Tadamichi

investment thesis

B3 (NYSE:OTCPK:Bolcy)share.regardless of 1st quarter of 2024 Both sales and profits were lower than market expectations, but this was offset by the company’s revenue diversification.

Additionally, the company’s P/E ratio is half the average. It seems that the assessment of competitors already takes into account all the risks mentioned in my coverage Start report. Additionally, the start of the US interest rate cut cycle could trigger volume improvement for the company.

B3 Results Update for Q1 2024

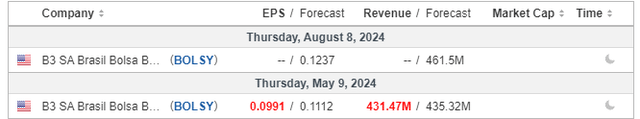

B3 announced its Q1 FY24 financial results on May 9th, and the results were below market consensus.

Next, let’s discuss B3’s performance in detail. We will explain trends in revenue, expenses, and profits.

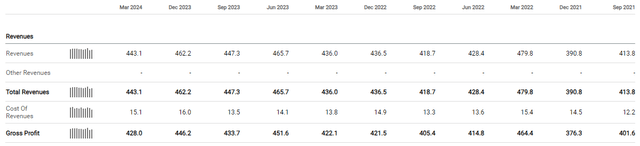

Revenue – Sales of listed segments are low

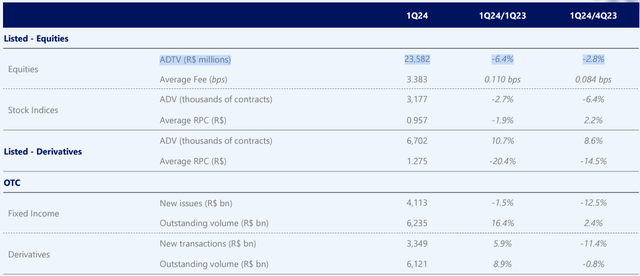

net revenue $443 million (-4.1% QoQ, +1.6% YoY). This was to be expected, given that the company reports trading volumes on a monthly basis. His average daily trading volume for the first quarter of 2018 was $4.72 billion, down -2.8% quarter-over-quarter and -6.4% year-over-year.

Results were primarily affected by the results of listed companies. Listing revenue was $280 million, down -1.4% quarter-over-quarter and -9.1% year-over-year. The large annual decline in this sector was due to low trading volumes on stock exchanges.

Meanwhile, OTC revenue was $79 million, representing strong annual growth of +13.2% year over year. Brazil continued to drive this strong annual performance with fixed income products. highest real interest rate World rates.

I think it’s important to mention that revenue has remained stable on a year-on-year comparison, even though volumes are down nearly 10% for the year. This is due to its revenue diversification strategy and exposure to the technology sector.

Lower interest rates tend to lead to higher valuations for all companies due to lower discount rates, but for stock exchange businesses this benefit is even greater as it affects trading volumes.

Therefore, I think the start of interest rate cuts in the US and the consequent increased room for rate cuts for Brazil’s central bank could trigger revenue improvements.

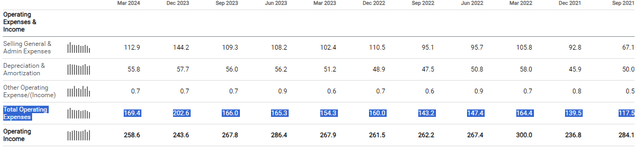

Expenses – growth more than revenue

Operating expenses totaled $169.4 million for the first quarter of 2024 (-16.4% sequentially, +9.8% year-over-year).

Expenses in the quarter benefited from lower data processing lines (-14% QoQ), third-party services (-56% QoQ), and promotions and advertising (-71% QoQ) .

This occurred because B3 was under budget for 2023 and decided to bring forward some costs to Q4 2023. As a result, EBITDA was $266.3 million (-16.5% YoY, +5.7% QoQ).

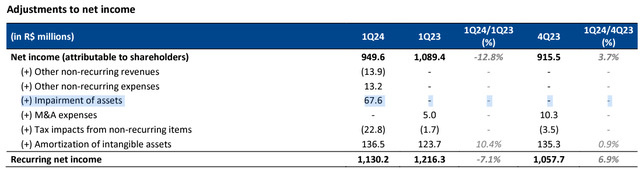

Net profit – as expected

Net income reached $189.4 billion (-11.9% YoY, +0.4% QoQ). The decrease for the year was due to lower revenue growth than expenses and “other” items, including a R$67.6 million (or $13.52 million) impairment charge taken in the quarter.

In summary, as published management data has already pointed out, B3 announced non-progressive results in the first quarter of ’24, with a decline in the trading volume of the listed segment, which is mainly contributing to the company’s improved performance. I was suffering from lowness.

Continuation of reduction cycle domestic interest rate The decision was postponed because first-quarter results were not enough to restore risk appetite among investors who had been tracking more resilient inflation and labor market data in the U.S. economy. lower interest rates That side. However, as you will see below, I believe B3’s valuation already discounts all of these risks well.

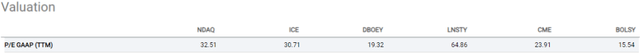

Valuation remains favorable

Using price-to-earnings ratio again, Intercontinental Exchange (NYSE:ice), NASDAQ (NASDAQ:NDAQ), CME (NASDAQ:CME), London Stock Exchange (OTCPK:LNSTY), Deutsche Börse (OTCPK:DBOEF):

If you add up the multiples of the six competitors and take the average, you get a multiple of 31 times earnings, which is significantly higher than B3’s multiple.

In addition to this, the company continues to maintain the highest profit margins among its competitors. Therefore, my recommendation is to continue buying the stock.

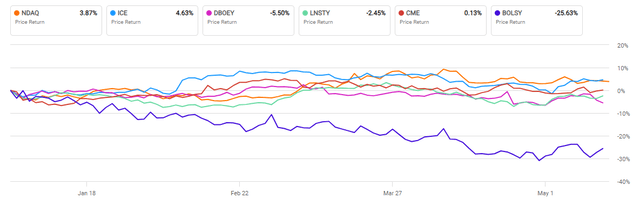

Before we talk about risks, I need to show you these graphs.

The company’s performance is the worst among its peers

As I mentioned in my introductory report, B3 has the highest profit margin, highest net cash, and highest dividend yield among its competitors, but this falls short of this year’s performance.

total return (In search of alpha)

This performance makes no sense from the company’s fundamentals. So my recommendation is still to buy the stock. However, it is important to be aware of some additional risks to papers before making an investment.

Potential threats to the bullish theory

conclusion

This latest report showed that B3 remains at a significant discount compared to its global peers. Although the competitive environment is becoming increasingly competitive, it seems unlikely that B3’s stock price will impact performance by half of his peer group’s P/E ratio.

The company’s performance fell short of expectations. Also, in the absence of short-term incentives, an improvement in the macroeconomic environment could trigger an increase in stock trading volumes.

Based on these analyses, we recommend buying B3 stock. Investors should pay attention to a company’s fundamentals and its discounted valuation. The risk-return ratio looks great.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.