This post is part of a series sponsored by TSIB.

A key element when considering a CIP or wrap-up is to have your broker conduct a feasibility study for your wrap-up sponsor.a Feasibility study is a tool used to compare costs between implementations.

Here we discuss the importance of feasibility studies in evaluating potential wrap-ups, the data used to create them, and guidance on what to look for in future wrap-up projects.

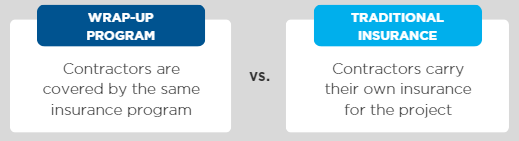

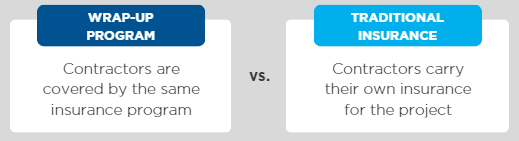

In addition to being a great risk management tool, the main selling point of using wrap-ups is that the project meets certain criteria. The cost of insuring the project Wrap-ups are almost always cheaper than traditional insurance methods.

insurance cost

With traditional insurance, costs are simply calculated. This is the sum of the insurance that each contractor includes in the contract price and the deductibles that apply to those insurances.

Post-processing costs are measured similarly. This cost is the premium paid to the program operator, plus the cost of losses within the wrap-up deductible and any collateral that may be required.

The feasibility study will estimate these costs; wrap up sponsor Compare them and make an informed decision whether to proceed with the wrap-up program. Feasibility studies play an important role in the decision-making process, so the data they contain is equally important.

data points

When conducting a feasibility study, several data points are collected, including:

- Project budget estimate

- project schedule

- Salary estimates are categorized by WC class code

- Insurance cost rates for various transactions related to the project

- Wrap-up fee

- Project Loss Pick Estimation

- Collateral cost estimation

Unfortunately, most of this information is not easily researchable. Not all brokers and consultants have this data. That’s why it’s important to work with a broker that has extensive knowledge, practical experience in placing wrap-ups, and managing wrap-ups in multiple jurisdictions. It is especially important to work with a broker that implements/manages a wrap-up program in the same jurisdiction as your project. A good broker/consultant will not only have quality data to use in the feasibility study, but will be able to evaluate it. The overall outlook is good.

project criteria

Not all projects are suitable for wrap-up programs. At the beginning of the process, a good broker will evaluate your project to see if it’s suitable for wrap-up. This prevents stakeholders from becoming too invested in a program and wasting time and money on a program that has no meaning for the project.

When evaluating this, it’s important to look at the type of wrap-up, as there are two main types: single project programs and rolling programs.

single project program

Single project aggregations tend to yield the best financial results for projects with construction volumes greater than $250 million. Larger projects have better economies of scale, which allows carriers to charge higher insurance premiums, making the deployment more attractive to carriers. However, that cost can be much lower than what a contractor would charge on their own insurance.

For small projects, wrap-up carriers may qualify for minimum premium requirements and program costs may be equal to or greater than traditional insurance costs.

The only exception to this rule is when utilizing GL-only wrap-ups. These programs are located almost exclusively in the surplus line market and can accommodate single project programs in the $50 million range in nearly every jurisdiction.

rolling program

rolling program That’s the answer to the “small project problem”. Summary Sponsors with a steady stream of work, but typically smaller projects, may choose to consolidate all their work into rolling summaries. These are best suited for projects with annual enrollments of at least $350 million and less than $150 million.

Whether you’re a project owner, general contractor, or broker and need help deploying wrap-ups for your clients, TSIB can help. TSIB has placed wrap-ups totaling $120 billion in construction and has registered over 39,000 contractors on the WrapWorks portal. We are a highly specialized insurance services company focused on the construction industry and wrap-up arrangements. We have the reputation and experience in the market to assist any wrap-up prospect you are considering.

Interested in learning more about how partnering with TSIB can benefit your next project? Speak with one of our wrap-up consultants to schedule a free feasibility study.

Get the most important insurance news delivered to your inbox every business day.

Get the trusted insurance industry newsletter