hapa bapa

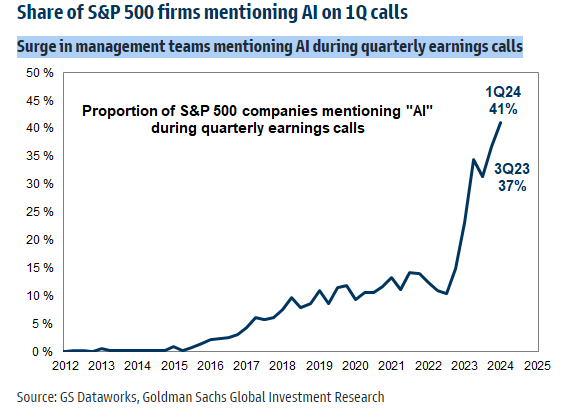

With the first quarter reporting season nearly over on Wall Street, the buzz around artificial intelligence (AI) is louder than ever. Goldman Sachs reports that 41% of S&P 500 companies mentioned AI on their quarterly conference calls.But some technologies have lost their luster Companies that claim to be focused on what AI can do.

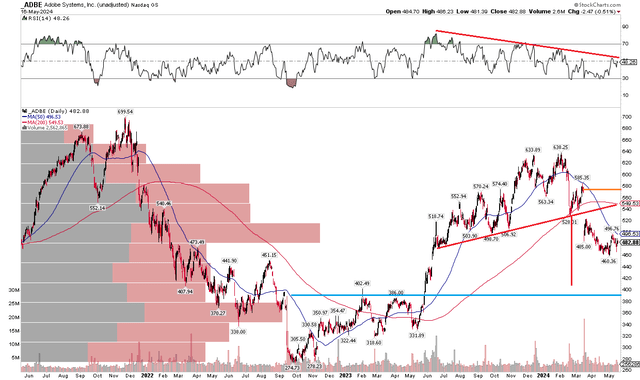

I repeat Adobe Pending Rating (Nasdaq:adobe). After plummeting earlier this year, the stock price has remained roughly flat since my last review of the company in June 2023. I think the company’s valuation today is good, but the momentum situation is shaky. Detailing the key levels on the chart to monitor in the company’s second quarter. The report is expected to be submitted within a month.

AI mentions

According to Bank of America Global Research, Adobe is leading the way in electronic document technology and Graphic content authoring application for creative professionals, designers, knowledge workers, high-end consumers, developers, and enterprises. Adobe’s flagship products include Creative Suite, Photoshop, Acrobat, Premiere, Dreamweaver, Illustrator, InDesign, and LiveCycle. The company’s PDF and Flash technology has become an industry standard and serves as a platform for other Adobe products.

Back in March, Adobe report First quarter results were disappointing.Although it is a quarterly publication Non-GAAP EPS $4.48 Revenue was slightly higher at $5.18 billion, an 11% year-over-year increase, beating Wall Street consensus estimates by 10 cents, but delays in AI implementation are likely to be impacting overall performance. It was done.

Its weaknesses are also included, Outlook for the second quarter is weak From Adobe management. Despite announcing a healthy $25 billion share buyback program, traders slammed the stock, which fell 13.7% in the trading hours following the announcement. Looking ahead, data from Options Research & Technology Services (ORATS) shows the implied move after the June 13 second-quarter earnings event is 6.6%. It will be important to watch what management says about monetization of the Firefly AI platform and expected annual recurring revenue.

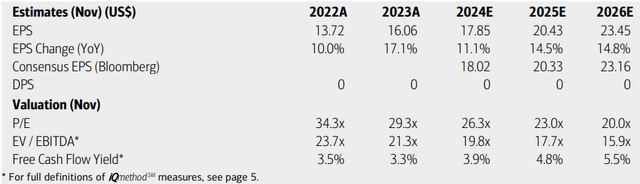

upon evaluationBofA analysts see: Increase in profits On a strong pace over the next 12 months. Operating earnings per share are expected to continue increasing through 2026, reaching over $20 during this year. Seeking Alpha’s consensus numbers show a comparable EPS trend, with numerous gains expected to date. Earnings upgrade Results from the past 90 days have been released ahead of Adobe’s Q2 report in less than a month.

A fast-growing company despite its size, it doesn’t pay a dividend, but its free cash flow is very healthy, and the company’s forward EV/EBITDA ratio is back below 20x, well below its five-year average. .

Adobe: Revenue, Valuation, Free Cash Flow Forecast

Assuming non-GAAP EPS of $19 for the coming year, and applying the stock’s five-year average operating P/E multiple of 36, the stock should trade around $684. However, if we take a PEG ratio approach and assume a PEG multiple of 1.9x and long-term earnings growth of 13%, below the high long-term average, the P/E ratio should be closer to 25x. Appraised value is $475. At a historical standard of 2.3 PEG, the intrinsic value would be closer to $570.

This is a wide range, but the EV/EBITDA ratio is heavily discounted, so even a modest reversion to the long-term average would provide some upside from here. In my view, a fair value in the low to mid $500s seems appropriate.

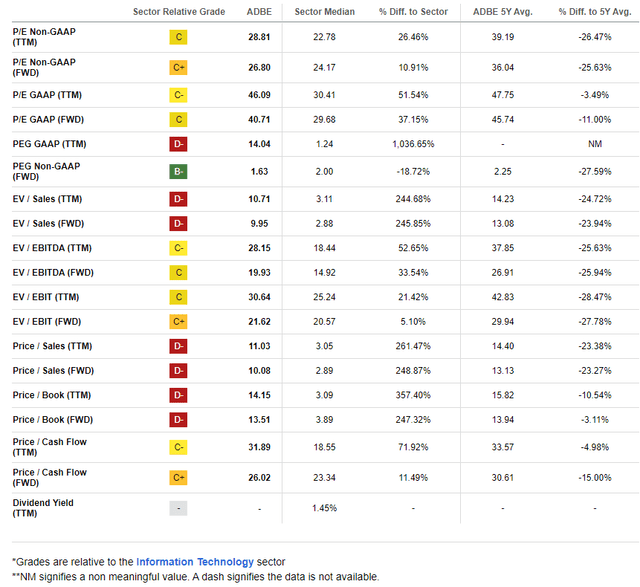

ADBE: Trading significantly below the long-term average P/E

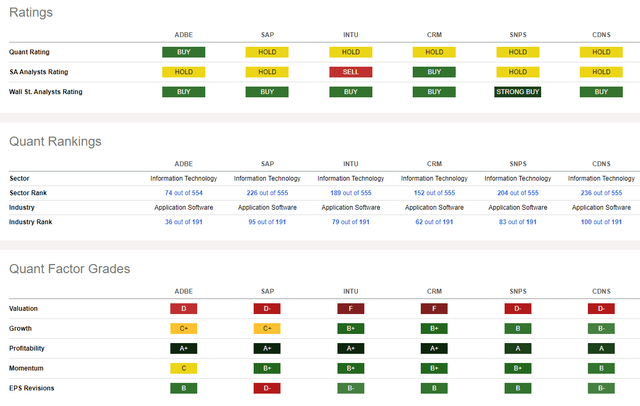

Compared to other companies in the industry, Adobe is characterized by a low valuation, but many of its competitors in the application software industry trade at high valuations. And while the historical growth trajectory is unimpressive, future earnings prospects are optimistic.

adobe sports Excellent profitability indicatorsIn my view, while you get a valuation premium; Stock price momentum That’s down from earlier this year, when the stock hit $638.

Competitor analysis

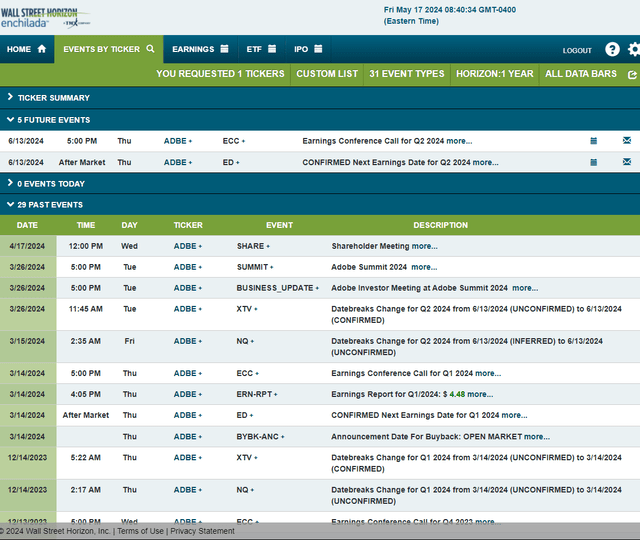

Looking ahead, corporate event data provided by Wall Street Horizon shows that the second quarter 2024 earnings date is set for AMC on Thursday, June 13th, with a conference call to be held later that evening. It is shown.you can Listen live here. I don’t see any other volatility catalysts on the calendar.

Corporate event risk calendar

technical view

Red flags are flashing on the tech stock’s technical chart, as Adobe’s earnings profile has seen significant upside and it has a reasonable valuation ahead of next month’s second-quarter results. In the graph below, notice the bearish double-top pattern in which the stock rose above $630 in February. Shares then plummeted following disappointing earnings reports, dropping further in March and ultimately hitting $460, down nearly 30% from its peak at the beginning of the year. This decline violated the uptrend support line, which has the characteristics of a bearish head-and-shoulders top pattern. Assuming this pattern develops, a downside reading target near $400 will be in play based on the height of the head and shoulders pattern.

Also, keep an eye on the major support near $400. This was the peak from late 2022 to early last year. Additionally, the RSI momentum oscillator at the top of the chart indicates long-term periods of weakening momentum. Before getting excited about ADBE stock, I would like to see the RSI gauge break the downtrend.

Overall, ADBE is an absolute buy around $400, but technically we believe there is some risk in the way it is trading today.

ADBE: RSI is bearish, inverted head-and-shoulders pattern underway

conclusion

I would like to reiterate that I reserve my rating for ADBE. Compared to my analysis last June, I view the current stock price as a better value, but the technical situation is risky ahead of next month’s earnings.