gordon’s life

Crocs Co., Ltd. (Nasdaq:crocs), in conjunction with its subsidiaries, designs, develops, manufactures, markets, distributes and sells casual lifestyle footwear and accessories in the United States and abroad under the Crocs and Haydude brands.

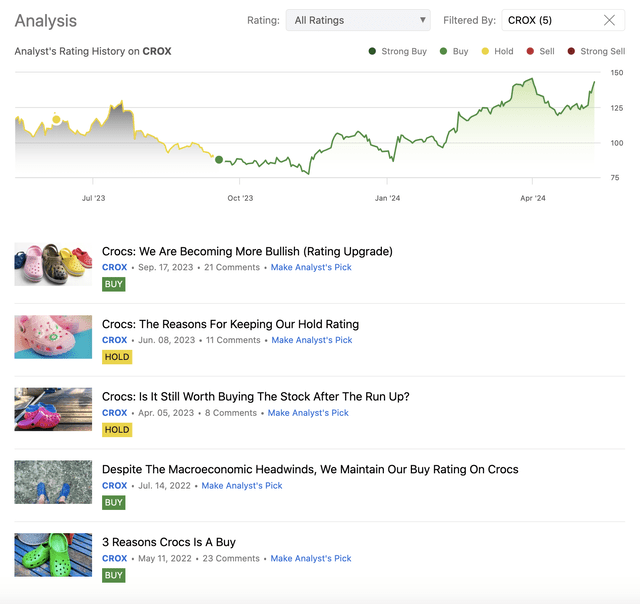

we have first published Analysis of In May 2022, we assigned an initial Buy rating to the stock due to strong growth potential and an attractive share repurchase program. In July of the same year, repeated The company’s attractive valuation and strong brand recognition led to this Buy rating. However, then in early 2023; be more careful. We downgraded the company’s rating from buy to hold due to the significant rise in stock price and (at the time) deteriorating profitability metrics.we maintained this hold Ratings up to September 2023 will be re-evaluated. became more bullish.

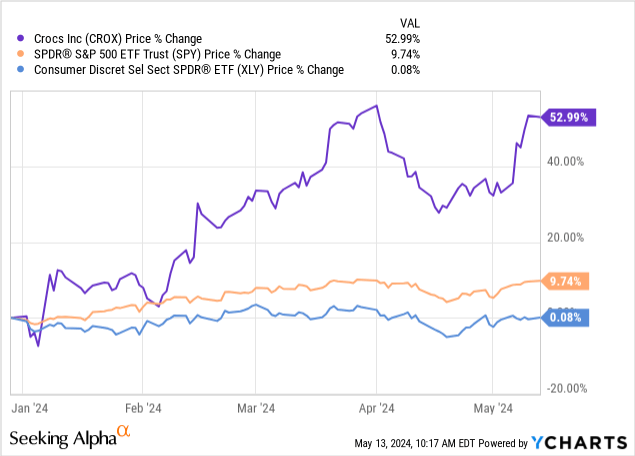

In fact, since then Earlier this year, the company delivered an exceptional performance, far outperforming both the broader market and the consumer discretionary sector.

The purpose of today’s article is to provide an updated view on the company from both a business outlook and valuation perspective, primarily based on the company’s latest financial results, which were just released recently. When discussing valuation, we will still use a set of traditional price multiples to assess a company’s relative attractiveness compared to its historical valuation and its peers.

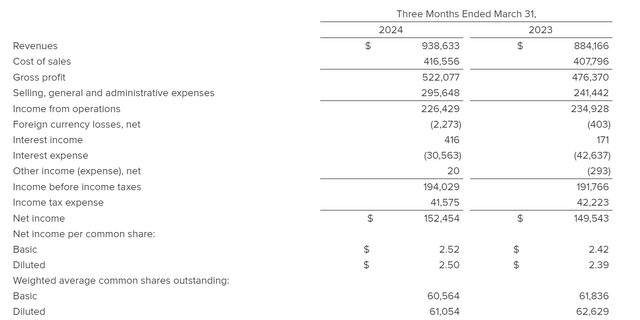

Quarterly financial results

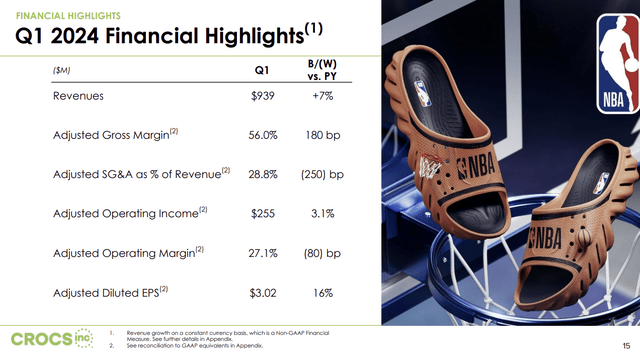

Crocs never cease to impress us. latest quarter In the same way. Even though we have often written about macroeconomic headwinds such as weak consumer confidence, rising inflation levels, and an uncertain geopolitical environment, Crocs has continued to grow. He set a record for the company’s quarterly revenue of $939 million, with a 6% year-over-year revenue increase. Not only were sales impressive, but so were profits. Diluted EPS increased 5% to $2.50 and adjusted diluted EPS increased 16% to $3.02. Looking to the future, we can’t complain either, as the Crocs brand’s strong performance is driving an increasing revenue outlook.

Let’s look at these numbers in a little more detail.

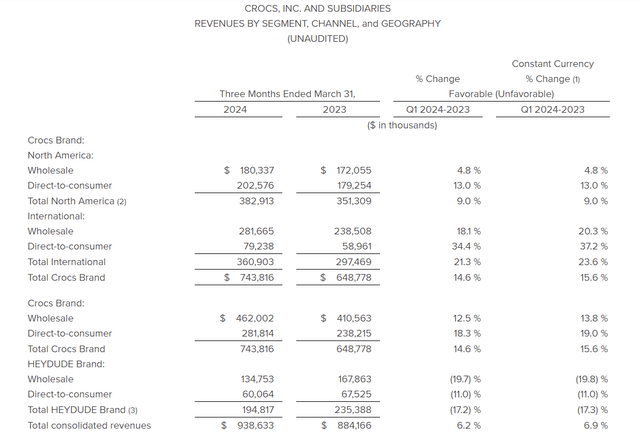

revenue

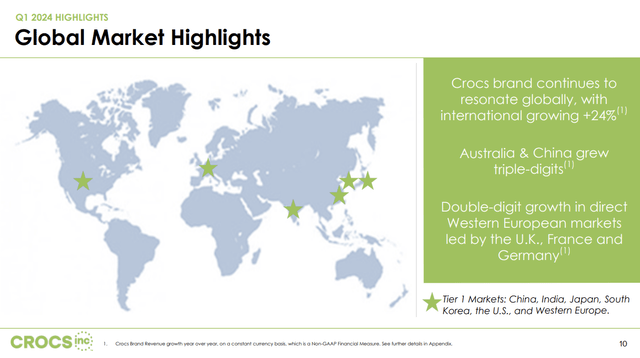

Consolidated sales increased by over 6%, or 6.9% on a currency-neutral basis. Breaking this down by channel, direct-to-consumer was the winner this past quarter, increasing 12.3% on a currency-neutral basis, while wholesale was up only 4.1% on a currency-neutral basis. If we analyze consolidated revenue by brand, a somewhat different picture emerges. It turns out that Crocs is much more powerful than his HEYDUDE. Crocs brand sales increased 15.6% to $744 million excluding currency effects, while Heydude sales decreased 17.2% to $195 million. Despite this decline, we are not too concerned about the development of consolidated revenue, as the Crocs brand accounts for the largest portion of sales. On the other hand, we are concerned that CROX’s recent acquisitions/brands are not gaining as much traction as we would like. Additionally, we can clearly see that the Crocs brand remains in high demand even during times of economic uncertainty, thanks to strong brand recognition and loyalty that HEYDUDE may lack.

It is also important to highlight key international growth markets, particularly China, which we believe will contribute significantly to the company’s financial performance as the country’s macroeconomic environment improves.

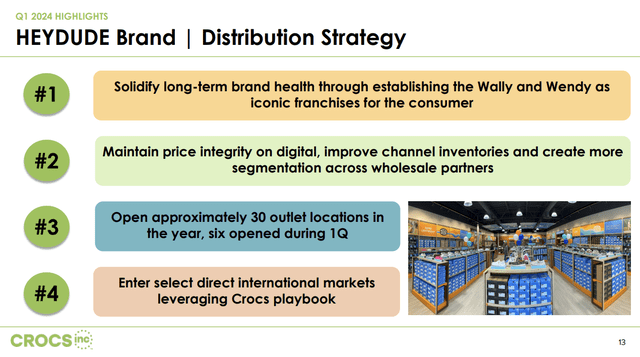

When it comes to the HEYDUDE brand, we believe Crocs understands the underlying issues and is working hard to create demand and ultimately increase sales for the brand. They outline a solid strategy in their investor presentations, but we want to see this strategy in action before putting any meaningful emphasis on potential improvements. I would like to underline the word “gender”.

Overall, we’re pleased with the income statement and like the growth the company has achieved over the past quarter. However, going forward, he expects positive developments in the HEYDUDE segment.

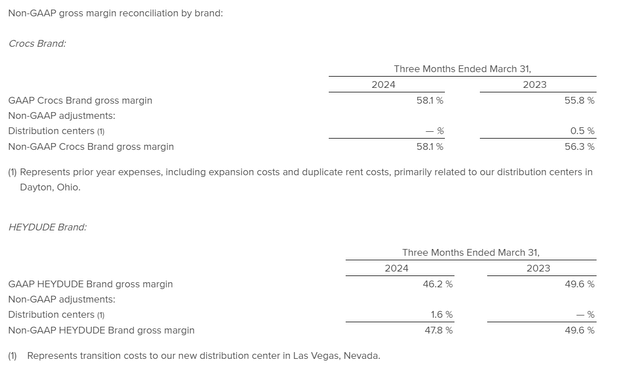

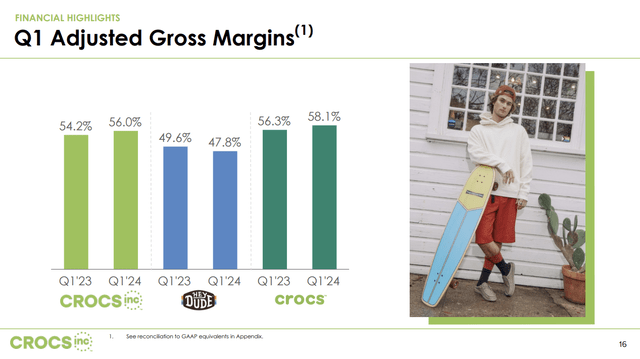

Profitability

The company’s profitability has also improved in some ways over the past quarter, as evidenced by gross margin expansion. However, the main driver of this expansion is the change in the contribution of the various brands Crocs and Heydude to total revenue. Crocs’ revenues are increasing and Heydude’s revenues are decreasing, so Crocs, which has higher margins, is a bigger part of the picture.

Gross profit margin (CROX) Gross profit margin (CROX)

On the other hand, selling, general and administrative expenses increased significantly, and the operating profit margin decreased slightly.

Selling, general and administrative expenses (“SG&A”) were $296 million, an increase of 22.5% from $241 million, and represented 31.5% of revenue. Adjusted SG&A expenses were $271 million, an increase of 16.3% from $233 million, and represented 28.8% of revenue.

EPS also increased, but the increase was slower than the increase in revenue, leading to a contraction in the bottom line net profit margin.

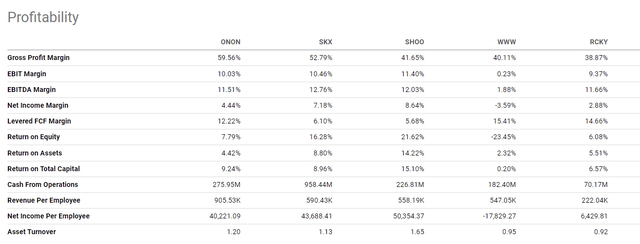

Comparing these numbers to those of CROX’s peers shows that the company’s numbers are still relatively attractive, despite some contraction.

guidance

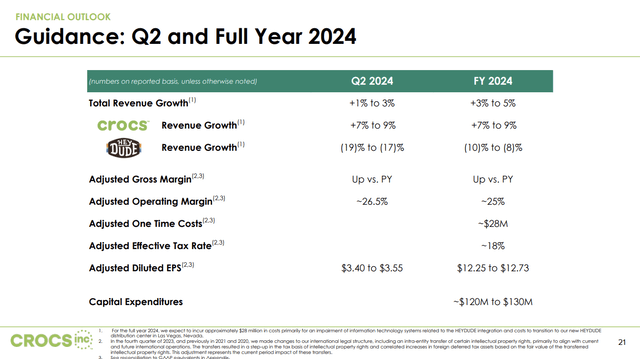

Going forward, the company is expected to continue to grow its earnings on a consolidated basis. However, the growth rate is expected to slow to 3-5% year-on-year. This slowdown is expected to be primarily due to a significant decline in HEYDUDE’s sales, which are expected to decline by as much as 8% to 10% year over year. However, this negative factor will be offset by the expected strong performance of the Crocs brand, with sales expected to grow 7% to 9% year-on-year.

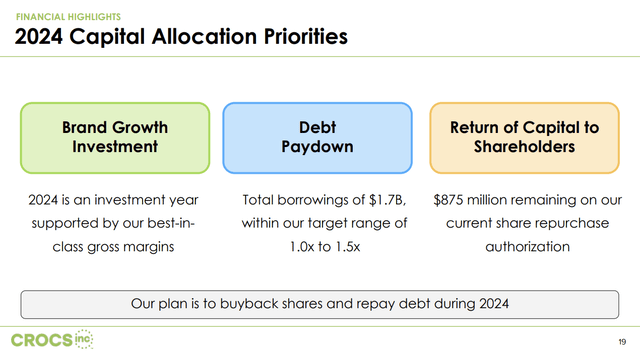

capital allocation

The company has set three priorities for its 2024 capital allocation strategy. These are brand growth investments, debt repayments and capital returns to shareholders.

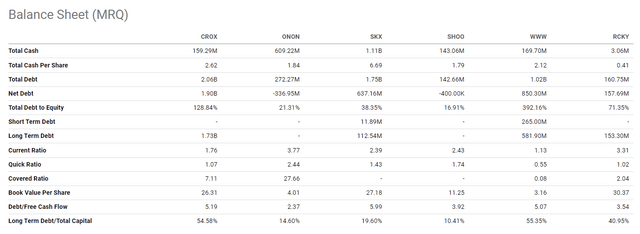

And we’re happy with those three priorities. Firstly, the company definitely needs to invest in further penetrating the market, especially when he talks about the HEYDUDE brand. Second, when we compare Crocs’ debt metrics and liquidity ratios with its peers, we see potential for improvement.

Balance sheet (in search of alpha)

And third, returns to shareholders have always been one of the reasons we consider investing in Crocs an attractive option. The company has $875 million remaining from its current share buyback authorization, which is a meaningful number when compared to the company’s market capitalization, which currently stands at approximately $8.7 billion.

Overall, we heard what we wanted to hear from management regarding capital allocation.

evaluation

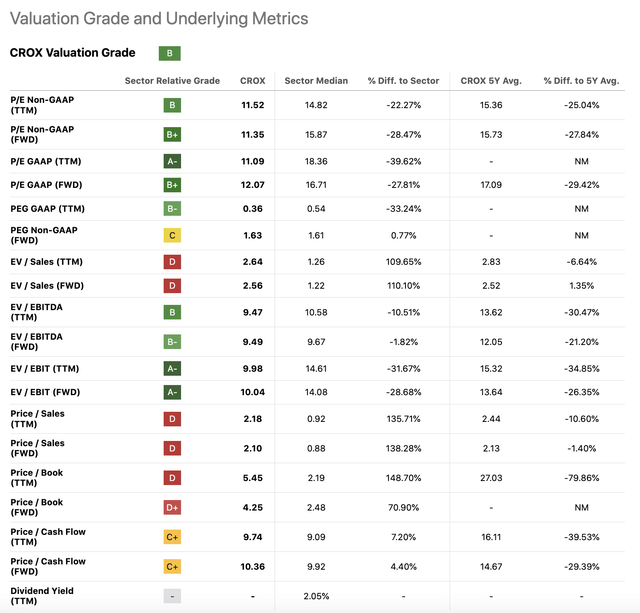

Previous articles have focused on the value side of CROX stock. Today we’ll take another look at traditional price multiples to see if the company still appears to be a value play.

The following table compares CROX’s multiples to its own historical average and consumer discretionary sector median.

What we can see is that CROX is selling at a discount to both the sector median and its own historical valuation. On the other hand, we understand that due to slower growth and the weakness of the HEYDUDE brand, investors are not willing to pay as much as they used to. Meanwhile, the company as a whole is still growing, with the Crocs brand showing double-digit growth worldwide and triple-digit growth in certain regions. For these reasons, we believe there is still room for upside from current price levels. Not just for growth, but also for the potential for multiple expansions.

From a valuation perspective, we think our bullish thesis is defensible.

conclusion

Crocs has delivered strong sales and net income growth over the past quarter. Revenue growth was driven by his Crocs brand, but was partially offset by his double-digit decline in HEYDUDE brand sales.

The company’s gross profit margin also improved. This was primarily due to the increased weight of the highly profitable Crocs brand in total sales. On the other hand, selling, general and administrative expenses increased, the operating profit margin decreased, and the net profit margin also declined.

Looking ahead, the company predicts that the HEYDUDE brand will continue to be sluggish and that overall revenue growth will slow.

From a valuation perspective, we believe CROX stock remains attractive.

For these reasons, we maintain a purchase rating.