An LeeInsurance claims occur during stressful times in a customer’s lifeoften it becomes a negative experience. At least, that’s what it might seem like. That’s why I was surprised to hear about our latest research report. Why bring AI to claims and underwriting?,

Settlement speed increases insurance claim satisfaction

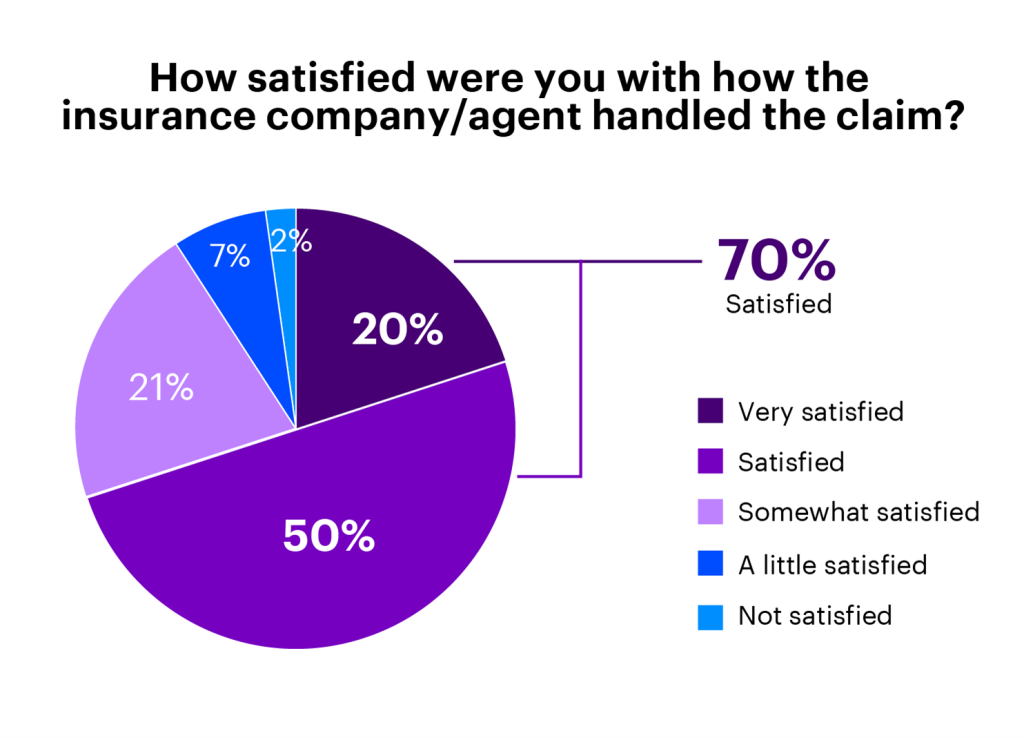

Overall, our research found that 70% of policyholders said they were satisfied or very satisfied with how their insurance company or agent handled their claims.

That’s quite a lot for a bill. And our research isn’t the only data point showing this.a 2021 JD Power Study Focused on Auto Insurance reached a record high in customer satisfaction with complaints, reaching 880 points out of 1,000.A similar 2021 JD Power Real Estate Claims Survey Although satisfaction decreased slightly (from 883 to 871), this ended a five-year streak of steadily increasing satisfaction scores. This is likely due to circumstances not directly related to the insurance company, such as pandemic-related supply chain disruptions or material shortages. ). So what makes it so satisfying?

Omnichannel communication and transparency are two reasons. Most insurance companies allow customers to start a claim on their website or app. Technology offers convenience in that photos can be used for inspections instead of scheduling personnel on-site visits. Additionally, some insurance companies offer dashboards to track claims throughout their lifecycle.

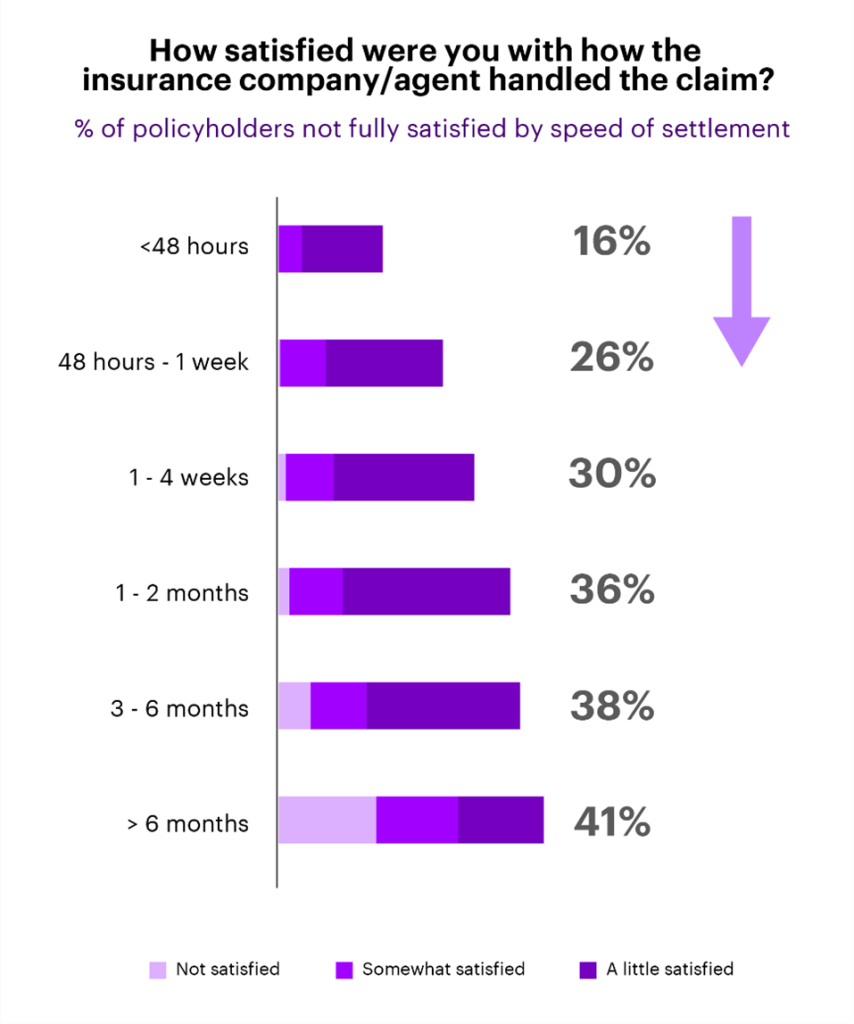

These are all important modernizations that help make your billing experience more seamless. But our research shows that there’s one factor that determines satisfaction more than anything else. It’s the speed of payment. The longer it takes to resolve a claim, the less satisfied the policyholder will be.

This insight is especially important for insurance companies. Because claims dissatisfaction is a leading factor in policyholders switching to another company, with 74% of dissatisfied customers having changed providers (26%) or considering changing providers (48%) ).

Insurers need to focus on AI to build high claims satisfaction rates

Knowing that payment speed is a key driver, how can insurers continue to achieve high levels of satisfaction and, more importantly, increase that satisfaction even further?

Insurance companies have been focused on omnichannel for years. We are now at a stage where continued investment in omnichannel is leading to diminishing returns. Of course, this doesn’t mean you should ignore omnichannel. New channels targeting younger generations, such as chat apps (such as WhatsApp), will continue to be an important strategy for insurers to expand their customer base. And perfecting or modernizing the omnichannel services that insurers currently offer is critical to staying relevant. What I’m saying is that omnichannel is a low hanging fruit, and most of us are already successful at it.

Instead, insurers should focus on AI to automate payment processes quickly, easily, and accurately. Of course, this is easier said than done. Automating payment processes requires robust data and analytics capabilities, all connected into a single ecosystem.

Separate intentions and actions

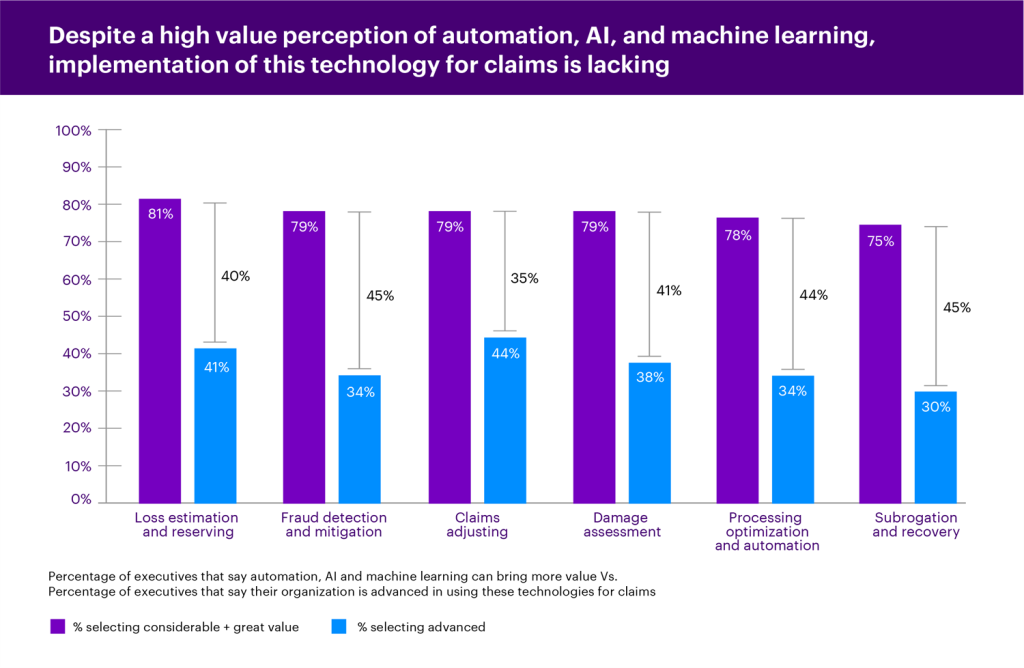

Executives are already recognizing the importance of using AI in billing. The chart below shows that for each area of the claims value chain, at least 75% of executives say AI and machine learning have the potential to deliver “substantial” or “significant” value. I am.

However, there is a disconnect between this intention and action. The same graph illustrates this gap, with only 44% of executives saying even in the most advanced area (billing adjustment) they are increasing their use of AI, automation, and machine learning. In this scenario, the definition of “advanced” is “early use” level or higher.

Insurance company executives need to consider their priorities holistically

This means that approximately 80% of executives recognize the value of AI in claims, and approximately 40% consider themselves advanced in various areas. Unsurprisingly, investments in insurance claims will accelerate over the next three years, with 65% of those surveyed planning to invest more than $10 million.

However, insurance companies need not be discouraged. This is because the priority of settlement speed aligns with other business priorities, such as reducing administrative costs and preventing claims leakage, and the solution is the same. That’s why executives should avoid trying to solve each problem individually and instead ask themselves how AI, machine learning, and other automation can transform their business in a way that helps them achieve multiple priorities simultaneously. You need to think about it. For example, increasing payment speed through automation naturally reduces administrative costs and avoids billing leakage, while also increasing customer satisfaction and retention.

Insurance leaders must also be courageous in tackling these big challenges and avoid devoting too much time and energy to simpler priorities (such as omnichannel).

Insurers know what value AI can provide, but adoption has been slow. Fortunately, the recent surge in interest in the cloud can help. The cloud is a critical foundation for leveraging the real-time data and modeling that powers this type of automation.

Overall, there is still much work to be done to bring technology platforms to the point where they can automate payment speed and leverage AI more effectively across the business. But it’s clear that insurers should invest in AI and automation to reap the most benefits, including happier customers, empowering employees, and increasing business resiliency.read our article Complete report on how AI is transforming the insurance industry You can learn more.

Get the latest insurance industry insights, news and research delivered straight to your inbox.

Standard disclaimer: