Trevor Williams/DigitalVision via Getty Images

overview

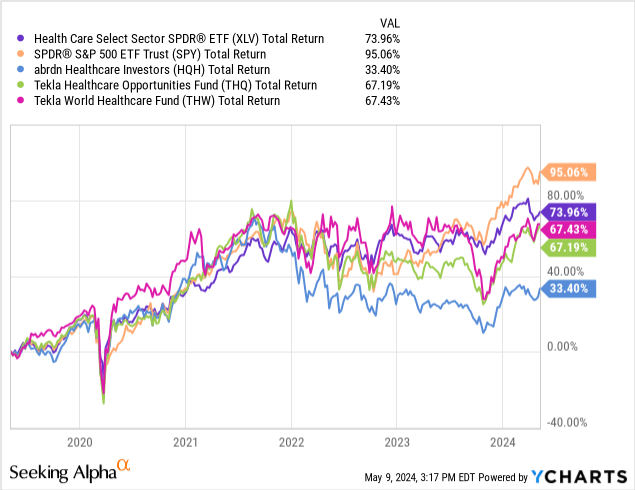

Healthcare sector (XLV) performance continues to be that of the S&P 500 (spy). This could be due to a variety of factors, including a slowdown in high interest rates. The growth and development of new medicines and new technologies in this space, regulatory uncertainty, drug patent expirations, and even the uncoupling of dependence on coronavirus-related illnesses to drive demand. While each healthcare, pharmaceutical, and biotech company may have significant differences, closed-end funds include: Abdon Healthcare Investor (New York Stock Exchange:main office) provides diversified exposure that allows you to capture upside movements while reducing downside risk.

However, when compared to peer funds such as abrdn Healthcare Opportunities Fund, we see that HQH’s performance is by far the best in terms of total return (THQ) or Abdan World Healthcare Fund (THW). Looking at the total return chart, prices have historically traded at levels comparable to these peer funds, leading up to the decline starting in 2022. I think this could be an opportunity to capture upside potential, as the fund could eventually close at a $100 gap. It will perform better over the long term, especially now that the dividend is much higher.

I previously covered At HQH, prices remained at an attractive discount of more than 17% to NAV. Although the price is still at a discount to NAV, I believe there are additional catalysts at play that make HQH a buy. In some situations, HQH operates as a closed-end fund that invests in the stocks of companies operating in the healthcare sector. HQH differs from its peer funds, THQ and THW, in that HQH focuses most on biotechnology companies, making the fund much more vulnerable to a high interest rate environment. I believe this is why the gap in performance between peer funds has widened so much. Interest rates began to rise rapidly in the first quarter of 2022, and coincidentally this is when the underperformance began to widen.

Biotechnology companies typically rely on debt financing to finance various growth initiatives, research and development, or day-to-day operations. In an environment of rising interest rates, significantly fewer companies will be willing to borrow capital because interest payments may become too expensive. Nevertheless, I believe that prices and total return potential may eventually increase as interest rates fall and healthcare costs increase. However, one of the major complaints I have with this fund is that it relies on capital returns to fund its distributions, even though it recently increased its distributions by a significant 26.3%. is.

Portfolio update

HQH’s portfolio remains diverse across biotechnology, pharmaceutical and healthcare sectors. Biotechnology takes the lead with 62% of the portfolio exposed to this subsector. This makes HQH a strong bet on a biotech recovery, but also makes it vulnerable as it poses higher sector concentration risk, as opposed to a fund more evenly split across subsectors.of Top 10 stocks held The funds listed below represent 45.11% of the total fund amount.

| ticker | company | percentage | difference (%) |

|---|---|---|---|

| (Regnu) | Regeneron Pharmaceuticals | 8.51% | +0.86% |

(VRTX) | vertex pharmaceuticals | 8.18% | +0.24% |

| (AMGN) | amgen | 7.39% | -0.06% |

| (guild) | gilead | 5.65% | -0.16% |

| (AZN) | AstraZeneca | 3.62% | +0.09% |

| (BIIB) | biogen | 3.08% | -0.72% |

| (Lily) | Eli Lilly | 2.67% | Not applicable |

| (ABV) | AbbVie | 2.11% | +0.27% |

| (ILMN) | Illumina | 1.97% | +0.21% |

| (BMRN) | biomarine farm | 1.94% | +0.32% |

For reference, I’ve included a column showing the difference in holding weights from when I first covered HQH in November 2023. The fund’s active management fee is 0.99% of net assets and other fees are 0.18%. . There are a total of 129 holdings within the fund, and the current portfolio turnover rate is 43%. A quick overview of recent holdings reveals a few that have been outstanding performers.

- Regeneron Pharma: Increased over 190% in 5 years and recently announced $3 billion in stock buybacks.

- Vertex Pharma: Net income increased 56% in latest quarter 1st quarter revenue.

- Amgen: Outperforming Revenue expectations Revenue increased 22% year over year.

catalyst

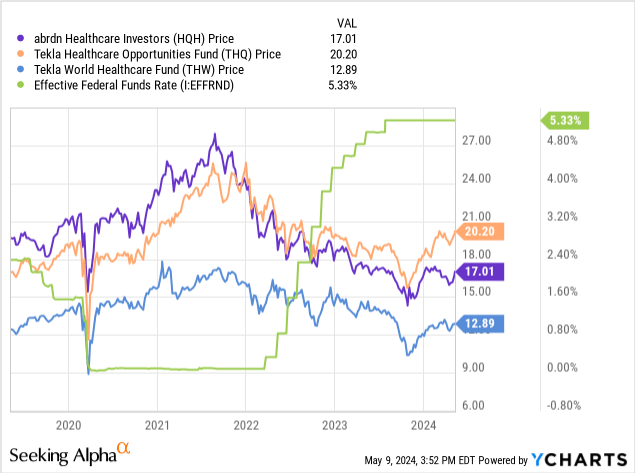

We briefly mentioned vulnerability to interest rates, but to further this point, let’s look at the price of HQH in relation to changes in the federal funds rate. We see that when interest rates were cut to near zero in 2020, the prices of all three of these funds rose as access to cheaper capital drove up valuations. However, as soon as interest rates started rising in 2022, prices fell and stabilized around the current range.

I don’t fully expect interest rates to go down this year, but that’s okay because rising interest rates give you the opportunity to keep accumulating. With inflation remaining high and the job market remaining strong with low unemployment, the Fed has no incentive to cut rates. In addition, consumption expenditure It still remains strong. But I think that perhaps a rate cut next year will infuse cash into the health care market by making bonds cheaper to acquire and allowing continued drug innovation.

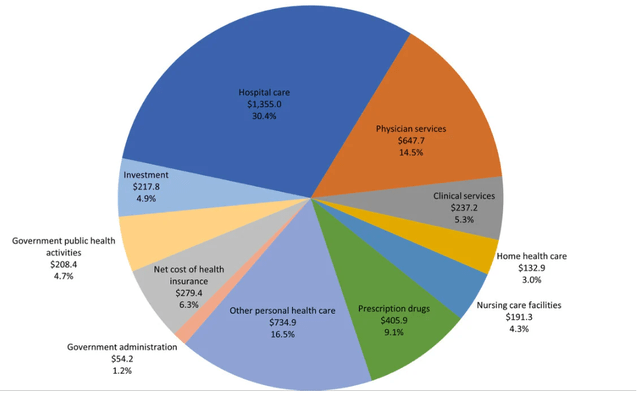

Additionally, people are living longer than ever before, with average life expectancy expectations He is currently 79.25 years old. As a result, we expect spending on health care to continue to rise as we live longer and seek to combat old age with better nutrition, medical, and wellness care. Based on research conducted by AMA researchnearly $45 billion was spent on health care in 2022, with the majority of that spending allocated to hospital care, physician services, prescription drugs, and other personal health care.

This increase in spending is driven not only by longevity, but also by rising drug costs.According to another study Conducted by PwC, the median price of a new over-the-counter drug will rise to $222,000, and overall healthcare costs are estimated to increase by 7% through 2024. This amounts to an estimated cost of $160 per year out of the consumer’s pocket. Therefore, I believe that HQH is a great way to reduce the burden of medical costs while also building a source of income from an area that is very likely to be your largest expense at some point in your life .

Dividend and valuation

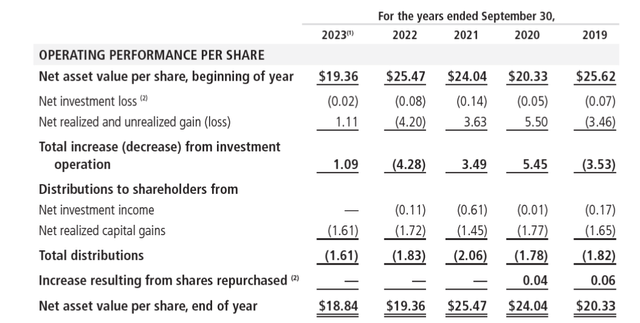

Headquarters’ NAV (net asset value) has declined since its peak in 2021 as interest rates rise. The Fund aims to make distributions at a rate of 2% of its net assets. The NAV per share in 2021 was $25.47, which we then see decreasing to $18.84 per share at the end of 2023. A decline in NAV over an extended period of time may indicate that HQH is not earning enough income to meaningfully grow net income; asset values may decline, leading to a deterioration in NAV and total return. There is a gender.

As a result, we find that net investment income and net realized gains combined are not enough to cover the entire distribution for 2021 and beyond. For example, in 2023 he NII showed a loss of ($0.02) per share, while the net realized profit amounted to $1.11 per share. This total of $1.09 per share was insufficient to fully cover the distribution, which amounted to $1.61 per share. The same was true for 2022, which contributed to the significant decline in NAV.

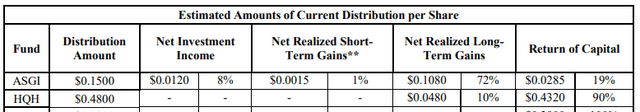

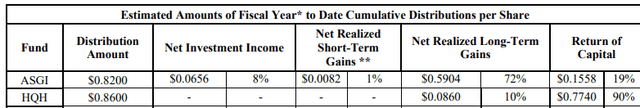

Dividends were significantly increased by 26.3% in February. After the raise, latest quarterly The current distribution is $0.48 per share, with a starting yield of up to 9.8%. Considering the unfavorable conditions, I wonder if the dividend was raised a little too early. You can understand from. Latest section 19a According to the report, 90% of the distribution was funded by capital returns.

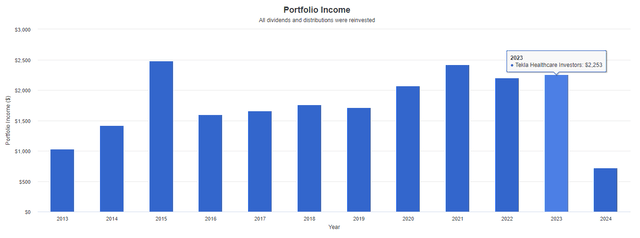

We will review the next annual report, due in late September or early October, to analyze how well the 2024 distribution is covered. We remain cautious here as the distribution was recently raised by 26.3%, but it still seems like NII alone cannot cover the distribution. But for those who have already held his HQH for a long time, the income he receives from the fund has doubled over the past 10 years.

Portfolio Visualizer allows you to see how your original $10,000 investment will grow in dividend income. This calculation assumes that no additional capital has been invested. However, this assumes that the dividends are reinvested. Starting in 2013, his annual salary in 2023 would have effectively doubled from $1,030 to $2,253. Therefore, HQH has certainly achieved its goal of generating a high level of income for its shareholders.

The price is still trading at an attractive discount of 13.28% to NAV. When I first picked up this CEF, the discount was a little more attractive at over 17%. Since then, the total return has exceeded 17%, outperforming the S&P 500 return by just 1%. For reference, prices are still trading below pre-pandemic levels of $20 per share. I think prices could recover to this level if market conditions become more favorable for biotechs due to the aforementioned catalysts.

Lower interest rates should boost valuations as demand within the sector expands and capital expenditures are likely to increase. Therefore, we believe the current price range is a great opportunity to continue accumulating. Looking at the discount history above, you can see that his current discount to his NAV level is one of the most attractive points of the past decade.

danger

HQH has already shown that it remains highly vulnerable to rising interest rates. There is a possibility that interest rate cuts will be delayed further, and we are now in an environment where the federal funds rate remains high along with inflation. This is likely to further deteriorate his NAV and share price for HQH, and could give him a better entry if he doesn’t think rates will be lowered in the next 6-12 months.

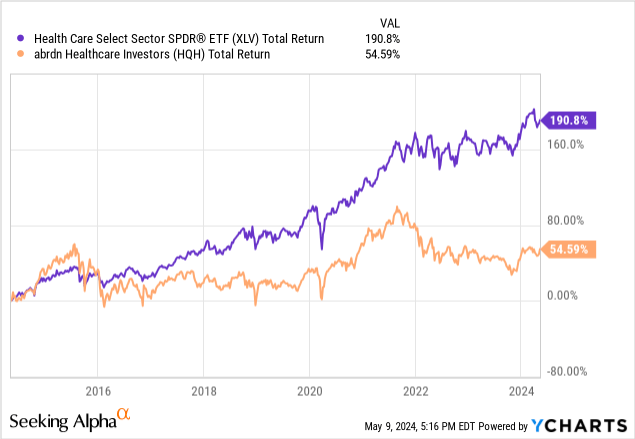

Additionally, the high yield offered by HQH may be more attractive to investors nearing or reaching retirement age. If you don’t need the income you get from these high-yield closed-end funds, you could be putting an unnecessary tax burden on your portfolio as well as underperforming the prevailing healthcare index to your own detriment. There is a possibility. Over the past 10 years he can see that his XLV total return is much better than his HQH total return.

Finally, if conditions do not improve, continued use of capital returns will be destructive to NAV. We understand that ROC may appeal the tax treatment, which would have a negative impact on the Fund’s future growth. Looking at the expected distribution since the beginning of this fiscal year, we can see that ROC accounts for 90% of the distribution.

remove

I believe that the gap in underperformance between HQH and peer funds could narrow as rising healthcare spending and increasing longevity of the population act as catalysts in the healthcare sector. However, while the valuation is at an attractive discount to his NAV level, current distributions are not covered by his NII or realized gains in the fund. Distributions are largely covered by capital returns, which, combined with unfavorable market conditions centered around high interest rates, has been destructive for a long time. While we can seize the opportunity for a recovery in this sector, we must also be aware of the risks if the recovery lasts longer than expected.