aapsky

FTAI Aviation Ltd. (NASDAQ:FTAI) stock has gained more than 173% over the past 12 months. In fact, FTAI Aviation’s stock price also exceeded my multi-year target. With that in mind, I will be discussing the most recent results and evaluating my price target for the stock again to detect whether there’s further upside or whether the stock price has caught too fast.

FTAI Aviation Sees Robust Growth In Q1 2024

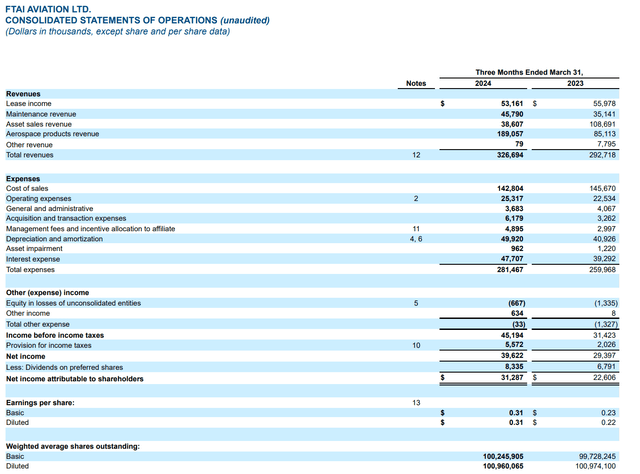

Revenues grew 11.6% to $326.6 million driven by higher aerospace products revenues but offset by lower asset sales revenues while lease decreased income from $56 million to $53.2 million and maintenance revenues increased to $45.8 million, marking an increase of more than $10 million. Expenses grew $21.5 million to $281.5 million and that was primarily driven by a $9 million increase in depreciation and amortization as the asset base is growing and an $8.4 million increase in interest expenses as the company is operating at a higher debt level. Operating income grew from $31.4 million to $45.2 million, indicating operating margins of 13.8% up from 10.7% a year ago.

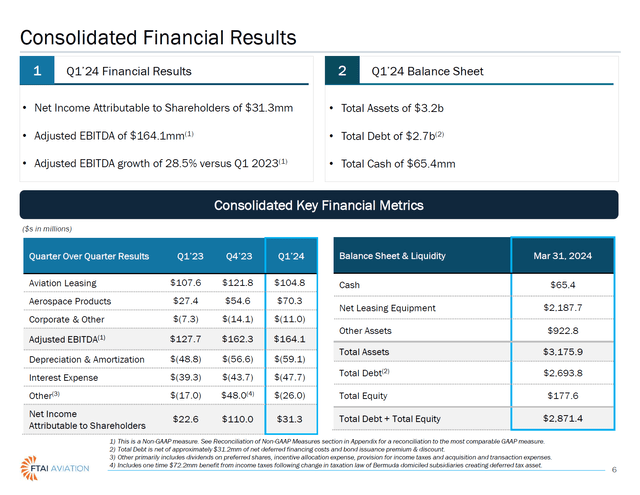

Overall, we see solid demand underpinned by high demand for engines and engine spare parts. The adjusted EBITDA numbers show strong year-on-year growth of 28.5% as well as sequential growth. So, the company is benefiting from a better scale as well as higher demand for engines and spare parts and I believe that the strong income levels seen now will also bolster the growth ahead which should lead to even better economies of scale.

FTAI Aviation Expects A Strong Year

With all demand drivers in play, FTAI Aviation is expecting Leasing EBITDA of $425 million and Aerospace Products EBITDA of $250. That brings the guidance for EBITDA excluding gains on sale to $675 million and the company has guided for $725 million in EBITDA excluding Corporate eliminations indicating a $50 million contribution from gains on sale. The run rate of EBITDA currently is $700 million, so the guidance of $725 million provides management confidence in continued EBITDA growth for the remainder of the year with a >15% growth rate targeted.

We see continued strength in Aerospace product demands that directly result in significant earnings growth for the segment while FTAI recently launched its V2500 engine program. The grounding of GTF-powered Airbus A320neo airplanes drives demand for V2500 solutions as airlines try to minimize downtime on their existing A320ceo family fleet. So, there could have been no better time for FTAI to expand its engine program with the addition of the V2500. The Leasing run rate is lower than what we saw in 2023, but that’s driven by timing variability on asset sales.

Is FTAI Aviation Stock A Buy?

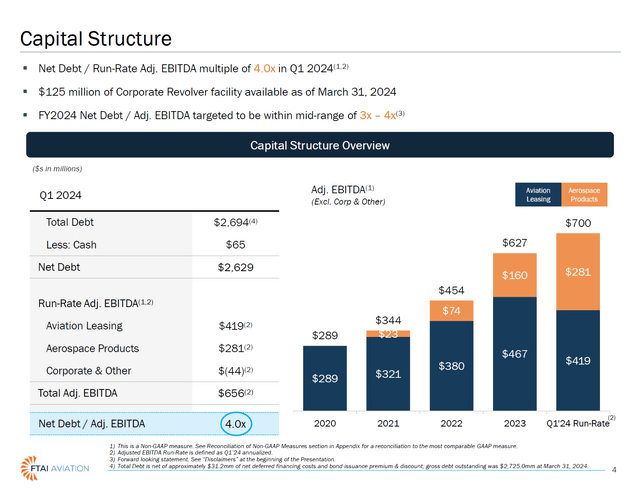

I normally value stocks with a strong portfolio of long-lived assets according to a price-to-book value. For FTAI Aviation, the book value per share would be $1.76. With a stock price of $78.09, we see that the company is trading significantly ahead of its book value. I do not derive from that the company is overvalued for the simple reason that it currently has quite a high leverage of 4x and that’s driven by the fact that the company is still in a rater cash-intensive growth mode For companies that are in a higher debt-driven growth mode, the price-to-book valuation might not be appropriate to use.

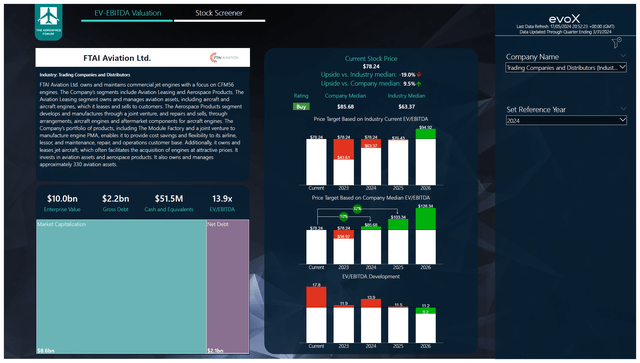

Based on an EV/EBITDA valuation which implements expected cash flows and the balance sheet data for FTAI AviationI continue to mark the stock a buy with an $85.68 price target for the year. That price target is up significantly driven by more depth to our modeling of stock price targets as well as a significant increase in expected EBITDA. EBITDA performance and expectations from 2023 through 2025 have increased more than 10% while FTAI Aviation will be purchasing half of its Senior Notes due 2025.

Conclusion: FTAI Aviation Remains Attractive

I believe that FTAI Aviation stock remains attractive. We’re seeing the company posting strong results, and while the company’s growth would likely already result in strong earnings, we’re seeing exceptional end-market strength driven by engine and airplane shortages that provide a significant boost to the business as well. As engine and airplane shortages are expected to plague the markets for some years to come, I believe that FTAI Aviation’s products and services will continue to enjoy strong demand and support its growth and stock price.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forumthe #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.