PM image

Effective dividends snowball, not only paying out an attractive level of dividend income today, but also doubling and increasing that dividend over time. For investors looking to build a snowball like this, the most helpful thing to do is to find stocks that: It offers an attractive combination of current yield and dividend growth rate. One way to do this is to buy broadly diversified funds that can be combined to produce a sufficiently high yield with a growth rate that exceeds long-term inflation. Since it is rare to find funds in sufficient quantity that offer both a good current yield and a long-term dividend growth rate, one approach is to find funds that offer attractive dividend growth rates and The dividend growth rate is not promising, but it is a combination of other funds that offer attractive current dividend growth rates. Harvest.

This article shows you can build a core position with proven dividends. growth funds like iShares Core Dividend Growth ETF (Knee search:DGRO), combine with several other high-yield funds to create a portfolio that delivers long-term dividend growth that outpaces inflation and generates a dividend yield that can fund your retirement under the 4% rule, creating a powerful dividend snowball. produce.

Why DGRO is a great core dividend growth ETF

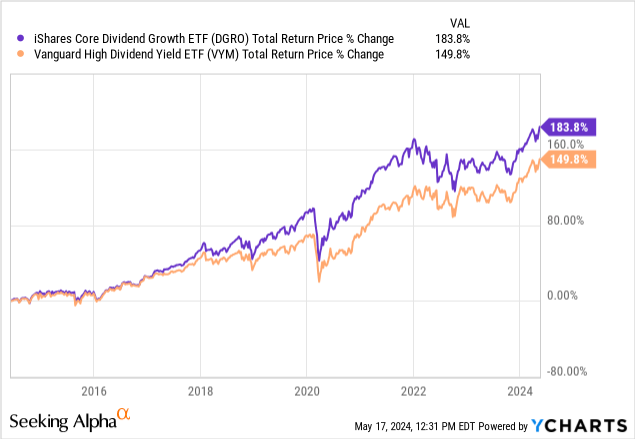

The iShares Core Dividend Growth ETF is the Vanguard High Dividend Yield Index Fund ETF (VYM) in the long run.

It also has a dividend yield of about 2.3%, which isn’t very high, but it’s decent, and while it’s less than the 4% rule yield, it’s still significantly higher than the dividend yield currently offered by the S&P 500.

Another reason we like DGRO as a core dividend growth stock is that its portfolio construction is based on three important rules. First, each stock in the portfolio must have increased its dividend for at least the past five years. This should demonstrate meaningful dividend growth momentum and management’s commitment to continue increasing the dividend going forward. Additionally, each member of the portfolio has a maximum payout ratio of 75%, indicating that the dividends of its underlying holdings are sustainable and likely to continue to grow. Another important factor in dividend growth is that you need to have an expectation that the stock you own will continue to grow earnings in the future.

DGRO excludes REITs from its portfolio because they tend not to be very dividend growth companies (as they are required by law to pay out at least 90% of their taxable income as dividends) However, DGRO has significant other diversification, making it an excellent core. I have it in my portfolio. Financial sector exposure 19.11%, Technology exposure 17.23%, Healthcare exposure 16.35%, Industrial exposure 11.56%, Consumer Defense exposure 10.6%, Energy exposure 8.28%, Utilities exposure 7.41 %, exposure to the consumer cycle 5.74%, and exposure to the financial sector 2.37%. 1.36% for basic supplies, communications and 0.27% for cash and cash equivalents. Additionally, in contrast to some dividend growth stocks such as VYM and Schwab US Dividend Stock ETF (SCHD), DGRO has significant exposure to the technology sector, as well as significant exposure to energy and utilities. This exposure to technology and energy means that Apple (AAPL) 3.14%, ExxonMobil (XOM) 3.13%, Chevron (CVX) 3.1%, Microsoft (MSFT) 3.01%.

Moreover, the company’s dividend growth track record is impressive at 9.7% over the past five years, 8.36% over the past three years, and 10.36% over the trailing twelve months. With an expense ratio of 0.08%, he is also a very efficient asset builder who can return most of his profits to shareholders through dividends. It is well diversified by individual holdings, with only 26.54% of the total portfolio held in the top 10 stocks, and a total of 423 holdings across the portfolio.

Weaknesses of DGRO and how to solve them with just two funds

That said, the fund’s main weaknesses are its lack of meaningful exposure to real estate or bonds, and its rather low dividend yield. Other he can solve these problems by adding two funds. These funds are Cohen & Steers Quality Income Realty Fund (RQI) and Virtus InfraCap US Preferred Stock ETF (PFFA).

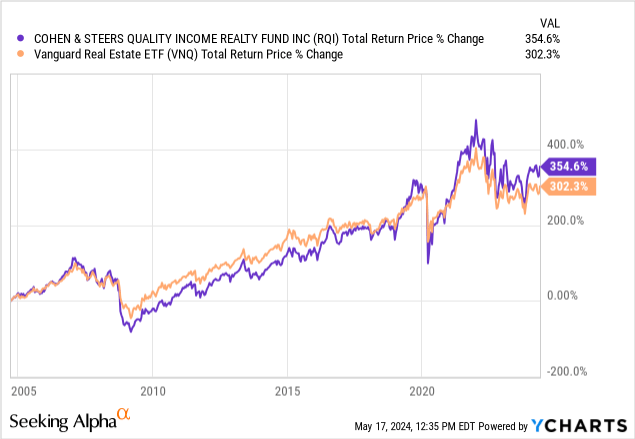

RQI is a real estate-focused CEF with a track record of delivering superior performance relative to the broader REIT sector (VNQ):

The trailing 12-month dividend yield of 8.25% paid monthly is also very attractive and looks reliable, having been able to maintain that yield even during the COVID-19 crash. A total of 206 holdings, with approximately 20% allocated to fixed income investments, provides well-diversified exposure to the real estate sector.

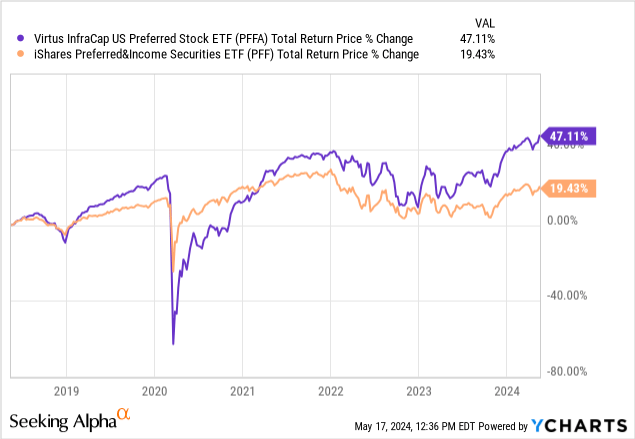

PFFA has a track record of outperforming broader priority sectors as well as RQI (PFF) has been around since its inception and pays a very attractive dividend yield of 9.52%, while adding well-diversified exposure to the fixed income sector with a total of 183 actively managed holdings. Masu.

While not a dividend growth fund like RQI, PFFA has grown its dividend at a 0.93% CAGR over the past five years and a 2.65% CAGR over the past three years, indicating it can at least offer modest returns. The dividend has been growing and is likely to remain so in the future.

With a portfolio of 70% DGRO, 15% RQI, and 15% PFFA, investors can enjoy a total dividend yield of 4.3%, comfortably meeting the 4% rule, while expected annual dividend growth of nearly 7% You can also enjoy discount rates. This follows his 5-year dividend growth CAGR of 12 months on a weighted basis for his three members in this portfolio. As a result, there is a good margin of safety in dividend growth, which is likely to still match or beat inflation for years to come, even if it declines significantly.

Key points for investors

As this thought experiment shows, an investor can build a portfolio that is well diversified by sector and individual holdings while generating enough current income to meet living expenses and enjoying dividend growth that outpaces inflation over the long term. You don’t need to have a large amount of funds to create one. .Of course, if you want to generate alpha against the market on a regular basis, you can use more Actively managed strategy An approach that focuses on individual stocks is required. But for investors who are simply interested in generating a relatively safe and attractive current income that is likely to meet or exceed inflation over the long term to cover their retirement living expenses. , DGRO, RQI, and PFFA.