SolStock/iStock (via Getty Images)

introduction

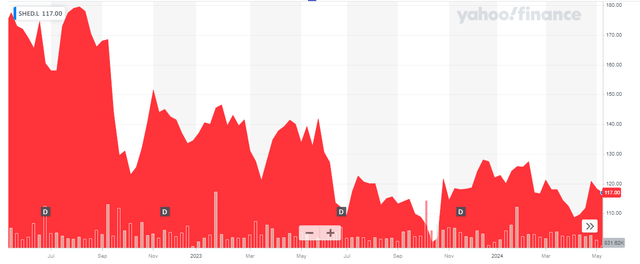

I see a lot of opportunity in the real estate sector, which has been so battered over the past 18 months. While some share price declines were a natural result, other his REITs were only dragged down by the deteriorating market conditions.stock price Urban logistics REIT (OTCPK:PCILF) also fell, which was somewhat expected given the sharp rise in interest rates in financial markets.

Yahoo Finance

Urban Logistics is principally listed in London and trades under the ticker symbol SHED. The average daily volume is Approximately 1.1 million shares, This makes it a great market to trade REIT stocks. The current market capitalization is approximately £550m. This article uses the pound as the base currency.

Business performance remains strong, but dividends should have been higher I cut it a while ago

There are three main factors I look at when looking at REITs. How is earnings related to distribution rhythm, how strong is the balance sheet in terms of LTV ratio, and how reliable are earnings in this era of high interest rates?

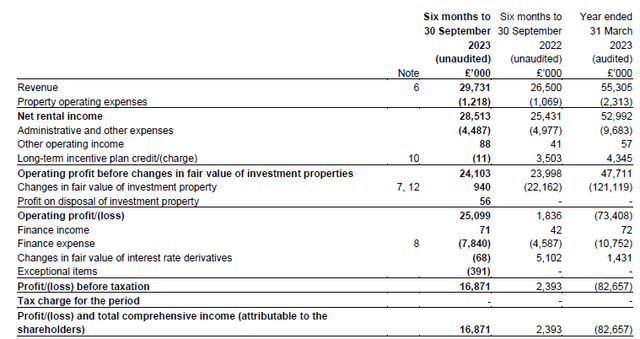

In the case of Urban Logistics, the answer to the first question is very simple. As shown below, the REIT reported: Total revenue of £29.7m (Of this, essentially £29.3m was rental income) As a result, net rental income was quite high at £28.5m. Total general and administrative expenses have decreased (and are expected to continue to decline as new management contracts with lower rates begin this year), but against the backdrop of higher interest rates as an average cost. Total finance costs increased to £7.8m. Debt increased by 88 basis points in the first half of the financial year.

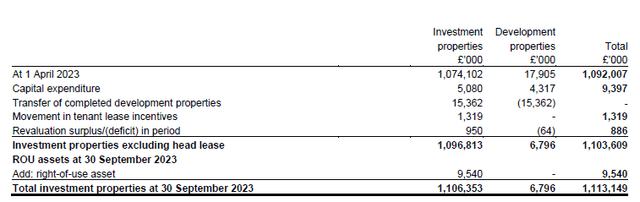

Urban Logistics Information for Investors

This still resulted in a net profit of £16.9m, but net profit (or net loss) is relatively irrelevant to a REIT, and EPRA’s revenue (equivalent to North American FFO) is a very small percentage of what a REIT actually does. It will help you get a better overview of what is going on. For example, performance excluding changes in the assumed fair value of real estate.

For Urban Logistics, the total EPRA income was £15.9m, which equates to an EPRA income of 3.38p per share.

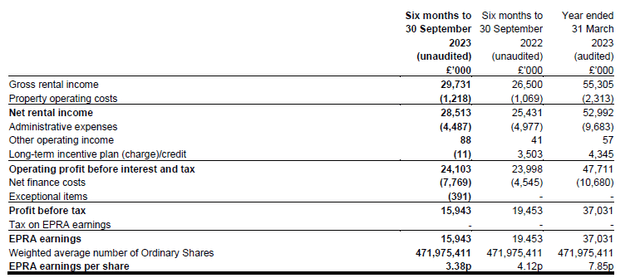

Urban Logistics Information for Investors

Note that these revenues do not include capital expenditures on assets. We know that the REIT has made over £9m of capital investment in the first half of this year, but looking at the breakdown of capital expenditure, we see that out of total capital expenditure, over £4.3m of his capital expenditure was in development assets. It has also been shown that they are related.

Urban Logistics Information for Investors

This means that the pure capital expenditure on the investment property was approximately £5.1m. The problem now, of course, is that if you subtract the £5.1m of property investments from his EPRA earnings, his adjusted EPRA earnings are left with just under £11m, or 2.3p per share.

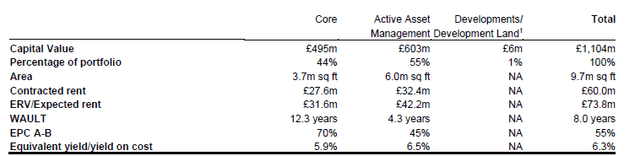

While this is disappointing, there is also a mitigating factor as REITs’ revenues increase significantly as leases expire and existing leases are renewed. As you can see below, the current contracted rent is just £60m, but the Expected Rental Value (‘ERV’) based on current market conditions is almost £74m, which is higher than £13.8m.

Urban Logistics Information for Investors

This means that, assuming total capital expenditure remains stable at £5m per term, the increased rental income will cover the capital expenditure and add an additional approximately 0.40p to EPRA’s revenue . At that point, his EPRA earnings, excluding non-development capital expenditures, will be around 7.6-7.8p per share.

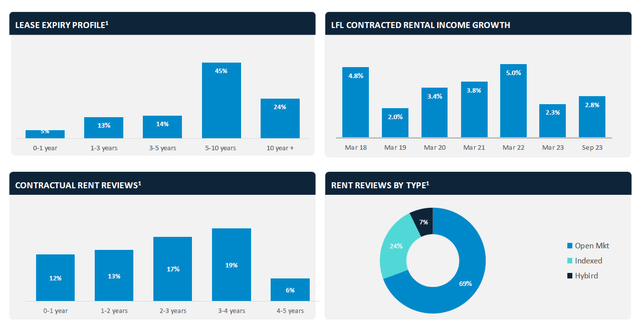

There is one caveat here. It will take time for REITs to push through with rent increases. As seen below, only 25% of rents are subject to contractual rent reviews over the next two years, but less than 20% of leases expire in the next three years, so long-term WAULT also works against his REIT.

Urban Logistics Information for Investors

So while we are confident that rental income will increase, it will take some time for the full effect to be felt. Furthermore, while EPRA’s profits are likely to continue to cover the current annual dividend of 7.6p per share, the payout ratio will remain around 100% of EPRA’s profits, or around 105-110% of adjusted profits. , is uncomfortably high.

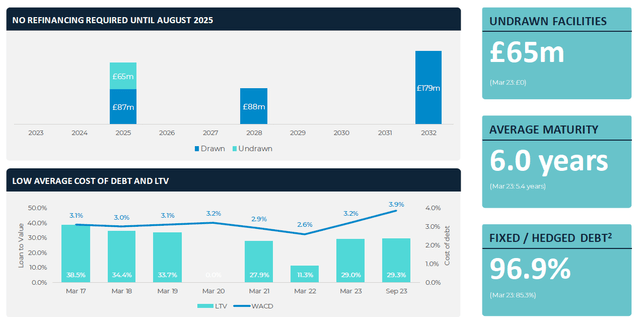

Fortunately, although the REIT has borrowed a total of £354m, it has almost £31m of cash on its balance sheet and its LTV ratio is below 30%, so its balance sheet can be dealt with. This takes his pro forma net debt position to £323m, giving him a LTV ratio of just over 29% when compared to his £1.1bn property portfolio. Excluding the £9.5m leased assets, the LTV ratio would be approximately 29.2% to 29.3%.

Urban Logistics Information for Investors

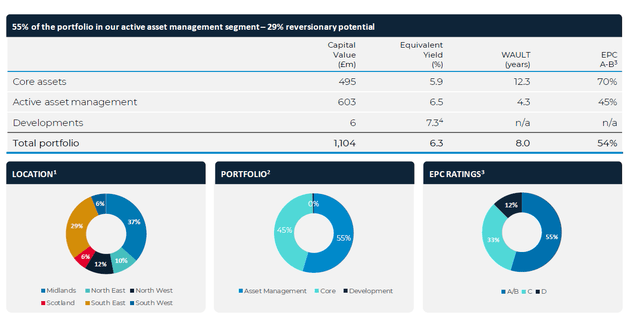

It is clearly a matter of interest to see the capitalization rate that Urban Logistics uses to value its assets at £1.1bn. The image below shows current annual net rental income of approximately £57m, resulting in a net initial yield of 4.9% and an additional yield of 5%.

Urban Logistics Information for Investors

Although this is a fairly low value in environments such as 5-year UK GILT yields 4.1%, by offsetting the current market rent with the current appraised value of the real estate portfolio, the book value of the asset implies a capitalization rate of 6.25% of the real estate market rent, which is acceptable for a logistics asset. This seems fair as the final quarter of Urban Logistics’ fiscal year has ended. Sold another asset at a premium of 1.9% Convert to net book value.

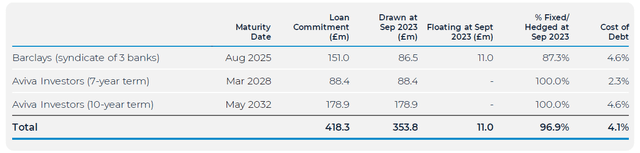

We believe average cost of debt will remain stable, at least for the foreseeable future, so we do not expect any negative earnings surprises. The REIT used the proceeds from the sale of several smaller assets to repay a variable portion of its debt. As seen below, £267m of the debt is pegged at 2.3% on his 2028 term loan, with an average interest rate of 2.3%. The 2032 term loan is 4.6%. This means interest expense visibility is good all the way through 2028.

Urban Logistics Information for Investors

The 2025 Barclays loan will need to be refinanced in August 2025, but as the average cost of that facility is currently 4.6%, we do not expect any significant negative impact. Even if refinancing rates were to be 150bp higher, the total impact would be just £1.3m (and this is likely to be offset by rent increases between now and summer 2025).

investment thesis

When it comes to urban logistics facilities, I’m between a rock and a hard place. I like the low LTV ratio and strong balance sheet. Current capitalization rates are quite low, but applying market rents to the portfolio yields acceptable capitalization rates. This means the NTA per share is 161.69p, which is reliable. While the current dividend yield of 6.5% (subject to the UK’s 20% dividend withholding tax on distributions from REITs) is attractive, investors should be aware that the current dividend yield is (slightly) above 100%. You have been warned that

That being said, the stock trades at about 15 times EPRA earnings, and based on current market rents EPRA earnings could increase by about 40%-45%. That sounds great, but keep in mind that EPRA’s revenue does not include capital expenditures, so the real net income including capital expenditures will be a little lower.

There are currently no positions available at City Logistics Facilities. Although it is a well-managed REIT, I hope that the stock price will become a little lower in the near future.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.