Hapa Bapa / iStock Editorial via Getty Images

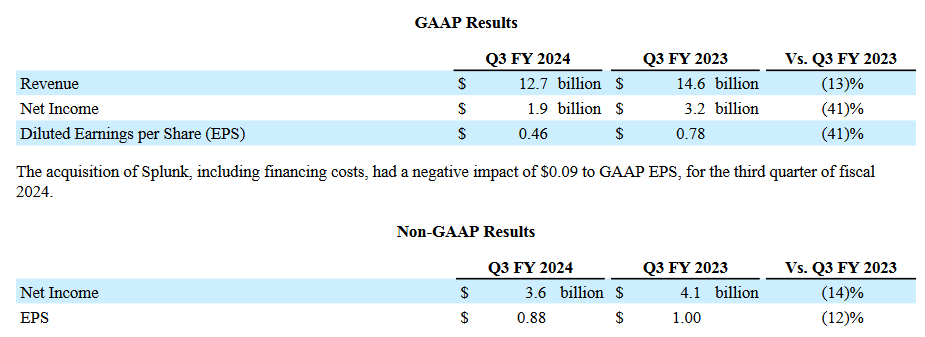

Cisco Systems Corporation (Nasdaq:CSCO) appears to be in a very good position with the company’s latest results beating analyst expectations income Despite showing the largest revenue decline in 15 years, the report said: During the third quarter fiscal period, Cisco recorded his earnings per share of $0.88 (beating analyst expectations) ($0.82 expected), with sales of $12.7 billion (more than the $12.53 billion expected by analysts). Overall, these numbers represent a 13% annualized decline in sales, the sharpest year-over-year negative growth since 2009, while net profit figures of 1 share It’s printed at $0.46 per month (or $1.89 billion). These numbers represent a 41% annualized decline compared to $0.78 per share ($3.21 billion) reported in the year-ago period.

Announcement of financial results for the fourth quarter of 2024 (Cisco)

In a statement accompanying this latest earnings release, management also explained Recent performance degradation may be due to delays such as: Cisco CEO Chuck Robbins added:

In a still dynamic environment, we delivered another solid performance in the third quarter…Cisco’s unique ability to integrate networking, security, observability, and data allows us to provide our customers with unparalleled digital resiliency in the age of AI.

Announcement of financial results for the fourth quarter of 2024 (Cisco)

Announcement of financial results for the fourth quarter of 2024 (Cisco)

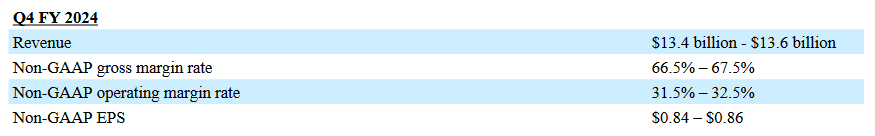

Additionally, Cisco has raised its fiscal year 2024 revenue guidance and now expects the top-line number to be in the range of $53.6 billion to $53.8 billion (which is higher than the previous analyst consensus of $53.1 billion). (forecast range of $51.5 billion to $52.5 billion). On the revenue side, Cisco now expects a more limited full-year potential range of $3.69 to $3.71 per share (up from the technology company’s previous estimate of $3.68 to $3.74 per share). ). Overall, these numbers still beat the prior analyst consensus estimate of $3.67 per share for the current period.

On the downside, Cisco’s networking division’s revenue is down 27% ($652 billion) annually, making the division (responsible for developing data switches) a poor choice for investors. It is important to continue to monitor this closely. Center) still accounts for most of Cisco’s broad revenue. Other notable quarterly trends include: Acquired Splunk for $28 billion. Broadly speaking, Cisco’s acquisition of a software security development company reduced adjusted earnings per share by $0.01 in the quarter. However, this acquisition added $413 million in revenue to the balance sheet during the third quarter.

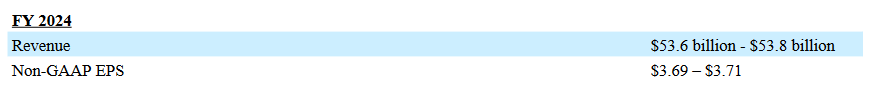

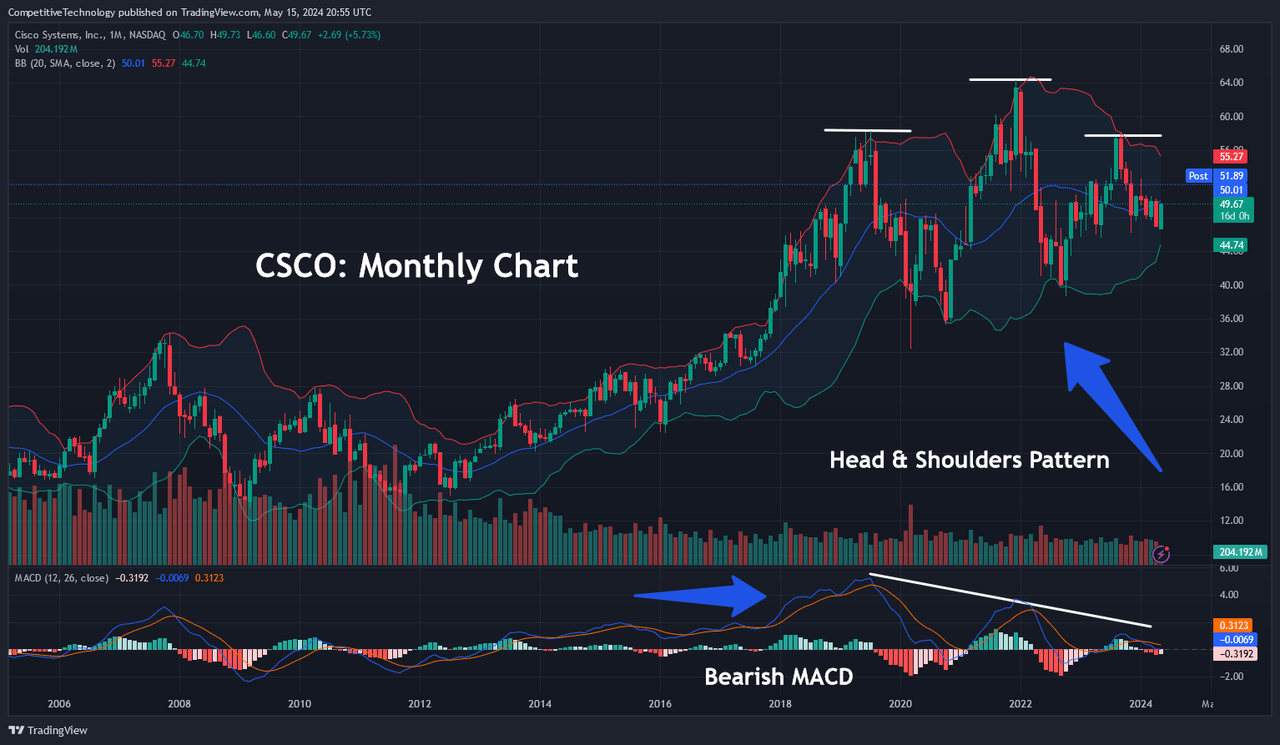

CSCO: Monthly chart (Source of income via TradingView)

There’s no denying that CSCO stock has really underperformed compared to the rest of the stock market over the past year. Prior to the company’s latest earnings release, CSCO was actually down on a year-to-date basis (2 %)doing. ). In fact, on the monthly charts, you can find some interesting evidence and contradictory technical signals that help explain these performances. On the positive side, we see that CSCO has consistently managed to find support near its monthly exponential moving average (EMA). In the chart above, these gradual pullbacks tend to occur around the 20-month, 50-month, and 100-month EMAs, which often prevents further downside tests of the 200-month EMA. On the other hand, we also see a clear bearish divergence in the relative strength index (RSI) monthly indicator readings. Generally, this situation tends to prevail before we see a significant decline in stock prices.

CSCO: Head and Shoulders Pattern (Source of income via TradingView)

In addition to this, the monthly chart also shows a relatively well-defined head and shoulders pattern. Of course, this is also a bearish pattern that predicts an acceleration of downside price movement once the “neckline” is broken. While the neckline itself is the least well-defined aspect of the pattern in this particular chart history, we believe the historical support zone around the $46 level could act as a viable price level for this aspect of the pattern. Masu.

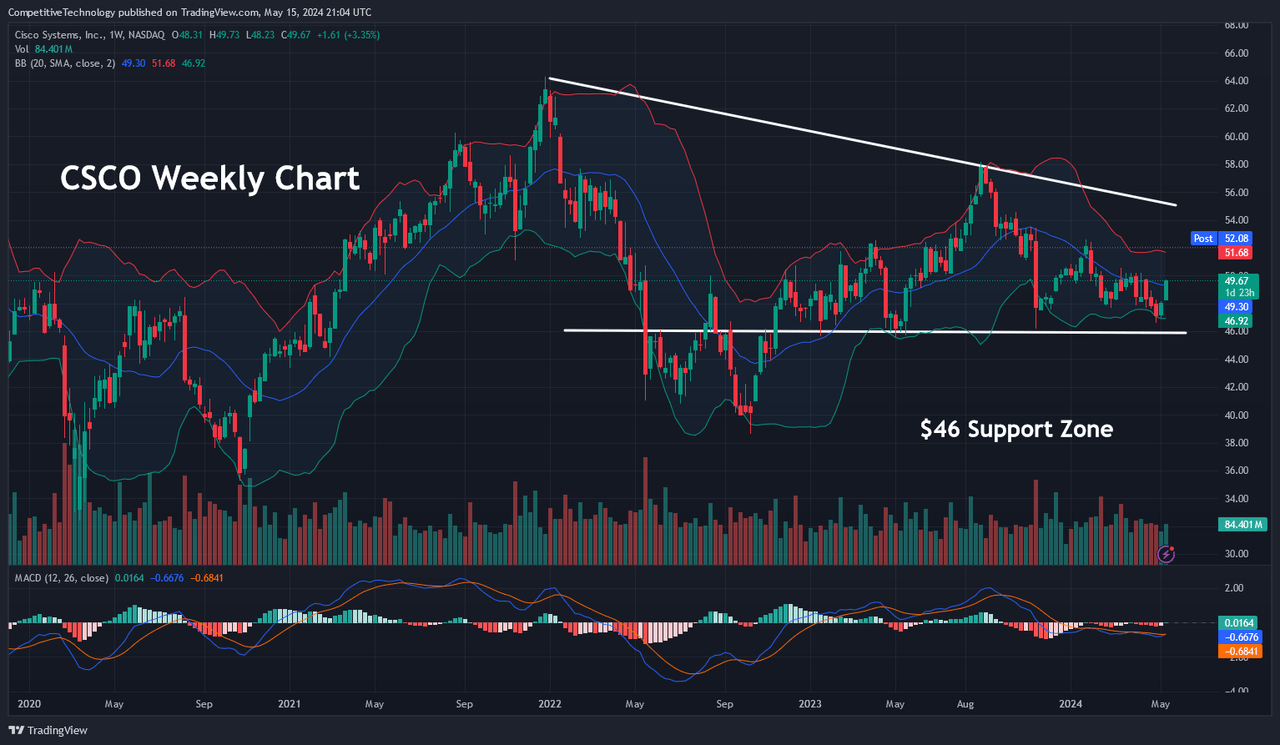

critical support zone (Source of income via TradingView)

If we move to the weekly chart, we can see a better depiction of the various price consolidation structures that have developed around this level (which also marks the historic low from May 2023). For the head and shoulders pattern to be confirmed, we would need to see a downside break in this neckline area before the technical outlook turns completely bearish. For these reasons, we currently view price support as a “line in the sand” that we use to define the difference between bullish and bearish views.

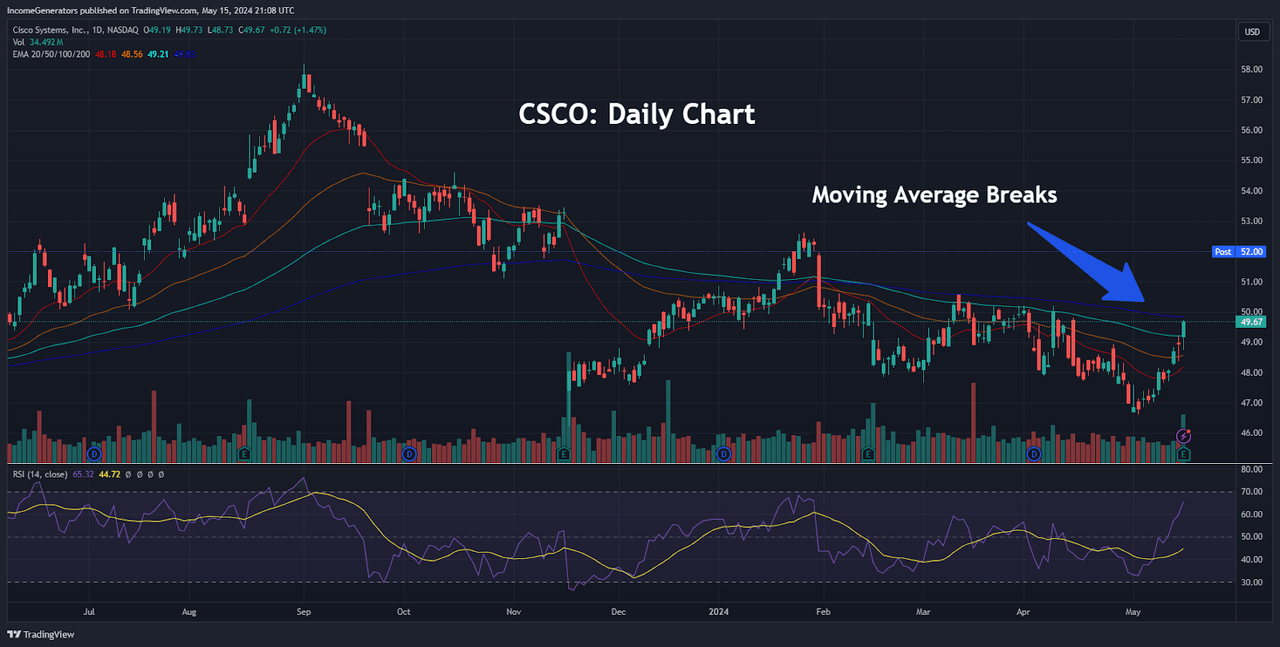

CSCO: Moving average break (Source of income via TradingView)

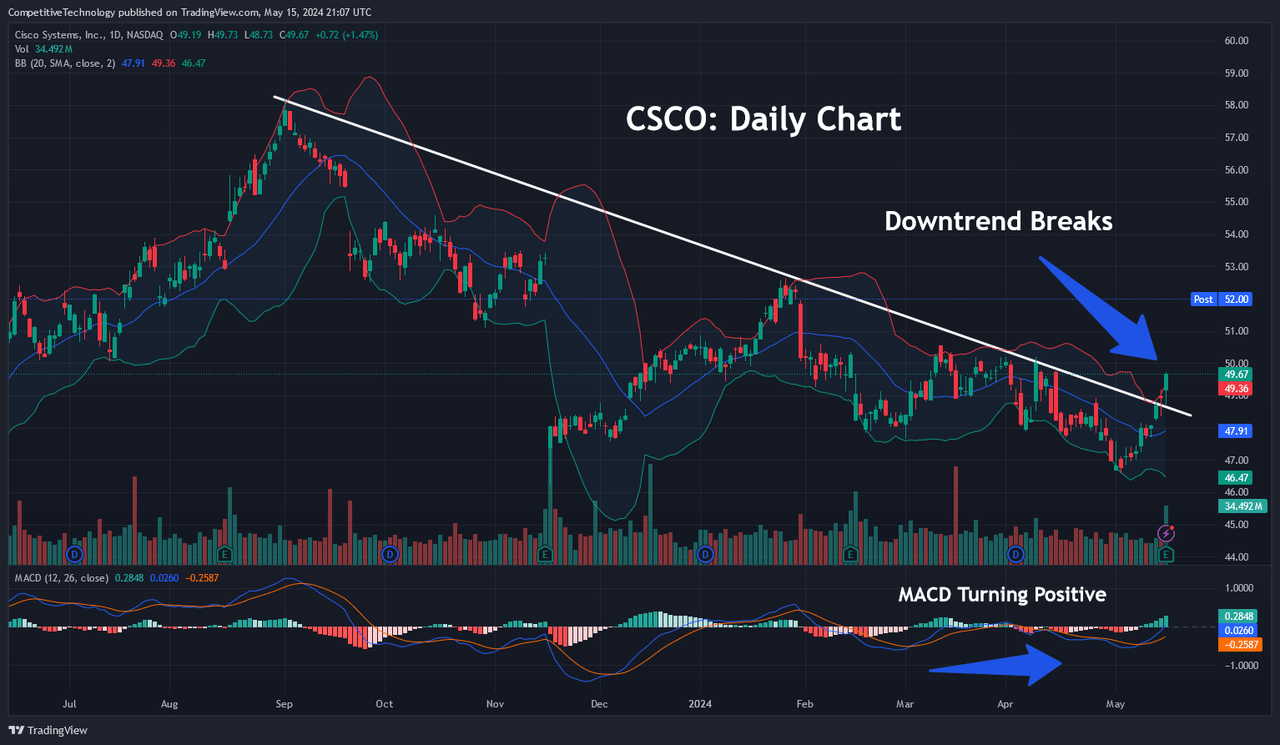

daily downtrend break (Source of income via TradingView)

On the positive side, there is evidence on the daily chart that suggests the neckline will hold (and price support around $46 per share will remain intact). Specifically, it refers to the recent break in the daily downtrend line seen on this time frame. At the same time, the Moving Average Convergence Divergence (MACD) daily indicator reading appears to be moving into bullish territory, with a large portion of the positive reaction to Cisco’s latest earnings release within the broader market. If seen, these signals would indicate potential. Achieves an excellent risk-reward ratio for long positions around current levels.

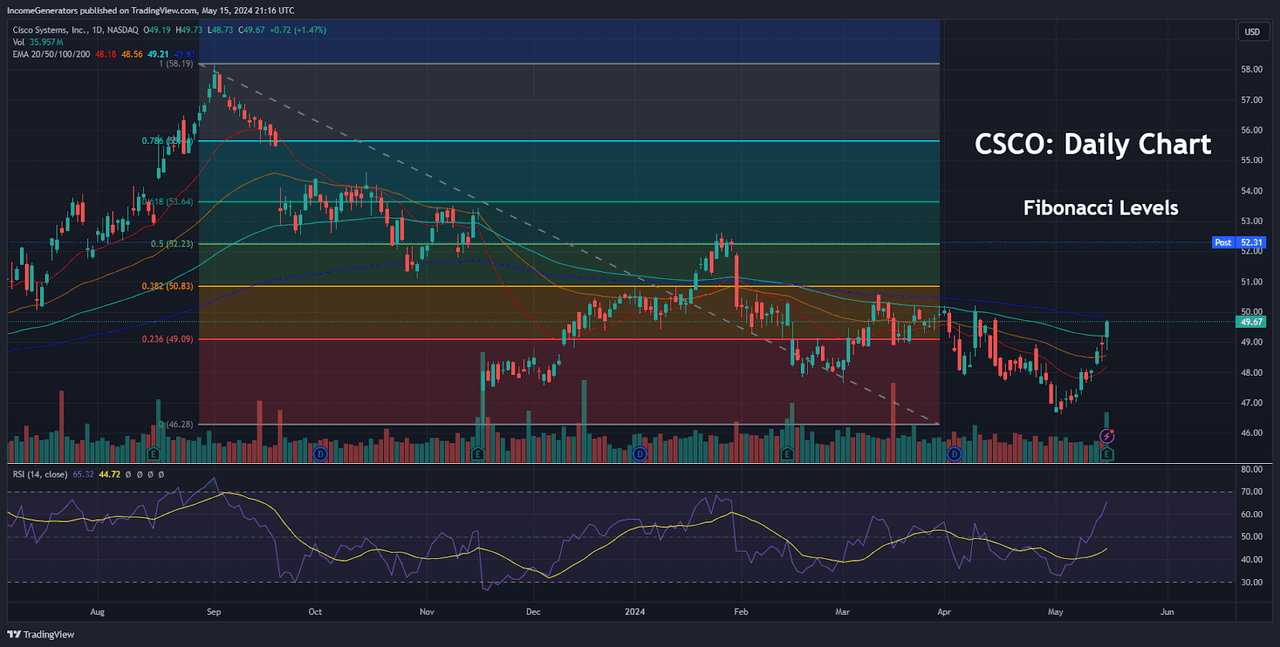

CSCO: Daily Fibonacci levels (Source of income via TradingView)

Unless our bullish outlook changes (and the critical $46 level is not broken to the downside), it will be important for investors to start identifying potential upside targets for long positions. To achieve this, Fibonacci retracement analysis can be used to define possible resistance levels to the upside. Using the September 2023 high of $58.19 and the November 2023 low of $46.20 as the basis for the dominant trend movement, we see that the 23.6% and 38.2% retracements have already been broken. We get it (both are considered very bullish events). . But perhaps most interestingly, after the stock failed near its January 2024 high of $52.62, it found strong resistance at the 50% retracement of the aforementioned price move. Of course, this failure poses a potential risk to the bullish outlook, but we would need to see a downside break of $46 per share before changing our positive stance on the stock. Unless (or until) that happens, the 61.8% Fibonacci retracement (located at $53.64) and 78.6% are potential upside targets that the stock can reach before it starts facing new selling pressure. We are looking at the Fibonacci retracement (located at $55.63). .

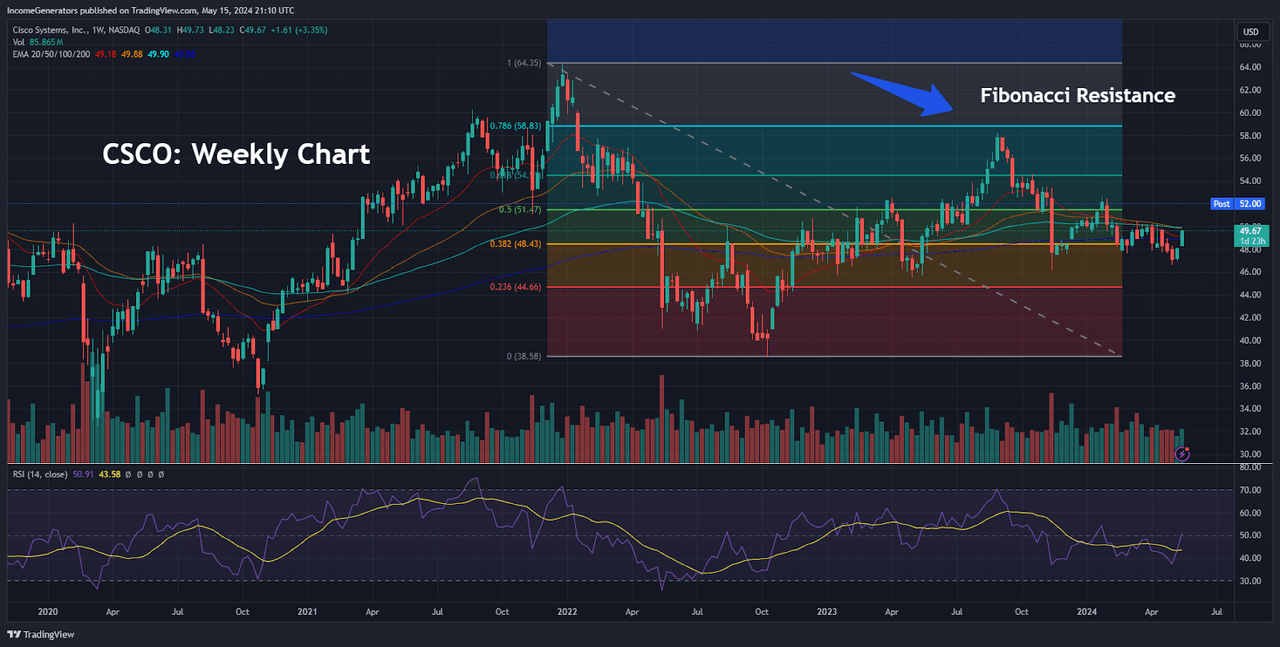

CSCO: weekly Fibonacci levels (Source of income via TradingView)

Finally, I would like to perform a similar analysis using a longer time frame (weekly chart), as this information can lead to somewhat different interpretations. Using the December 2021 high of $64.29 and October 2022 low of $38.60 as the dominant trend movement, CSCO stock took a 78.6% retracement before failing at the August 2023 high of $58.19. You can see that we have found a strong resistance line. These price structures would be considered a major trend move if the key $46 per share level were broken on the downside, so we are betting on the next downside price target moving to the October 2022 low. It will be important for families to understand. ($38.60). For these reasons, we believe it is prudent to establish a long position near the current level with a stop loss below the aforementioned pivot point. Overall, we expect Cisco’s quarterly earnings results to react favorably based on the fact that despite the decline in revenue for the period, Cisco still beat analyst expectations on both guidance and profit numbers. doing. Fortunately, the company’s acquisition of Splunk has already begun to show strong evidence of positive results, and we believe this puts Cisco on solid footing to accommodate these positive earnings revisions in the coming quarters. I am.