hocus-focus

My thesis

As a person who uses Dropbox (NASDAQ:DBX) app daily, I can say that it became an inevitable part of my life, and it is as vital to me as electricity or the internet. According to my DBX analysis, it is not only an essential tool for a modern individual, but also a highly efficient company, which I see from its impressive profitability profile. As a pioneer in the B2C cloud industry, Dropbox has a massive footprint, which gives it a competitive advantage. The stock saw a big sell-off this February after disappointing Q4 2023 earnings, which made the valuation quite attractive. The latest earnings report shared on May 9 was strong, which also adds to my optimism. Dropbox looks like a well-rounded business, and it is attractively valued, which makes me give it a Strong Buy rating.

About the Company

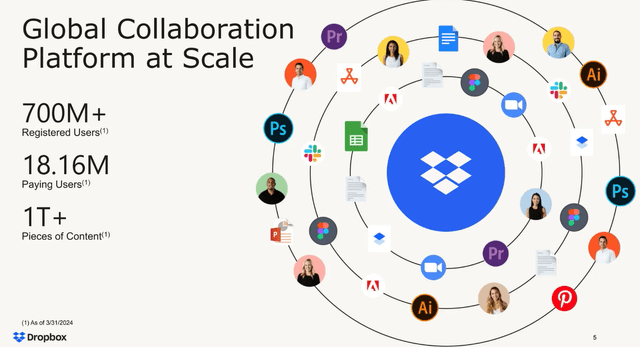

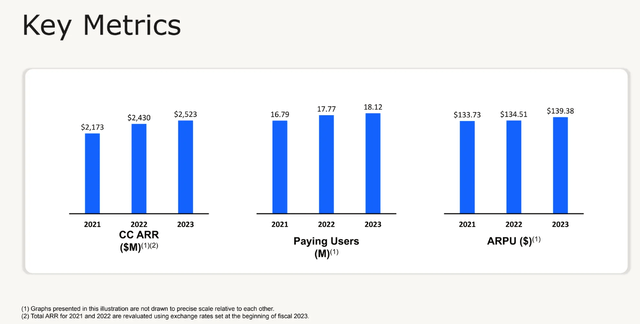

Dropbox is a pioneering B2C cloud company, offering storage services to help users better organize their digital properties. According to the company’s 2023 annual report, DBX had more than 18 million paying users as of December 31, 2023. The company’s flagship product, Dropbox Business, has a strong 4.3 out of 5 rating at gartner.com. The sample is quite representative with more than 2,000 ratings from users, with more than half of them assigning Dropbox Business a five-star rating.

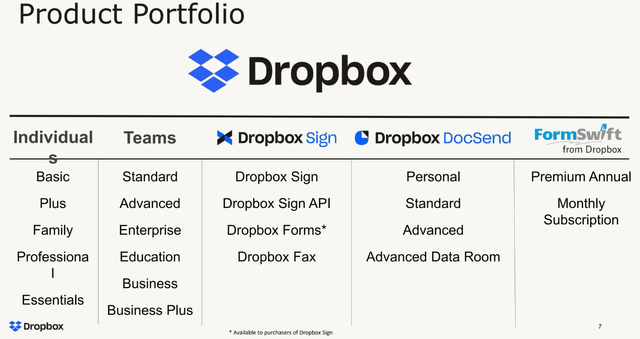

The company started its journey in 2007 by offering content backup services primarily. However, the team made a lot of effort to make Dropbox a more comprehensive platform with offerings both for individuals and businesses. The company currently focuses more on providing a well-rounded solution for business teams which includes collaborative workflows, project management, contract management, video editing & review, content & user controls.

The company also introduced its AI-powered universal search tool for work in summer 2023, which helps individuals and businesses to optimize time spent on searching for files and content. Apart from AI-powered search, Dropbox also added generative AI features in October 2023. Since Dropbox Dash is a relatively new product, there are no reviews on the internet, and we do not have much statistics shared from the management. However, IDC’s study suggests that the search and knowledge discovery software market is expected to demonstrate a CAGR of 30.7% between 2023 and 2027.

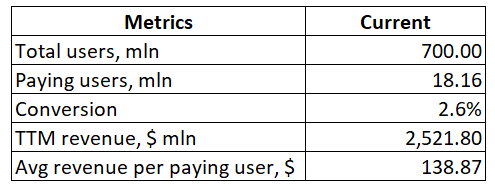

Having a diverse set of services offered to customers allows Dropbox the room to execute the “Land-and-Expand” strategy. The company strives to convert its registered users to become paying users and prompt existing paying users to upgrade to more high-end subscription plans or purchase additional licenses and add-ons. Having 18 million paying users and 700 million registered users also enables DBX to leverage scale and user insights to enhance existing products and drive adoption of new ones, and this is one of the main growth drivers the management highlights in the fresh earnings presentation.

Having a large user and paying subscribers base together with a solid further “Land-and-Expand” potential is a strong fundamental blend for any IT company but does not guarantee value for shareholders because not all businesses are able to sustain profitability.

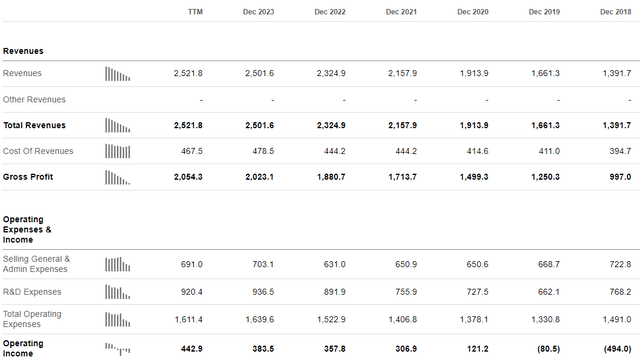

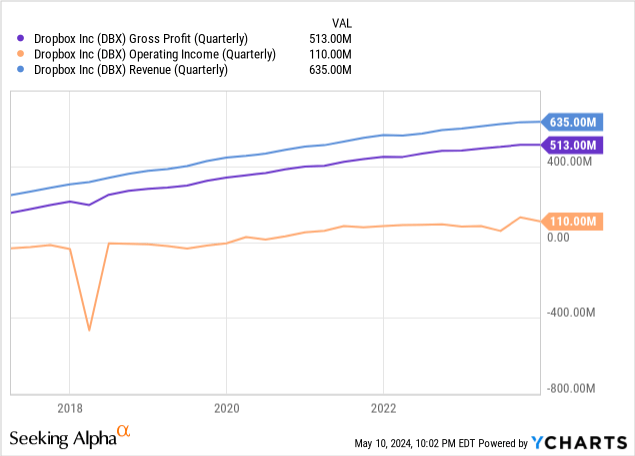

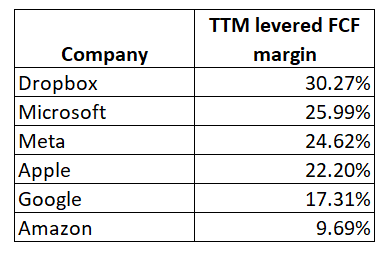

But fortunately for DBX investors, the company demonstrates a robust profitability profile. The gross profit correlates perfectly with revenue, and the operating income also demonstrates growth. According to Seeking Alpha Quant ratings, Dropbox’s profitability continues improving compared to the past five years’ averages and is much stronger compared to the sector median. DBX’s levered FCF margin is higher than all the world’s largest technological companies. This underscores the strength of the company’s business model, which is an indication of fundamental strength.

DT Invest (based on Seeking Alpha)

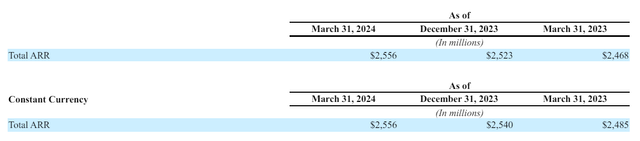

The good point for investors who prefer more predictability is that Dropbox’s business provides good visibility of future revenues. According to the management, the total annual recurring revenue (Total ARR) is the key indicator of the trajectory of the business performance. This metric increased in Q1 on a YoY basis, meaning that we can expect continued revenue growth in upcoming quarters.

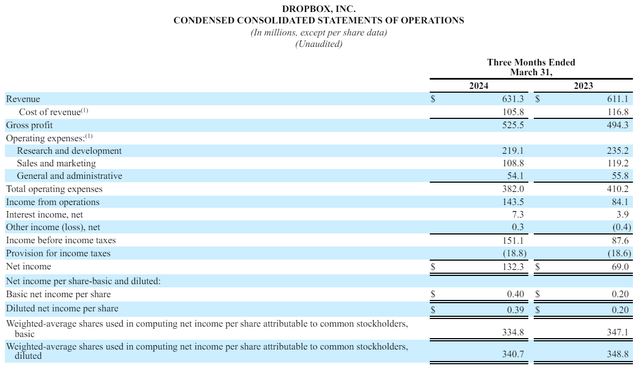

The latest 10-Q report was released recently, and I want to discuss it as well. Revenue grew by 3.3% YoY, beating consensus estimates slightly. The company once again demonstrated strength in profitability as its cost of revenue and total operating expenses declined despite revenue growth. As a result, diluted EPS almost doubled YoY, from $0.20 to $0.39.

What do we have at the end of the day? Dropbox has a large audience of users, which is still growing, and the company consistently creates new offerings to drive its upselling potential. Dropbox has an unparalleled FCF margin, which means that there is still large potential to invest in the development of new products and services, which will further spur the company’s upselling potential. Besides the potential to continue driving revenue growth, a recent 10-Q demonstrates to us that costs are also under strict control, which helps in improving profitability for shareholders. Summing up all these positive points, I think that DBX is a well-managed business with the potential to continue driving revenue growth and keep costs under stringent control.

DBX bears might say that the above charts demonstrate that Dropbox’s key metrics growth (users, ARPU) has slowed down significantly in recent years. However, as the company rolls out new AI-powered products, as Dropbox Dash described above, I expect metrics growth to accelerate. I also see a clear shift from being a company that only offers cloud storage to a comprehensive teams’ collaboration ecosystem for small and medium businesses ((SMBs)). This is a sound strategic move because success in cloud storage heavily relies on hyperscale capabilities, an area where DBX will also be behind Big Tech. Dropbox has made several acquisitions in recent years to expand its suite of offerings. Given the ongoing growth in the company’s revenue and user base, it is evident that the management is effectively executing the strategic shift to become an ecosystem for SMBs.

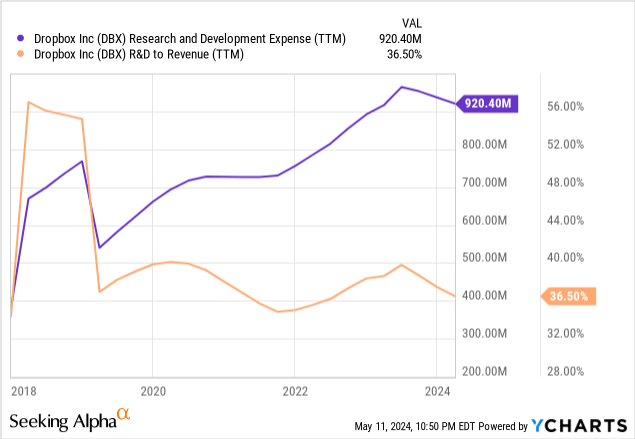

Analyzing the Q1 earnings call transcript also gave me a few positive points. The management reiterated its commitment to continue investing in improving users’ experience, especially related to AI-enabled product experiences. This means that Dropbox improves its offerings in line with the evolving technological landscape, and the management understands that retaining existing customers is as important as attracting new ones. Dropbox invests more than one third of its revenue into R&D, which is around a billion dollars per annum. This commitment to innovation makes me positive about the company’s ability to keep users’ experience at a high level and develop the Dropbox’s suite of products in line with the best technological practices.

The second big improvement that I want to highlight is that during the earnings call the management announced that now Dropbox suite has real-time Co-Authoring integrations with Microsoft 365, including Microsoft Copilot integrations, giving users the ability to query their Dropbox files directly from within Microsoft Teams. It is a crucial development which will highly likely significantly improve the experience for users.

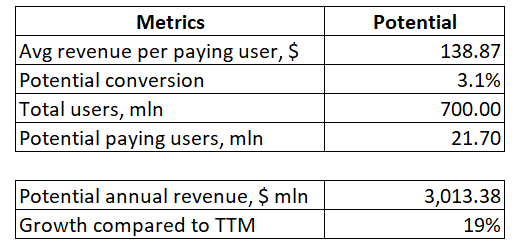

With investing more in R&D to leverage AI capabilities and expanding integrations with leading application suites (like Microsoft 365), Dropbox is building a strong basis to increase conversion of its 700 million registered users to paying subscribers. I think that DBX’s historically low conversion was due to the limited offering of primarily a cloud storage application. However, as the company continues expanding its suite with more tools and capabilities, there is a high probability that conversion might improve. My rough estimates suggest that on average, the company currently generates around $139 per paying subscriber per annum. The conversion rate is relatively low at 2.6%.

DT Invest

If the company maintains the same average revenue per paying user and expands its conversion to paying users by just 50 basis points, it will have a significant impact on the company’s topline, by contributing to a 19% revenue growth. Since the company has historically demonstrated profitability expansion with revenue growth, I am also optimistic about the profitability should the conversion improve.

DT Invest

Finally, the stock currently trades at 2018-2019 levels after a selloff caused by the latest earnings release. Before the latest selloff, the stock climbed to the highest levels since the 2021 stock market rally, which was driven by unprecedented stimulus for the U.S. economy. Short-term trends in the stock price are mostly affected by news, while secular trends are better seen in long-term share price movements.

The stock demonstrated a notable rally after a 2022 stock market sell-off, and several positive catalysts suggest that it is highly likely that the market overreacted to the latest earnings release. My positive view is justified by the comparison of Dropbox’s TTM financial performance and demonstrated in 2018. Revenue almost doubled, and the gross profit and operating income outpaced revenue growth, indicating solid operating leverage.

Intrinsic value calculation

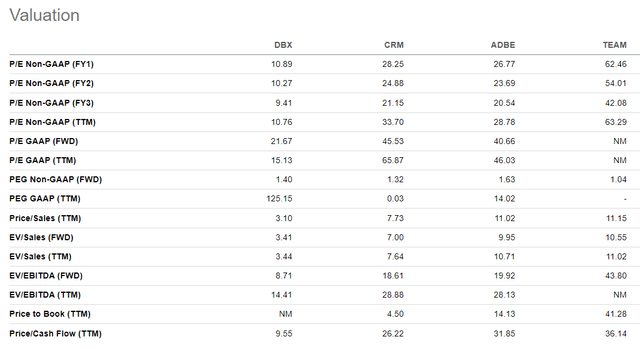

In its 10-K, Dropbox’s management names several large companies as its competitors, and most of them are trillion-dollar companies. To conduct peer valuation ratios analysis, I will choose the smallest of competitors names (but still, they are much larger than DBX): Salesforce (CRM), Atlassian (TEAM), and Adobe (ADBE). Despite having stellar profitability, valuation ratios of Dropbox are significantly lower than the above-mentioned competitors. As presented in the below table, most of Dropbox’s valuation ratios are lower than competitors’ by several times.

DBX market capitalization is $7.83 billion, and the stock saw its all-time high in June 2018 when it traded close to $40. The current share price is close to the lower edge of the last 52-week range. According to Quant ratings, most of the valuation ratios look attractive compared to industry peers and historical averages.

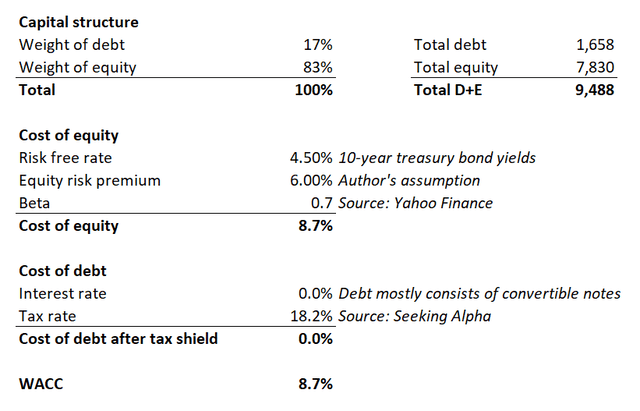

To figure out DBX’s intrinsic value, I must run a discounted cash flow (DCF) model. Future cash flows must be discounted at some rate; therefore, DBX’s WACC is the first thing I should figure out. In the below working, I share my calculations and sources of input data.

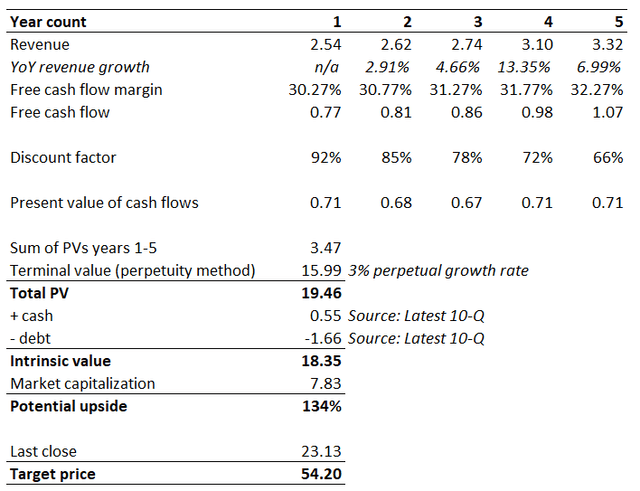

WACC is 8.7%, and now I must continue with figuring out other vital assumptions for my DCF. Since DBX’s business model ensures relative predictability of its financial metrics, I rely on Wall Street analysts’ revenue projections of DBX. We can find DBX’s TTM levered free cash flow (FCF) margin in the stock’s “Profitability” tab, which is 30.27%. In the same tab, readers can see that Dropbox’s FCF margin improved compared to the past five years’ average. Therefore, in my DCF, I also expect this metric to improve by 50 basis points yearly. I use a 2% perpetual growth rate, in line with the U.S. historical inflation averages. Cash and debt balances should not be ignored in DCF calculations as well, which I also incorporated.

As shown in my above working, DBX is grossly undervalued. While my DCF assumes modest revenue growth, the company’s stellar FCF margin significantly positively affects the overall intrinsic value. My target price is $54, which is 134% higher than the last close.

What can go wrong with my thesis?

As we saw in 2024, DBX dropped sharply by 29% from $32 to $23 after Q4 2023 earnings release. This is a big one-day move, softly speaking, which indicates that DBX investors’ sentiment is extremely sensitive to weak earnings even despite the overall company’s strategic strength and solid fundamentals. Therefore, DBX investors might face a similar situation in the future.

Dropbox is a relatively small company compared to the U.S. technological giants. For example, giants like Amazon (AMZN), Google (GOOGL) and Microsoft (MSFT) also offer B2C cloud storage solutions. Most iPhone users also use iCloud, the storage solution offered by Apple (AAPL) and seamlessly integrated with its operating systems. However, all these players were around for several years and DBX still continued to expand its paying user base. Therefore, the competition risk for DBX is substantial, but so far DBX has managed this risk well by differentiating and developing its platform.

As a cloud storage and workflows company storing information from 700 million users, Dropbox faces extremely high cybersecurity risks. According to the 10-Q, in April 2024, there was unauthorized access to the Dropbox Sign production environment. Internal investigation is ongoing, and the company may discover other impacts or new events related to this incident may occur that could disrupt Dropbox’s operations or financial performance.

Summary

Dropbox has a massive user base and loyal paying audience, and the company wisely leverages this advantage by expanding the line of its offerings. This creates more upselling opportunities, which is then converted into a stellar profitability. The stock is currently grossly undervalued after this February’s dip, and the latest 10-Q report is strong and once again highlights the company’s unparalleled profitability.