mg studio

introduction

In this article, we will consider investing in Essex Property Trust, Inc. (New York Stock Exchange:ESS) in light of 2024 Q1 Results. In particular, he is considering issuing his 10-year senior unsecured notes with a maturity of $350 million. April 2034 compared to current capitalization rate. We also consider past stock repurchase activity by management to support our theory. We then use the acquisition yield of his 49.9% interest in his BEXAEW portfolio of joint venture partners to estimate the net asset value per share. We consider the impact of each of these three of his financial outcomes and conclude that Essex stocks are slightly overvalued.

Reason #1: Value compared to bonds

In the first quarter of 2024, Essex updated its guidance for net operating income (NOI) across consolidated communities. The range up to 2024 is $1.266 billion, with a cap of $1.2296 trillion. This guidance incorporates a same property NOI growth rate of 0.0% to 2.80%. Regarding apartment REITs in general, Comparable store growth for the past four quarters was 2.48%. Let’s consider the upper end of the NOI range as the base case.

Also in Q1 2024, Essex updated its total market capitalization and details of cash and cash equivalents on hand. See Table 1 for Essex’s NOI and market capitalization related statistics.

| Table 1: ESS Capitalization Rate (in thousands of dollars, excluding per share data) | |

| Net operating income (NOI) | $1,229,600 |

| Use of uppercase letters | |

| Total net debt | $6,552,992 |

| capital | |

| Total number of shares of common stock and potentially dilutive securities (in thousands) | 66,475 |

| Stock price on May 14, 2024 (intraday) | $267.92 |

| Total capital | $17,809,982 |

| Total market capitalization | $24,362,974 |

| Cash and cash equivalents (including restricted cash) | $507,870 |

| Corporate value | $23,855,104 |

| ESS capitalization rate or “cap rate” | 5.15% |

Source: Seeking Alpha Stock Price and Essex Property Trust Q1 2024 Earnings Announcement and Supplement

When adopting the perspective of a cash-rich individual or group considering purchasing a multifamily property, one of the first metrics to consider is the capitalization rate or cap rate. Now apply the same measures to your entire business. Cap rate is simply net operating income divided by a measure of asset value. Net operating income (NOI) is a cash flow measure after deducting direct real estate-related expenses but before subtracting indirect expenses such as interest expense and corporate overhead. Conceptually, managers (or owners) have no discretion over property taxes, but they do have some discretion over the amount of leverage used and the level of general and administrative expenses. Looking at Table 1 above, if you were in a position to spend $23.8 billion, you would have $1,229.6 million in cash flow because you could purchase income-producing assets. Using current prices, this would be a 5.15% return on investment.

Is this a good deal?

See Table 2. It shows the last trading yield on his $350 million senior unsecured notes recently issued by Essex. This instrument was replaced on his May 15, 2024.

| Table 2: ESS Fixed Income Products | ||

| explanation | mature | Last transaction yield |

| $350 million 5.5% senior unsecured notes | April 2034 | 5.64% |

sauce: Finra.org

Table 3 compares final trading yields for fixed income products and business cap rates.

| Table 3: Final Transaction Yield V. Cap Rate | |

| ESS cap rate | Last transaction yield |

| 5.15% | 5.64% |

Finance is based on several fundamental principles, one of which is the balance between risk and reward. If you can, in theory, buy bonds with a higher yield and less risk than the business’s overall cap rate, it may be worth reconsidering your business’s investment thesis.Investing in bonds can increase your yield by 49 basis points rear Incorporates upper end of full-year NOI guidance. Additionally, NOI still excludes general and administrative expenses and other items.

Now, some readers may point out the reality that deep-pocketed investors and groups don’t pay all cash to buy an entire business. They will use leverage. Of course, if he used leverage, he would probably borrow money at 5.64% to buy an asset that would produce a return of 5.15%, which is still not a positive spread.

This negative spread between cost of debt and cap rate is one item that can indicate overvaluation. To restore the negative spread, either interest rates would have to fall or NOI would have to increase more than expected. If asset prices fall, the positive margin may recover. Let’s consider asset value in a little more detail.

Reason 2: Absence of share buybacks

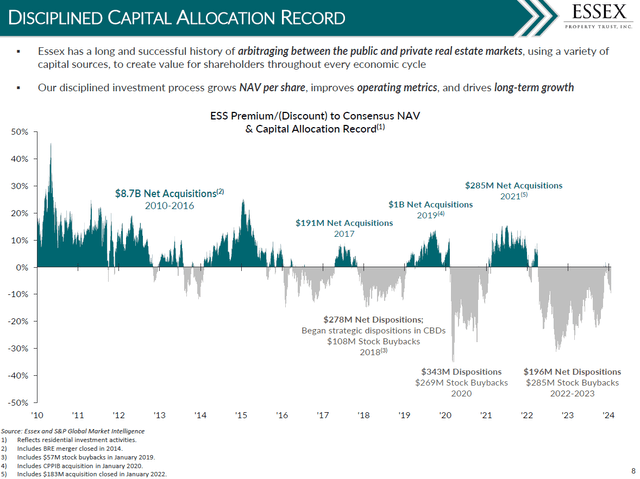

Please see document 1.

Essex Property Trust Investor Presentation March 2024

The Y-axis shows the deviation of the stock price from the stock’s net asset value per share (NAVPS). 10% indicates that the stock is priced at a 10% premium to his NAVPS, -20% indicates that the stock is priced at a 20% discount to the stock. Masu. As the exhibit shows, if the stock price reaches a significant premium, Essex will issue shares to fund acquisitions. Meaningful. When stock prices are high, companies sell their shares at high prices to fund acquisitions. If the stock price is undervalued relative to his NAVPS, he will buy back his own shares and possibly dispose of unprofitable assets to finance his share repurchase activities. These are the kinds of activities that prudent management would be expected to undertake.

As an investor, you don’t want to buy when a stock is selling, as this indicates that the stock is overvalued. Conversely, Essex starting to buy shares could mean management believes its shares are trading at a discount to his NAVPS. From Q4 to Q1, Essex did not repurchase its own shares. To be fair, they haven’t sold a significant number of shares yet. The last time they bought back their own stock was Q1 2023, average price per share of $218.88. They kept in place $302.7 million of remaining purchase authority under their share repurchase plan since the first quarter of 2023. In the recent financial reportHe said he had no plans to become a stock buyer in the near future.

Reason 3: Net asset value per share

In the current rising interest rate environment, trading volumes in many REIT sectors are subdued. Sellers are waiting for the Federal Reserve to lower interest rates, which would lower acquisition costs for potential buyers and increase the pool of buyers. This will put upward pressure on asset prices. Nevertheless, some deals have ended. And the completed transactions offer a glimpse into where the market stands in terms of the types of real estate assets relevant to Essex.

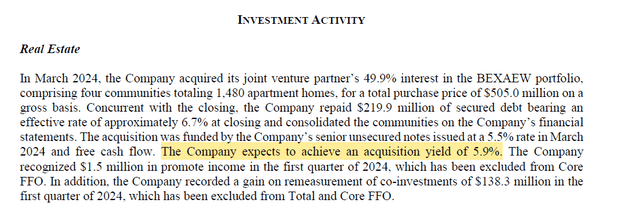

View excerpts from our first quarter earnings release and supplemental data. We have highlighted the most relevant sections.

Essex Property Trust Q1 2024 Financial Results Announcement and Supplement

Assuming management has the best available information, a 5.9% acquisition yield would be priced to close the deal for the type of assets that Essex would potentially be interested in. One interpretation is that it would be necessary. Earnings yield is similar to cap rate. Essex formally defines acquisition yield as “the NOI that we expect to achieve within the next 12 months, less the estimated property management costs allocated to the project, and the estimated capital expenditures per unit of gross sales.” is defined as “price divided by value.” It’s an asset. ”As a confirmation, the implied cap rate for the apartment sub-sector for the fourth quarter of 2023 was 6.20%.

Table 4 estimates the net asset value per share using a cap rate of 5.9%. First estimate the value of operating assets, then estimate the value of non-operating assets, and then combine the two.

| Table 4: Net asset value per share (thousand dollars) | |

| operating assets | |

| 2024 NOI | $1,229,600 |

| cap rate | 5.90% |

| asset value | $20,840,678 |

| Total net debt | $6,552,992 |

| Number of issued shares | 66475 |

| Operating assets per share | $214.93 |

| non-working assets | |

| Real estate under development | $24,631 |

| joint investment | $1,062,575 |

| Cash and cash equivalents (including restricted cash) | $507,870 |

| marketable securities | $91,295 |

| Notes and other receivables | $183,040 |

| Prepaid expenses and other assets | $83,189 |

| Total non-operating assets | $1,952,600 |

| Number of issued shares (thousands) | 66475 |

| Non-operating assets per share | $29.37 |

| Net asset value per share | $244.31 |

There is Well-founded research These support the view that purchasing REITs at a discount to NAVPS will lead to outperformance, and conversely, purchasing REITs at a premium to NAVPS will lead to underperformance.

There are no hard and fast rules for calculating NAVPS. For example, some analysts adjust the value of various non-operating assets. Also, analysts often praise her REITs for having strong management teams. One item to consider is capital expenditures that do not produce revenue. These include roof replacement, paving, building and mechanical systems, exterior painting, siding, and more. The NOI numbers used do not include these items. In his subsequent four quarters, non-revenue-producing capital expenditures were $2,639 per apartment, and Essex’s portfolio was approximately 51,499 apartments.

sauce: Essex 10-Q Q1 2024

conclusion

Another basic principle in finance is the “equity risk premium.” The idea that equity investments require a premium over fixed income investments because the cash flows of stocks are not guaranteed or contractually backed. In this article, we looked at Essex’s cap rate as a business and compared it to investing in fixed income products. We supplemented our view with a lack of stock repurchase activity by management in recent quarters and subsequently confirmed our theory by incorporating estimates of the business’ net asset value per share. . There are many adjustments the reader can incorporate, but the base case is that ESS should currently be considered slightly overvalued.