Giuliano Benzin

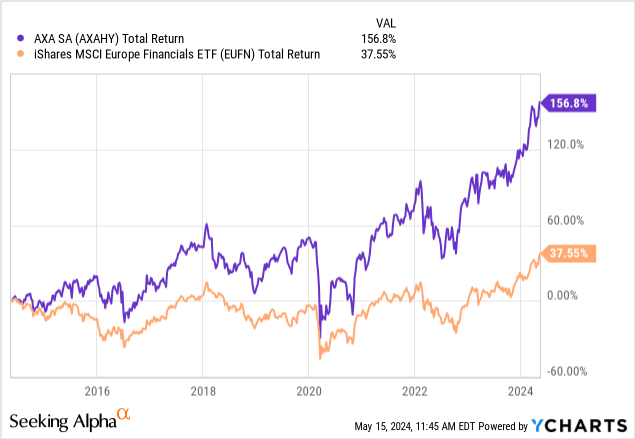

Shares of French general insurance company AXA (OTCQX:AXAHY) (OTCQX:AXAHF) has had a solid performance over the past decade, and the broader European financial space (EUFN) The total return for that period was up to 155% (up to 10% p.a.).

Underpinning this impressive performance is the company’s strategy to move away from traditional capital-intensive savings accounts in the life insurance sector and towards income underwriting and capital-light savings products. As a result, we believe that AXA still offers investors reasonable upside potential, supported by a transparent and attractive capital return policy, as the company generates healthy levels of profitability. I believe. I open that name with a “buy” rating.

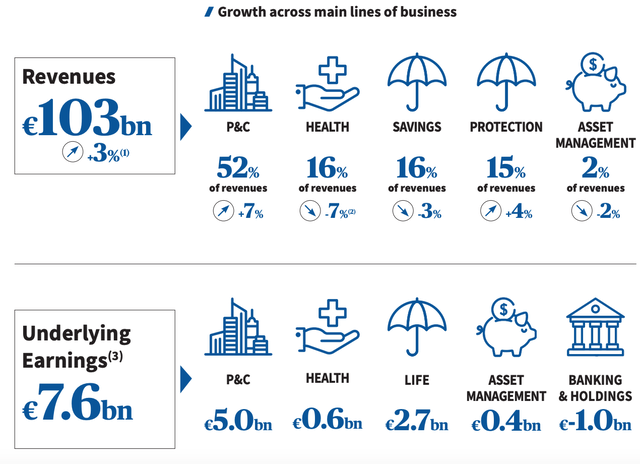

AXA currently generates approximately €100 billion in annual premium and other income, making it one of the world’s largest insurance companies.Just over half (approximately 52%) of this revenue comes from contributions Property and Casualty (“P&C”) insurance, with just under half coming from Life & Health (“L&H”). AXA also has an asset management division, which contributes low single digits (approximately 2%) to sales. P&C insurance includes a variety of commercial property and casualty insurance, including auto (up to 62% of P&C premiums) and retail insurance. L&H is a savings and protection business.

AXA 2023 Universal Registration Document

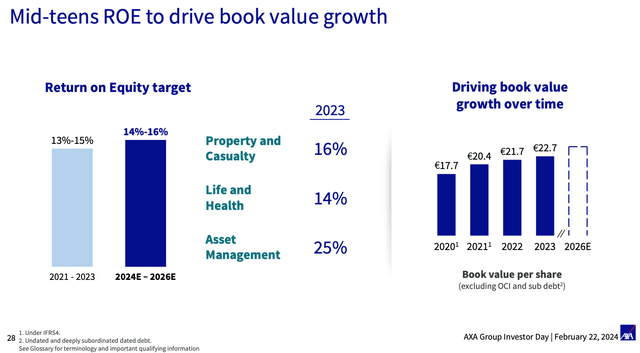

Last year, AXA generated underlying profits of €7.6 billion. The company’s property and casualty insurance business operates at a higher return on equity (“ROE”) than his L&H, so its contribution to revenue was even greater at 65%. The same goes for asset management, which structurally has a much higher ROE than other lines. L&H accounted for the rest.

This represents a significant change compared to AXA’s business a decade ago. At the time, Life accounted for about 60% of sales and a similar share of profits. Additionally, a significant amount of the life business was earmarked for capital-intensive general account savings. AXA’s corporate website does a good job of concisely summarizing these products compared to less capital intensive products.

This segment distinguishes between general account business and unit-linked business. The amount paid into the general account is guaranteed by the insurance company, and the insurance company assumes the operational risk. Insurance companies make a profit from the difference between the income they receive from their investments and the fees paid to policyholders. Unit-linked products are primarily invested in stocks. The amount invested in these vehicles is typically not guaranteed.

sauce: AXA Life & Saving

As the above suggests, traditional general account products are inherently interest rate-linked. One of the problems with this, he said, is that providers can offer high guarantees to policyholders even if the yields they earn on their own assets decline. Indeed, this was a feature across European markets in the 2010s after interest rates collapsed to zero following the global financial crisis. Note that Europe, including AXA’s home market of France, accounted for approximately 73% of L&H revenue last year. Additionally, the capital requirements for traditional general account products are also relatively high, as the risk of these products is in his AXA.

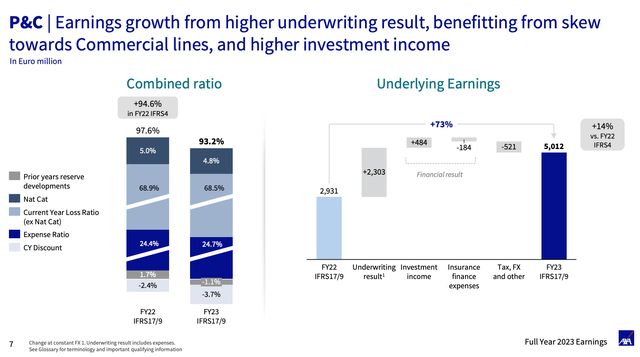

Shifting its business mix to property and casualty insurance means that much of AXA’s revenue will be generated from underwriting profitability, which is the difference between the amount AXA collects in premiums and the amount it pays in claims and out-of-pocket expenses. This is the difference between Last year, the former covered about 68.5% of the company’s non-life insurance premiums (excluding natural disasters), but the operating expense ratio remained at just under 25%. With a non-life combined ratio of 93.2%, AXA’s underwriting business is profitable. We believe this change is attractive to long-term investors because underwriting income is not linked to capital markets.

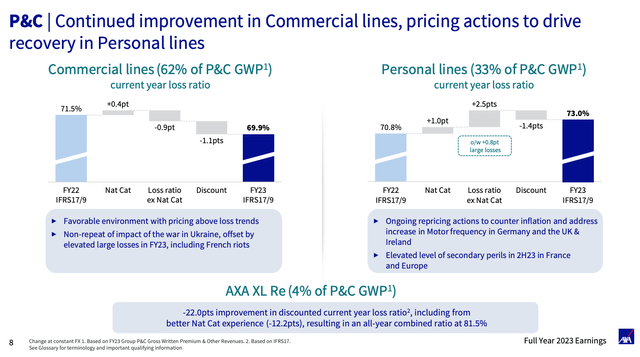

AXA’s P&C combined ratio was strong, but there were some bearish factors in the retail sector. This is due to the impact of inflation on claims costs and the normalization of claim frequency post-COVID-19, which resulted in an increase in loss rates in the personal lines business last year.

AXA is taking deliberate steps to address this. Q1, AXA report Personal lines insurance premiums amounted to €6.4 billion, an increase of 6% compared to the previous year. The price effect for this period amounted to +10.3%, with AXA basically making concessions to sales volumes in favor of price increases. I view this as a positive as this disciplined approach should support the bottom line in the short term.

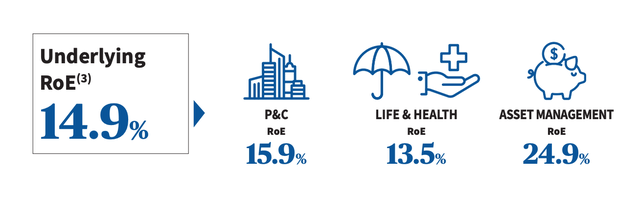

Although AXA’s underwriting business is profitable, there is clearly still an investment element in non-life insurance, as insurance companies also make money by investing in customer premiums. In fact, because of this, many insurance companies operate their underwriting operations at a loss and expect to make up the difference with investment income. AXA reports a combined ratio of less than 100%, so it is essentially paid for by borrowing from customers. This has led to increased profitability, with the P&C division achieving a solid ROE of 15.9% last year, even though the majority of its investments are in fixed income securities such as government bonds.

AXA is not only tilting its business further towards property and casualty insurance, but also changing the product mix within its life insurance business. This includes selling fewer traditional savings products and steering customers toward products such as unit-linked insurance instead. Because the risk for these products lies with the policyholders rather than on AXA’s balance sheet, they are relatively capital-light, further boosting ROE. Last year, sales of traditional products were only about 2 billion euros, or about 4% of total L&H sales and 2% of total group sales, but in the first quarter Sales decreased by 14%. Meanwhile, AXA reported an 8% year-over-year increase in unit-linked insurance sales and a 19% increase in sales of less capital-intensive general account products (such as zero-guarantee insurance). Despite being still the least profitable division of the company’s business, L&H’s ROE last year was still a respectable 13.5%.

AXA 2023 Universal Registration Document

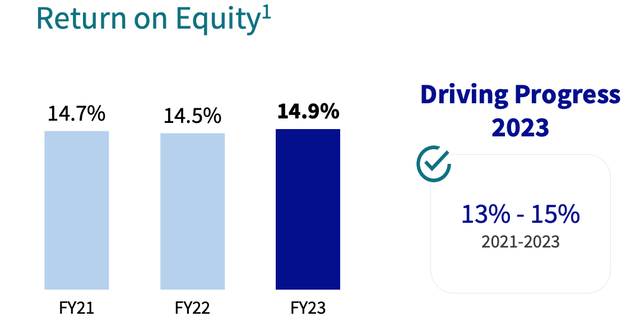

AXA’s remaining business, asset management, is generally a capital-light activity anyway (AXA’s ROE is around 25%), so the group’s overall profitability is good. Last year’s revenues of €7.6 billion equated to an underlying ROE of 14.9% for the group, roughly in line with the revenues of the previous two years.

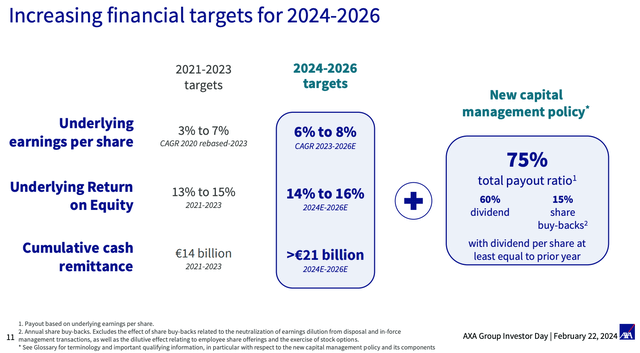

One benefit of this is that AXA can afford to pay out a relatively high percentage of its earnings through dividends and share buybacks, especially since premium growth is highly linked to GDP. Being a large global company means that AXA’s growth can reasonably be expected to match the world’s nominal GDP growth rate (say around 5-6% per year). In fact, AXA is targeting EPS growth of 6% to 8% by 2026, which would be around 5% at the midpoint excluding the impact of share buybacks. This is consistent with management’s plan to distribute 75% of profits to shareholders, with return on equity skewed towards dividends (60% of profits) over share buybacks (15%).

AXA: 2024 Investor Day Presentation

This makes the current stock price appear undervalued. With management proposing to retain around 25% of profits, AXA can expect ROE of around 15% and book value growth of around 4%. This is the level of profitability that management expects AXA to achieve from 2024 to 2026, and is also consistent with the company’s recent historical averages, as noted above.

With 15% of profits allocated to share buybacks, this should provide an additional ~2% tailwind to balance sheet growth per share. Therefore, over the next three years, I expect him to increase his book value per share (“BVPS”) by just under 6% per year. His BVPS at the end of 2023 is €22.70, so his three-year book value per share target is €26.80.

AXA: 2024 Investor Day Presentation

AXA generates a high ROE and is growing, so its stock price should command a healthy premium to BVPS. Assuming an ROE of 15%, a long-term annual growth rate of approximately 3% after 2026, and a cost of equity of 10%, a multiple of approximately 1.7x would be appropriate. This gives his three-year price target for Paris Ordinary Shares of €45.60 (up to $49.60 per ADS).

Additionally, AXA’s return on capital policy means that, at a payout ratio of 60%, cumulative dividends from 2024 to 2026 will be approximately EUR 6.70 per share (approximately $7.30 per ADS). Including this, his three-year total return price before tax is approximately €52.30 per share (approximately $56.90 per ADS). This would imply an annualized return of approximately 16% from his current share price of $36.24 per ADS, making AXA stock look attractively valued for prospective investors. That’s why I open them with a “buy” rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.