Delta’s operation at NYC’s JFK airport will see record traffic this summer Alphotographic/iStock Unreleased via Getty Images

The past four plus years have been some of the most difficult for the airline industry. While most of us would like to forget what happened during the early days of covid, few airline investors can forget the gut-wrenching drops in demand that the global airline industry saw as the virus swept across the planet. Within weeks, airlines were carrying less than 10% of their demand in January 2020. Demand recovery on a sustained basis in domestic markets came first in the spring of 2022 and expanded to international markets a year later. Airlines spent the last two years trying to rebuild their businesses and their operations, which had been torn apart during nearly two years of limited demand. Tens of thousands of airline employees retired, leaving the industry to hire and train many new workers.

U.S. airlines were fortunate that the federal government poured tens of billions of dollars into the industry, as well as in other parts of the U.S. economy. Other countries stayed locked down much longer and offered much less aid to their airlines. The result has been that U.S. airlines are in a better position than their peers than in decades.

As with so many entities, those that were strong going into the pandemic managed to grow stronger and recover, while those that were weak have become relatively weaker. Macroeconomic forces continue to weigh on consumer-based businesses, including airlines; a majority of Americans say they are worried about their financial future and struggle to afford the basics of everyday life. The Fed continues to weigh its next moves, battling inflation, even while consumer sentiment for many is worse than before the pandemic.

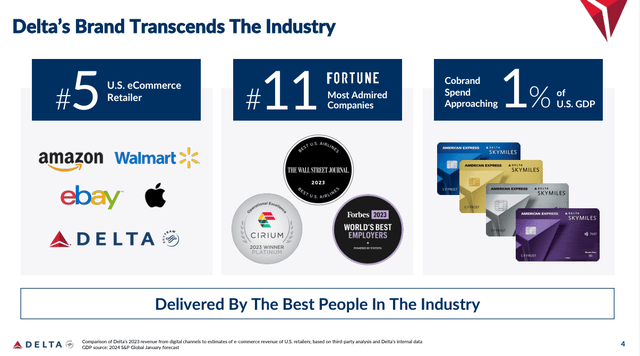

DAL brand (ir.delta.com JP Morgan conference March 2024)

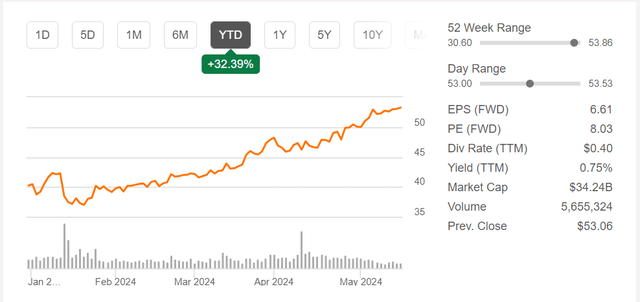

Airline stocks have been very slow to recover even with strong demand, especially in international markets where the big 3 – American (AAL), Delta (NYSE:DAL), and United (UAL) have the advantage of a relatively stronger position in the global marketplace with higher priced tickets on domestic routes. Many investors might have missed that DAL stock has just broken through the $50 mark that it has not breached in four years. Widely perceived as one of the best-run airlines in the world, with the highest revenue and market cap, DAL investors have waited to benefit from the company’s successes – and those returns are now coming in my view. Let’s examine the drivers behind DAL’s recovery and determine if it is sustainable and if there is more appreciation that DAL investors can enjoy.

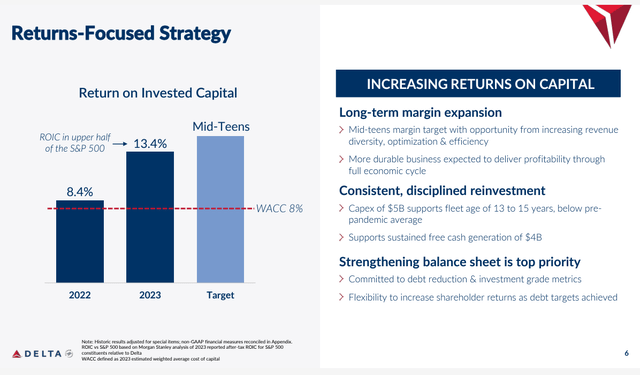

DAL returns focused strategy (ir.delta.com JPM Conference March 2024)

Delta Reset its Business Model

Delta was delivering industry-leading financial performance before the pandemic and used the crisis to further strengthen the existing strategies it had in place while deploying new strategies to grow where it saw opportunity. Those pandemic area strategies included expanding its network in highly competitive coastal U.S. markets, strengthening its international network while building a strong platform for growth, refining its fleet advantages, and preparing for the balance sheet repair that would have to come after the pandemic.

Delta’s first decades of existence were as one of the outsiders in what was then the closely regulated era of the airline industry, where the government chose winners and losers. With origins in the Mississippi delta and then later in Atlanta long before that city achieved much significance in the American economy, Delta was left out of many opportunities that other airlines had to grow. Deregulation of the U.S. airline industry in 1978 greatly benefitted Delta, and it has grown from the sixth largest airline in 1978 to the largest by revenue now. Delta grew through mergers and acquisitions but was still heavily an airline that obtained much of its revenue from its core interior U.S. hubs of Atlanta, Detroit, Minneapolis/St. Paul and Salt Lake City.

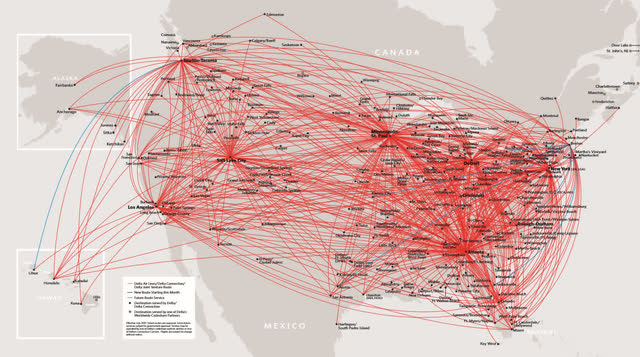

Delta domestic route map (Delta.com)

One of Delta’s most significant strategies during the covid era was to redeploy assets during the recovery into the largest major coastal markets of New York City, Boston, Los Angeles and Seattle. While Delta had a significant presence in New York City and Los Angeles through previous mergers and acquisitions, Delta trailed competitors. Now, Delta is the largest airline by domestic revenue and total number of flights in Boston, New York City and Los Angeles. Many of those major coastal markets are some of the largest destination markets from scores of cities across the United States, allowing Delta to further strengthen its position throughout the country, where it is the #1 or #2 airline in two-thirds of the top U.S. cities.

The significance of domestic strength is related to Delta’s ability to leverage its relationship with American Express (AXP) in the richest airline loyalty and credit card relationship in the global airline industry. Delta expects to continue to grow its relationship with Amex, which it says entails almost 1% of U.S. GDP passing through its co-brand AXP/DAL credit cards.

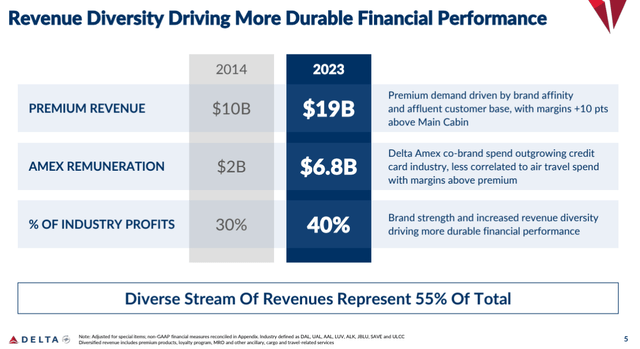

DAL revenue diversity (ir.delta.com JPM Conference March 2024)

Delta also expects to grow its airline maintenance services for other airlines by billions of dollars each year, largely through exclusive contracts it has with aircraft engine makers Pratt and Whitney (RTX), General Electric (GE), and Rolls-Royce (OTCPK:RYCEY). While the entire airline industry has suffered from airframe delivery delays and engine reliability issues on new generation engines that are running hotter and harder than ever, DAL expects to add billions of dollars of high-margin engine maintenance revenue to its income statement as manufacturers release sufficient number of parts for the repair of faulty engines and new aircraft growth to generate more flight hours.

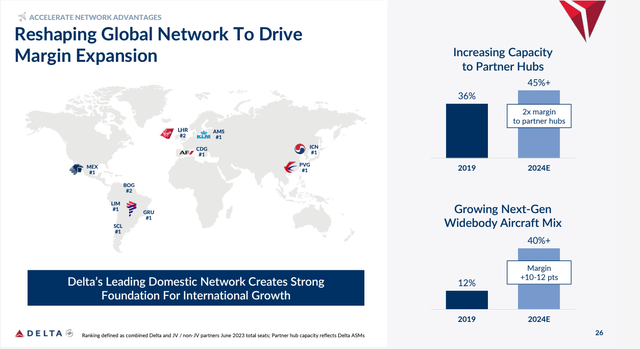

Delta also is doubling down on its international network, both through service on its own aircraft and through its partnerships with its joint venture partners; Delta owns equity in a number of those partners. Delta execs say they expect to grow their international revenue from 30% of total revenue to 50% in the remainder of the decade.

The U.S. DOT just released fourth quarter 2023 profitability by global region data for U.S. airlines, and Delta leads its competitors in profitability on international networks. Delta’s international network was profitable in all global regions in the fourth quarter, the only U.S. airline that achieved that mark. American’s transatlantic and transpacific networks lost money in 2023 offsetting its profits in Latin America, meaning that AAL’s international system operates on a breakeven basis. United, which fashions itself as the U.S.’s largest international carrier, lost money on its transpacific system in the fourth quarter and was slightly above breakeven on its transatlantic system. For all three global regions, Delta’s international system was 50% more profitable than United’s even though United flew 30% more capacity.

Delta is poised to grow its international network as it takes delivery of more than a dozen Airbus A350 and A330NEO aircraft in 2024, extending its commitment to acquiring its widebody aircraft exclusively from Airbus. Its newest A350-900s are equipped to be the longest-range aircraft in the U.S. carrier fleet and promise to offer fuel efficiency more than 20% better than the Boeing 777s which Delta retired during the pandemic. The A350-900 is also larger than the B787-9 which AAL and UAL use as their longest range new-generation aircraft. Earlier this year, Delta added to its order book with 20 firm order and 20 option A350-1000 aircraft for even more size, range and fuel efficiency; those aircraft will begin service for DAL in 2026.

Delta has deepened its relationships with its global partners. Its joint venture with Air France/KLM (OTCPK:AFLYY) and Virgin Atlantic is the largest across the Atlantic, and will add Scandinavian Airways to the partnership later this year. In Latin America, Delta partners Aeromexico and Latam both reorganized during covid under chapter 11 of U.S. bankruptcy laws. Delta is confident that the U.S. DOT’s preliminary decision to revoke its joint venture with Aeromexico due to the Mexican government’s handling of slots at Mexico City airport will be scaled back as the U.S. and Mexico attempt to find a solution regarding the overcrowded airport. Delta’s partnership with Latam, the multi-country airline in S. America, is undoubtedly at the root of Delta’s massively improved profit in Latin America in 2023 which yielded the best profits per unit of capacity among U.S. airlines in Latin America. Delta says its partnership with Latam is still young and has significant ability to generate more profits, making it certain that Delta’s position in Latin America will continue to improve. In Asia, Delta awaits a decision by the U.S. DOJ on the merger of Korean Air and Asiana, the former of which is a Delta equity and joint venture partner. Delta’s growth to S. Korea has been curtailed pending a decision from the DOJ, the last major government to give approval for the merger.

Delta international network and partners (ir.delta.com)

Industry Cost Leadership

Delta has taken the unusual role of becoming the industry cost leader post pandemic. The idea of being a cost leader in most industries means that a company sets the lowest cost but the opposite has been true of Delta. In the wake of massive retirements in the industry and the shortage of skilled aviation professionals such as mechanics and pilots, Delta has taken the position of being the first to raise employee salaries and also to lift them more frequently. While Delta employees have long been some of the best compensated in the airline industry, Delta has widened the gap in recent years.

Delta’s motivation to put upward pressure on labor costs lies with its need to be assured of a steady supply of employees as it continues to grow; airlines have long demonstrated that growth is necessary in order to ensure profitability. Right now, historically very profitable airlines such as Southwest (LUV) struggle to return to profitability because of their inability to grow because of Boeing’s aircraft delivery delays. Because Delta is predominantly sourcing its aircraft from Airbus right now, it has been less impacted by aircraft production delays and has thus been able to sustain industry leading levels of growth, even though DAL expects the rate of capacity growth it saw in 2023 to ease this year and beyond. Delta does have MAX aircraft on order for delivery beginning next year by contract but says it has sufficient alternatives with both Airbus and Boeing as well as through extending the life of its current fleet to ensure it has the capacity it needs to grow despite expected Boeing delivery delays. Delta is returning some of the aircraft it planned to ground during the pandemic to service.

Delta’s desire to continue to push labor costs up is undoubtedly competitive. Delta can afford higher labor costs while many of its competitors cannot. Given the scarcity of skilled aviation labor, the market would force labor costs up anyway, but Delta led the industry in settling first with its pilots at industry-high rates, then extended pay raises to most of its remaining employees (which are non-union) with multiple pay raises including another set to take effect this summer. In addition, Delta pays the highest profit sharing in the airline industry and is set to retake its position as having the highest corporate profit sharing of all U.S. corporations. Some low cost carriers are posting losses, while even American and Southwest posted net profit margins below 2% in 2023. Southwest settled with its flight attendants earlier this year while American and United have not yet lifted the pay of its flight attendants post-covid, meaning that their costs are likely to further erode their profits which already trail Delta.

Industry leading pay and profit sharing is part of Delta’s strategy of ensuring its employees deliver good service to its customers, and the latest DOT and non-governmental surveys indicate that is happening. J.D. Power just handed Delta awards in its 2024 North American Airline Satisfaction Study, while the Wall Street Journal rated Delta as the U.S.’s top airline. Fortune has recently named Delta as one of the best employers, while airline data analytics company Cirium has once again awarded Delta for its operational excellence, mirroring data from the U.S. Dept. of Transportation. Delta people are aligned with their company’s goals, which helps the company to become an even stronger choice among high-revenue business travelers which are the bread and butter for large airlines; Delta carries more corporate and business revenue than any other U.S. airline; that revenue is expected to continue to grow as business travel recovery continues.

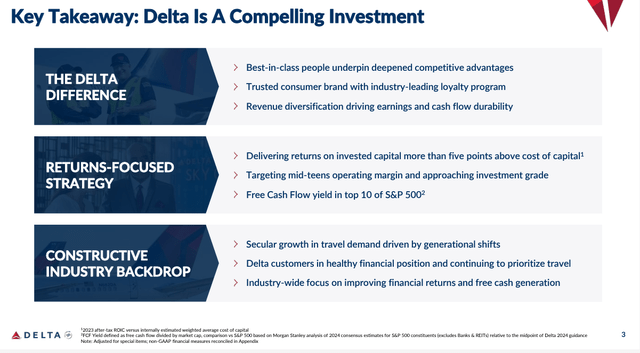

DAL compelling investment (ir.delta.com)

Financial Metrics that Rival other Industries

Delta execs have repeatedly stated that the company no longer measures itself against the financial performance of other airlines but rather against all American corporations. It is that focus that has allowed the company to achieve return on invested capital metrics that align with the top half of the S&P 500; given that airlines have historically not covered their cost of capital, Delta has transformed itself to be a competitive investment.

DAL chart YTD 15May2024 (Seeking Alpha)

Delta expects its free cash flow to grow to $4 billion per year, even with $5 billion per year of new aircraft spending and reduced debt. Delta pays a dividend and intends to regain its investment grade credit rating with all three credit agencies. Although it says its priority is debt reduction, it does not rule out stock buybacks or increased dividends. If Delta achieves its financial goals, shareholders will likely see improved benefits in 2025 and beyond.

Delta Air Lines is widening its advantages relative to the industry, and investors are finally receiving the payday for which they have waited. The consistency with which Delta is reaching its publicly stated financial goals means that investors should continue to benefit from the appreciation of DAL stock.