Kelbeat/iStock via Getty Images

SunPower business overview

Sunpower Co., Ltd. (Nasdaq:SPWR) is a solar energy company that manufactures, distributes, and sells solar panels, energy storage units, and other related products primarily for the residential market. The company also has subsidiary products such as: This is software and finance that gives companies a sense of vertical integration and greater control over their customer base, allowing them to have a customer base that has lower default rates on average. Several overarching trends have been observed in the solar power industry in recent years. First, solar panels are becoming more efficient and advanced. Second, solar panels will also become cheaper and more affordable, which should provide a tailwind for overall industry growth. Third, there is intense competition, especially from China, and some of the costs are said to be subsidized by the government, which may give them an advantage. For companies doing business there.

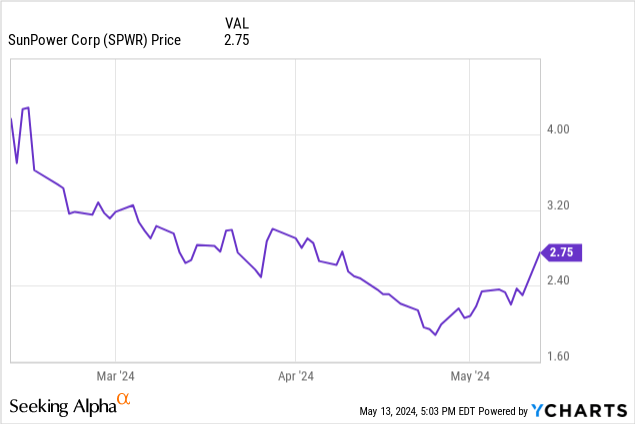

Apparently the Biden administration preparation Increase tariffs on many Chinese products, including but not limited to electric vehicles, solar panels, and related products. As the market digested this news, the stock prices of domestic solar power stocks such as SPWR rose steadily.

The new increases could double or even triple the tariffs the U.S. collects on certain clean energy products from China, but the impact is unclear. Chinese solar companies tend to have multiple manufacturing and distribution centers outside China, and could theoretically use these locations to export to the United States and overcome some of the tariffs. Again, products manufactured outside of China may not have the same price advantages or subsidies as products manufactured in China.

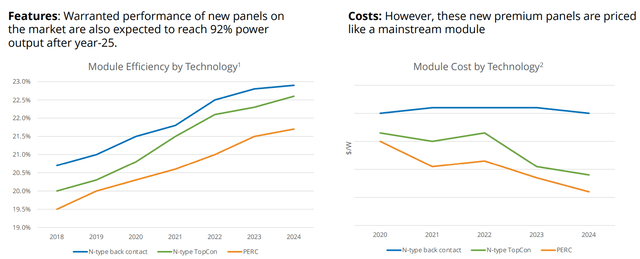

SunPower, on the other hand, could benefit from these tariffs because it means less competition, or at least less price pressure from China. For premium panels, he sees two major trends across most product types: increased performance efficiency and reduced costs. While these trends have served the company well in recent years, it still suffered from a lack of scale that could have kept costs down and improved overall profitability. Less pressure from Chinese competitors might make it a little easier for SunPower to scale up and eventually reach profitability, but not only will the company continue to grow in size, but costs will also increase. It will take quite a while to get there because we will have to cut back. This will be explained in the next section.

Efficiency and Cost Trends (SunPower Corp)

Operational indicators

Recently, the company has been affected by: announcement The company announced that it will postpone the publication of its 10th quarterly report due to the need to recalculate some of its financials. The company’s most recent annual report, prepared for 2023, includes errors in capitalization, classification of sales commissions as selling expenses instead of operating expenses (in other words, gross margin instead of operating margin). admitted that there had been a number of misstatements regarding the amount counted in the calculation of the rate. ) and other adjustments. Whether this is a big deal will become clear after the company finally issues its latest report, but in terms of some of the most important metrics such as cash flow, earnings, and the health of the company’s balance sheet. may not differ much.

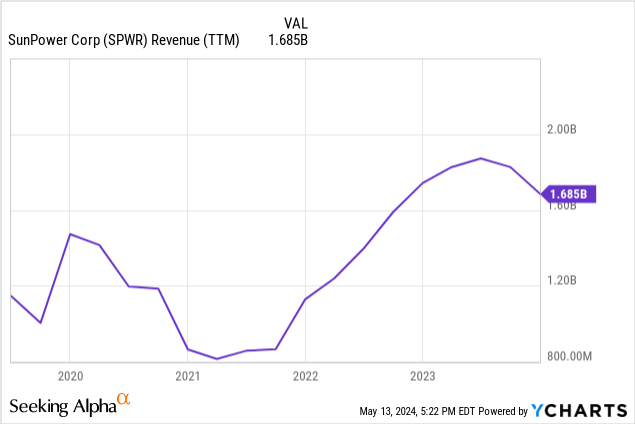

Looking at the company’s earnings trends, although it was on a growth track, it suffered a sharp decline last year, with sales decreasing by about 9% from the previous year. A slowdown in new home construction due to rising mortgage rates was part of the economic slowdown. Demand was hurt by the slowdown in construction activity, as a significant portion of demand for the company’s premium products came from new homes. This was partially helped by slightly stronger demand from new multifamily housing, which has not historically been a market associated with solar energy.

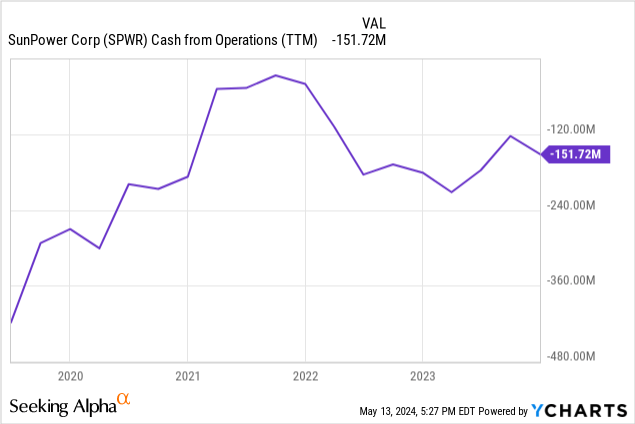

The company has been reporting negative operating cash flow for quite some time, and this needs to be corrected soon if the company wants to be solvent and not dependent on continued cash funding. Dew. The company already knows this, as it announced several cost-cutting measures in its last earnings call, which it says are expected to save around $100 million once fully implemented. These measures include consolidating locations, renegotiating contracts with suppliers, increasing production efficiency, reducing distribution costs, and lowering overall overhead costs. Although these measures can significantly reduce costs, they may not be enough. For example, the company’s operating cash flow last year was negative $151 million. So even if you cut costs by $100 million, your cash flow will still be negative at $51 million. To close this gap and achieve positive cash flow, in addition to reducing costs, you will need to significantly increase revenue. So far, we haven’t been able to get there, but newly proposed tariffs (if implemented) could provide the needed push.

SunPower stock valuation

It’s always difficult to value a company with negative earnings, but it’s even harder when it also has negative cash flow. Typically, a company’s net income, operating income, or operating cash flow are used to calculate a company’s valuation and assign a multiple, but if these values are negative, these metrics are less useful.

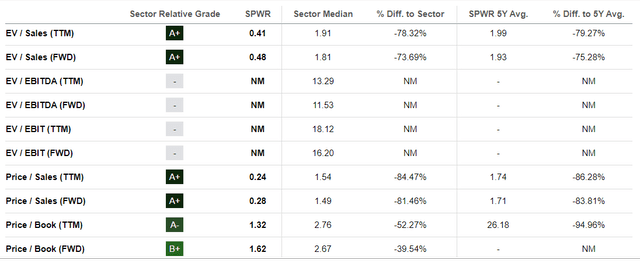

You can also consider alternative metrics such as EV vs. Sales, Price vs. Sales, and Price vs. Book Value, but unfortunately, none of them will tell you the complete picture. Looking at the company’s EV to sales index, it is 0.41, which is lower than the sector median of 1.91, and the company’s price-to-sales ratio of 0.24 is lower than the sector median of 1.54, which goes without saying. The book value ratio is 1.32. Although this is below the sector median of 2.76, these don’t mean much if the company is not profitable, or at least cash flow positive. At least, it can be said that it is not expensive considering sales and book value.

evaluation (In search of alpha)

SPWR stock analyst forecasts

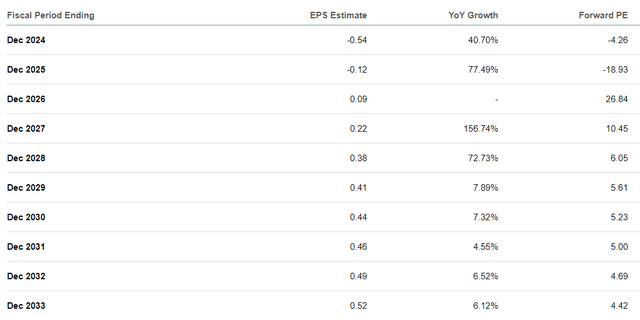

Another source of company valuation is analyst forecasts, which are forward-looking in nature. While forward indicators are less certain than trailing indicators, we also know that the market is forward-looking and pays more attention to forward indicators than trailing indicators. This is why companies with strong forward-looking values can outperform companies with weak forward-looking values in the market. First, remember that this company is a small-cap stock, so there aren’t that many analysts covering it. There are only a few analysts covering this company, and their forecasts can change from year to year. As you can see below, analysts expect the company to be in the red this year (54 cents per share) and again in 2025, but not by as much (just 12 cents). Analysts believe the company will turn around and eventually become profitable from 2026 onwards. Based on the 2026 forecast, the company’s forward P/E ratio would be 10.45 times, and based on the 2027 forecast, the forward P/E ratio would be 6 times, but if it actually achieves that number, it would be a fairly low level. Analysts expect the company’s growth rate to slow after 2029, with annual growth of just a few cents, but that’s too far out to make a good prediction. right.

Analyst predictions (In search of alpha)

conclusion

At a forward P/E of 6x (based on 2028 earnings) this could be a great buy if you believe the company can meet or exceed analyst expectations over the long term. It’s too early to tell whether that will be possible. Achieve it. The company is currently trying to increase revenue while increasing efficiency and cutting costs, but it will take some time to see the effects. If you can achieve scale fast enough while aggressively cutting costs, you could be profitable, but it will take a lot of work to get there. If the U.S. government were to increase tariffs on solar imports from China, it could significantly ease competitive pressure on SunPower and provide some boost to the company’s revenue and profitability prospects. There is sex.

In the future, improvements in technological efficiency may make solar panels more affordable, and regulations in states such as California will also help increase sales of these products. The sector is expected to grow at a healthy rate for years to come, but this also means that even with tariffs there will be intense competition, with companies having to choose between quality and price to steal market share. We have to outdo each other in both. This is likely to put a limit on how fast companies in this space can actually grow. I also wouldn’t be surprised to see more consolidation and M&A activity in this space. This will help large companies like this company scale faster.