Explore Alpha Picks on Seeking Alpha

Read the article diving deeper into the research study here

The transcript found below is for readers who would like to follow along. Please note that the transcription may not be 100% accurate.

Daniel Snyder: Hello, everyone. Welcome to this great new Seeking Alpha Webinar. I’m Daniel Snyder. Hanging out with me today is the one, the only Mr. Steven Cress, Head of Quantitative Strategies here at Seeking Alpha. Steve, how are you doing today?

Steven Cress: I’m doing very well, Daniel. Thank you so much for having me back on again.

DS: Of course, we love having you on and I love this subject matter today, right? We’re riding the AI wave in the markets. And today, you’re going to be talking about five companies that are leveraging AI and what the story is and what the metrics are. So I hope everybody is ready to dive into all of this, but I think you have my favorite slide of the presentation right here at the top, right?

SC: We do.

DS: All right. It’s not really my favorite, but let’s go ahead and get this over with. So now we are not advising you personally concerning the nature, potential, value, or suitability of any particular security. You alone are solely responsible for determining whether any investment, security, or strategy, or any product or service is appropriate or suitable for you based on your investment objectives and personal and financial situation. Past performance is no guarantee of future results and Seeking Alpha is not a licensed security dealer, broker, or U.S. investment adviser or investment bank.

And with that being said, let’s dive into these five companies and they’re not all in just tech sector, which I’m excited about. So…

SC: They’re not. And I want to give our members today and anyone who’s joining on the call, a little bit of an idea of how quantitative analysis works and how we select these AI stocks. And I can say similar to artificial intelligence, quantitative analysis has really revolutionized the way that stocks are selected. It’s a very efficient process for doing it. You can assess huge, huge amounts of data. You can identify patterns and you can forecast market trends.

So how does it start? It all starts back to the basics. With – even with quantitative analysis, it goes to the basics. There’s investment research. And we’re basically using for our quantitative analysis or for maybe using another word, quantamental analysis, fundamental investment analysis.

And fundamental investment analysis has been around for hundreds of years. And it involves an analyst that researches a company. They evaluate what the company does. They speak with management. They look at the company’s financial health. They look at cashflow statements, balance sheets, income statements, and financial metrics for that single stock.

And a good analyst will be able to take that stock and measure it maybe against a dozen other companies. And that analyst, very typical of analysts that work at maybe Morgan Stanley or Merrill Lynch or Goldman Sachs, they’ll cover a certain sector. And within this sector, they’ll have anywhere from 12 to 20 companies that they cover.

So in terms of a human approach, it’s a good way to approach covering 20 companies. But with the power of computer processing, and when we introduce the quantitative concept, we can take those basic analysis strategies and methodologies that a really good analyst will use, but apply it not against a dozen stocks, but literally against thousands and thousands of stocks.

So our quantitative process has the ability to go through those cash flow statements, income statements, balance sheets, and metrics for literally 4,500 stocks, and we refresh it every single day.

So there’s no way a human analyst, even through the dozen companies that they have, they’d be able to come up with fresh opinions and recommendations every day. We can do that with our quantitative process.

So we look at where the stock prices are, where their revenues are, where earnings are, profitability, the valuation metrics, and each day we score them to come up with a directional recommendation.

And part of our quantitative analysis is making sure we have a good strategy. So that strategy, it’s typically grounded in mathematics and statistics. And what we do is we create a strategy and backtest it over a long period.

So what we have found at Seeking Alpha and what’s core to our strategy is we focus on companies that are collectively strong on Value, Growth, Profitability, Momentum, and Analyst EPS Revisions.

So those are the core characteristics that we look at. And underneath those characteristics, there’s a lot of underlying metrics. There’s 100 underlying metrics that we assess and score, but we have the ability through our quantitative analysis and computer processing to take that method and have a huge universe of stocks.

So that’s where we start. And as I did mention, we focus on some very specific investment characteristics. And when we do that for Growth, Value, and Profitability, we measure it relative to those companies’ sector.

So, by example, we’re looking at Exxon and we measure those investment characteristics. We try to provide an instant characterization of what that company looks like on a value basis versus the entire energy sector. If we’re doing it for a company like Pepsi, we’re looking at it across the entire consumer staples sector. And sometimes that picture is worth a thousand words.

So what we have here is the Factor Grades that we use at Seeking Alpha. And as you can see, we have academic letter grades that range from F to A+. And when you see, by example, if you look at the Valuation Metric on the right-hand side, it has a D grade. That means that that company would be overvalued versus the sector.

However, if you look underneath and you see the B for Growth and the A+ for Profitability, it would mean that it has much stronger growth and much, much stronger Probability versus the rest of the sector.

So that’s kind of what we want to do. We want to help investors quickly assess stocks. And really, they could look at these core investment metrics and they’ll see that instant characterization of how a company stands versus the sector. And we have a pretty good track record at it.

Using this strategy, going back to 2010, if you were to have invested $10,000, that $10,000 would have turned into $244,000 versus if you just put $10,000 in the S&P over that 14-year period, it would be $50,000. And what this backtest reflects is every single Strong Buy that we’ve had going back to 2010. So we’re not cherry picking. We’re not taking a couple of ideas from any type of theme or any type of sector or industry. This is all our Strong Buys. We put them into a portfolio every day. And if it falls out of the Strong Buy, it comes out of the portfolio.

So what we’re doing here is it’s not so much as an investment product that we’re trying to show you this performance. We want to show you this performance to let you know that the strategy works very, very well.

DS: And just want to point out real quick, Steve, that the backtest is done with S&P, and it’s not just us internally running this.

SC: That’s the backtest. And, yeah, we show backtested strategy from 2010 to 2019, but we actually started this for Seeking Alpha in 2020. So those are actually live trades from 2020 through 2024. But as Daniel said, don’t take our word for it. This goes through a third-party. It’s S&P Global. They have a portfolio performance attribution system. So our stocks are loaded up into that system and they calculate the performance. So it is a third-party. I really appreciate you highlighting that. Thank you.

So again, sort of an independent study recently from the University of Kentucky, Professor Russell Jame, came out with a study on Seeking Alpha’s Quant Ratings. And the University’s study is independent and that assessment found that the Seeking Alpha Quant Ratings strongly predict future returns and offer pronounced benefits for investors relatively new to quantitative analysis.

And it also found that authors or contributors that write on Seeking Alpha’s platform that utilize the Quant Grades have better performance than the authors that do not. And again, this is an independent study. It’s an empirical study. And the conclusion was that the Quant system works really well, not even on its own, but they compared it to other type of multifactor models based on other academic institutions.

So they’ve looked at two-factor models, three-factor models, five-factor models, and across the board, the Seeking Alpha Quant model outperformed all of them. I have the link there, so if anybody wants to take a look at their study, they can. It’s about 50 pages.

We also wrote up an article to sort of summarize that at Seeking Alpha. But again, it’s a third-party. And actually, when they came out with a study, their initial one, we didn’t even know about it. They contacted me afterwards. Subsequently, they had a follow-up to it where they included information from us. But in the initial study, we didn’t even know that they were coming out with it. So we were really pleasantly surprised to see it.

So, Daniel, this brings us to the moment that a lot of us are waiting for on the call, the AI Frenzy, which really started sort of late during the pandemic and going into 2023, had started to send stocks to record highs. And it truly is a Frenzy, but it truly is a technology that many, many companies and many, many individuals are using throughout the globe.

So I really put it out there, right, really sort of like with the advent of radio, television, electricity, the automobile. And one of the differences is though, so many individuals and so many companies across the board are using AI almost immediately. So it really is quite a revolution.

To give you an idea of some of that scale in terms of numbers, and really keep in mind, AI just started to come about in 2023. A lot of the technologies used to develop machine learning, obviously, have been in existence for probably the better part of a decade or 15 years, but that’s all sort of coming to fruition right now, and NVIDIA was one of the top companies to lead it in 2023.

So in 2023, expenditures totaled about $153 billion. Most AI took place in banking, the retail sector, professional services, and manufacturing. AI sent stocks to a record high 22x just in the first quarter of 2024, with nearly one-third of the S&P 500 companies citing AI in their earnings call.

So this is really a technology that many of them just started introducing to their companies in 2023. And by the time they got to the first quarter of 2024, nearly one-third of the companies in the S&P 500 were saying AI has an impact on their earnings.

Another stat here is that AI-centered tech industries are expected to reach $300 billion by 2027. I actually personally feel that’s a low stack. I wouldn’t be surprised to see if that stack is far surpassed. And really, we’ll go through the companies that we’re picking today. They’re all large companies.

But whether you’re a company the size of JPMorgan that has 300,000 employees or a company that’s the size of Seeking Alpha that has less than 300, we’re both using AI. And there’s a lot of companies in between those that have 300 employees and those that have 300,000 that are starting to use AI, and some people use it on a daily basis.

Now, of course, since I’m in Quant, you may say I obviously use AI on a daily basis, but I use it in ways that you would never expect, even if it has to do with ChatGPT and just improving writing sentences. So that’s a small example.

You, but Daniel use it in videos that you’re comprising. I wouldn’t be surprised at all. Editorials use it – editors use it to help them when they’re editing articles. So AI is just really becoming prevalent all over the place. And we really saw this in 2023, the year after really the pandemic, there was a lot of nervousness in the market going into 2023. You would not have known that by the performance of the market, and that’s because the Magnificent 7 really led the charge. And Magnificent 7 during 2023 were up about 111%.

But if you extracted those seven stocks, or even with those seven stocks, if you just took the median return for the market in 2023, it was actually negative 16%. So the S&P was up somewhere north of 20%. The Magnificent 7 up 111%. But the median return for the S&P was actually negative 16%.

And the reason why there was that negative return on a median basis is investors were really fearful about rising interest rates, inflation continuing to go higher. So it was really sort of a defensive environment. So people were putting money into companies that were extremely profitable.

So the Magnificent 7 definitely qualified in that category. They are companies that are profitable, But it’s really emerged that many of the Magnificent 7 companies were starting to make a change, employing more and more artificial intelligence in their businesses.

And when NVIDIA came out with their quarterly results early in 2023, and there was such a big boost due to AI, and then you had companies like Super Micro Computer, which were attributing a lot of their success to AI, it really started to catch on.

So for – what we’re bringing forward, I’m going to get to these names. I’ve selected five stocks leveraging AI. Two of them are tech firms. Three of them are actually manufacturing companies. They’re up on average 45% in the past year and 16% year-to-date.

To put that in relative terms, year-to-date, the S&P is about – up about 9%. So these stocks on average are up about 16%. Over the last year, the S&P I believe was up roughly 23%, and these stocks over the last 52 weeks were up 45%. So they’re really beginning to show.

So I’ve given you a little bit of the backdrop for the Magnificent 7 and how these companies have done and how outside of them being defensive companies, AI had a lot to do with them doing well in 2023. But as we’ve come into 2024, one-third of the companies in the S&P, as I mentioned, have implied AI in their earnings calls.

So it’s now expanding far beyond the Magnificent 7 to many, many more stocks, and not only in the S&P 500, but the broader indexes like the Russell 2000 and 3000, many of the companies are announcing it.

So picking top stocks for ‘23 and 2024. Many people who are on this call might recognize that I produce a list at the beginning of every year with my top 10 recommendations. And the top 10 recommendations have attributes that are very similar to the attributes that I use to select the AI stocks. As I mentioned earlier, those five factors are Valuation, Growth, Profitability, Momentum, and EPS Revisions.

And now when you look at those core investment characteristics, and you currently look at the Magnificent 7, many of them actually don’t qualify. I think actually two of them are really Strong Buys out of the Magnificent 7, because most of them are really overvalued, and many of them don’t even have growth that is that strong.

So this is the methodology that we use for picking our stocks in 2023 and 2024. So to let you know how that did, since their selection, the top stocks for the 2023 portfolio have delivered a return of 162%.

So it’s basically a year-and-a-half in. Those 10 stocks are up 162%. For my top stocks for 2024, those stocks are currently up 51%. And as I mentioned, year-to-date, the S&P is up about 9%. And those top 10 stocks on average are up 51%. So we’re using the same core factors that we use to pick our top stocks in 2023 and 2024 to pick our top AI stocks.

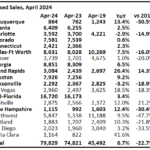

This is just a quick list I wanted to show you in case you’re not familiar with the stocks that I picked in January 1 of this year. We had AppLovin, so far it’s up 120% year-to-date; GigaCloud Technology is up 92%; Modine Manufacturing, up 77%; Celestica, up 70%; Rolls-Royce, up 45%; Abercrombie & Fitch, up 45%. And I got to tell you, Daniel, people did not like that I picked Abercrombie & Fitch, but the stock has definitely panned out well. It had all the metrics we were looking for and hit the sweet spot. So that’s why it was selected as one of the top 10.

Facebook at the time was a Strong Buy. That stock is up 38%. Bank Intesa, that’s an ADR, up 31%. And the two stocks that have not performed are Dorian, which is an energy company. And MHO is down 7% this year, but last year was up tremendously. So it was a great pick in 2023.

So our top five stocks, leveraging AI, okay? How do we pick these stocks? All right, anybody could do this. If you’re on Seeking Alpha’s platform, on Seeking Alpha Premium, this is simply what I did. I took three ETFs that focus in AI stocks, and I took the ticker symbols for those ETFs. So I loaded them up into Seeking Alpha’s portfolio tool.

So if you’re not familiar with it, Seeking Alpha has a portfolio tool. You could load up your own personal stocks and you can create as many portfolios as you want. You could do one for yourself. You could do one for your kids. You could create themes. I personally create a lot of themes. And one of the themes that I have is AI and AI robotic baskets.

So I’ll show you some of the other themes that I have. I’ll go to the platform. But when you go to the platform on the left-hand rail, you’ll see where you load up your portfolios. So I simply loaded up those ticker symbols, and I’m going to take you to right now.

So I’m actually on Seeking Alpha’s platform, and I’m going to scroll down and you can see I’m a little bit crazy when it comes to having different thematic baskets. So I have drone baskets, I have cybersecurity baskets and Indian ADRs, I have the Internet of everything, mega tech stocks. I was kind of curious how Motley Fool did. They did not do that well for their stocks for 2023, but I’m not going to throw them under the bus. We did incredibly well. I have a self-driving EV basket, but let me bring you to the AI and robotics basket, which you see right here.

So when I load up all these securities, I can actually take a look at all the metrics that are of interest to Seeking Alpha’s Quant System. So we have the Valuation Metrics. We have the Growth Metrics, Profitability, Momentum, and EPS Revisions. We total up the scores for these metrics. It hits a sweet spot, and we come up with the total Quant score. And this is how we selected the stocks.

So we’re using our own model, our own Seeking Alpha algorithm that has worked very, very well. We’re applying it to stocks that are focused or have a significant amount of their business or a good portion of their future business in artificial intelligence or robotic baskets and using our Quant methodology these are the ones that came out on top.

So I’m going to go over a couple of those today. We selected five for the purposes of today. So the #1 company, this is a technology company, probably not a surprise to a lot of people. It is Google. And as you can see, the Quant Rating on it is a Strong Buy. You could see the Factor Grades. Valuation tad expensive, but not by any measure the most expensive in the sector, comes in with a D+ for Valuation. But on Growth, it’s stronger than the sector. It’s got a B+. Profitability, just about one of the most profitable companies in the world. Momentum has been very strong, and analysts are loving this company. You can see it’s got an A.

If you look to the right side, you can see the rating that the Seeking Alpha contributors have had their consensus on it, and Wall Street consensus is a Buy. The Seeking Alpha Quant System had a Strong Buy on it, and it hasn’t let us down. As you can see by that performance, it’s been pretty good.

So I’m actually going to go back to the Seeking Alpha platform, so you can see it firsthand yourself. And if you’re not familiar with the platform we have on Seeking Alpha, it’s a crowd-sourced system of research. So many, many different investors can write articles and put their opinion out. So you could see some of the contributors have Buy recommendations on it, Hold recommendations, quite a lot of Buys on Alphabet.

And then, of course, we have a wonderful news team that basically for large companies like Google will have news on it almost every day. And then on the right hand rail is where you find the Quant Ratings. And these get refreshed every single day. So when you see that Strong Buy, that’s not a Strong Buy that’s four weeks old or four months old. That gets refreshed every single day.

So that’s a little bit of a difference. Like when you have a professional analyst at Goldman Sachs or Morgan Stanley, they’re only going to write every couple of weeks on Google. Our system updates the numbers every single day. So when you’re looking at the Valuation Factor Grade or Growth or Profitability, this gives you that instant characterization of how it compares to the sector every day. And if we click on it, it will show us the underlying metrics. So it’s a very transparent system, Daniel.

So the grade gives you that instant characterization, but you don’t have to take our word for it. You could look at the absolute data point. So if you look at the revenue growth year-over-year for Google, you’ll see it was up 11.7% versus the sector that had a revenue growth rate up of only 2.5%. So that would place Google at a 367% premium to the growth rate of the sector.

So that’s the top line. You could go down and look at the bottom line basis. The forward EPS growth rate for Google is 23% versus the sector at 6%. If you’re interested in what the sector is, you can scroll down a little bit, and you could see that it is in the communication services sector. And part of the beauty of the system is we show you exactly where the stock ranks out of all the other stocks in the sector and within its industry, as well as all the stocks that we measure.

So we’re looking at about 4,500 stocks and Google ranks #16 out of the 4,500, but in its sector and its industry, it ranks #1.

DS: Hey, Steve, real quick, if I can jump in. Just want to make sure that we clarify this point, because somebody might be looking at these grades for the first time, right, seeing Quant says Strong Buy, but the Valuation Grade is a D, so how does that make sense? Because maybe if something was a Strong Buy, it should have As across the board, right?

SC: Nope, it doesn’t. So the metrics are not equal weighted in terms of – or the factors, I should say, and the metrics are not equal weighted. We have backtested these to see which ones have the greatest predictability in terms of future performance. And some metrics are stronger than others.

So the threshold that we found where we could have a stock in terms of its Valuation, qualifies a Strong Buy is at the D level. But Daniel, if that was actually a D-, that threshold would be broken and the stock would be an automatic Hold.

So Google sort of right at the fence of its valuation. But the beauty of looking at the underlying metrics is that you can actually find metrics that look pretty good. So if you look at the P/E on a forward basis instead of non-GAAP. If you look at P/E GAAP, it’s actually a C versus a D.

So the multiple on a GAAP basis is 22x versus non-GAAP at 26x. So it looks a little bit cheaper on a GAAP basis. And the premium is 28% to the sector at a P/E of 17x. So it’s actually – it’s a little rich, but it’s not incredibly rich. And then if you look at it on a PEG basis, which is one of my favorite metrics, that actually combines both the P/E and the growth rate, it’s actually a C+. So you can actually make an argument, when you look at the underlying metrics that a stock looks fairly strong.

I’m going to take us back to our presentation. So Google, obviously looking good. It’s a member of the Magnificent 7. It’s our #1 Quant-rated stock in the communications sector. Obviously, Google is capitalizing on AI trends. And if you’re not familiar with the products, they have something called the Gemini AI Chatbot. And through a lot of their R&D, it has a global footprint that really has it well-positioned for the next wave of AI innovation. The stock is up 21% year-to-date versus the S&P up 9% and it’s up 57% for the last 52 weeks versus the S&P, which is up only about 25%. The company has consecutively beaten analyst estimates.

And in the last 90 days, 48 analysts have taken their estimates up, not one has taken their estimates down for Google. So they’re really very, very positive and the company also authorized its first dividend ever of $0.20 per share.

Getting to our #2 stock is Okta, ticker symbol, OKTA. As you can see, this has almost straight As across the board, with the exception of the Valuation. It’s got the Quant Strong Buy. So the value is a little bit better than what we saw for Google. Let me give you some details. Probably a lot of people are not familiar with this company.

They are in the tech space, and they operate as an identity partner throughout the world, the United States, internationally. And they have a suite of products that are used to manage secure identities. So whether it’s a single sign-on as an application, or if you’re using a sign-on across a cloud or through a specific premises or through multiple devices, this is obviously very important.

So most people that work in companies today, and even if you don’t work in a company, you’ll have your own private password. You get the idea of having sort of a secure sign on it. The stock is up 46% in the last six months, over 25% for the last 52 weeks. They have a very, very strong pipeline going into the fiscal year 2025. They recently relaunched an AI product, which is the Okta AI. It’s a tool that lets customers harness the power of AI to protect against cyberattacks.

So I don’t think I have to tell anybody the importance of cyberattacks. It’s so important that I actually have a portfolio that has a theme of cybersecurity. So it’s at the forefront of a lot of people and companies as well as governments. So this company is coming to the forefront. They’re ranked #3 in our Quant model for Internet services and infrastructure stocks.

The company has had 15 straight beats for EPS expectations. That’s incredible. The last 15 quarters, they’ve been able to beat, and they’ve had an impressive 37 upward revisions in the last 90 days and 0 downward revisions. According to consensus estimates, EPS is now projected to grow at 40% and sales are projected to grow at 10% in 2025. So this company did not authorize that dividend. So we’re just going to take that sentence out. Sorry about that.

I’m going to bring us to our next slide on it. And I’m actually going to put the slideshow. So the…

DS: It sounds like this company is the answer to Warren Buffett’s fears that he was just talking about over the weekend about the scammers.

SC: Yeah. I mean, the scammers are prevalent on a global basis. And they might reside in China or Russia or Ukraine. They reside everywhere. It’s not just actually in those countries. A lot of those scammers are right here in the United States. They’re trying to make money, but companies like this one are developing stronger technologies to fight cybersecurity, and a lot of corporations are putting billions and billions of dollars into fighting it.

As you could see over here, they have close to 19,000 customers. Their growth rate is a 24% CAGR growth rate. And as you could see, they did $3.38 billion in their remaining performance obligations. So the company has just been doing really well. And it looks like going into 2025, they have a stellar pipeline as well.

So that’s going to bring me to our next company, which is actually a really old company. So we had two technology companies, Emerson Electric. A lot of people might have known this more as like an industrial electronics component company. Again, straight As for this company. We love it on Growth, Profitability, Momentum, EPS Revisions. The Valuation is getting a bit expensive, but again, it has a great overall Quant score, which brings it to a Strong Buy.

So this company was founded in 1890, okay? This is not like – AI is not like your dot-com bubble period of the year 2000, where you had unheard of companies that had no revenues, no earnings with market caps that were in the stratosphere, okay? AI is coming through to companies as old as this one. 1890, it’s amazing.

So I kind of remember as a kid, they have like electrical motors, they made fans that you could buy in Sears. Probably people don’t even know what Sears is anymore. But Sears at one time was one of the biggest retailers in the United States, and they sold fans from Emerson Electric.

So this company has been able to change throughout the times, and now they’re known as a technology and software company that provides solutions for industrial companies, commercial companies, and in consumer markets.

They have six specific segments. They have final control, control systems and software, measurement and analytics. They have a company called AspenTech. They have discrete automation, so they’re very big in the automation sector, as well as safety and productivity. They rank #4 in our electric components and equipment stocks. Year-to-date, the stock is up 18.64% and over the last year, it’s up 27%.

So beating the S&P both year-to-date and over the last year. As I mentioned, they’re a tech and software company. They use advanced real-time modeling and machine learning and artificial intelligence in their software applications for manufacturing and their software.

The company in 2024 was named the IoT Company of the Year. And that is an award that leads to sort of innovation and automation. So this company base that started in 1890, in the year 2024, it’s getting this very prestigious award for innovation and how they’re using artificial intelligence.

So in terms of some numbers, we have an A- for this company in Profitability. Their gross margins were nearly 50%, EBIT margins were 20%, and net income margin nearly 70%, and return on assets 23%. So you could see why we like Emerson. And again, this is sort of just featuring that award.

Taking us to another stock that is quite old. And I remember I put this in an article last year as one of the top AI stocks, and I can’t tell you the criticism that I got. People thought of this company, look, they make farm equipment and tractors. They do, but they make some of the most advanced industrial machinery in the world.

So here, the growth – it’s a very large company. The growth is a little bit slower than some of the other companies that I’ve highlighted, but they’re incredibly profitable. They’ve had really strong Momentum. Analysts increasingly are liking this company, and the stock has actually performed really as well. You could see this is the one-year history, so it’s done very well. It’s been a solid Strong Buy for a one-year period.

Caterpillar was founded, Daniel, in 1925. And, of course, they did start with basic tractor equipment, but they quickly got into construction and mining equipment, and that’s where the company really focused. They’re one of the world’s largest construction companies. They have a very strong brand, and they do a whopping last year, or for this year, they’re – it’s anticipated they’ll do a whopping $67 billion in sales.

So I had said early on in the call that AI really started to hit the newspapers and the financial media in 2023. Companies started like NVIDIA saying, what a big difference it was making. But it’s not like AI and machine learning just came about in 2023, companies have been working on it for a long time.

And Caterpillar actually had their first prototype of autonomous mining more than 30 years ago. So they were really at the forefront of artificial intelligence and autonomous machinery. And as it mentions here, it was in mining trucks that were at a Texas Limestone quarry that used advanced algorithms. That was really amongst the very first autonomous operations that were out there.

I actually remember being at a trade show in Germany, and this was about 10 years ago. And I’m at this trade show, I’m at a Caterpillar booth, and they’re showing how their operating equipment that was in a mine in South Africa, demonstrating it from this booth in Germany. They really were at the forefront. And I got to tell you, when I wrote the article, I got a lot of criticism, saying, what are you kidding? Like, Caterpillar, an AI company, they certainly – CAT is up over 60% in the last 52 weeks.

And as I said, it’s been a Strong Buy for over a year as well. They just recorded record profits. They had a record $5.1 billion in cash deployed. So across the board, some great numbers for Caterpillar. And here’s just further showing you the operating profit margins, the adjusted operating profit. Some of these numbers are up double-digit, their profit per share up double-digit, 54%, adjusted profits per share up 14%. So probably they’re using it in their equipment, but they might be using it to run their company as well, and they’re really demonstrating their profitability.

DS: Steve, you want to know another weird little fact about Caterpillar here?

SC: Yeah, I’d love to hear it.

DS: So I was just on Seeking Alpha, right, looking at the Quant Rating history for the last three years, went back a little bit further. Did you know that the Quant System flipped to a Strong Buy this latest time back in November of 2022. And I don’t know if anybody else remembers this, but November of 2022 is when OpenAI released their LLM and took over the world. And that’s when the world noticed AI, right?

And there’s these companies like Caterpillar that, like you mentioned, have been using machine learning and integrating AI capabilities for years before this. And it’s like, they just hit their stride at the same time.

SC: Yeah, they probably didn’t think to call it AI back then. Certainly, when I was developing my Quant model, many people tell me, it is machine learning, it is AI, we’re using a system of Z-Scores and we’re measuring predictability historically to determine what those future metrics should look like.

I would have never called it AI probably even tree years or four years ago, I wouldn’t have called it AI. But certainly, it’s using software that is predictive, that learns from itself, and measures probabilities to make decisions. That’s what industrial equipment will do.

But we use it within our own Quant System as well. It’s a completely data-driven process. It’s systematic. It’s not as if I’m actually out picking these stocks. I developed the Quant model, but the Quant models would select the stocks and the Strong Buys. These ratings could change tomorrow and I wouldn’t know it until I see it because it’s a data-driven process that does it for us.

So again, AI is not focused necessarily on the Magnificent 7 or technology companies, as you will see in our next stock, which is General Motors. And what I really like about General Motors is this is straight As across the board. This company looks good on Valuation, it looks good on Growth, it looks awesome on Profitability, looks great on Momentum, looks great on Revisions.

And a lot of people just like when they look at General Motors as a stock that we’re recommending, they think about this automaker from like the 1970s and 1980s. Probably some of the technologies that they’re using today may have been started to develop back then. But they are really coming to the forefront on matching Tesla in terms of autonomous vehicles.

And if you’re not familiar with it, they have a company called Cruise, which is robotaxis. And they also have Super Cruise that’s being released in a number of their Cadillacs right now. Super Cruise is an advanced driving system, which is basically hands off the wheel, hands off the pedals and the brakes, changes lanes. It’s really trying to go head to head with Tesla, there is a little bit of a difference.

And Tesla is sort of taking this route with their autonomous driving where it could cover all roads. And they’ve had a couple of accidents at Tesla. They learn from their data and what happens with Super Cruise, it’s enabled in certain roads. It’s not all roads. That is – GM is really shooting for safety here. They want to have as few incidents and accidents as possible.

So that’s why their ADAS is just focused on certain roads. But while you’re on those roads, you could feel really comfortable taking your hands off the wheel. So for those that don’t think GM is leveraging AI, they’re certainly doing it. And, of course, they have their OnStar system. So they’ve been working on software for a very long time as well. So there are a number of different silos where they have AI and machine learning at GM.

And in terms of how it’s showing up through the numbers, they have yet crushed our knees again. They’ve done it for the last seven quarters. Year-to-date, the stock is up 25% versus the S&P up 9%. And over the last year, they’re up 34%. It’s also one of our most recent Alpha Picks stocks too. And it’s done well right out of the gate as an Alpha Picks stock.

So, of course, the monster numbers here for the first quarter, $43 billion in revenue, free cash flow at $1.1 billion, earnings came in at $2.62, and the EBIT adjusted margin came in at 9%. So really great numbers for the first quarter.

Q1 sales were up more than 50% sequentially, with 20% from its Cadillac luxury unit. And it’s amazing, like Daniel, for years, I guess, you’d say in the ‘40s and ‘50s and ‘60s, Cadillac was really sort of the gold standard in cars and it lost its luster after that for many years, going into the ‘70s, the ‘80s, ‘90s, 2000s. They stuck with the brand, and now the brand, with autonomous features and also EV features, is really coming back, and people are loving these cars.

And as you can see in the first quarter, having those sequential sales up 50% sequentially is huge for a company of its size. So I think we’re seeing some great things out of them in terms of machine learning and AI from GM.

So we – I‘ve just got through sort of how we pick stocks for AI. I loaded up a lot of stocks from three different ETFs, probably a couple hundred stocks there, one to our portfolio tool. I showed how we did it for our top 10 stocks for 2023 and 2024, basically using our Quant model to identify those top 10 stocks. It’s a fair amount of research and time. It’s a lot easier than some conventional methods.

Seeking Alpha’s Premium site will help you make decisions quickly. But Daniel, I will say there are some people that just want us to do the work for them. They don’t want to do all that research.

So about a year-and-a-half ago, I created a system called Alpha Picks. And Alpha Picks is an advisory service that we have, which does the hard work for you. Each month, we select two of our favorite Quant stocks. We actually have additional parameters and criteria for it to make the Alpha Picks portfolio on top of the criteria that we already have that are very stringent.

I mentioned we have those five core investment characteristics that we look at for Alpha Picks or some additional criteria. And we sort of filter those on any given day, 450 Strong Buys down to just two stock picks a month.

So we launched this service back in July of 2022. And since that time, it is up 122% versus the S&P, which is up only 35% for that period. So as I mentioned, only two stocks per month. We have – this is an advisory service that is really there for people who like to be long-term investors. It’s not focused on high frequency traders, so we’re not throwing out 10 ideas a day or five ideas a day. It’s just two ideas a month.

And on occasion, we’ll tell you to let go of some of those stocks. So really at the max, maybe on any given month, there will be a total of like three or four trades. But there will be a number of months where we’re just doing the two Buy recommendations.

So as a long-term product, when a stock is in that portfolio, the rating could drop, it could go down to a Hold. That doesn’t mean get rid of it. Hold means Hold. And we’d like to keep those stocks as a Hold in the portfolio for about 180 days. After 180 days, if it hasn’t moved back to the Buy territory or Strong Buy, at that point, we’ll get it out of the portfolio. Bottom line is, this is investing service where we make it really easy for you. We do the homework.

So if you’re interested in that, that’s called Alpha Picks. Two stocks a month, as you could see, the performance is huge. And it’s not a one-trick pony and it’s not a one-month pony. You could see if we went back over the last year, it’s up 91% versus the S&P up 22%. Year-to-date, it’s up 24% versus the S&P at that time, it was up 6%. This was a couple of days ago from May 4. So the returns are a little bit better now.

And in Alpha Picks, we actually selected Super Micro Computer on November 15th in 2022. And since that time, Super Micro was up 152%. One of the other stocks we selected was Modine Manufacturing, up 387%. I can tell you, Daniel, in the Alpha Picks portfolio, we actually have seven stocks that are up over 100%. And currently, there’s about 34 stocks, and 15 of the 34 stocks are up over 50%.

So it really is selecting the best stocks for our Quant System, and the performance is there. So for those of you who would rather we do the work for you, you should check out Alpha Picks. Daniel, that’s really it from my side. I’d like to find out Daniel, if you have any questions or any questions that have come in through the webinar, I’ll stop sharing the screen and…

DS: Absolutely. First off, thank you so much for that. I just want to start off this portion by just going over the five stocks again for the people that may have joined in the middle of this. So you have Google, that was at the top. Of course, Okta, that cybersecurity play. Emerson Electric Company, which is old as old will get, I had no idea about that.

SC: Yeah.

DS: And then Caterpillar; and lastly, General Motors. Those were the top stocks here today that are leveraging AI within their business operations. And you’re starting to see that trickledown effect within the earnings is kind of what you communicated here today.

So just wanted to say thank you for that.

The first question I have for you that you mentioned quite a ways back in this webinar is that you had three ETFs you looked at when you started to put the portfolio together. Just kind of curious, would you mind sharing what those three ETFs were?

SC: Yeah, and I’ll tell you what, you can do it yourself, Daniel, that’s easy. Go to Google, just type in three largest AI ETFs, and boom, there it is. So if we were to do that on our screen right now, I could go in there and I’ll share my screen again. It’s that easy.

So let’s go in there. Want to show people how we do this?

DS: Yeah, yeah, let’s see what you got.

SC: I’m going to bring up Google and we’re going to type in three largest AI ETFs. Boom. So you could see them coming right up here. And if you go into a couple of these articles, even Motley Fool has three top artificial intelligence. And you’re going to see across the board, they’re all the same ETFs. All these articles will have the largest ETFs there. Some of them will have more. This one has seven of the best robotic ones.

And you could just go into these ETFs. Many of them have the same stocks. Some of them will have stocks that are a little bit different. But I want people to be able to do this on their own. And you could simply – our portfolio tool is awesome. Because when you go into these articles, you can literally just copy the ticker symbols and paste them right into the portfolio tool, and it will come up there and it will rate all those stocks just the way ours did.

So it will show you which ones are the Strong Buys, it’ll show you which ones are the Buys, it’ll show you the ones that are Holds. And just as importantly, it’s going to show you the ones to avoid. So when you’re looking at our screen here, you can see there’s a whole host of stocks that are in these AI ETFs that we have a Sell on or a Strong Sell on.

And you know what I want to do, Daniel? I’m actually glad I’m back on this. I want to show people. When you’re in the portfolio tool, these are the ratings that I’m showing you. You can actually click on various pages. You can click on Valuation. And you could see what the common value metrics look like, like P/E, PEG, price to sales, you could click on Growth and it’ll show you Revenue, it’ll show you EBITDA, it’ll show you EPS.

But what I really want to show you here, since we have it sorted by our Quant Strong Buys is the Performance, okay? So here is the Performance. Let’s look at the year-to-date column of our Strong Buys. You could see Super Micro is up 181%. Google up 21%. GM 26%. GoDaddy up 24%. Okta, the cybersecurity one, is up a little bit less. And when there are potential threats in cybersecurity, sometimes these stocks will actually take a step back, but they’re always good buying opportunities. Caterpillar up 18%.

So these are the Strong Buys. As I scroll down, and we get into that territory where we had the Sells and Strong Sells, look at the year-to-date performance on these stocks. So these are the Quant stocks with a far poor ratings. You could see these stocks are not only negative in terms of performance, some of them are seriously negative. You’re looking at down 40%, down 33%, down 35%, down 65%, down 70%, down 70%.

So again, I’ll flip over here, bring us back to the ratings, and it shows you how well the Quant system works. So these were the stocks that had performance that was double-digit negative that we have as the Sells and Strong Sells.

And again, what is that Quant system? We’re looking for stocks that are collectively strong on Value, Growth, Profitability, Momentum, and EPS Revisions. That’s our Quant strategy. It’s worked well for a really long time. And you can apply that not only to AI, but you can apply that to cybersecurity themes, drone themes, Chinese securities, industrial baskets, beverage baskets, consumer discretionary baskets. You can think of any theme you want. This strategy really works well across the board.

DS: So I’m glad that you’re here on the site. Oh, can you pull that back up for me?

SC: Sure.

DS: A really good question that came through about if we go into the Valuation metric, specifically of the Factor Grades and maybe Growth and Profitability as well, the question was when you’re looking at the Valuation metric, are the metrics underneath within the grade, are those ranked in order of importance?

SC: So where it’s ranked in order of importance is the overall Quant score. So what we do is we score up all these metrics, and they’re not equal weighted. As I said, some are more predictive than others. So the ones that are more predictive, according to our backtest, get a higher weighting.

There are a number, as I showed you when we went through the Valuation page and Growth page, there’s a lot of underlying metrics that contribute to the overall factor score. So this would be the overall factor score for value. And then what we’re doing is we’re taking these scores and adding them up to get the overall Quant score. So here we have it, Dan, in descending order of the Quant, and this is the total score from all those underlying factors.

DS: Yeah, I think the question was a little bit deeper, Steve, in regards to looking at the PEG metric and the P/E ratio and the ones that are actually within the Valuation Grade. Are those equally weighted to come up with the Valuation Grade?

SC: Nope. Sorry, I didn’t make that clear. I apologize. They are not equally weighted. Certain metrics here have a higher weight. So again, we backtest all these. For the Seeking Alpha model, we backtested these going back 14 years. But actually, as you know, Daniel, I’ve been doing it a lot longer. I’ve been working with these models since 2000, so roughly like a 24-year period. And there is a change. Sometimes metrics work, sometimes they don’t.

But what I found over a long period is certain metrics do work better than others. And those are the metrics that we’re giving a higher weight and that applies for the underlying metrics as well. So PEG could have a higher weight here than you would have for conventional P/E, and it might have a higher weight than EV to EBITDA. So they are not equally weighted.

DS: Great. Thank you so much. Now a question came in about seeing different ways that we present the ways that ratings are changed on specific stocks. So I will highlight that if you are a Premium member and you put symbols within your portfolio, you get a portfolio summary email in the morning that can highlight when ratings have changed.

But maybe Steve, real quick, you want to jump into the portfolio and show people where they can find the upgrades, downgrades, as well that shows the switch of the ratings.

SC: Yeah. So actually, I could see that every single day right in my main dashboard. So I could just scroll down a little bit. I’m a member of Pro. It’s a notch above Premium in terms of the services that are offered. I love Pro because I call it Pure Alpha. And the reason why I call Pure – Pro Pure Alpha is it shows me those ideas that make money. And that’s what I’d love to see front and center.

So here, there are some hot themes from our leading analysts. So we highlight these articles, and I’m getting down to your question. Here’s an earnings calendar. And as they go down further, we’re going to see an area where there’s upgrades and downgrades. So, of course, I took that page off today because I was playing around with it, but there’s another way to do it.

So all you have to do is type in upgrades and down – you don’t even have to put and downgrades in. It comes right there. Just put in upgrades and downgrades and boom, there it is. And this is available on Premium. So you could see all the stocks for Quant. Or if you were interested, you could see SA Analyst or Wall Street as well, where there have been rating changes. And this shows you stocks that have gone from Hold to Strong Buy, Buy to Strong Buy.

Every once in a while, they’ll catch a stock that’s moved from a Sell to a Buy or Strong Buy, but we show that list every day. Dan, am I answering your question there?

DS: Yeah. And I just want to remind everybody that the Quant model does run in the morning every single day before market opens…

SC: Yes.

DS: …hours before market opens. So you have plenty of time to jump on here, check out what the rating changes have happened overnight and evaluate the information, right?

So leading into the next question, Steve, when people see the Strong Buy recommendation from the Quant model. Somebody was asking us, does that mean like Buy right then, right? So how would you say that the Strong Buy rating from the Quant model, what does that translate to?

SC: Yeah. Well, what it translates to is it means that the security is mispriced. So that is what a Strong Buy means. It means that it’s not being fairly valued by the market. And when we look at a stock from the Quant system, the conventional value that people will think about is like look at P/E ratio.

But really, since we’re scoring against the rest of the sector, in a way, our Growth factor, our Profitability factor, our Momentum factor, our EPS Revision factor, we’re – those all, in a way, are sort of value metrics that we’re looking at because we’re assigning scores and we see how it compares to the median of the sector. So it gives us an ability to place like a value on Growth or a value on Profitability or a value on Momentum, and as well as a value on Value. So that gives us sort of a picture of how to look at these stocks. And when it comes up as a Strong Buy, it’s telling us that it’s mispriced. And relative to the sector, this stock should be trading higher.

Now, if a stock has a Strong Buy for a year, that means that it’s not fairly valued. And, in fact, in Alpha Picks, in order to reduce the volatility, I don’t like stocks that flip back and forth because Alpha Picks is meant for long-term investors. The stock has to be a Strong Buy for at least 75 days before it can make it into the Alpha Picks portfolio.

So if it goes to Strong Buy, that doesn’t mean your only window of opportunity is to buy that stock the day it becomes a Strong Buy. It is a Buy as long as that Strong Buy or it’s a Buy as long as that Buy rating is on it.

DS: Yeah, I will say the way I like to see it is I look at it and it’s more of idea generation going. Oh, I need to dive deeper into whatever stock I’m looking at. For example, the other day I was looking at a Royal Caribbean Cruise lines, right, when they announced that they’re going to hire tons and tons of more employees this year, and people are just cruisers are going to cruise, right?

So I saw the Quant Rating was a Strong Buy, and I sort of dove a little bit deeper into it just research-wise. But just seeing that was like, oh, there’s something here that I need to take a second look at. So that was – that’s just kind of point I was …

SC: That’s good. I like, look at the growth on this.

DS: Yeah. Incredible, incredible stuff that I was just researching the other day, like I mentioned. But Steve, we’re coming up here at the top of the hour. I want to go ahead and start wrapping this up, so everybody can go on with their day. Thank you so much for taking the time to put these five stocks today…

SC: Absolutely.

DS: …leveraging AI. And for anybody that’s watching this replay right now, there’s links underneath the video. We’ll post the University of Kentucky Research study, as well as the Alpha Picks if you want to explore that as well. But yes, thank you again, everyone, for taking the time to hang out with us today. Steve, is there anything you want to say before we jump off?

SC: I just really want to thank everybody for attending the webinar and for those that are clients at Seeking Alpha or Alpha Picks. We really value your membership and we hope that you’ll be able to conduct great investment research using these tools. So thank you for your business.

DS: Yes, thank you indeed. And Steve, just so you know, I did see a couple of shout outs. People love that you keep doing these webinars. So we’ll do some more of these soon.

SC: Thank you. I’ll keep it up.

DS: There’s another one, another thing next week. Keep an eye out, everybody, but we’ll see you then. Have a great week.

SC: Thanks a lot. Bye-bye.