seaway

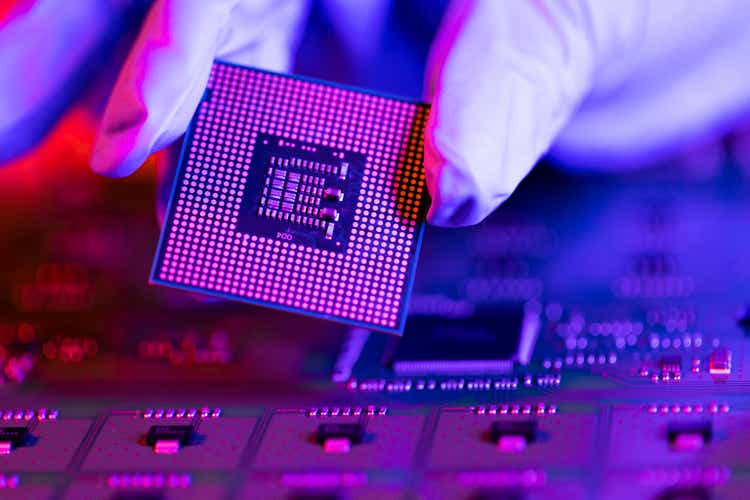

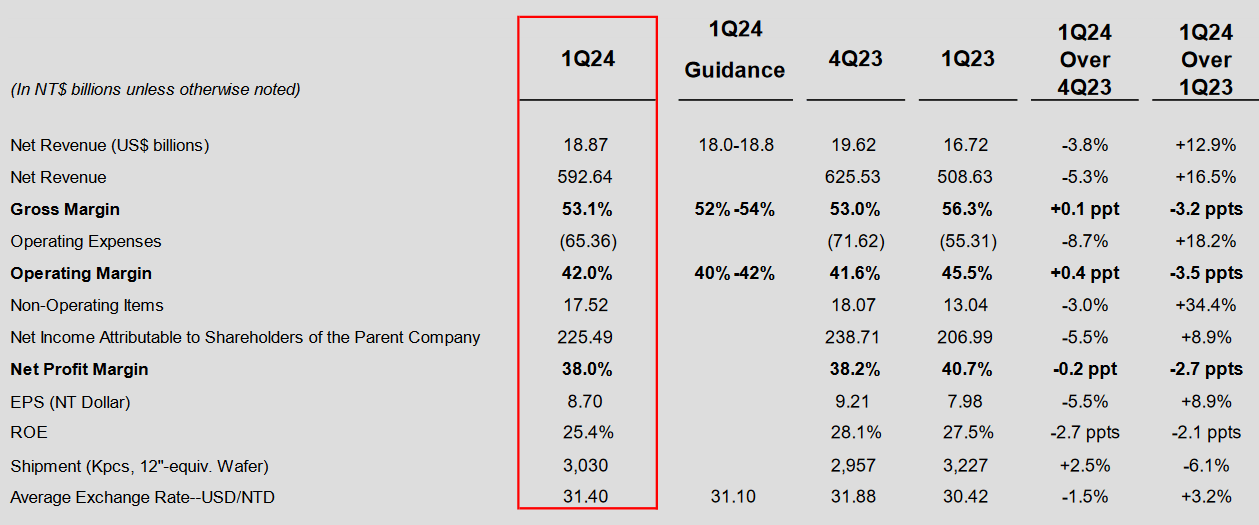

Taiwan Semiconductor (New York Stock Exchange:TSM) Central processing unit maker is breaking through a key long-term resistance level after announcing Q1 releases income The numbers beat analysts’ expectations for both sales and bottom line.Strong global demand for advanced chips Used in artificial intelligence systems, companies can Annualized growth rate Net revenue increased 16.5% ($18.87 billion) and net income increased 8.9% ($6.95 billion) annually. In both cases, the results significantly beat consensus estimates ($17.97 billion in net revenue and $6.58 billion in net income), and these numbers also beat previous guidance, with quarterly revenue of $18.0 billion. This indicates that it is likely to fall within the range of $18.8 billion. .

Q1 2024 Revenue (Taiwan Semiconductor)

This quarter, Taiwan Semiconductor expects global demand to remain strong. 5 nanometers and 3 nanometers Chips that continue to grow throughout In 2024, Apple (AAPL) and Nvidia (NVDA).

Q1 2024 Revenue (Taiwan Semiconductor)

Overall, Taiwan Semiconductor expects revenue from its artificial intelligence server chip products to more than double for the full year, as widespread need for energy-efficient processing power continues to surge across the high-tech industry. Expect. The company expects second-quarter sales to be in the range of $19.6 billion to $20.4 billion.

Q1 2024 Revenue (Taiwan Semiconductor)

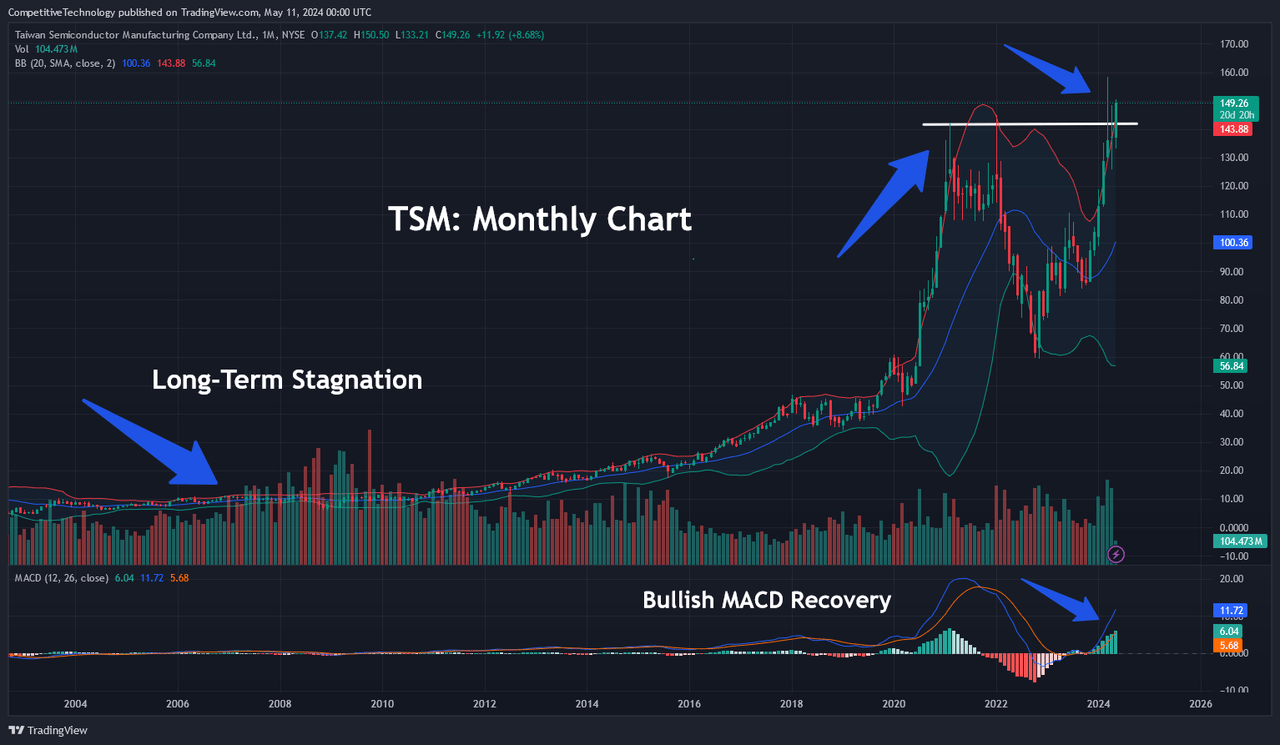

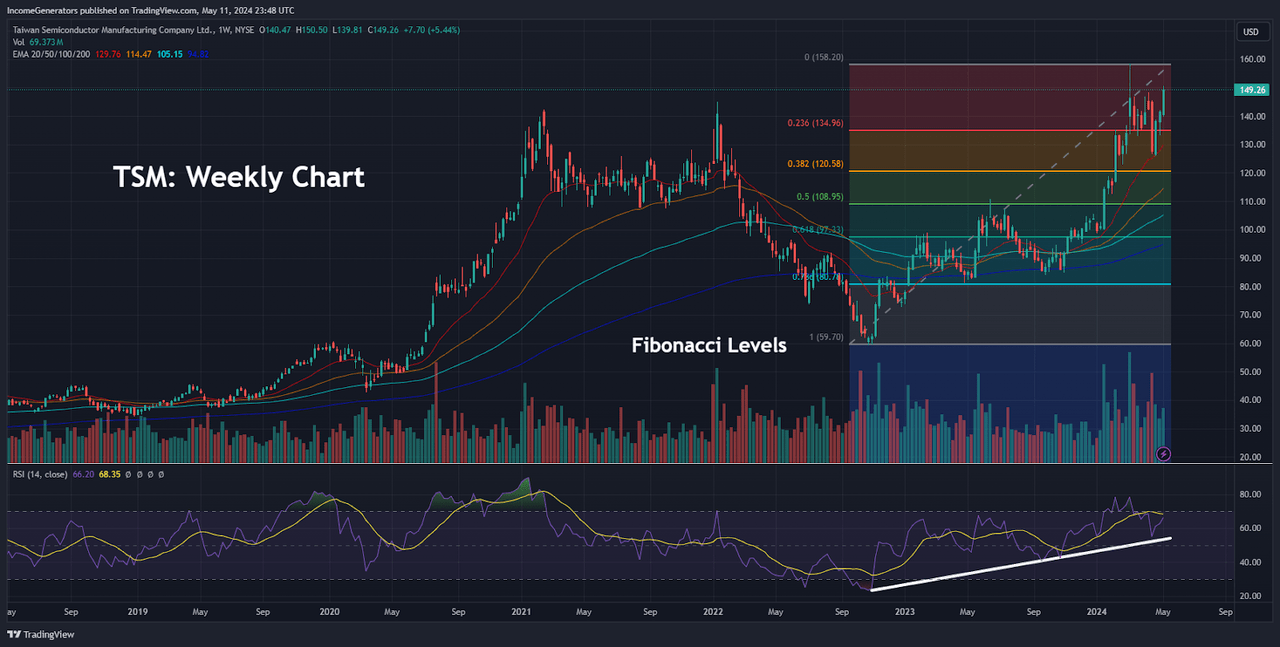

Given both the strength of these numbers and the relative stability of the company’s long-term outlook, investors are looking at the potential Identifying the price level will be important. The price history shown below shows that TSM stock has rallied significantly recently, breaking out of key long-term resistance on the monthly chart in the process.

Breaking through major historical levels (Source of income via TradingView)

After a long period of relative stagnation, TSM’s stock price has soared in the wake of the coronavirus pandemic. However, these extreme price movements ultimately persisted, and the clear change in market dynamics that came to exist in the early 2020s also shows that they should not be dismissed as event-driven . The stock experienced a period of decline throughout most of 2022, but all those losses have now been recovered, and the monthly reading of the Moving Average Convergence Divergence (MACD) remains bullish, making this stock suggests that further upside may be in store.

TSM: Monthly chart (Source of income via TradingView)

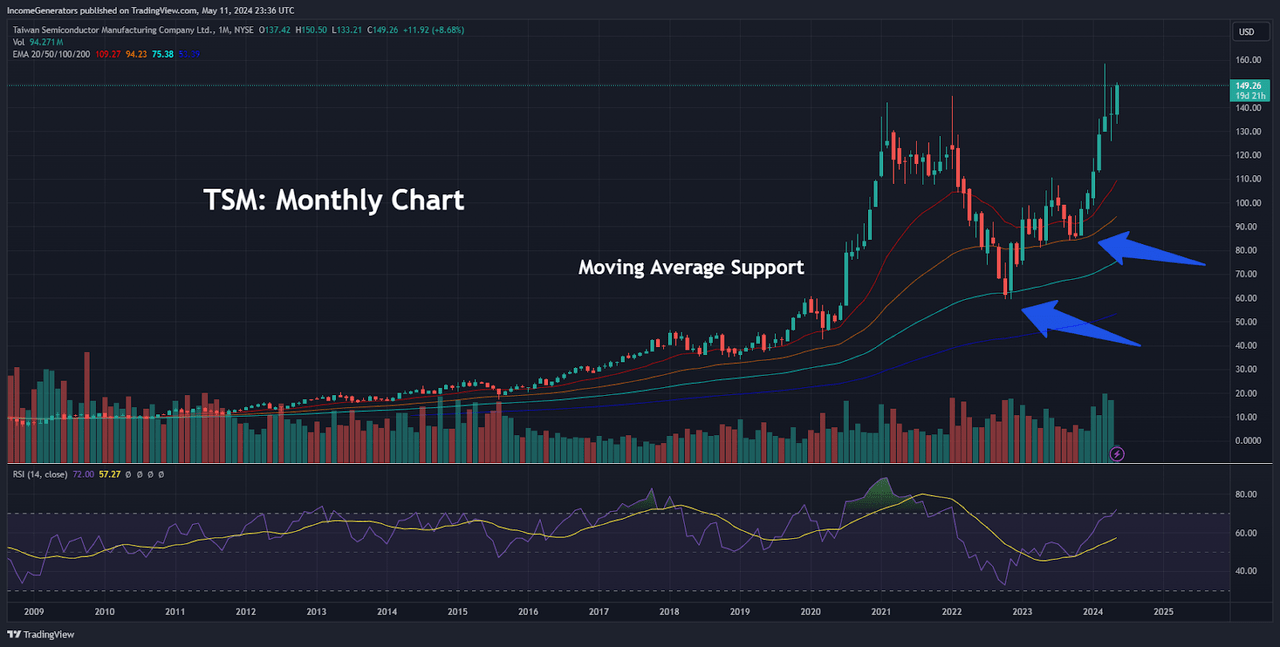

Supporting this bullish outlook is the fact that TSM stock has managed to find support at well-defined price intervals. Specifically, the stock was able to halt a significant decline in 2022 after finding strong support at its 100-month exponential moving average. A similar event also occurred in 2023 when TSM saw an increase in buying activity when the stock price fell to its 50-week exponential moving average. average. Additionally, the Relative Strength Index (RSI) monthly indicator measures not significantly overbought (despite the stock’s significant jump), which means TSM still has room to rise before going too far. suggests.

TSM: Weekly chart (Source of income via TradingView)

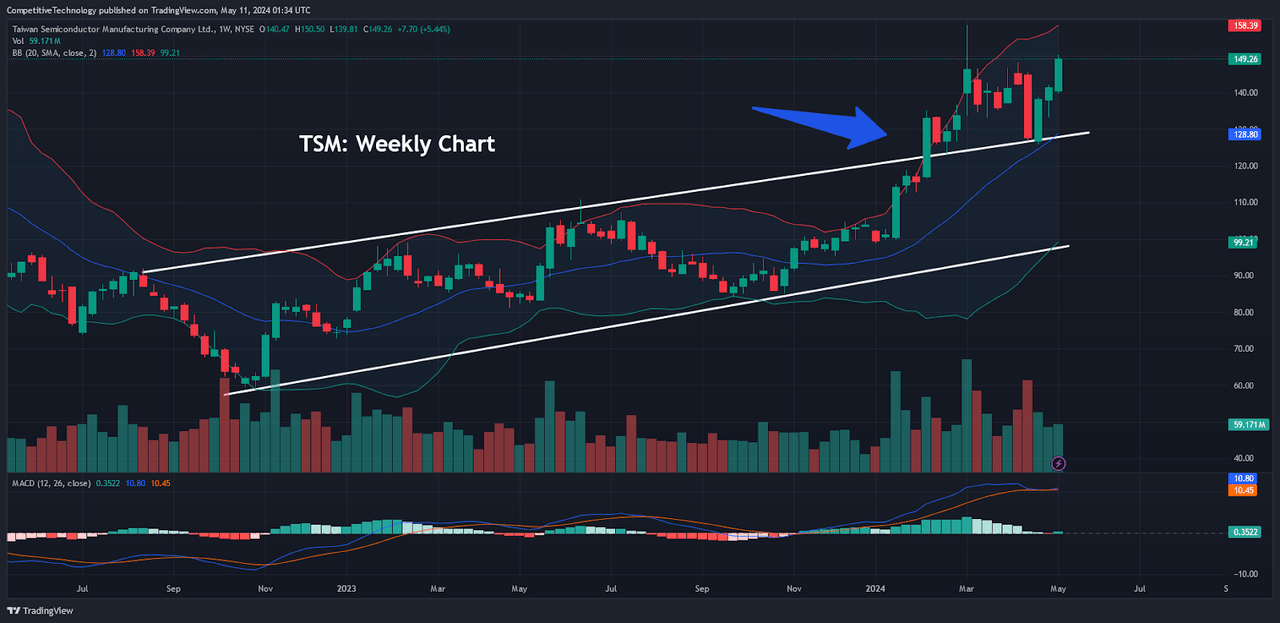

A look at the weekly chart provides further reasons to continue to support the bullish outlook. Specifically, the stock price has already broken out of the uptrend price channel that began to form towards the end of 2022. The breakout of this channel has been tested to the upside, so the latest price move can be viewed with a higher level of validity. The bullish momentum currently characterizing the stock price movement is confirmed by the positive reading of the weekly MACD reading over the same period.

TSM: Weekly chart (Source of income via TradingView)

When we see a bullish uptrend movement, such as the price structure recorded on TSM, it is possible to identify potential downside targets that can be used to establish a new buy entry if the stock price starts to fall. It can be very difficult. To accomplish this, we generally look to Fibonacci retracement analysis as a means of identifying potential price targets to the downside. If we start with a dominant trend move, we should start from the October 2022 low of $59.43 and extend towards the March 2024 high.

Here we see that the stock has already broken through the 23.6% Fibonacci retracement (located just below $135) before finally finding support at the 20-week exponential moving average. Of course, this downside break opens the door for further downside correction and the next level of support using this analysis can be found at the 38.2% Fibonacci retracement near $120.60. If TSM stock loses support around the $120 handle, the next potential downside level would be a 50% retracement just below the $109 decline (also at the June 2023 resistance high). within a very close range). Finally, if all these levels move down, the 61.8% Fibonacci retracement level is the ultimate target. This level sits just above $97.30 and is relatively consistent with the January 2024 low of $98.80.

Overall, Taiwan Semiconductor has strong revenue performance, a persistently positive business outlook (based on continued demand for advanced processors used in artificial intelligence systems), and prospects for continued market share growth. We believe it provides an excellent example of supporting technical context. price. Although there are short-term risks to the company’s revenue outlook due to seasonal fluctuations in smartphone demand, widespread implementation of large-scale language models (programs such as ChatGPT and similar products offered by various Chinese technology companies) , it is sure to have a major impact in the future. We expect a wide-ranging impact on Taiwan Semiconductor’s performance in the coming quarters. Whenever a stock sees this type of bull market rally, there is always the potential for downward corrections and profit-taking by investors who are already long on the stock. As a result, we have outlined several potential support zones that can be targeted as buy entry levels if this type of downside price movement materializes.

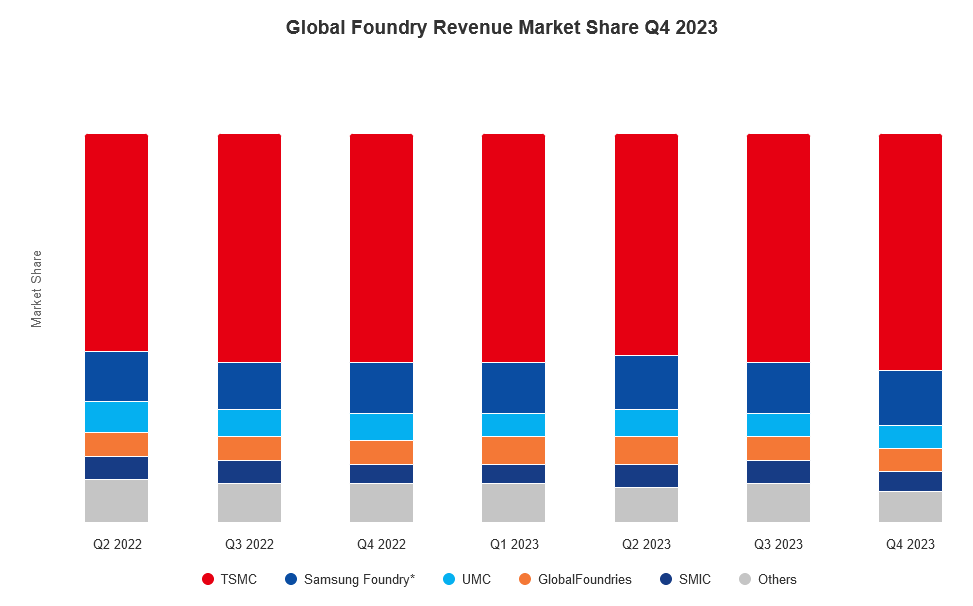

World Foundry Revenue (Counterpoint Research)

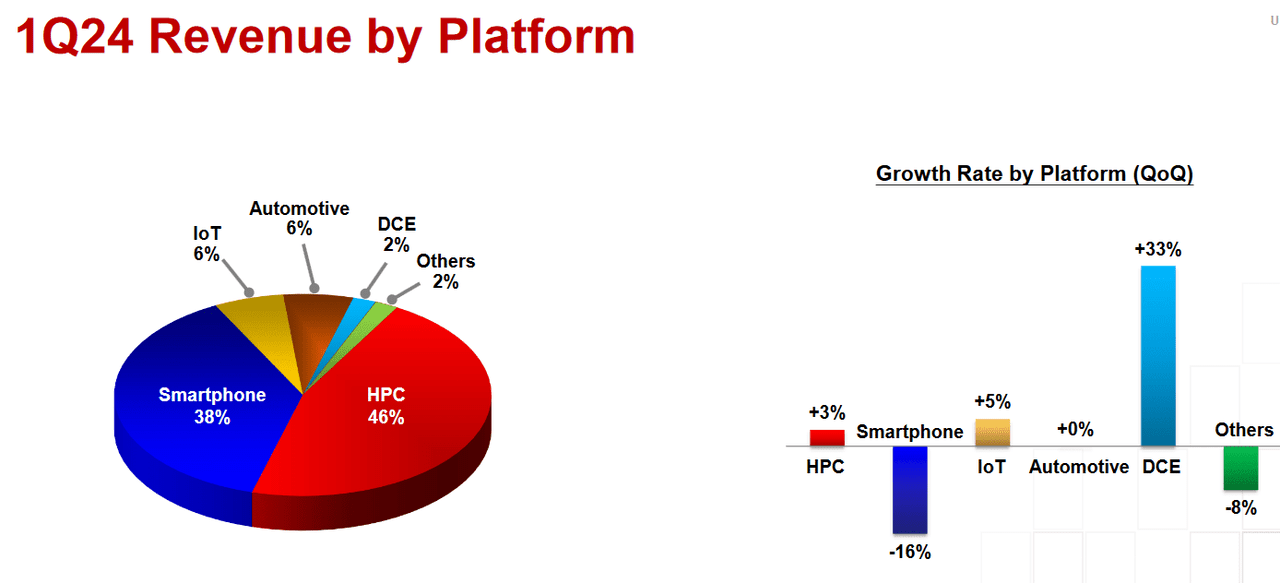

It is clear that competitors of Taiwan Semiconductor, the world’s largest manufacturer of advanced central processing equipment, still have significant ground to make up before reaching similar levels. In the fourth quarter of 2023, Taiwan Semiconductor recorded a staggering 61% of its revenue from worldwide processor foundry production. To see how impressive this number really is, we can take the example of Samsung Foundry, the second largest producer (which accounted for just 14% of global revenue). Additionally, Taiwan Semiconductor’s net profit margin currently stands at 40% (the highest in the company’s history). The industry-wide average net profit margin is less than 15%, and this high level of performance is exceeded primarily thanks to chips provided by Taiwan Semiconductor. 7nm or less (Shown in second chart image). These processors tend to allow for much higher profit margins, so Taiwan Semiconductor’s dominance in this area of the market suggests that the company’s profitability expectations remain well within reach going forward. I am. Overall, we believe TSM provides an excellent example of long-term earnings growth and technical chart signals aligning in the same strong bullish direction. We also believe TSM stock remains attractive despite the stock’s price breaking above significant historical resistance.