Tom Warner

overview

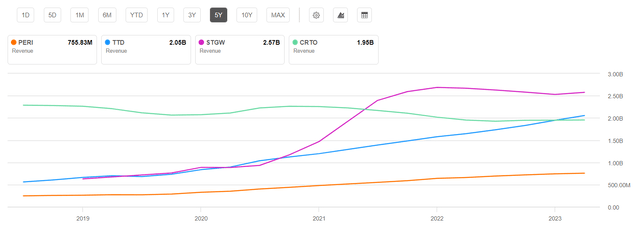

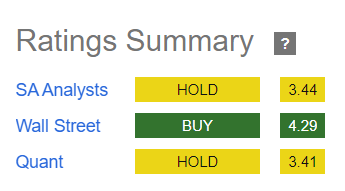

I am studying the adtech industry because I believe it is an attractive market with very good economics (economies of scale and network effects). I am writing an investment thesis called. App Labin (app) and Perion Networks (Peri). Right now I am analyzing The Trade Desk (Nasdaq:TTD). One of the most important conclusions about this industry is that scale matters. At The Trade Desk, we understand that. From my perspective, the business strategy is very sound, but the stock price is reasonable, so I would recommend waiting. As shown in Figure 1, my recommendations are consistent with other Seeking Alpha analysts and SA Quant.

Figure 1: Finding alpha

Digital Advertising: A New World of Opportunities

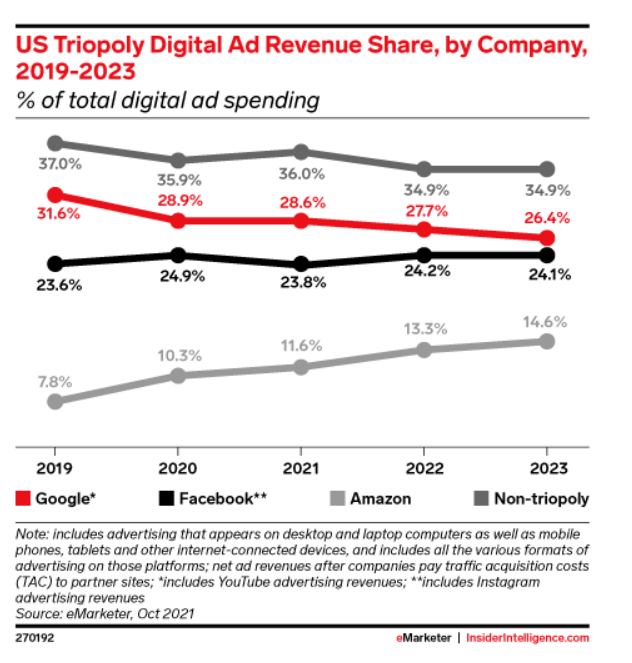

First, let’s explore the vast potential of the open web market, an area of opportunity for The Trade Desk. The market can be divided into: Two parts: the so-called walled garden. Consists of all companies that manage apps/websites, primarily social network operators such as Google (google), meta(meta),Amazon. According to eMarketer, these three major players in the US digital advertising industry account for 64% of the market. The total industry size in 2023 is $200 billion, with a remaining player market of $70 billion. I also include other companies like TikTok, which is worth $16 billion in the US, and Snap, which is worth about $4 billion in the walled garden market. Therefore, I estimate that the potential open web market revenue is worth $40 billion.

Figure 2: E-marketer

Trade Desk focuses on the demand side of the advertising industry, so we compete in all markets, including walled gardens and the open Internet. In other words, it’s trying to control digital ad spend for all brands and agencies. The walled garden is primarily controlled by Google or Meta, so its influence is minimal, but the open internet presents opportunities. The increasing supply of premium content, especially through video streaming, is also creating new possibilities for advertising, such as out-of-home digital advertising.

Business strategy

Let’s dive into The Trade Desk’s business strategy. The company is strategically positioned on the demand side of the business and aims to control advertising budgets for brands and advertising agencies. We connect these clients to all digital advertising media through an AI platform that can evaluate millions of advertising opportunities per second. The company focuses on premium he content on the open internet and has established agreements with premium he suppliers. The company plans to leverage the effectiveness of his UID2.0, which creates a standard for client identification and allows clients to use their own data without relinquishing control.

What is being measured is premium content is 67% more effective than other websites with low-quality content. These publishers charge more, but the results are much better. In the end, The Trade Desk is more profitable. The company works with Disney, NBCU, LG, Vizio, Cox Media, TF1, M6, Roku, and other premium players.

Trade Desk reaches more than 90 million households and 120 million CTV devices, delivering 15 million ad impressions per second. Its size is one of the largest in the industry, and managing it requires the needs of a diverse group of partners, including supply-side platform companies, brands, agencies, publishers, and content owners across various media (display). We need to operate a sophisticated platform that connects , mobile, social, CTV, retail, etc.)

there is Expansion of adoption Percentage of UID2.0 among industry associations. Our competitors also use this user identification system. Management declares Cookie depreciation will reduce publisher revenue by 30% and 50%, and adoption of UID2.0 will increase CPM by 30%. There’s no objective research yet, but it’s a good starting point before Google’s cookie depreciation.

Trade Desk focuses on the US market, generating 88% of its revenue. We see further expansion opportunities in the European, Asian and Latin American markets. I estimate it could reach at least 50% of offshore revenue. This means there is 76% room for improvement in achieving the right combination. The downside is that other markets, such as Europe, have stricter rules, making it difficult to maintain margins.

To me, this is a sound business strategy that is poised to capture leadership in the adtech industry. It is a business with network effects and economies of scale. As long as more publishers work with The Trade Desk, more brands and agencies will work with them and revenue will increase exponentially. As a company grows, its development, sales, and marketing costs per unit decrease. This is the vision I envision for The Trade Desk.

competition

Trade Desk has two competing groups. DSPs from major companies such as Google (google) and Adobe (adobe) and smaller players in the adtech space. Google network Revenue for the last quarter was $7.4 billion, down 1% from the same period last year. adobe digital media Generated $3.8 billion, an increase of 12%. Both companies are larger than The Trade Desk, with quarterly revenue of his $500 million and growth of 28%. Still, the rest of the companies are within two large organizations with different priorities, so the benefits are weighted. Trade Desk is more focused on demand-side platforms, which gives it closer ties and a more level playing field with the players who drive advertising budgets.

Other competitors are smaller ad tech companies, and The Trade Desk’s advantage is scale, which is important in this business. As you can see in Figure 3, we show the revenue from our main competitors. The Trade Desk is the second but larger Stagwell (STGW), has remained flat.

evaluation

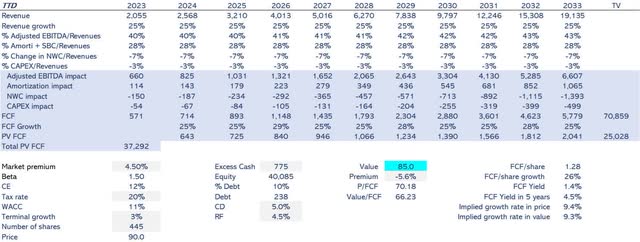

As always, we set revenue to the total revenue of the past four quarters to get the latest quarterly results. That is, the revenue for 2023 will be $ 2.055 billion, an increase of 25% from last year. Growth is expected to be 25% over the next 10 years, and thereafter he expects growth to continue at 3% forever. This 25% constant revenue growth rate is conservative as I expect The Trade Desk to gain more market share in the digital advertising market. The company is a leader in demand-side platforms, and its scale will give it an advantage in capturing more market share each time. This business has become so complex that only a few companies will succeed, and I suspect The Trade Desk will be one of them. In addition to that, there is also the international expansion that I talked about earlier.

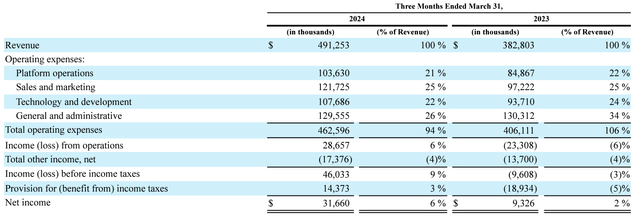

This business has economies of scale for leaders, and as revenues increase, costs decrease proportionately. Adjusted EBITDA for the last four quarters was 40% of his. This margin has widened by 3 percentage points over the past decade to 43%. As an illustration, from our previous 10th quarter report, we can see that general and administrative expenses decreased from 34% to 26% of revenue, and platform costs decreased from 22% to 21% (Figure 4). This shows this evolution.

These outlooks were confirmed in the last earnings report, where revenue accelerated 28% to $491 million, beating expectations of $480.5 million. Earnings rose 13% to 26 cents, compared to analysts’ expectations of 22 cents.

I expect tax savings from non-cash items to be 28% of revenue (averaged over the past four quarters), lower than the past three years. Investment in net working capital will be conservatively 7%, similar to 2024, as it was much higher in the early years. We expect capital expenditures to be 3% of revenue, which is the same as before.

Since the beta is 1.50 and the risk-free is 4.5%, the cash flows are discounted at a WACC of 11%. It has 10% debt to equity and a terminal value of 3%.

As shown in Figure 5, my estimated value is $85 per share, a -5.6% premium to the current stock price.

risk

The main risk I see for The Trade Desk is that the margin expansion we’ve been discussing may not materialize. This means that there are no economies of scale and costs are commensurately higher. This can happen if digital advertising platforms are a commodity for advertising agencies in the market, increasing sales and marketing costs (25% of revenue) to win business from clients . Platform and technology costs (21% of revenue) could increase disproportionately if AI costs do not decrease while platforms become more competitive with expensive features.

We model this risk by reducing the current margin by 2 percent from the worst-case scenario of 2028. In this scenario, the company’s value would fall to $76.8 per share, a 15% discount to the current stock price.

Another risk I’m assuming is new player, companies like Google will disrupt the market and race to dominate it, leaving The Trade Desk behind. The impact on businesses is dramatic, but the probability of occurrence is less than 1%. It’s hard to beat The Trade Desk in today’s business development and with 15 years of experience. It would be easy for a company like Google to acquire the company.

conclusion

I like this company, which boasts impressive growth rates of nearly 30% and adjusted EBITDA of nearly 40%. As used in the software world, this is the rule of 70: exceptional performance. This opportunity stands out because the advertising industry is undergoing major changes in two aspects: 1) premium content, especially high-margin CTV growth, and 2) new media (retail, podcasts, outdoor digital, etc.).

The stock price is in line with my valuation, so I recommend waiting for a price correction. While the market is bullish on expectations of Fed rate cuts, I think it’s worth the wait to buy this blue-chip business at a reasonable price of less than $80 per share.