increasing access to these neurotransmitters in the brain.

Source: Corporate Presentation, February 2024.

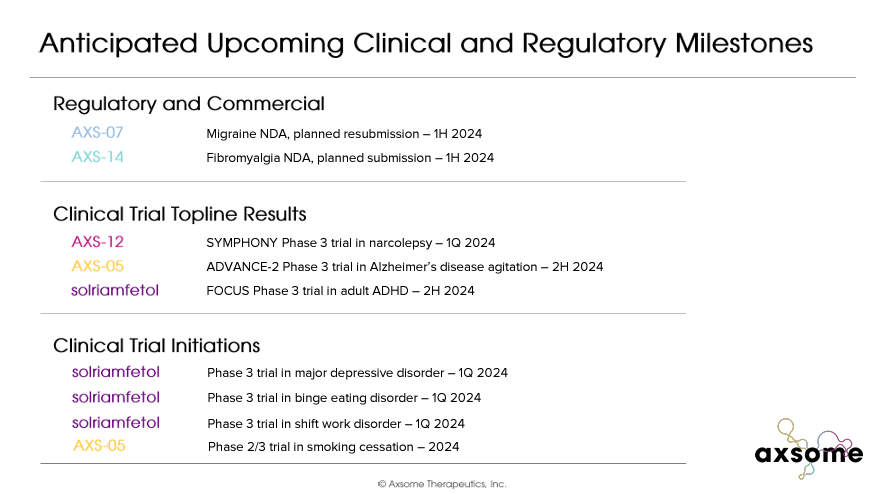

In addition to Auvelity and Sunosi, the company’s pipeline includes five late-stage drug candidates. 1) His AXS-05 for Alzheimer’s disease excitement is in Phase 3 clinical trials. Breakthrough FDA therapeutic designation. AXS-05 is being developed in Phase 2 for smoking cessation and may be a promising value driver in the future. 2) AXS-07 is indicated for migraine treatment and AXSM Plan to submit A new new drug application (NDA) approval phase for the previous commercialization is expected in the second half of 2024.

The third drug candidate is 3) AXS-12 and AXSM for narcolepsy. Announced results From Phase 3, where the primary endpoint was met. This means that AXS-12 is also on track for FDA approval. 4) AXS-14 for fibromyalgia is in Phase 3 and progressing to NDA after meeting approvals. Primary endpoint The state of the trial.

Finally, 5) Solriamfetol is entering Phase 3 for new indications, including major depressive disorder (MDD), and we expect to see top-line results in 2025. AXSM also expects topline results for binge eating disorder (BED) to be available in 2025. As for attention-deficit/hyperactivity disorder (ADHD), the company expects he will see top-line results in the second half of 2024. In addition, Solriamfetol is scheduled to begin Phase 3 in Q2 2024 for shift work disability (SWD).

Source: Corporate Presentation, February 2024.

AXSM commercial products and drug candidates handle 10 serious mental and neurological disorders that affect approximately 150 million patients in the United States. Therefore, the market potential is huge.In fact, AXSM believes that its portfolio Peak sales Up to $16.5 billion. Portfolio diversification also reduces regulatory risk, as if one drug candidate is not approved, the company still has other drugs in its pipeline.

Promising Trials Plus launches in 2025

recently financial statement, AXSM announced the progress of AXS-07 and AXS-14, which are nearing NDA submission. The company also mentioned its ACCORD-2 study on the AXS-05 drug candidate, which is prescribed for Alzheimer’s disease agitation. This trial is scheduled to begin in 2025, with he expected to complete in the second half of 2024. It is worth mentioning that his ACCORD-2 trial of AXSM is not required for FDA submission, but is designed to add robustness to the study.

During the conference call, executives explained that AXS-05 is positioned as a potentially safer and more effective drug for the treatment of Alzheimer’s disease than FDA-approved brexpiprazole. Brexpiprazole, commercially known as Rexulti. Rexulti is an antipsychotic drug that stabilizes mood by modulating serotonin and dopamine receptors. Executives said clinical trial results show AXS-05’s dual mechanism of action provides better symptom control while reducing side effects, giving the company a competitive advantage if the drug is approved. He said that it suggests that he has sex.

This is important because Alzheimer’s agitation is present in more than 70% of Alzheimer’s patients and is associated with accelerated cognitive decline and increased risk of death.there were 6.7 million In 2023, the number of AD patients will increase in the United States alone, so the market will become quite large.

Source: Corporate Presentation, February 2024.

As previously stated, in March 2024, AXSM announced There were positive topline results for AXS-12, a drug prescribed for narcolepsy. The drug met its primary endpoints by reducing the frequency of cataplexy and severity of excessive daytime sleepiness (EDS) compared to placebo and was well tolerated by patients. The FDA has granted orphan drug designation to AXS-12, and executives believe they could begin selling it by 2025. AXSM also believes it can launch AXS-07 and AXS-14 for migraine and fibromyalgia in 2025, barring any unforeseen delays.

Room for Growth: Valuation Analysis

However, as you can imagine, this is a very intense research effort.Therefore, if the company said Research and development expenses reportedly increased from $17.8 million in the first quarter of 2023 to $36.8 million in the first quarter of 2024 due to the development of several clinical trials and the preparation of NDA filings. Balance sheet I would argue that it can afford this rapid pace of research, given that it has around $331.4m in cash and equivalents. In fact, I believe this is a good strategy given that the company’s portfolio appears to be relatively close to receiving more FDA approvals. After all, the sooner we receive FDA approval for more drug candidates, the faster we can recoup our investment and generate additional revenue areas.

Additionally, the company’s total debt is approximately $178.7 million, but its quarterly interest expense is relatively manageable at only approximately $1.1 million.Overall, I think the company’s latest quarterly Cash burn is approximately $53.6 million. This number was arrived at by adding the most recent quarterly CFO and net capital expenditures. Annualizing this cash burn estimate, AXSM burns $214.4 million annually. A comparison with the current cash balance suggests that AXSM has 1.5 years of cash reserves. However, it’s worth noting that AXSM’s revenue has also been growing rapidly, meaning the runway for this capital could grow.

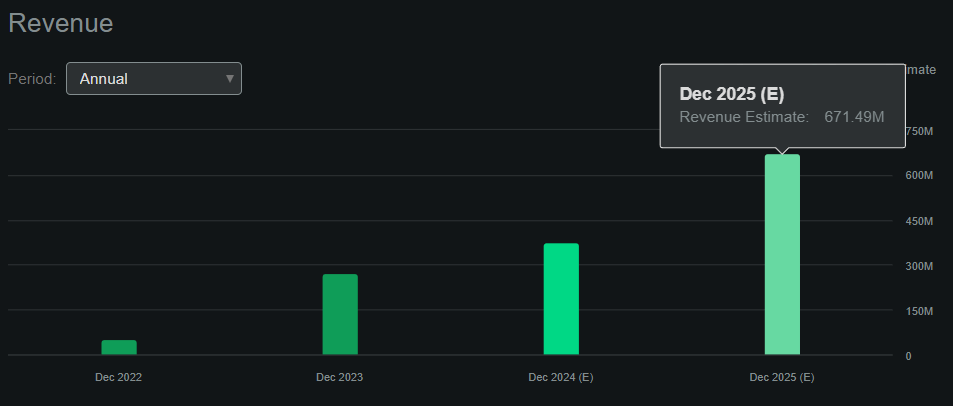

Source: In Search of Alpha.

The company is expected to generate $671.5 million in revenue by 2025, up from $376.2 million in 2024, according to Seeking Alpha’s AXSM dashboard. This is a 78.5% year-on-year revenue increase, and remember that AXSM plans to launch several services by 2025. drug candidate. Therefore, I imagine that the company’s revenue will continue to grow even further from 2025 onwards.

AXSM’s market cap currently stands at $3.7 billion, implying a forward P/S ratio of approximately 5.5.This is slightly higher than that sector median The forward P/S multiple is 3.6, which is fully justified as the AXSM appears to be firing on all cylinders for the time being. Furthermore, considering AXSM’s potential peak sales could be $16.5 billion, the current price would seem cheap by comparison. So I think AXSM has a strong IP portfolio with FDA approval and a track record of trading at reasonable valuations. Therefore, I rate his AXSM as a Buy, as its investment proposition is very attractive for long-term investors.

Investment Notes: Risk Analysis

Naturally, the main risks are associated with ongoing clinical trials. If the market is disappointed with upcoming test results or if the FDA pushes back on the test results, the stock is likely to fall. This would be reasonable, as the stock appears to be trading at a slight premium compared to its peers. Additionally, AXSM’s current funding period of just 1.5 years is potentially concerning. If sales at Auvelity and Sunosi do not continue to grow, shareholders could face dilution risk.

Source: TradingView

Finally, while we stated that AXSM’s drug portfolio could have peak sales of $16.5 billion, the reality is that market acceptance is also not guaranteed. Additionally, the execution risks associated with ramping up commercialization efforts present unique risks and challenges that cannot be ignored. However, despite all these risks, we believe that AXSM currently offers significant benefits that far offset these risks.

Promising investments: Conclusion

Overall, AXSM’s diverse IP portfolio is promising across all drug candidates. Barring any setbacks in the regulatory process or clinical trials, the company is relatively close to FDA approval. AXSM’s intellectual property could generate up to $16.5 billion in revenue, making it a good opportunity for investors compared to its current market cap of around $3.7 billion. However, while risks still exist, such risks appear to be manageable as long as AXSM continues to expand sales of his Auvelity and Sunosi. Therefore, for investors who understand the risks inherent in biotech, I rate AXSM a Buy.