Shahvshin 86

Aurora (Nasdaq:Australia) is a company developing Aurora Driver, a self-driving technology. This technology is integrated into cars to enable driverless capabilities.

All-time share performance has been lackluster. The stock hit an all-time high of $17 shortly after going public in 2021, and has continued to rise ever since. It worsened and reached the $3 price level the following year. Since then, AUR has traded primarily within the $1 to $3 range. However, over the past year, AUR has gained some momentum, as evidenced by its 140% price increase. Despite this, AUR is currently trading at $3.2 per share, down -13% year-to-date.

I rate the stock as neutral. My $2.5 PV price target suggests that the stock looks overvalued today despite relatively good progress across technology readiness and pilot projects with key customers. Masu.

financial review

As with other companies developing disruptive technologies, today’s relatively weak fundamentals are highlighted. The fact that AUR is still in the investment stage. Apart from $68 million in revenue generated in 2022 as a result of a collaborative project with Toyota, AUR has not yet launched and generated revenue from Aurora Driver technology. AUR plans to commercialize the Aurora Driver at some point in the future, leveraging a Driver as a Service (DaaS) business model.

10Q

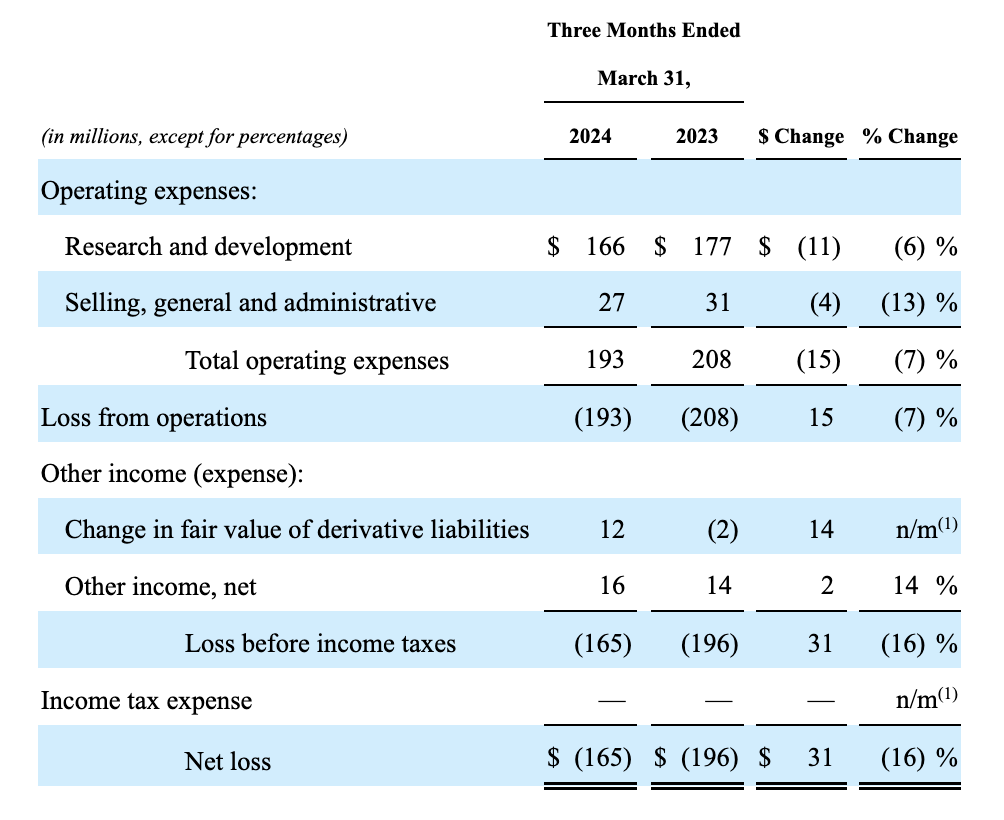

That’s why AUR today will focus on getting products to market as quickly as possible while making the most of the liquidity we have. So far in the first quarter, as expected, AUR continued to post a net loss, but overall it was narrower year-over-year, indicating good business execution. Net loss decreased primarily due to changes in non-operating items such as the fair value of derivative liabilities, while the main driver of operating expansion was significant optimization of research and development expenses and SG&A expenses. As a result, operating loss decreased 7% year over year to -$193 million.

First quarter liquidity was $1,197 million. This means that AUR does not need to immediately raise capital in the next one or two quarters to sustain its operations. Operating cash flow (OCF) burn for the first quarter was -$150 million and capital expenditures were $8 million. Annualizing this for the entire year results in cash flow for the year of -$632 million. Predicted. However, cash burn may be lower depending on the situation. For example, last year AUR had a similar level of cash burn, including $15 million in capital expenditures for all of 2023. So my forecast for fiscal year 2024 could be very bullish because he assumed capital expenditures to be $32 million. That’s more than double.

catalyst

AUR’s successful commercial launch of Aurora Driver in Q4 2024 should provide significant upside potential for the stock. In my opinion, success here should be defined by AUR’s technology readiness and ability to finalize contracts with major customers.

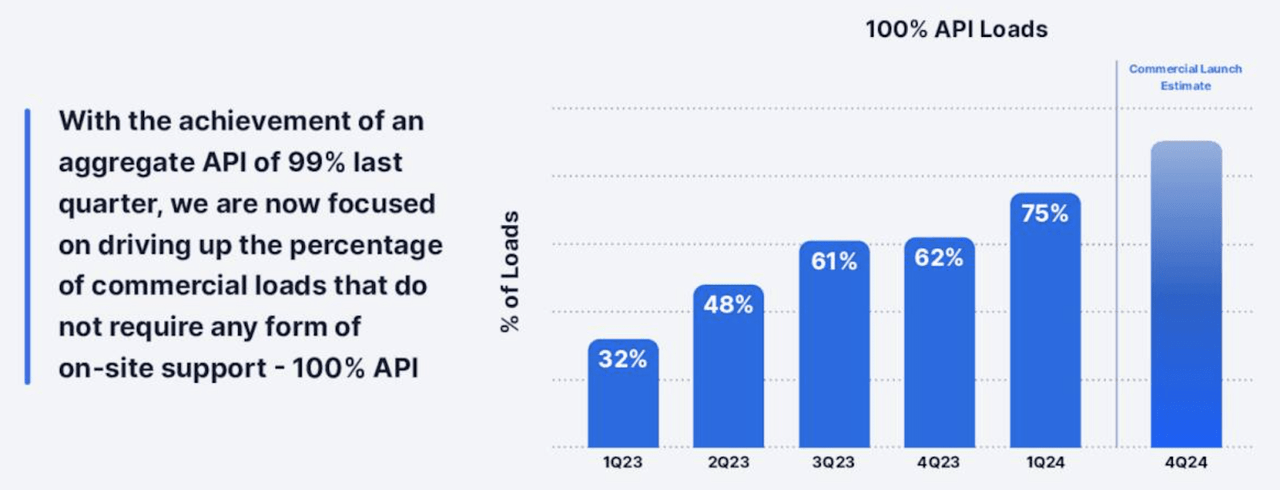

In my opinion, AUR has made pretty good progress in terms of technology readiness so far in the first quarter, as evidenced by the continued upward trend in the percentage of API (Autonomy Performance Indicator) 100% commercial loads. It looks like you’re accomplishing it. API indicates the amount of load handled by an autonomous technology, so a higher API score correlates with more powerful technology capabilities. AUR expects to be 90% load to 100% API by launch date and will continue to iterate and improve the technology further into the fiscal year, as management comments: suggests.

During the first quarter, 75% of commercial payloads in the launch lane were 100% API, an improvement of 13 points from the previous quarter and reflecting meaningful progress toward the approximately 90% commercial launch forecast. Masu. With the recent introduction of intermodal trailers into our pilot operations, we are now including these loads in our API measurements and are ready to expand beyond the 53-foot drive end following our planned commercial deployment. We emphasize that

sauce: Announcement of first quarter financial results.

AUR should also be in a good position to finalize contracts from pilot customers. In the first quarter, we made positive progress on pilot projects with major customers such as FedEx and Uber Freight. This is underlined by the continued efforts of these customers to increase the commercial load by his AUR, according to management comments.

As we prepare for commercial launch, we continue to transport freight autonomously for all of our pilot customers, including FedEx, Werner, Schneider, Hirschbach, Uber Freight, and more. We currently schedule approximately 120 commercial loads per week. This is three times the amount of commercials he was running a year ago.

Source: First quarter financial results announcement.

danger

As one of our analysts noted on the Q1 earnings call, despite strong overall demand, the current relatively uncertain macro environment will delay contract completions by major customers. There is a possibility. In general, I see autonomous solutions as more of a long-term tool for logistics companies than an immediate cost-saving tool. Therefore, macro pressures may temporarily reduce the priority of adopting self-driving technology in a worst-case scenario.

Rating/Pricing

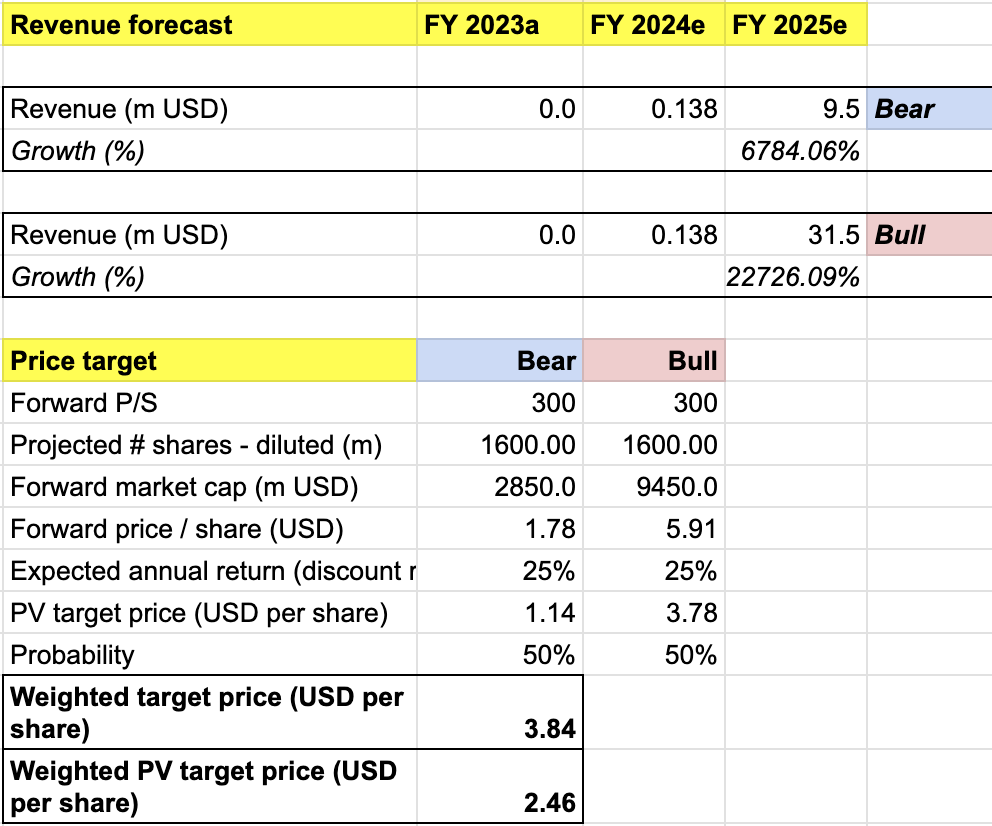

My target price for AUR is determined based on the following assumptions for a forecasted FY2025 bull vs. bear scenario where AUR is expected to realize its first significant return, according to market consensus.

Bullish Scenario (50% Probability) Assumptions – I expect AUR to achieve revenues of $138,000 in 2024 and $31.5 million in 2025. market estimates. Given the commercial success of such a disruptive technology, I would speculate that expected earnings would rise 300x to capture the market reaction, suggesting that the stock price would rise to $5.9. Masu.

Bearish scenario (50% probability) assumption – AUR has FY2024 revenues of $138,000 and then $9.5 million, consistent with market expectations. We also expect P/S to rise 300x, with the possibility of a correction to the $2 price level sometime in FY2024 or FY2025, likely due to contract closing delays or technology issues. there is.

unique analysis

Integrating all of the above information into my model resulted in a weighted 2025 price target of $3.84 per share. We also require a discount rate of 25% to account for the risks associated with owning AUR stock. I think AUR stock is a growing company that is still in the pre-commercial stage. My 50/50 chance of being a bull is based on my belief that the outlook for both years is still lacking.

In the end, we reached a present value/PV weighted price target of $2.5 per share. This means that if my 2025 2025 price target of $3.8 is met, $2.5 per share is the highest price point at which an investor can buy the stock to realize a projected annual return of 25%. means. Currently, at $3.2 per share, the stock is trading at a 28% premium to my target price, indicating it is overvalued. I rate the stock as Neutral and advise interested investors to look for better entry points.

On the other hand, I also believe that if AUR can reach expected milestones this year, it could still present an interesting speculative opportunity for current stockholders. In my opinion, in this situation AUR could see significant price appreciation due to positive market reaction, which could benefit current holders. I believe the impact is further amplified by the fact that AUR’s valuation may still be primarily driven by the growth story rather than financial numbers in the short term.

conclusion

AUR is a developer of innovative self-driving technology and partners with blue-chip OEMs and leading logistics companies for pilot commercialization. As of Q1, the technology seems pretty ready. The development of pilot projects also seems to be trending positively, and so far the client has increased the autonomous commercial load with his AUR. However, AUR remains a pre-commercial company and will likely not start receiving any major revenue inflows until FY2025 at the earliest. My PV price target of $2.5 indicates that the stock appears overvalued. Interested investors are advised to look for better entry points.