mckevin

Sixth Street Specialty Lending (New York Stock Exchange:TSLX) has implemented one of the most impressive portfolio strategies in the BDC industry and has been able to generate solid risk-adjusted returns for many years. while earning one of the highest portfolio yields. One of the encouraging outcomes of the company’s business plan is that its receivables are below the industry average. With its healthy liquidity position and extensive middle market penetration, Sixth Street is believed to be well positioned to benefit from increased investment opportunities in the private credit markets.

BDC market trends are improving

The business development industry has become a reliable asset class for a wide range of buy-and-hold investors. The industry has demonstrated resilience in the face of extreme fluctuations in the economic and credit markets over the past two years, generating solid cash returns for shareholders in the form of regular, special and additional dividends.what they achieved was credit loss were significantly lower than traditional financial institutions, averaging about 1% in 2023 fair value. Accounts receivables were also significantly lower, at around 1% for the best performing BDCs such as Sixth Street.

While the Fed seeks to keep interest rates at peak levels for an extended period of time to meet inflation and job market-related goals, the improvement in trading activity over the past two quarters has meant that middle-market companies and private equity sponsors are pushing higher levels. This shows that they are beginning to adapt. Long-term interest rate environment. This is reflected in increased trading activity across the BDC industry and private credit markets. For example, Goldman Sachs BDC (GSBD) generated $359.6 million in new investment commitments, compared to $166 million in the prior quarter.BXSL) $1.2 billion in new investment and over $700 million in financing marked Most active quarter in the last three years. Carlyle secured loan (CGBD) report Originations increased 30% in the first quarter due to improved leveraged buyout activity.

Overall, BDCs are poised to take advantage of emerging credit market opportunities as they offer creative lending solutions, structural flexibility, and pricing certainty. Higher portfolio yields, generous cash returns, effective portfolio management, and strict underwriting policies also contribute to his BDC’s performance.

A solid business plan gives Sixth Street a positive outlook

Fitch rating agency recently increased Sixth Street’s rating was changed from stable to positive, citing the company’s credit history, rigorous underwriting policies, consistent operating results, and debt-to-equity ratio in the range of 0.9x to 1.25x. There is. I believe that the rating upgrade is the result of the company’s portfolio and management strategy. For example, Sixth Street’s strategy of avoiding diversification into cyclical industries, focusing on specific sector themes, and investing only at the top end of the capital structure reduces accruals and provides strong liquidity. It has helped us generate solid risk-adjusted returns while maintaining our positions. .

Sixth Street invests in fixed income with a hold-to-maturity plan and uses a bottom-up approach, due diligence, and active portfolio management to protect its investments. The company also benefits from its relationship with Sixth Street Partners, a global investment firm that manages over $77 billion in assets. Sixth Street Partners supported it participate He was active in several cross-platform transactions, including a lead role in the debt financing of Clearlake Capital and Insight Partners’ acquisition of Alteryx. Moreover, the company’s strategy of gaining voting rights helps protect its position. As of the end of the March quarter, the firm had effective voting control over 78% of its fixed income investments.

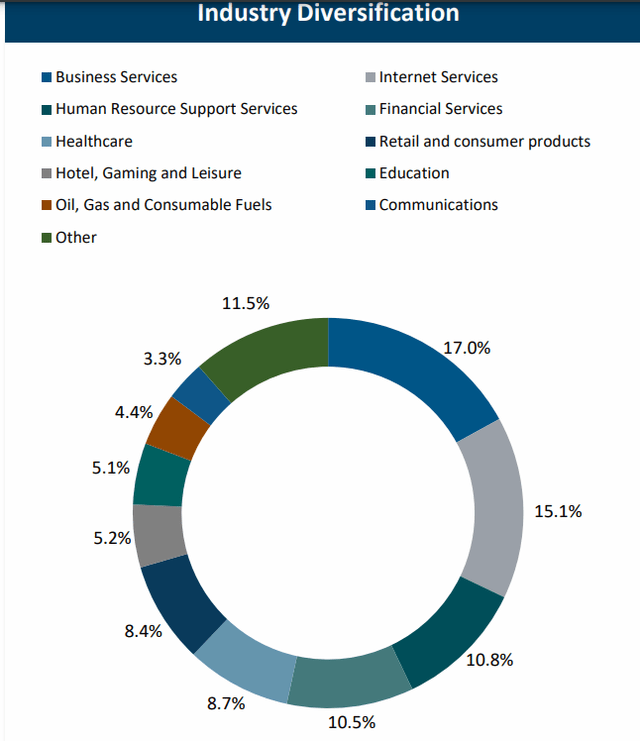

Portfolio diversification (1st quarter presentation)

Sixth Street invests primarily in core market private companies with EBITDA between $10 million and $250 million. The firm avoided portfolio exposure to cyclical industries, but diversified its investments across non-cyclical industries. His portfolio consists of 100 fixed income investments, and his average investment size is $33.5 million.

Sixth Street continues to pursue attractive investment opportunities due to its strong liquidity position.recently quarter, with total commitments of $264 million and total funding of $163 million across nine new portfolio companies in eight different industries. On the positive side, despite investing in non-cyclical industries, Sixth Street’s debt-weighted average yield in the most recent quarter was 14.0%, one of the highest yields in the industry. Peers Goldman Sachs BDC and Blackstone Secured Lending Fund ended their latest quarter with weighted average yields on their investment portfolios of less than 12%. Additionally, Sixth Street’s return on equity metrics are among the best in the industry thanks to its high portfolio yield. First quarter return on equity was 13.6%, consistent with our target return range of 13.4% to 14.2% and significantly above our cost of capital of 9%.

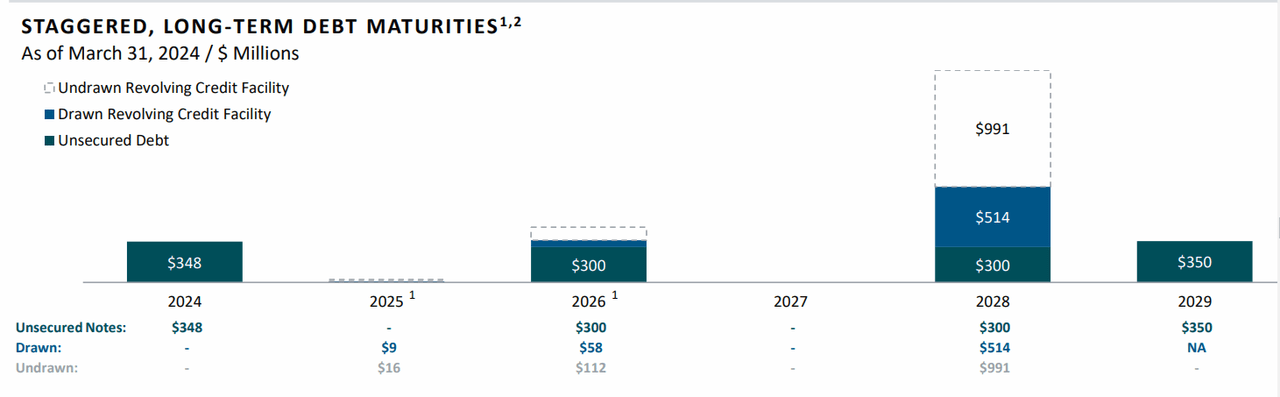

Debt maturity (1st quarter financial results announcement)

In addition to its portfolio management and underwriting strategy, Sixth Street continues to execute on its successful business plan of maintaining debt maturities that are longer than the useful lives of its debt-funded assets. For example, as of the end of the most recent quarter, 78% of the company’s debt maturities are beyond his three years. Additionally, the maturity of his revolving credit facility has been extended to 2029, strengthening his liquidity position. Additionally, a small equity raise and a $350 million five-year bond issue in early 2024 also further increased the company’s investment potential. The company also appears to be in a comfortable position to repay the $347.5 million in late 2024, as it has $1.1 billion in revolver production capacity. The debt-to-equity ratio at the end of the first quarter was 1.14x, compared to the target range of 1.25x.

Dividends are safe as earnings significantly exceed dividends

Although spreads have declined and competition has increased, the company continues to generate healthy net investment income due to low receivables, high portfolio yields, and steady growth in portfolio totals. Adjusted net investment income per share for the most recent quarter was $0.59, a slight decrease from $0.62 per share in the prior quarter and an increase from $0.53 per share in the year-ago period. Net investment income was $0.59 per share, significantly exceeding the quarterly distribution of $0.46 per share. Along with this, the company also announced a special dividend of $0.06 per share. The company currently has a spillover profit of $1.06 per share.

Apparently, there is no risk to the stability of the dividend. Indeed, the company’s strategy of investing in growth opportunities across numerous non-cyclical industries and actively managing those investments is likely to enable it to maintain strong net investment returns. Improving market fundamentals also increase growth potential. Additionally, because 99% of fixed income investments are volatile in nature, the rise in future interest rate curves over time continues to support Sixth Street’s net investment income.

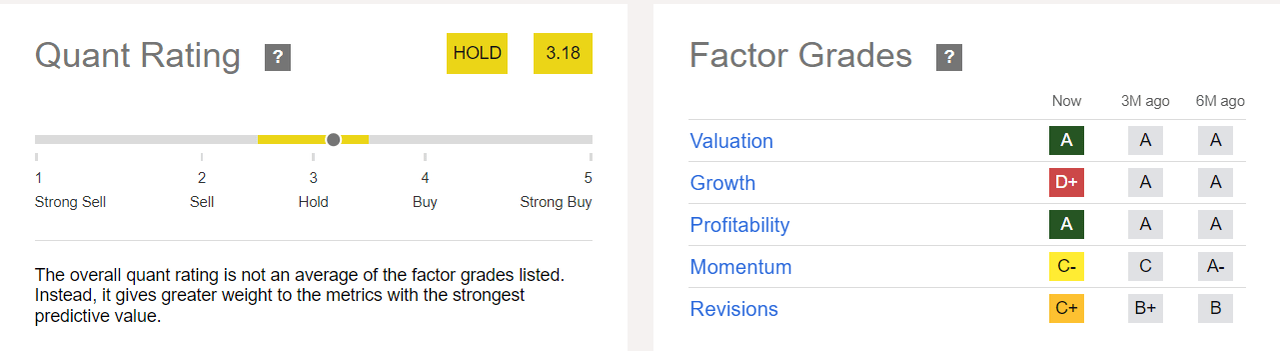

Quantitative evaluation and evaluation

Quant rating (finding alpha)

Sixth Street Specialty Lending has been assigned a Hold rating based on the SA Quantitative System. Hold ratings are primarily due to low scores on growth factors. In the most recent quarter, investment income and net investment income were slightly lower than the prior period due to the impact of increased competition on spreads and portfolio yields. As the interest rate outlook lengthens, we expect the total portfolio to steadily increase and growth rates to improve. In addition to this, investors’ concerns about the impact of interest rate cuts on revenue and profits led to stock underperformance through 2024, giving it a low score on momentum. However, after the Fed communicated its long-term policy outlook, stocks began to rebound. Therefore, your momentum score may also improve.

On the positive side, the company’s valuation is in line with the industry average and below the sector median. The company’s net asset value is also increasing year by year. Since late 2022, the net asset value has increased by more than 5.5%. Net asset value is now approximately $17.11 per share, up from $17.04 per share in the previous quarter. Although the company’s stock is trading above its net asset value, I don’t think paying a premium for quality dividends and future growth is a bad choice. The company also recently issued Stocks that command a premium compared to their net asset value. This reflects investors’ willingness to pay a premium for high-quality businesses, higher risk-adjusted cash returns, and future growth prospects.

Risk factors to consider

The Fed’s strategy of keeping interest rates at the highest level supports a floating nature portfolio, but it could also pave the way for credit deterioration.in the revenue phone, CEO of Sixth Street Specialty Lending, predicted the tail would be growing on margins. This means that while rising interest rates are supporting interest margins, they are also having a negative impact on borrowers’ ability to repay their debts. The company added one new debt investment in accrual status in the latest quarter due to difficult conditions. If the Fed keeps interest rates high for an extended period of time, there is a risk of further credit losses.

The conclusion is

BDCs have proven to be one of the safest asset classes over the past few years due to their attractive business model and strong demand for direct lending. Also, FY2024 could be one of the best years for his BDC in terms of earnings and cash returns, as the BDC’s floating rate portfolio is likely to benefit from higher interest rates due to long-term interest rate policy. Sixth Street is one of the strong BDCs due to its superior business and portfolio management strategies. A healthy liquidity position and reduced receivables will enable us to take advantage of the recovery in trading activity. Therefore, Sixth Street Specialty Lending looks like a solid option for investors seeking income with a long-term investment in mind.