flyview productions

Over the past year, I have become familiar with many financial institutions. I mainly focus on small and medium sized banks. Very few companies have a market capitalization of more than $10 billion.And the lot was $2 billion. Under size. But his one of the smallest is: Northeast Community Bancorp (Nasdaq:NECB), a company with a market capitalization of $188 million as of this writing. But small doesn’t necessarily mean bad. In fact, the bank’s small size probably works in investors’ favor in this case. That’s because the company is currently attracting the attention of many analysts and investors. Digging deeper, the stock appears to be very attractive and the asset quality appears to be high. Considering these factors, coupled with the attractive growth the bank has achieved in recent years, After all these years, I can only rate it as a “strong buy.”

great little bank

According to Northeast Community Bancorp management, the company is the owner of a New York State-chartered savings bank headquartered in White Plains, New York. The company was originally founded in 1934 as a community-based company. for many years, has grown to operate 11 branches in several counties in New York and three counties in Massachusetts. He also has three loan production offices, two of which are in New York and one in Massachusetts.

Through this network, the Bank carries out various activities. For example, originating a construction loan. That’s the main focus. However, we also issue loans that fall under the commercial and industrial categories, the multifamily and mixed-use residential real estate categories, and the nonresidential real estate categories. The Company provides retail deposit services to its customers and, until recently, also participated in providing investment advisory and financial planning services to certain customers. However, in December last year, the company agreed to sell these specific businesses to focus on its core business.

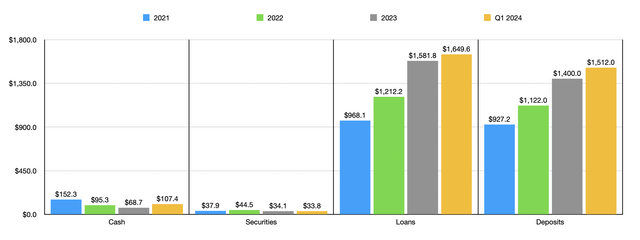

Author – SEC EDGAR Data

Over the past few years, the management team has done a great job growing this institution. For example, the value of deposits jumped from $927.2 million in 2021 to $1.4 billion in 2023. This is an impressive growth rate of 22.9% on an annualized basis.This growth continued 1st quarter Total deposits in 2024 were $1.51 billion. In addition to this, it is also worth noting that only 24.6% of deposits are currently uninsured. When looking for a financial institution, I prefer this number to be as low as possible. However, I have set a threshold of 30% as the maximum I am comfortable with. So it’s great to see this drop below that number.

Over the same period, the amount of loans on the books further increased. From $968.1 million, he skyrocketed to $1.58 billion, and finally in the latest quarter he reached $1.65 billion. The largest portion of this, approximately 78.2% of the total, is construction loans. These are typically loans provided to customers in increments of $5 million or $10 million. However, when you add them all up, they end up with $1.22 billion on the balance sheet. Other than this, residential real estate loans represent the largest exposure. That number comes to $231.1 million, of which $197.9 million is concentrated in multifamily housing. Commercial and industrial loans were a distant third with $108.9 million. The good news here is that there appears to be little focus on long-term office assets. This is a weakness in the loan and real estate markets. It is unclear what this number is. However, nonresidential real estate loans totaled $19.1 million last year. This is likely to include office assets.

Author – SEC EDGAR Data

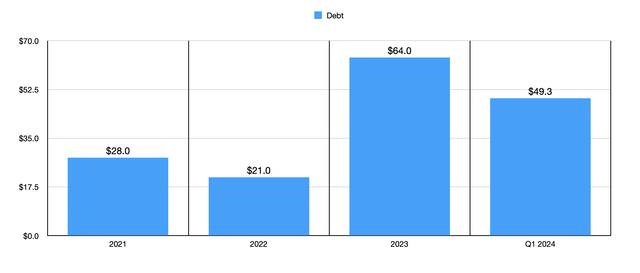

Deposits and loans increased, but there was some weakness in securities. However, that decrease only took him from $37.9 million to $34.1 million by 2023. As of the first quarter of this year, the securities had further declined to $33.8 million. Over the same three years, the value of cash and cash equivalents plummeted from $152.3 million to $68.7 million. But now, that number has gone back up to $107.4 million. Debt nearly tripled during this period to $64 million, but had fallen to $49.3 million at the end of the first quarter of this year.

Author – SEC EDGAR Data

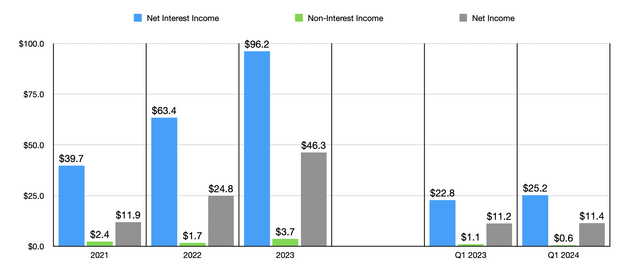

Growth across the institution has resulted in steady revenue and profit growth. Net interest income increased from $39.7 million in 2021 to $96.2 million in 2023. Growth in the company’s loan portfolio and higher interest rates contributed to the significant increase in interest income from loans. Interest income in 2022 was only $70 million. But last year it was a whopping $127.5 million. Yes, rising interest rates and increasing debt have caused some issues, including interest expense increasing from his $8.1 million in 2022 to his $35.3 million last year. But that didn’t stop net profits from skyrocketing. Non-interest income changed only slightly from $2.4 million to $3.7 million, while net income nearly quadrupled from $11.9 million to $46.3 million due to the growth achieved in net interest income . Net interest income in the first quarter was $25.2 million, up from $22.8 million in the same period last year, but net income was $11.2 million to $11.4 million as non-interest income decreased from $1.1 million to $0.6 million. There was only a slight increase in

Author – SEC EDGAR Data

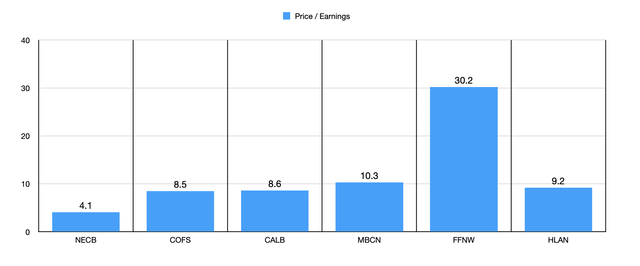

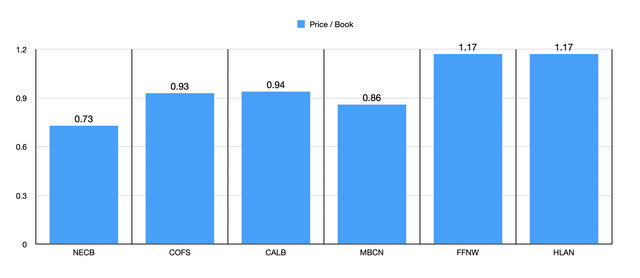

These numbers make it very easy to assess the value of the company. In the chart above, you can see how the stock is priced based on its price-to-earnings ratio. The stock trades at just 4.1x. This is one of the lowest numbers I’ve ever seen, and probably the lowest I’ve seen in this area in recent months. However, this chart also shows how the stock is priced compared to similar banks. But of the six companies, Northeast Community Bancorp ended up being the cheapest. The same goes for booking multiples using prices, as shown in the table below.

Author – SEC EDGAR Data

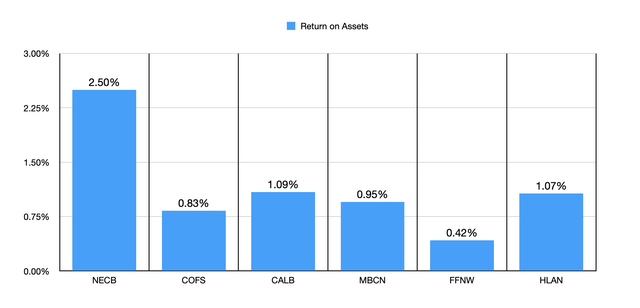

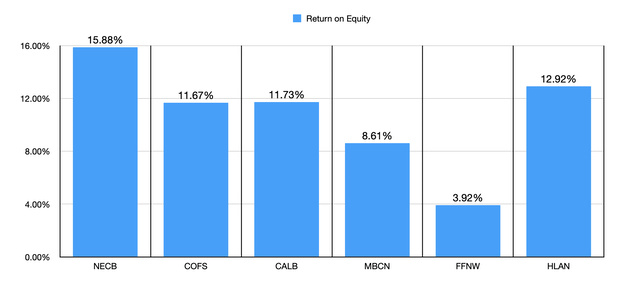

Attractiveness from a valuation perspective is important. But you also need to pay attention to the quality of your assets. In the first chart below, you can see this process in action with the return on assets for this institution and the same five companies I am comparing. With a reading of 2.50%, our outlook is the highest of the group. In fact, the same is true when using return on equity. This can be seen in his second graph below. With a measurement of 15.88%, Northeast Community Bancorp is significantly higher than the next highest of the 5 companies.

Author – SEC EDGAR Data

Author – SEC EDGAR Data

remove

Based on the data provided, we have to say that we’re highly impressed with Northeast Community Bancorp. This bank seems to be doing very well. The company has a solid track record of growth, and the stock is attractively priced both in absolute terms and relative to similar companies. The quality of the assets has proven to be incredibly high. The company has relatively little debt and high profits. Putting all this together, it’s hard not to rate this a “strong buy.”

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.