david henderson He has written an excellent paper on the effects of tariffs on price levels. I agree with his analysis, but here I will try to reframe the argument in hopes that it will be helpful. Let’s start with some suggestions.

1. Under most policy regimes, the imposition of tariffs leads to an increase in the price level. These include the Fed’s current (asymmetric) flexible average inflation targeting (FAIT) regime, as well as the gold standard, money supply targeting, and nominal GDP targeting.

2. There are several policy regimes, such as price level targeting and symmetric FAIT, in which tariffs are not inflationary. I don’t know of any country that has adopted either regime.

3. Tariffs reduce real production. Therefore, if the monetary authorities prevent the price level from rising, NGDP will decline. This would increase the unemployment rate beyond that directly caused by the tariffs.

If a politician says his tariff proposal won’t cause inflation and you believe him (yes, I know…), you should be very worried.That would mean that tariff planning would be combined with a welfare-damaging financial system. even bigger than the others.

Will tariffs cause inflation? Let’s hope so!

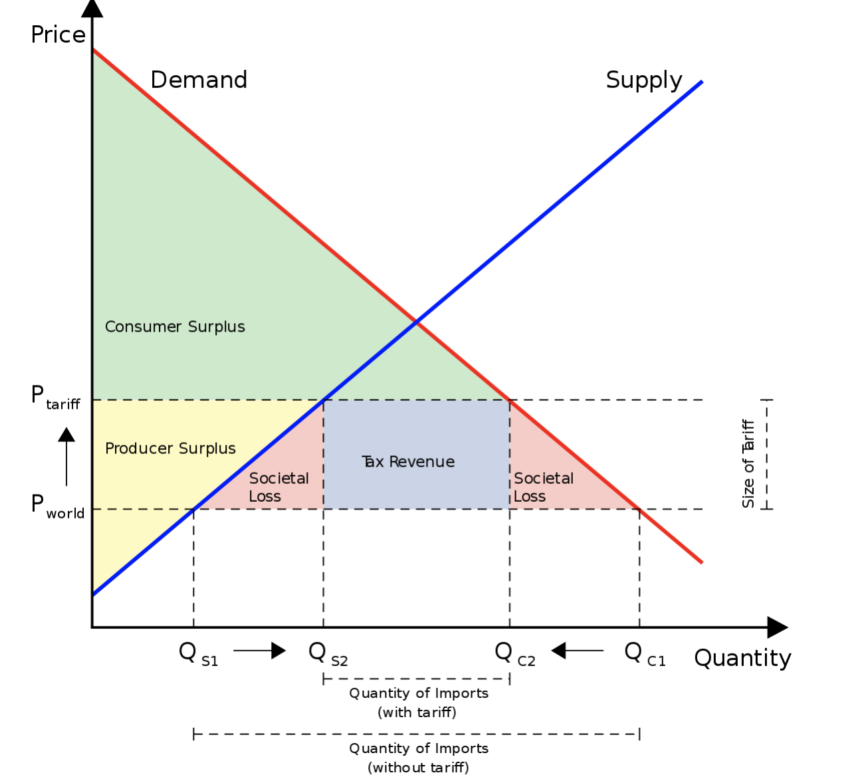

PS. The most powerful argument against tariffs is not that they cause inflation, but rather that they cause a decline in real output.