D-Keyne

Aspen Technology (Nasdaq:AZPN) is a company that develops and provides industrial software and services that assist in asset management, monitoring, and optimization.

All-time share performance is decent. AZPN he listed in 1994 at a price of $8.8 and is currently trading. At $221 per share, it’s a 25x increase. Despite fluctuations over the past year, the stock price has also been trending upward for the past five years. AZPN has delivered over 32% price return over the past year, and recently he is up 2% year-to-date.

I rate AZPN as neutral. My one-year price target is $223 per share, and I expect an upside of 1%. AZPN continues to see strong demand due to industry tailwinds and may be well-positioned to capture it with its newly formed sales team, but the macro environment remains uncertain, a key driver of risk That is my opinion. .I We believe that there is a balance between risk and reward.

financial review

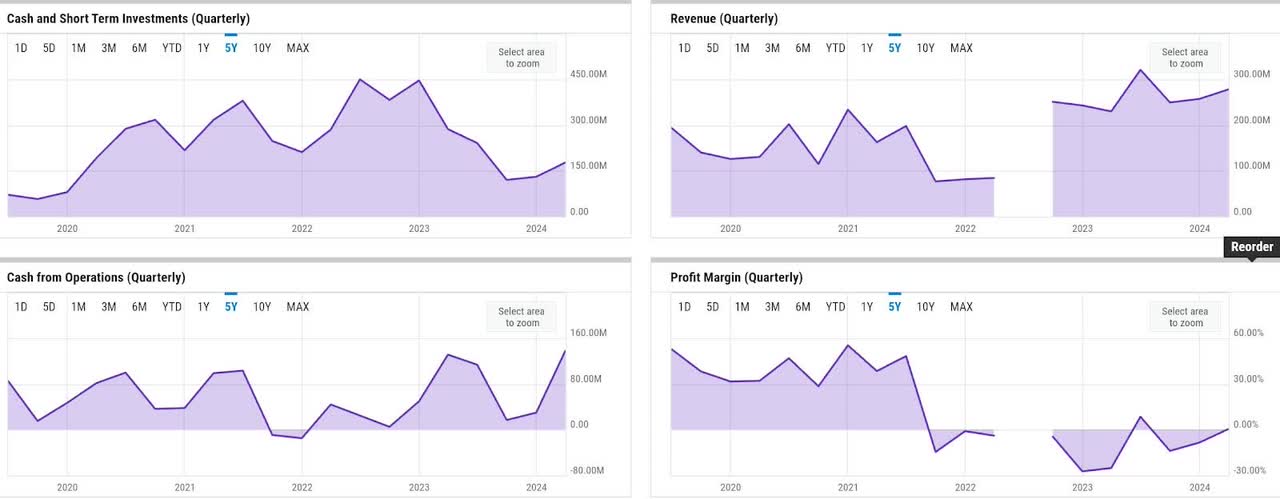

Fundamentals are relatively mixed. Revenue growth continued to normalize after his M&A with Emerson’s software division in 2022. In the third quarter, AZPN generated $278 million in revenue, an increase of almost 21% year over year. However, despite the consistent upward trend in operating cash flow (OCF) generation, it appears that AZPN still has a lot of work to do to improve its profitability. AZPN seems to be on the right track here. Net profit margins have improved sequentially, and AZPN finally reached breakeven again in the first quarter after several quarters of net losses. His stable OCF generation also supports relatively solid liquidity. AZPN ended the quarter with approximately $178 million in liquidity.

catalyst

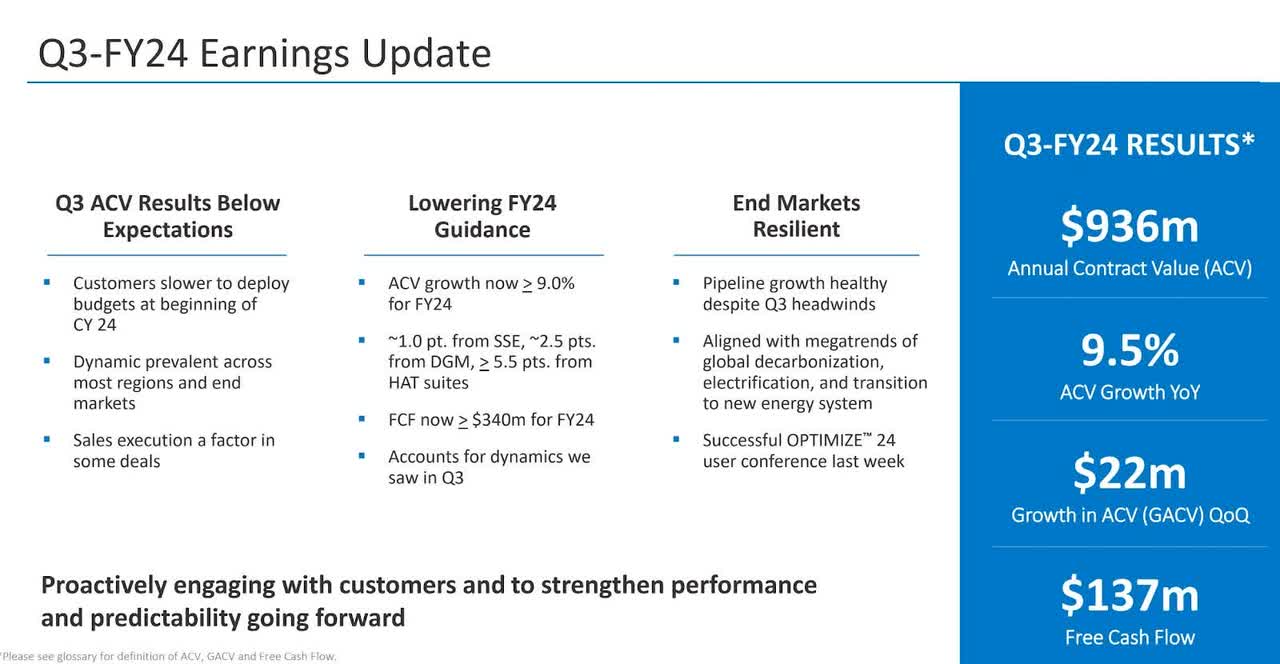

I believe that AZPN should see even stronger and higher quality growth acceleration in FY2025, despite the ACV growth outlook for the current fiscal year being lowered to 9.9% as announced in the Q3 earnings call. is thinking. In fact, the slowdown in ACV growth we saw as of Q3 was due to unforeseen circumstances. – Structural issues that actually indicate future revenue growth.

The first issue management mentioned in the third quarter was the slow deployment of budgets by leads. However, although sentiment appeared to have slowed last month, management also said that customers’ expectations for budget developments remain in line with 2023. In my view, this suggests that his AZPN is still in the right position. Pipeline growth has remained healthy, especially despite temporary headwinds, maintaining the growth trend.

The second issue that caused some temporary headwinds in the third quarter was the maturation of the sales team under new leadership. However, in my opinion, this internal sales realignment will actually lead to stronger revenue heading into 2025, especially assuming the team eventually matures and perhaps produces tangible results starting in the next quarter. It should show growth.

In that regard, the newly formed sales team should enable AZPN to unlock organic growth opportunities in DGM (Digital Grid Management), primarily through driving revenue growth. In the third quarter, DGM continued to see strong demand, likely due to long-term trends in grid modernization and electrification. As such, management commented: A strong third quarter win should open up opportunities for expansion with existing customers.

The suite, which started with Digital Grid Management (DGM), continues to see strong demand, with multiple additions in the third quarter as the company continues to grow wallet share with existing customers and acquire new loads. Obtained a temporary license. For example, during the quarter, we won a large distribution management and optimization contract in North America, beating our competitors in nearly every evaluation category, including compliance, technology, security and performance.

sauce: Announcement of third quarter financial results.

danger

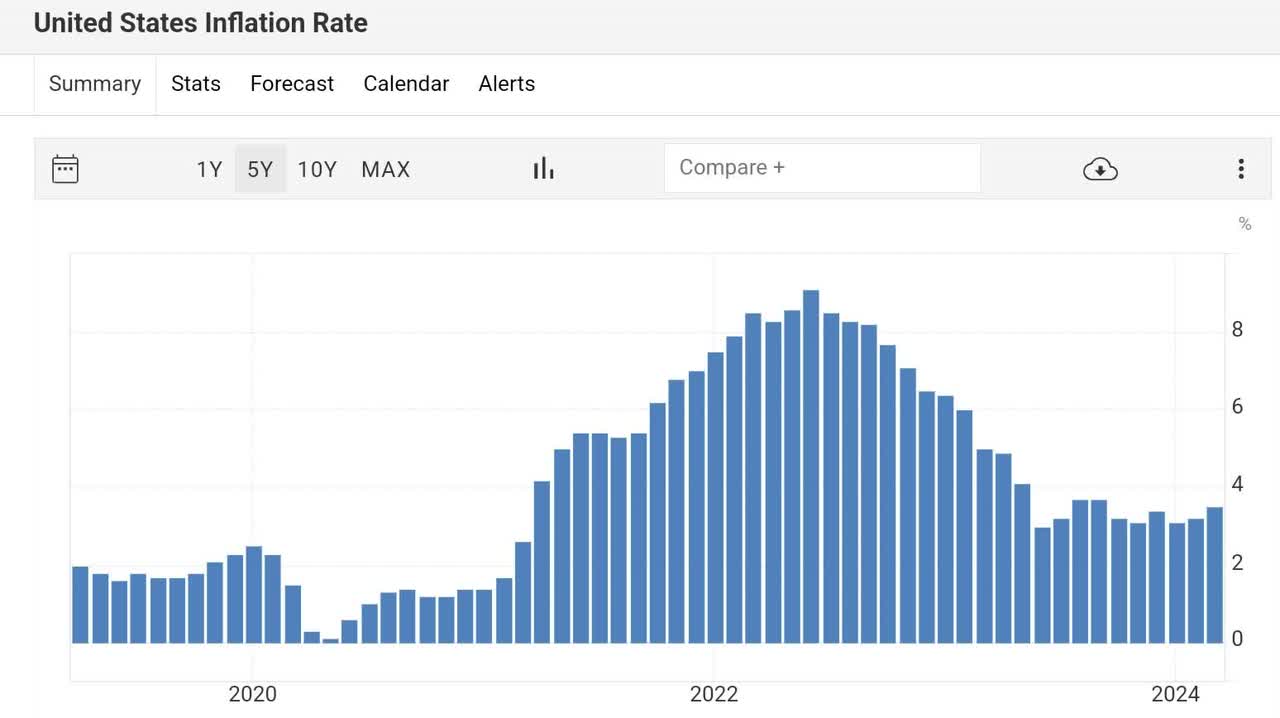

I believe the only significant risk to my thesis is the still uncertain macro landscape as of today. Although prospect sentiment remains relatively stable, if the high inflation environment does not improve in FY2025, budget commitments could change, impacting revenue estimates and stock prices.

Currently, inflation in the United States remains fairly high, even though it has already slowed since last year. This has recently led to the Fed reconsidering a rate cut in 2024. In addition, the inflation rate is persistently above 3.5%, still a long way from the 2% target.

Additionally, we believe risk factors may also be emerging from a recently formed sales team under new leadership. As with any new team with a new leader, for example, there can be potential mismatches and lack of cohesion that can actually slow sales execution. On the other hand, macro factors can further exacerbate this particular problem.

Evaluation/Pricing

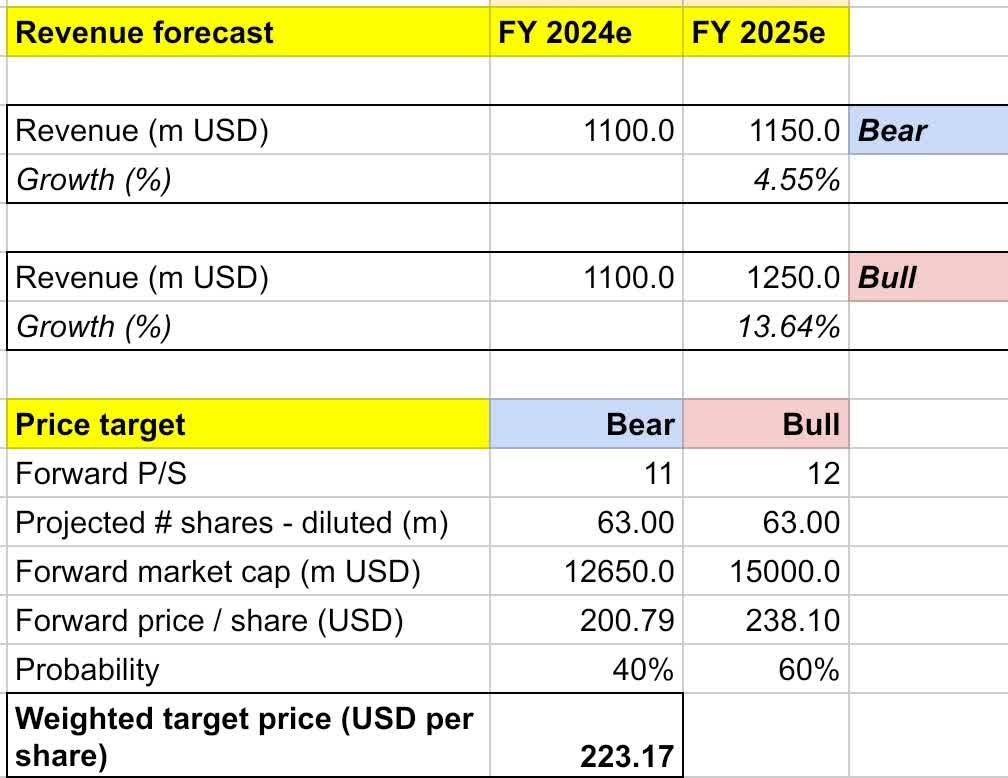

My target price for AZPN is based on the following assumptions for bullish and bearish scenarios for FY25 forecast.

Bullish scenario (60% probability) assumptions – Sales are expected to increase 13.6% year-over-year to $1.25 billion. market estimates. I assume his future P/S expands slightly to 12x, which means the stock price will rise to $238.

Assuming a bearish scenario (40% probability) – AZPN’s fiscal 2025 sales will be $1.15 billion (up 4.6% year-on-year), approximately $20 million below market expectations, with macro issues remaining and budget This suggests that development will be difficult. The P/S ratio remains at 11x, and the stock price correction reaches $200.

unique analysis

Integrating all of the above information into the model results in a weighted 2025 price target of $223 per share, which is expected to increase by approximately 1% over the year. I rate the stock as neutral.

As a side note, my 60/40 bull-bear probability assignment is that the long-term tailwinds driving overall demand for AZPN’s products will still outweigh any potential slowdown due to macro challenges. is based on the belief that My forecast remains conservative as it also reduces bearish earnings by $20 million and does not factor in share repurchase activity through FY2025 and FY2025. AZPN still has $57 million worth of stock, although it expects to repurchase shares worth $243 million. That said, I still don’t think the upside represents an attractive risk reward at this point.

conclusion

AZPN is a company that provides software solutions for asset management and optimization and is currently benefiting from increased asset deployment in the grid modernization space. As of the third quarter, the pipeline remained healthy, and AZPN is looking ahead to fiscal 2024 and 2025 with more land acquisition under new leadership and with a newly formed sales team. We are well-positioned to seize opportunities for exploitation and expansion. Macro issues remain important risks for stock prices. , I think investors should be cautious as the high inflation environment continues. My price target predicts a 1% upside, which I still don’t think represents an attractive risk-reward at this point.