Lighthouse Films/DigitalVision (via Getty Images)

One of the biggest winners on Monday’s market was AMC Entertainment Holdings (New York Stock Exchange:AMC). The theater chain’s stock price soared more than 78% on the day, rising even higher in after-hours trading on the back of online influencers. Roaring Kitty tweets for the first time in recent years, sent all “meme stocks” into a frenzy. Unfortunately for AMC investors, this sudden turnaround won’t last long, as the company’s latest report last week shows that its financial situation here continues to deteriorate.

Why I’ve been bearish for a while:

AMC was one of the companies hardest hit by the pandemic as consumers avoided going to movie theaters and theater capacity limits took effect over time. During this tough period, the company could have easily gone bankrupt, but management utilized a range of debt and equity. Raise to stay afloat.I am officially Moved to sell rating Back in August 2022, the company’s stock price was a split-adjusted $130, and it was clear that the company needed to raise more capital.

Since then, AMC stock has plummeted as continued cash burn led to further capital increases. The stock has more than doubled from recent lows and was trading around $6 in after-hours trading on Monday, leading to huge short-term gains for some lucky shareholders. But this is a stock that traded above $726 on a split-adjusted basis (excluding proceeds from APE preferred units) during the original meme madness, and almost no one who has held it since then You will have lost everything. Given the recent surge, the stock price will essentially return to a flat line in 2024.

Monday’s rally came after Keith Gill, known online as Roaring Kitty, tweeted an image of a man slouched in a chair. In 2021, he said Gill’s posts on Reddit and other sites led to himGME) and AMC. His first online post in years sent heavily shorted GameStop stock soaring on Monday, as did a number of former meme stocks, including AMC.

Last week’s quarterly report:

Large gatherings cast a shadow Last week’s first quarter report The ball hit from AMC wasn’t exactly a home run. Management celebrated the fact that it once again beat street expectations, but the company has only missed the top line twice in the past five years and is the only company to beat its bottom line on an adjusted basis 13 times in a row. Analysts aren’t necessarily setting the bar high when it comes to forecasts for AMC, which would see the weakest sales growth in the past four quarters.

The first half of 2024 was affected by last year’s writer’s strike, so sales actually decreased compared to the same period last year.of Domestic box office revenue Due to limited release, films are down more than 22% year-over-year, as many aspiring film producers postponed the release of their blockbusters to later this year or 2025. For the first quarter of 2024, AMC reported an operating loss of over $108 million on a GAAP basis, which is a small loss. Revenue improved compared to the same period last year, largely due to her more than $36 million in gains from vendor dispute resolution. AMC detailed that adjusted EBITDA was negative $31.6 million in the quarter, compared to positive $7.1 million in the year-ago period.

Further cash burn and dilution:

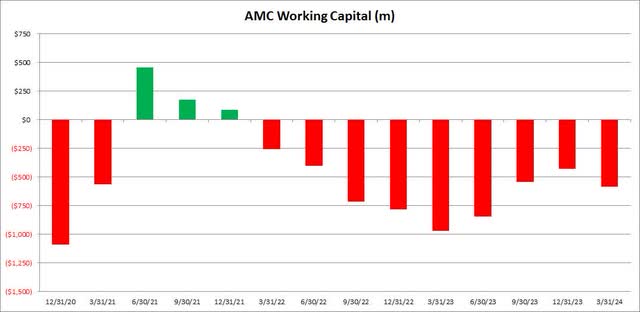

The company has been losing money and has incurred significant cash burn in recent years, further straining its already strained balance sheet. In the first quarter, AMC reported a cash burn of $238.8 million, which was a slight increase from the same period last year. The company ended the period with $624 million in cash compared to $4.54 billion in debt. Perhaps the worst part of last week’s report was that working capital became even more negative on a sequential basis, as seen in the chart below. This $590 million hole meant that AMC had far more bills next year than it had liquid assets on its balance sheet at the end of the first quarter.

AMC Working Capital (Company Declaration)

Management has been celebrating for several quarters that the debt mountain is being cleared. That’s true to some extent, but only because they’ve diluted investors significantly over time. Since the end of 2023, the number of outstanding shares has increased from approximately 260.5 million shares to nearly 295.6 million shares as of May 8, as an ongoing stock sale program continues to bring in much-needed cash. .

AMC still has about $150 million left in its plans, but raising the full amount won’t bridge the working capital gap, much less meaningfully reduce its massive debt pile. I can’t. As a reminder, pre-pandemic, the number of Class A shares outstanding was only about 5.2 million shares on a split-adjusted basis. So this is one of the biggest dilution stories in the market today. If this meme rally continues, I wouldn’t be surprised if management announces further stock sales to raise more capital.

Valuations remain depressed:

AMC is certainly trading like a distressed asset. Despite rebounding strongly during the day and rising further to $6 in after-hours trading on Monday, the stock trades at about 0.38 times estimated 2024 sales, compared to rival Cinemark’s 0.93 times (CNK). Cinemark currently has some debt, but also has positive working capital, profits, and free cash flow. AMC analysts thought the stock was worth $4.42 as of Monday, suggesting significant downside from here. Average target price It continues to decline every quarter.

Final thoughts/recommendations:

AMC stock soared Monday as the meme stock craze returned, but the company remains in dire financial straits. The company still has nearly $4 billion in net debt, but its working capital remains at a significant deficit, which worsened in the first quarter. Cash burn remains large as market weakness leads to huge losses in the short term and management’s only option in the short term is to continue to significantly dilute investors.

In my opinion, the stock will remain a sell until AMC significantly improves its debt situation and shows signs of ceasing to dilute investors on an almost quarterly basis. Long-term investors should not buy into this meme stock madness, as history suggests we are only witnessing another bubble. While AMC may be a good trading vehicle right now, the stock remains down over 99% from its meme stock peak in 2021 and will likely fall again due to further dilution.