marrio31

Shares of Viking Therapeutics (NASDAQ:VKTX) have surged in the last 12 months, driven by the success of its obesity candidate, the subcutaneously administered VK2735. VK2735’s efficacy, safety and tolerability data to date look very competitive, even when compared to the so-called triple G agonists such as Eli Lilly’s (LLY) retatrutide. And more recently, the company also reported intriguing results of the oral formulation, although these results have not resulted in further share price gains.

I believe the data VK2735 generated make Viking an attractive takeover target or big pharma partner, as there are several big pharma companies that are significantly behind in the obesity development race and may want to participate, and acquiring or partnering with Viking would give them a jump start of a couple of years.

The standalone value proposition is more questionable as it will take years and additional dilution just to get to where Eli Lilly and Novo Nordisk (NVO) are today, and the market is evolving rapidly, possibly in the direction of combination treatment approaches. However, even a niche market position for VK2735 could yield billions in annual sales.

The company also has a MASH/NASH candidate VK2809 in development with data that look competitive to Madrigal Pharmaceuticals’ (MDGL) frontrunner Rezdiffra, but this asset is now more of an afterthought for Viking investors and cannot really justify the current valuation.

Subcutaneous VK2735 delivers strong efficacy, safety and tolerability data in a phase 2 trial in obese patients

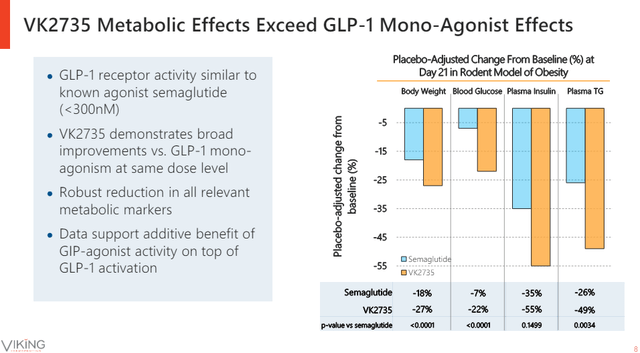

Prior to reporting clinical results of subcutaneously administered VK2735, Viking consistently talked about the candidate’s preclinical profile and how well it compared to Novo Nordisk’s semaglutide (Ozempic/Wegovy). However, how it compared to Eli Lilly’s tirzepatide, a dual GLP-1/GIP agonist that shares the mechanism of action with VK2735 was more important and was not shown in investor presentations (semaglutide is only a GLP-1 agonist).

Viking Therapeutics investor presentation

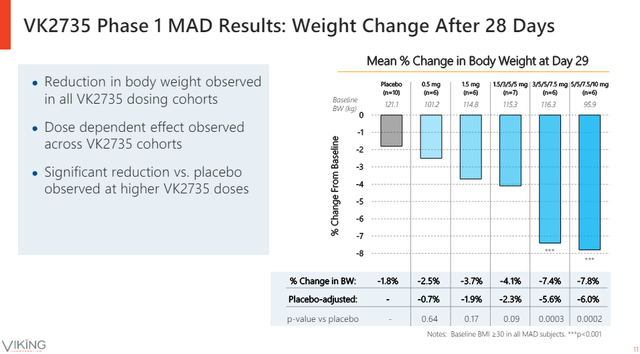

The 29-day phase 1 data showed an indication of robust efficacy with up to 6% placebo-adjusted weight loss after only four doses of the highest VK2735 dose tested in the trial (and a 7.6% absolute decrease in body weight).

Viking Therapeutics investor presentation

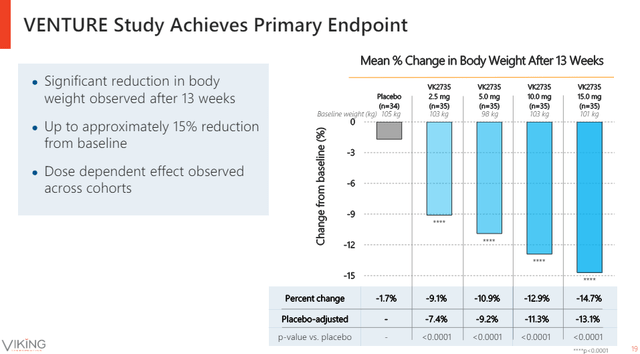

The more important catalyst was the 13-week phase 2 readout. The results look very competitive. The two highest doses achieved 12.9% and 14.7% absolute weight reductions and 11.3% and 13.1% placebo-adjusted reductions after 13 weeks of treatment.

Viking Therapeutics investor presentation

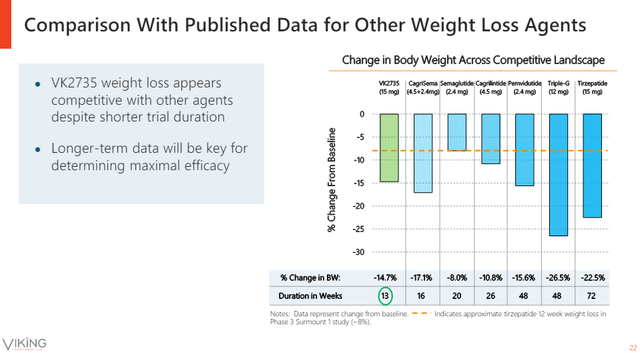

The company’s presentation slide below shows how the 15mg dose of VK2735 at week 13 compares to later time points of several of the key competing products and product candidates, including Eli Lilly’s triple agonist retatrutide.

Viking Therapeutics investor presentation

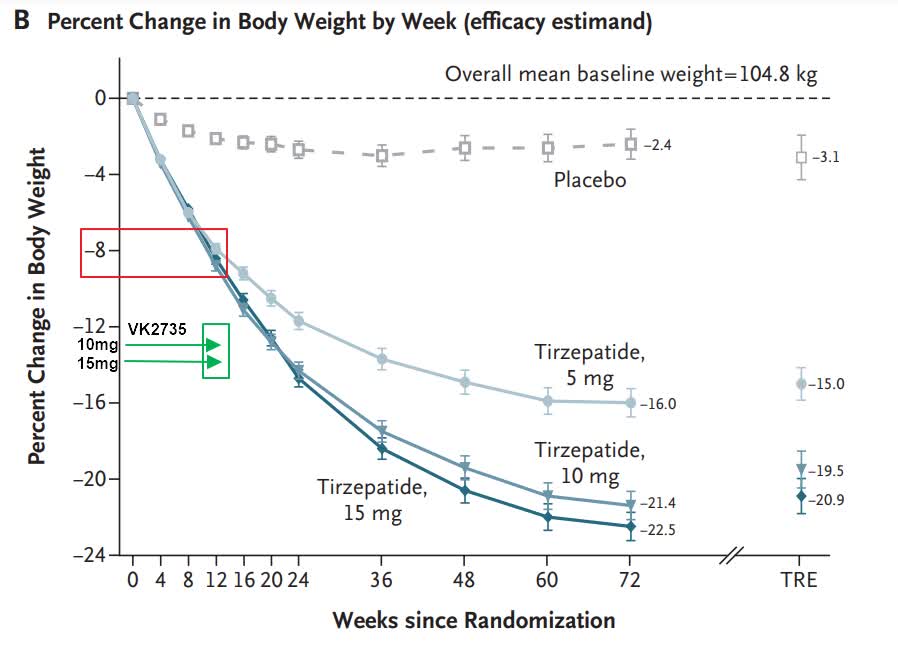

Tirzepatide still looks to be ahead on that slide, but only because Viking compared its 13-week data to tirzepatide’s 72-week time point. I took liberty to pinpoint the VK2735 weight loss data for the 10mg and 15mg doses on the weight loss graph from tirzepatide’s trial. 12.9% and 14.7% body weight reductions of VK2735 compare well to what looks like nearly 9% for tirzepatide at week 12 and approximately 11.5% at week 16.

New England Journal of Medicine

VK2735 looked generally safe and well-tolerated in the trial with fewer early discontinuations for all doses combined compared to placebo, a 13% discontinuation rate for all doses combined and 14% for placebo. The highest 15mg dose of VK2735 did have a higher discontinuation rate of 20%.

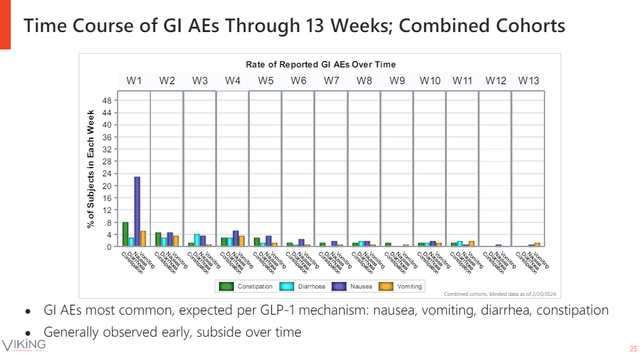

Gastrointestinal side effects are on-target effects of the incretin class, but the majority of adverse events were mild or moderate and nothing stands out compared to semaglutide or tirzepatide. Importantly, these side effects are mostly experienced at the start of treatment and they tended to subside over time.

Viking Therapeutics investor relations

The phase 2 results put Viking in a good position to explore options for further development of VK2735.

Investors left unimpressed with oral version of VK2735, but good tolerability leaves room for exploration of higher doses

The stock surged after the positive phase 2 results of the subcutaneous version of VK2735 (SC VK2735 going forward for convenience), but it seems the stock has topped in the near-term and that it may need some time to consolidate, and the preliminary results from the trial of the oral version of VK2735 failed to make a difference.

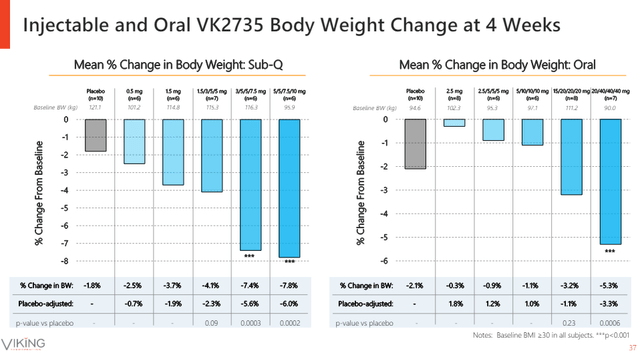

However, the preliminary results look intriguing, to say the least, and promising when put in proper context. There was a more pronounced placebo weight loss effect in this trial that made the placebo-adjusted results of oral VK2735 less impressive, and the initial doses had a lower weight reduction effect than placebo. But the two higher doses delivered decent absolute and placebo-adjusted weight reductions.

Below is the presentation slide showing how the 28-day data of SC VK2735 compare to the oral version. It looks like the oral VK2735 is not too far off the subcutaneous version at the highest dose levels.

Viking Therapeutics investor presentation

The GI tolerability results look very promising and discontinuation rates were generally low with 5% for the VK2735, combined. GI tolerability has so far been the killer of oral versions of incretin drug candidates.

Management is encouraged by the combination of good weight loss and good tolerability and the company will explore higher doses of oral VK2735 to see if additional efficacy can be squeezed out of the candidate without sacrificing safety and tolerability. Dose escalation is ongoing with data expected later this year.

The phase 2 trial with oral VK2735 is expected to start in the second half of the year, and if the data from additional dose cohorts show further improvements, I would expect the phase 2 trial to enroll rapidly.

Viking would be a great fit for big pharma companies that want to catch up to Novo Nordisk and Eli Lilly, through a buyout or global partnership

I have been following the obesity market and the incretin drug class with increasing interest in the last quarters, but (wrongly) thought Novo Nordisk and Eli Lilly were too big, in terms of market capitalization, to really reward shareholders with the success of semaglutide, tirzepatide and additional novel candidates in development such as the Novo Nordisk’s cagrisema or Eli Lilly’s retatrutide.

I thought other big pharma companies would be able to catch up faster, but that has not happened yet and most other companies have resorted to external sources of innovation to try and catch up with the two leaders.

I would otherwise not consider Viking as an investment, but it is increasingly looking like it is very hard to develop a high-quality incretin product candidate, and even more so if it needs to be orally available. As such, and considering the available data from trials of both SC and oral VK2735, I believe Viking would be a perfect fit for big pharma companies that want jump start their obesity pipeline, shave off a few years of preclinical and clinical development and greatly reduce the risk of failure as VK2735 is significantly more de-risked than a preclinical or early clinical stage big pharma program.

And, of course, a buyout is not the only option. If Viking does not want to be acquired, partnering VK2735 could also be an attractive proposition, and Viking and a big pharma company could, for example, jointly develop and commercialize VK2735 in the United States and the big pharma company could be in charge of ex-U.S. commercialization and pay royalties on net sales to Viking along with milestone payments. This tends to work well for successful products targeting big markets. A few examples:

- Genmab (GMAB) we see today is primarily the result of Johnson & Johnson (JNJ) in-licensing Darzalex which is now a $10 billion a year product based on the last trailing four quarters and Genmab received more than $1.7 billion in royalties during the same trailing four quarters.

- The COVID-19 vaccine collaboration worked out very well for BioNTech (BNTX) and Pfizer (PFE) and BioNTech collected tens of billions in revenues from the vaccine while Pfizer took more of the operational risk.

- Dupixent is on its way to becoming one of the largest, if not the largest pharmaceutical product in the world in terms of annual net sales ($11.6 billion in 2023 and still growing 20%+ a year), and Regeneron (REGN) is benefiting greatly from the collaboration with Sanofi (SNY) and splitting profits (with Sanofi taking a larger share and greater commercial and development efforts). Regeneron’s share of profits from the antibody collaboration with Sanofi exceeded $3.3 billion in the last four quarters.

Even reduced economic participation through the out-licensing of VK2735 could create significant value for Viking Therapeutics, and I would go a step further and say that it would be better for the company in the long run as partnering VK2735 would:

- Significantly reduce or even eliminate dilution going forward through a sizable upfront payment and development, regulatory, and commercial milestone payments.

- It would speed up the development of VK2735 and it could get to market much faster, in obesity, but also in other very important markets such as type 2 diabetes, the cardiovascular risk reduction market which would require a massive investment and take 5-6 years to complete, and also the smaller adjacent markets such as knee osteoarthritis, obstructive sleep apnea, and potential new markets such as MASH/NASH, and even Alzheimer’s disease prevention which is the latest step Novo Nordisk is taking.

- Having a big pharma partner would greatly reduce the manufacturing and related supply risks, especially for a product that would require high scale manufacturing like VK2735.

- Viking would not need to create a global commercial infrastructure, and it could use the milestone payments from the big pharma partner to create a local U.S. infrastructure to moderately participate, if it wants, in U.S. commercialization to get better economics in the largest market.

A buyout would provide the easiest way out and transfer all the risk to a big pharma partner and it would be a nice near-term reward for Viking shareholders, but if there are no willing buyers, I believe partnering would be a better option than Viking trying alone.

However, that is not to say standalone Viking cannot succeed. There are paths for standalone value creation as well, although I believe this is a suboptimal value creation path and would prefer a buyout for the quicker payout or a big pharma partnership for reasons stated above.

Standalone Viking can work in the long run but rapid obesity market evolution poses long term risks

The best way for standalone Viking to work in terms of shareholder value creation is to get to the largest market as fast as possible. This means the company should prioritize the obesity market and get SC VK2735 through pivotal trials as soon as possible, launch the product in the U.S. to start collecting revenues and then aggressively expand into other indications and expand commercial operations outside the U.S. 12-18 months after the (presumably) successful U.S. launch. If oral VK2735 works well, I would add it as the second priority, also in obesity and also in the U.S. first.

And if I were Viking, I would also look beyond the incretin class and look for ways to gain an additional edge over competitors, and make itself more valuable and more attractive to potential suitors down the road. There are non-incretin approaches to weight loss that could work as monotherapy and in combination with incretins and they could work to address the main limitation of incretins – the loss of lean body mass alongside fat loss and the likely worsening body composition when patients go off the drug and regain the weight and end up with even more fat mass than lean body mass. I wrote about some of these approaches in my recent article on Regeneron (REGN) and its new obesity pipeline efforts.

This may just be wishful thinking on my side, but I am mentioning these new approaches as relevant for Viking and as potential avenues to enhance long-term shareholder value.

Management team

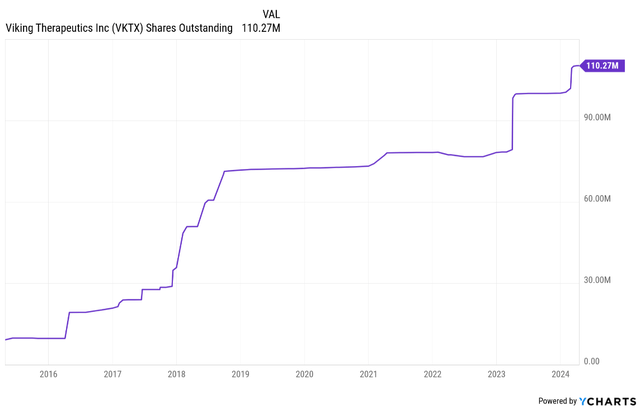

Viking is led by founder and CEO Brian Lian, Ph.D., and his background includes biotech research analyst roles, and prior to those, he worked at Amgen as a research scientist. He should be given credit for getting Viking where it is today and while the early years on the market were marked by massive dilution, these were tough years and dilution was necessary to survive, and as of today, I have no reason for concern about how the company is being run. And as you can see from the shares outstanding chart below, dilution was very modest since 2018 (well, modest for a development-stage biotech company).

The other executives are experienced with 20+ years in the industry each for Chief Operating Officer Marianne Mancini and Chief Financial Officer Greg Zante, as well as SVP, pharmaceutical development, Dr. Geoffrey Barker.

Similarly, the Board of Directors is filled with seasoned industry executives.

There is also some value on the NASH side of the pipeline and probably some platform value

VK2809 does not look like a drug that can come close to matching or exceeding the upside from VK2735.

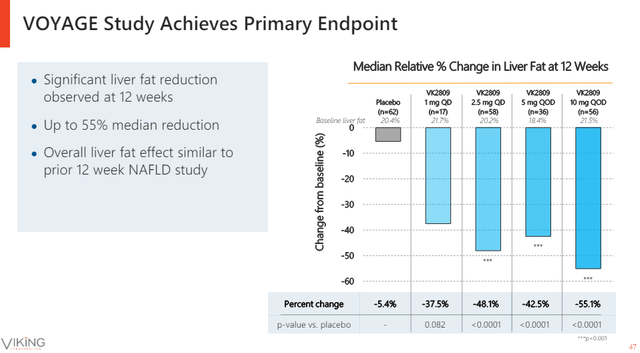

VK2809 on its own looks like a decent drug candidate and it has generated positive phase 2 results last year.

Viking Therapeutics investor relations

We should get a better picture of how competitive VK2809 is on fibrosis endpoints when Viking reports biopsy results from the phase 2 trial this quarter.

The MASH/NASH market is not evolving as rapidly as the obesity market, but we may see other drugs on the market before VK2809 arrives.

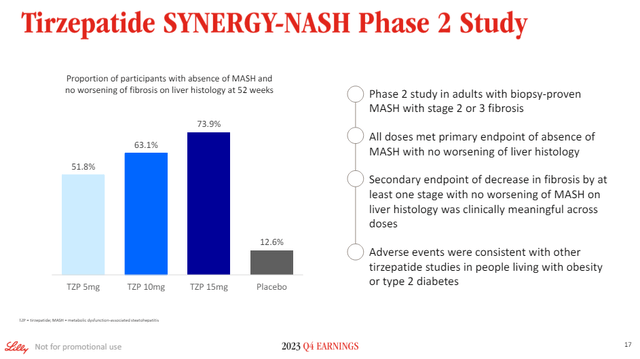

The jury is still out on the incretin class, but it is not impossible for VK2735 to end up being a better MASH/NASH drug than VK2809 itself. Eli Lilly’s tirzepatide generated good NASH resolution data in a recent trial, but it seems to have fallen short on fibrosis improvement, suggesting there may still be a potential place for Rezdiffra and VK2809 and other non-incretin approaches.

Eli Lilly investor presentation

Given the circumstances, I welcome any upside from VK2809, but would not assign a lot of value to it in its current state – years behind Rezdiffra and with many other potential approaches showing good potential.

Beyond VK2809 and the early-stage rare disease candidate VK0214, there could also be some platform value as both VK2735 and VK2809 look like pretty good drugs on their own, especially VK2735 when compared to direct competitors such as tirzepatide. And this platform could be a source of new drug candidates that could create more upside for Viking in the following years.

Risks

The major risks for Viking were discussed throughout the article but to summarize:

- The obesity market is evolving rapidly and it looks like it is going the direction of combination approaches that improve body composition by preserving lean body mass versus the monotherapy approach of the incretin class. This fast evolution should make the management team think hard about its next steps and if I were them, I would seriously consider a buyout, a partnership, or work hard to find ways to participate in the future combination markets. One way would be to partner with another biotech company that has the other side of the coin – a candidate that can preserve lean body mass in combination with incretins such as VK2735.

- A standalone approach to future development of VK2735 will be costly if Viking is to have a similar value proposition as Ozempic/Wegovy and Mounjaro/Zepbound as they have either generated data and/or will soon have labels that cover benefits well beyond weight loss – type 2 diabetes, cardiovascular risk reduction, positive effects for knee osteoarthritis, obstructive sleep apnea, potentially NASH, and even Alzheimer’s disease prevention. And there could be more by the time VK2735 reaches the market just to treat obesity.

- Even the incretin market is evolving rapidly and big pharma companies may resort to cheaper options such as in-licensing GLP1/GIP or triple G candidates from younger biotech companies instead of acquiring Viking. Roche did this in late 2023 by announcing the acquisition of Carmot Therapeutics for $2.7 billion upfront. And China is becoming an increasingly popular source for early-stage drug licensing and coming up with quality product candidates, not just cheap knockoffs of their Western competitors.

- The NASH/MASH market is also evolving with multiple approaches and clinical candidates in development and Madrigal has a significant head start with Rezdiffra.

- Viking is well funded after the sizable follow-on offering in the first quarter and a pro-forma cash position of nearly $1 billion at the end of 2023. Cash burn has been very modest to date compared to this sizable balance with only $74 million used for operating activities in 2023, but given the company’s plans to aggressively pursue the development of VK2735 for obesity, cash burn will increase considerably in the following quarters. The estimated runway was not provided by management other than them saying the company is now funded through many of the upcoming inflection points, and I estimate the current balance will be sufficient to fund the company for more than two years. Additional dilution is likely if the company is not acquired in the following years or if it does not find a partner to co-develop and co-promote VK2735 in the obesity and other addressable markets.

Conclusion

Viking Therapeutics is the latest addition to our Growth Stock Forum model portfolio. VK2735 data look competitive and I believe make Viking an attractive buyout candidate or big pharma partner. I prefer both outcomes over Viking continuing as a standalone entity. A standalone Viking can also create shareholder value and/or develop in a way that could make it more valuable to acquirers or partners down the road.

It is not easy to value a company like Viking given the rapid evolution of the obesity market, but the Street price consensus of $114 suggests analysts are expecting Viking to generate approximately $3 billion in annual peak sales by the early 2030s. In a buyout scenario, we are likely looking at a 60-70% premium to entice Viking management team and shareholders and that means a potential buyout price in the $130+ range if we look at the current share price.