oats power

AEM stock is outperforming

Recently, gold mining stocks have attracted the attention of many investors due to the solid rise in gold prices.The theory behind owning gold mining stocks is that investors can profit from rising prices You can gain ownership of gold while mitigating many of the downsides of owning gold (such as lack of active cash flow, lack of dividends, and relatively high fees).

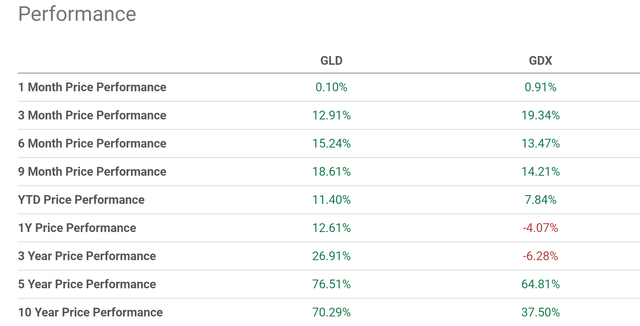

But a quick reality check shows that this is not the case. The following graph shows the VanEck Gold Miners ETF (GDX), converted to gold price (expressed in SPDR Gold Shares, GLD). As you can see, gold mining stocks have lagged gold in both the short and long term. For example, over the past 10 years, gold prices rose 70.29%, but gold miners only rose nearly half that amount, about 37%. From the price of gold.

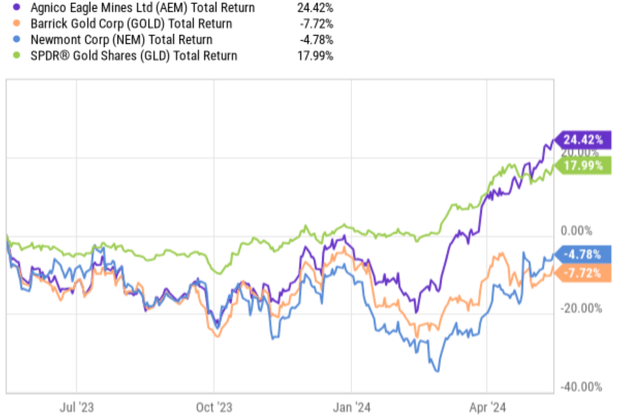

After seeing the forest, let’s go down the mountain and look at the trees. The following graph shows the total revenue and total gold revenue for the three major gold miners over the past year. These gold miners are Newmont Corporation (Nemu), Barrick Gold Corporation (Money),and again Agnico Eagle Mines Limited (New York Stock Exchange:AEM), today’s main topic. As you can see, over the past year, gold prices have experienced a significant increase of nearly 18%. In contrast, his two leading miners, GOLD and NEM, actually suffered total losses (4.78% and 7.72% respectively).

AEM is the only company in this group to post positive returns and outperform the gold price. So the next logical question is, of course, “Why?” In fact, this is such a rich question that I’ll have to break it up into several parts.

- Why did the gold miners group underperform the gold price so much?

- Why did AEM perform better?

- And finally, and ultimately, can AEM’s superior performance continue?

In the rest of this article, I will analyze all three parts in more detail and discuss why my answer is correct. yes On to the third and ultimate question.

Why did goldminders underperform gold prices?

In my opinion there are two main reasons. First, it is difficult for miners to time their expansion (or contraction) in response to changes in the gold price. Mining is not a good example of rapid movement. The duration of mining projects is measured in years and even decades. Investors interested in gold miners should read the following report to understand the time lag among gold miners. Gold price and gold miners deeply. I’ll quote the main points here (highlights added by me).

In some cases, the time from discovery to production of a gold mine can be Between the ages of 15 and 18. This means that once miners exhaust and expand their current mines, there will be a lull due to the current lack of investment in exploration. This issue illustrates a persistent problem within the mining sector. The World Gold Council has charted five bullish (price rising) and bearish (price falling) cycles in the market since the 1970s, but each time a recession hits, instead of investing in exploration, It appears that spending has been cut back to maintain livelihoods. This compounds the problem the next time a bullish period arrives. As a result, miners are slow to react and unable to take advantage of high prices to bring new mines online.

The bottom line is that by the time most miners react, the rise in gold prices could be long gone.

mining cost

The second factor that causes performance degradation is mining cost. A miner’s profit is their revenue (which of course increases as the gold price increases) minus their costs. As a result, even if miners’ costs rise at the same pace as the gold price, profits remain the same. Even worse, if its cost rises faster than the gold price, its price will actually fall.

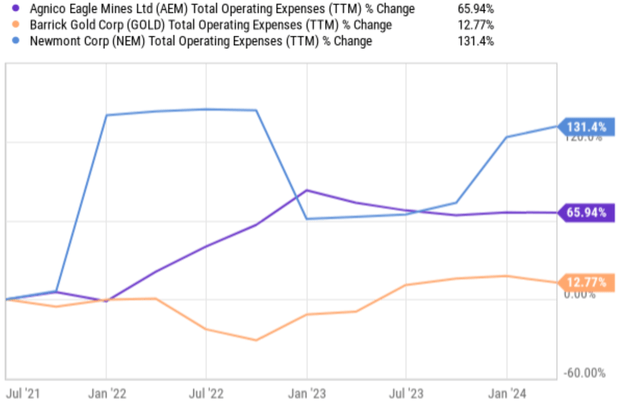

This latter scenario is not a theoretical argument. The way I see it, that’s what’s actually been happening in recent years. The following chart shows the operating expenses of three large gold mining companies over the past several years. Specifically, trends in operating expenses are displayed quarterly. As you can see, NEM’s operating expenses have more than doubled over this period, and GOLD’s operating expenses have increased by approximately 12.8%. AEM costs also increased by approximately 66%.

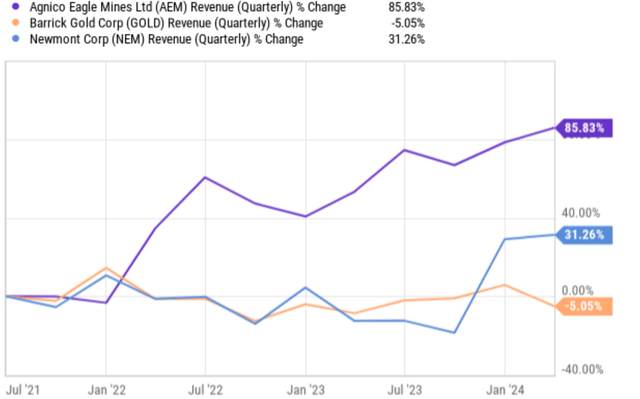

Of course, if sales can grow at the same pace (or even better), increasing costs won’t be a problem. But unfortunately, this is not the case for GOLD or NEM (or many other miners), as seen in the following chart below. NEM’s revenue grew only 31% during this period, lagging far behind operating expense growth. And GOLD’s revenue actually suffered some decline during this period. AEM is the only company in this group that has been able to significantly (over 85%) increase revenue over costs.

Other risks and final thoughts

Now let’s answer the third and ultimate question. Can AEM’s historic outperformance continue? My answer is yes. This will continue for at least the next 3-5 years. I don’t think that historic outperformance is a coincidence. I rather think they are driven by good fundamentals, and I don’t think these fundamentals will change in the coming years. First, AEM operates many of its major mines in the most geopolitically stable regions, such as Canada, Mexico, and Finland, insulating it from cost and production volatility. It also enjoys some of the most profitable mines, including 50% ownership of Canada’s Malartic mine.

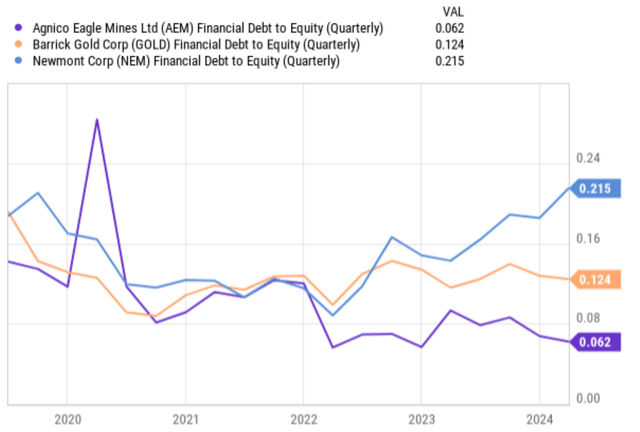

Second, AEM has historically been very disciplined in its capital allocation and has, in my view, one of the strongest balance sheets among large gold miners (see chart below). Undisciplined miners overexpand in hopes of catching up with the gold price, but for disciplined companies with strong balance sheets like AEM, there are opportunities for strategic acquisitions at bargain prices. It will only be born in the future.

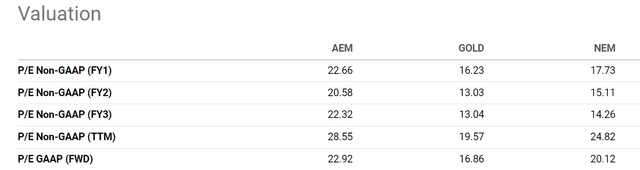

From a downside risk perspective, AEM sees risks common to all gold miners, such as gold price fluctuations (which are notoriously volatile) and inflationary pressures (related to rising labor and fuel costs). facing risks. However, there are some company-specific concerns as well. AEM has a much higher valuation compared to its peers (see next graph below). Additionally, unlike some of its peers who have diversified their products (many gold miners also produce metals other than gold), AEM relies almost exclusively on gold (99% of its production). , making them more vulnerable to downturns in certain metal markets.

Overall, my conclusion is that these risks are well compensated by the quality of the business and financial strength. In my opinion, the P/E premium is well justified given the quality of the mine, the cost advantage, and the strength of the balance sheet. I don’t have any strong feelings about buying gold mining stocks under the current circumstances (although I do have a sizable gold ETF position). But if I wanted to own a gold mining stock, I would choose AEM among the factors I’ve discussed here.