Kagkansein/iStock, Getty Images

roche holding (OTCQX:RHHBY) this week announced positive top-line results from a Phase 1B clinical trial for its obesity drug candidate CT-388, sending the company’s stock up 4% on the day of the announcement.result Although the placebo-adjusted weight loss of 18.8% at week 24 appears strong, much valuable information remains, particularly in the areas of safety and tolerability, and complete data are needed. We have to wait for the announcement. Medical conferences to get a better picture.

Still, this was a good start for Roche. $2.7 billion acquisition With Karmo bringing this asset into the pipeline in December 2023, I see Roche as well positioned to deliver shareholder value in the years to come.I also know that obesity and The cardiometabolic pipeline is not priced in at current levels.

Review of CT-388 Phase 1b Results

This is the information I got from Roche Thursday press release:

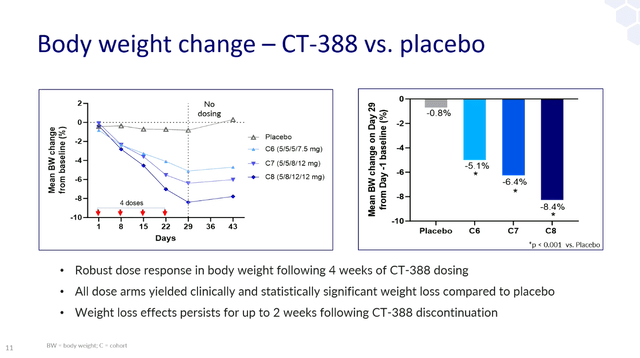

- Once weekly subcutaneous injections of CT-388 reduced body weight by 18.8% over 24 weeks in obese patients.

- At week 24, 100% of participants treated with CT-388 achieved >5% weight loss, 70% achieved >15% weight loss, and 45% of patients achieved >20% weight loss Achieved weight loss.

- In a subgroup of prediabetic patients at baseline, CT-388 treatment normalized blood glucose in all patients.

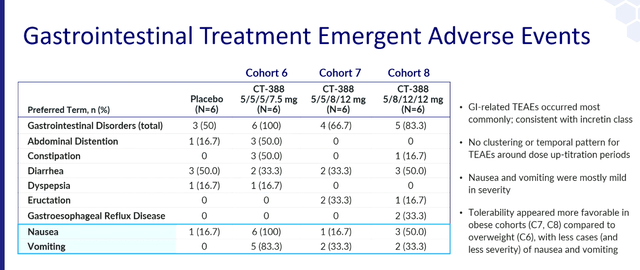

- No new or unexpected safety signals were detected, and CT-388 demonstrated safety and tolerability growth “consistent with its drug class.”

There is no doubt that this is a positive result in terms of placebo-adjusted weight loss. However, even comparisons between trials are not easy due to insufficient details provided by Roche. Baseline characteristics, absolute weight loss produced by CT-388 and placebo, and descriptive safety data raise more questions than answers. The term “consistent with its drug class” has many meanings and we need to see the actual incidence of side effects that are important for this drug class such as nausea, vomiting, and discontinuation rates to provide further insight. there is. Tolerability of CT-388.

It seems to have a strong weight loss effect on its own. I gave an overview of the obesity market in my article. recent articles upon Viking Therapeutics (VKTX). Viking provided us with more data at his 13-week point so we can better understand its competitive profile in terms of efficacy, safety, and tolerability. Viking has provided much of the information needed to make informed comparisons between trials, with all the usual caveats.

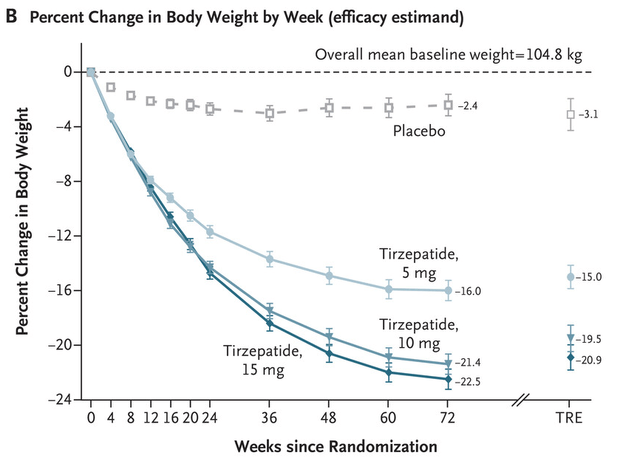

Returning to CT-388, its 18.8% placebo-adjusted weight loss compares very well to CT-388. Eli Lilly’s (Lily) Tirzepatide at the same time point. At high doses of tirzepatide, almost 16% absolute weight loss was achieved at week 24, but after placebo adjustment it was only about 13%. Tirzepatide took 48 weeks to reach the CT-388 range for placebo-adjusted weight loss. Its efficacy appears to be within the approximate range of the best weight loss drug candidates.

And from Karmotz 4 week data release Last year, we know that the four-week efficacy of Viking’s VK2735 was in the approximate range. In the 4-week study, the highest dose of CT-388 gave him an absolute weight loss of 8.4%, while the highest dose of VK2735 gave him 7.8%.

Carmo’s four-week safety and tolerability data reported last year showed adverse events consistent with a class effect, but the number of patients was too small to draw conclusions.

Overall, I’m cautiously optimistic that Roche has a good weight loss drug on its hands, and unless the safety and tolerability data reveal any significant problems, the company will We believe it has the potential to become a new strong competitor in the market.

This is just the beginning of Roche’s cardiometabolic pipeline

Roche and all other big pharma companies have a lot of work to do to catch up. novo nordisk (NVO) and Eli Lilly Both have a significant head start and are working hard to improve their competitiveness in the obesity market.

So this is just a promising start for Roche, and there is a lot of work to do to catch up. The Calmot acquisition also brings the oral GLP-1 agonist CT-996, which does not yet have confirmed clinical data, and a preclinical pipeline.

Another way for Roche to participate in the obesity market is to develop or acquire complementary pipeline assets for incretins that can be used as monotherapy or in combination with incretins.

One such candidate is GYM329, a recycling and antigen-sweeping monoclonal anti-latent myostatin antibody. GYM329 is in Phase 2 development for the treatment of Facioscapulohumeral Muscular Dystrophy (“FSHD”) and Phase 2/3 Development for the treatment of Spinal Muscular Atrophy (“SMA”) But Roche is also conducting a Phase 1 trial in obese patients to confirm its weight. Loss and impact on body composition. I wrote about this approach in a previous article. February articles upon regeneron (Regnu) We are also developing myostatin antibodies in combination with incretins as potential monotherapy in obese patients and to improve fat mass loss and prevent lean body mass loss.

Beyond obesity, Roche’s expanding cardiometabolic pipeline is also likely being underestimated.Dilevesiran, an antihypertensive drug candidate in-licensed by Roche from the United States alnylam (alney) In a market where there has been little innovation in recent years, the last year holds great potential for the next decade (see my article) article Alnylam article covering this transaction), and through continued business development activity over the next few years, this side of the pipeline will expand significantly, making it one of Roche’s fastest growing business segments over the next decade. It is highly likely that this will happen.

No obesity pipeline success in analyst model

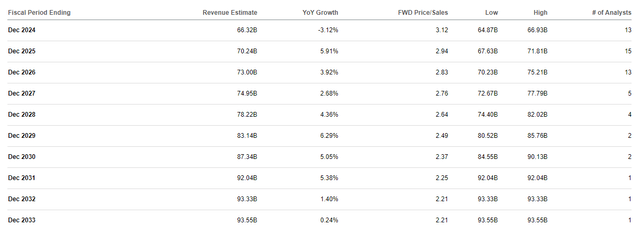

Looking at the long-term consensus earnings forecast, there is no spike in future earnings expectations if Roche is successful in developing obesity, type 2 diabetes treatments, and the adjacent markets being created by Novo. You can see. Nordisk and Eli Lilly are also working to reduce obstructive sleep apnea, knee osteoarthritis, cardiovascular risk, and even prevent Alzheimer’s disease, one of Nordisk’s new initiatives. I’m here.

This suggests that Roche’s obese and adjacent pipeline initiatives represent upside optionality rather than significant downside risk at current levels.

Roche has a healthy product portfolio and a strong pipeline, which we plan to further strengthen through M&A.

Roche’s existing drug and diagnostic product portfolio and pipeline (excluding obesity) looks strong and I believe the company is well positioned for good value creation in the coming years.

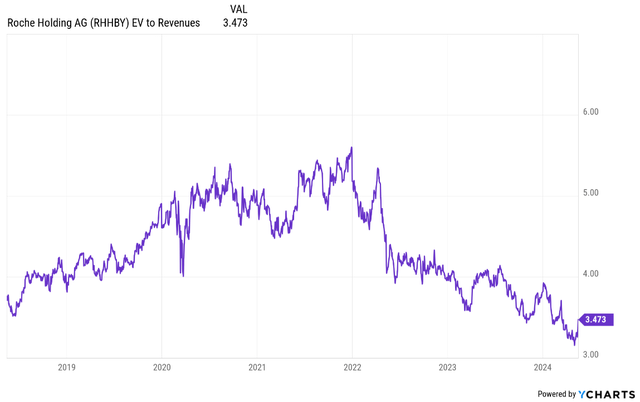

The stock is trading at a low earnings-to-earnings multiple, and with the COVID-19 windfall finally in the rearview mirror, an EV/earnings multiple of 4. ~5x range, and possibly even more. That scope will expand as the company begins to be evaluated for growth potential across its obesity pipeline and cardiometabolic pipeline beyond obesity. Given the five-year time horizon and Roche’s current growth expectations, this equates to a share price increase of at least 9-10% per year (over 60%), with the potential to reach 15% or more if growth expectations increase. there is. Under the assumption of a meaningful contribution from the cardiometabolic pipeline.

Additionally, Roche has a strong balance sheet and cash flow with M&A capacity, and through the introduction of product candidates such as dilevesiran and acquisitions of companies such as Calmot, we will continue to grow our pipeline and product offerings in the coming years. I expect that the portfolio will be further complemented.

conclusion

While many questions remain about CT-388 pending the release of full data, this week’s top-line data press release announced Roche’s intention to officially enter the ultra-competitive obesity market. Thing.

CT-388 and dilevesiran are also cornerstone product candidates in an emerging cardiometabolic pipeline that I believe will be a source of significant growth for Roche over the next decade or more. With the COVID-19 windfall in the rearview mirror, investors can now expect a return to top- and bottom-line growth, potentially pushing valuations back into previous ranges. If the company can demonstrate that it is a strong competitor in the industry, it could potentially outperform it. Obesity and adjacent markets.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.