jet city images

Well-known brands and well-known companies are not necessarily good investments. Iconic companies like Apple (AAPL) sometimes make good investments. General Electric (G.E.) and General Motors (GM), consistently underperforming the broader market index.

PepsiCo (Nasdaq:pep) is one of the most well-known brands and companies around the world.Major food and beverage provider Sell With products in more than 200 countries and territories, we boast iconic brands such as Pepsi, Frito-Lay, Quaker and Gatorade.

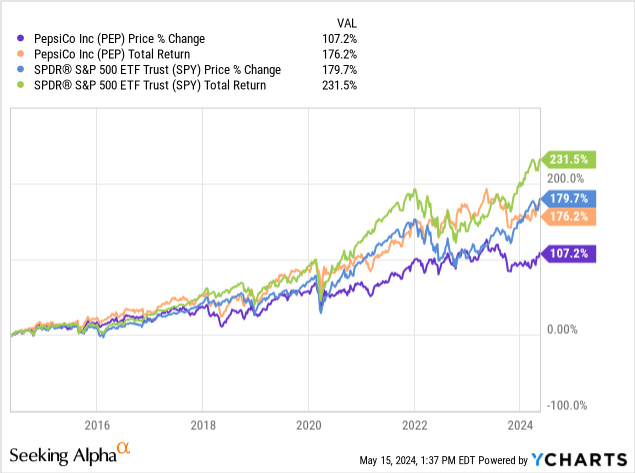

Still, while PepsiCo’s performance hasn’t been bad over the past decade, it has consistently underperformed the S&P 500 index by a wide margin since 2014. The leading beverage provider gained 110.13% during this period, as measured by total return. The S&P 500 rose 180.29% when measured by total return over the past 10 years.

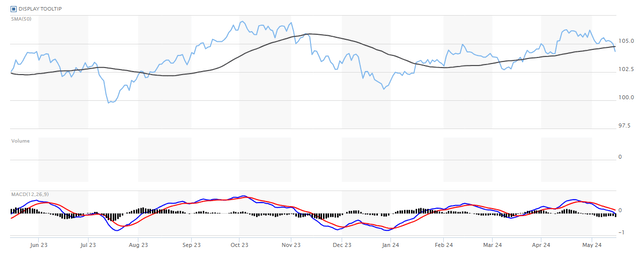

i am the last I have written I rate the company a Hold primarily because of the strength of its core food and beverage brands, slower inflation, and the potential for a weaker dollar against most major currencies. I’m downgrading the stock to sell today. PepsiCo’s recent earnings report indicates that management’s pricing power will likely be limited going forward, and the company’s volume growth has been negative. Large beverage and food providers are likely to continue to face significant currency headwinds as inflation also remains above the Fed’s target, and Chairman Powell remains reluctant to cut interest rates or reverse the current interest rate cycle for several reasons. They are likely to be cautious.

PepsiCo’s recent first quarter earnings report and commentary clearly showed that the consumer struggle is starting to accelerate. As reported by the company, income Normalized per share was $1.61 and revenue was $18.25 billion, beating normalized EPS estimates by $0.09 and revenue estimates by $145.79 million. Management reported stagnant sales growth for the beverage and food provider’s core brands, even though the company has recently implemented only modest price increases. . The company states the following for its beverage division: fell 5%, and Frito-Lay North America also reported a 2% volume decline. These volume declines were significant because the company only raised beverage prices by 6% and Frito-Lay prices by 3%. Quaker Oats’ recalls related to food safety issues also had an impact on sales, as expected. under In this segment it is around 22%.management team too repeated Even in the current difficult economic environment, there are increasing signs that consumers are being forced to retreat.

PepsiCo’s sales volumes declined in previous quarters, but that came after the company implemented significant price increases that more than offset some of the lower purchasing levels.company raised From July to September last year, prices fell by 11%, but sales volume fell by only 2.5%. The beverage and food provider’s recent, more significant volume decline occurred despite very modest price increases. PepsiCo’s recent report shows that its competitor Coca-Cola (K.O.) recently report Strong earnings, including 1% organic sales growth in the company’s core businesses. Koch Company reported flat sales volume growth in North America, but worldwide sales volume increased 1%. Although Coke has significantly increased prices since costs started rising in early 2021, the company hasn’t seen the same negative volume trends as PepsiCo. Koch also raised its full-year outlook and said it expected to raise prices again in some markets where inflation remains a major issue, adding that the company now has pricing power that PepsiCo does not have. It was suggested that

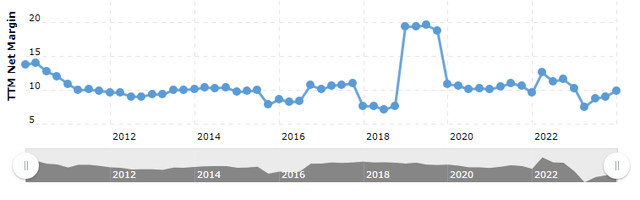

The company is likely reaching breaking point with rising prices.Wages have not risen as much as prices have in the past three years, and consumer delinquency rates have also increased. woke up Up to nearly 9%.Recent New York Fed Survey Indicated One in five Americans says they feel maxed out by rising credit card debt and interest rates. Although PepsiCo’s profit margins have steadily recovered since hitting their lowest level in nearly a decade in March 2023, the company has It depends on possible price increases.

chart of PepsiCo’s profit margin (macro trend)

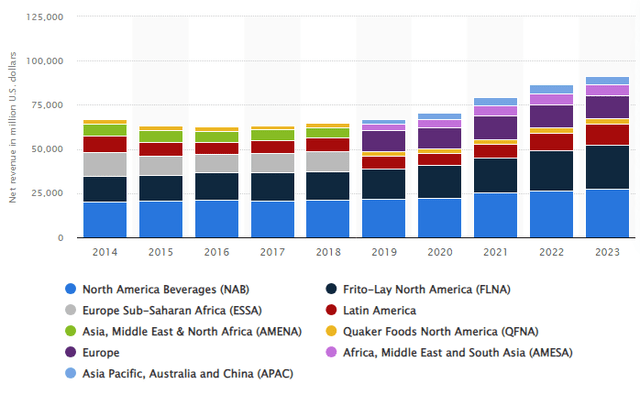

The company also continues to face significant currency headwinds, including the dollar’s appreciation against the euro and most major currencies over the past year. Food and beverage providers are almost 40% of our net revenue comes from outside the United States. Just in the first quarter.The company increased net revenue by 2.3%, but there were currency headwinds. influenced Revenue is minus 0.5%. Management is projecting a negative currency impact of 1% going forward, but this may be an overly optimistic estimate for several reasons. Coke also reiterated in its report its significant concerns that currency headwinds will continue into 2024. Recent Also income and expenditure report.

PepsiCo international revenue graph (Statista)

The Fed also recently It made clear that interest rates will likely have to remain high for an extended period of time, despite some economic indicators showing inflation slowing slightly to 0.3% in May. Other recent data still points to rising inflation, including the producer index, which rose an alarming 0.5%. Energy prices tend to rise as summer approaches, with more travel to the United States.

Since the price level, the inflation rate remains high, and the inflation rate is also above Chairman Powell’s target of 2%. The Fed’s statement came despite the European Central Bank taking a more dovish stance, analysts said. Expect it Banks plan to cut interest rates in June.China is cut Core interest rates have also become an important level recently as the country’s real estate market struggles. The ECB continues to show further willingness to aggressively cut interest rates.

The dollar has appreciated steadily against most major currencies since the beginning of the year, and the US economy remains the strongest in the world. The dollar is likely to continue to perform well this year as the Federal Reserve maintains a more hawkish stance than many central banks around the world.

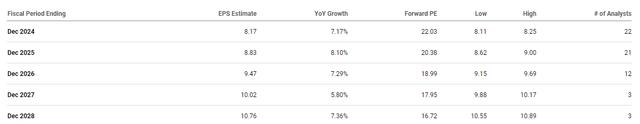

This is why PepsiCo currently appears overvalued using several metrics. Even if the current company transaction At 23.14x forward GAAP estimates, the food and beverage provider’s five-year average valuation level is 24.43x expected forward GAAP, with analysts expecting the company to earn just 4% to 6% annually over the next four years. We predict that it will continue to grow.

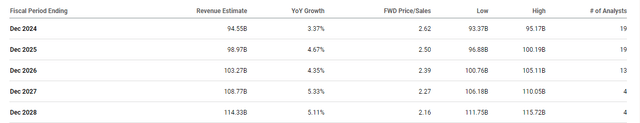

Grid of analyst forecasts for Pepsi’s revenue growth (In search of alpha)

The sector’s median valuation is also 19 times expected future GAAP earnings, with peers such as Coke with much stronger fundamentals trading at similar valuations to PepsiCo. Coca-Cola trades at 22.37 times forward GAAP earnings. PepsiCo is also forecast to grow its earnings per share at just 7-8% annually, but these estimates are expected to grow as consumers are increasingly struggling in the current difficult economic environment. seems too optimistic.

Analyst forecasts for PepsiCo’s EPS (In search of alpha)

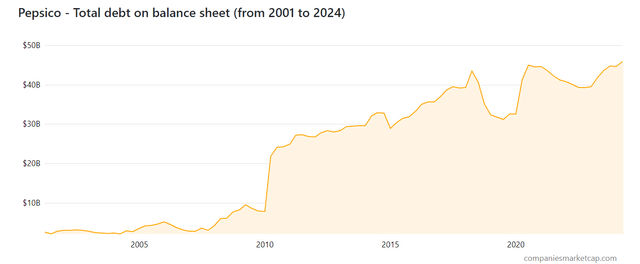

PepsiCo’s debt levels have also increased significantly over the past decade. The company currently has nearly $45 billion in debt, so it’s unlikely that management will make any large additional share buybacks. The company announced a $10 billion share buyback in early 2022.

Pepsico debt graph (Company market capitalization)

The drinks and food company’s debt levels are currently near the highest in 20 years, with rising interest rates clearly increasing borrowing costs. Although competitors such as Coca-Cola have similar debt levels, Coke’s core business is significantly stronger than PepsiCo’s, and Coke’s cash flow over the past decade has generally been 10% to 15% higher than that of major food and beverage providers. Coca-Cola has nearly $42.5 billion in long-term debt.

All investment theories have risks, and if prices fall, the Fed becomes more dovish, real wages rise significantly next year, or there is a stronger economic recovery, PepsiCo clearly stands to benefit in a number of ways. You will receive it. The ECB could also wait for the Fed to pause the current interest rate cycle before cutting rates, in which case the euro would likely perform well against the dollar and other major currencies as well. Still, such a scenario remains unlikely.

Value is hard to find, and iconic companies don’t always make good investments. Currently, there are growing signs that consumers are pulling out of PepsiCo, and currency headwinds remain strong. The company is also facing a major product recall. While this well-known food and beverage provider has been able to rely on price increases over the past few years, management may face even greater challenges going forward.