Jezim

introduction

Cisco Systems (Nasdaq:CSCO) is a company that has been on my radar for some time. I’ve never watched them very closely, but I’ve always listened to their earnings and briefly reviewed their financials.Actually, I was also a shareholder for a time. This was shortly before I sold my position.

I revisited the company since its latest Q3 results, and I decided to open a position bullishly due to its strong fundamentals and growth potential. We also look at the company’s recent earnings, fundamentals, and why Cisco could be a dividend stock that will benefit investors in his 2026 and beyond.

brief overview

I’ve been familiar with Cisco Systems for years, as many information systems engineers and Navy IT personnel come to work for Cisco Systems after retirement, often with a computer background.

Cisco is The technology company was one of the largest in the late ’90s and early 2000s with a market capitalization of over $500 billion. The tech company, like many companies in the information technology sector, grew rapidly in the 1990s until the dotcom bust caused its stock price to collapse, and it never recovered.

Cisco sells and manufactures Internet protocol and networking products for the United States and other IT industries. This includes Europe, the Middle East, and China. They operate in different segments. cloud, security, software.

Cisco

Latest Earnings

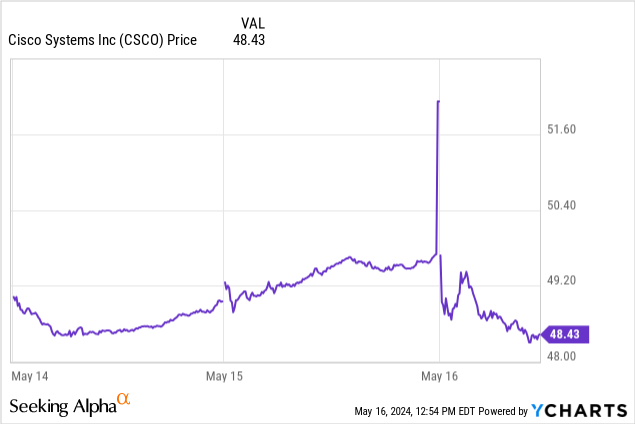

Cisco Reported third quarter earnings The stock rose rapidly on May 15th and has since returned to just above the $48 it is currently trading at. Investors were optimistic as the tech company raised its full-year outlook, which usually triggers a positive reaction in the market. In the chart below, you can see that CSCO’s stock price briefly exceeded $52.

On the other hand, like with Starbucks, a reduction in guidance could also hamper a reaction from the market, which typically has a negative impact as the stock price declines.SBUX) When the full-year forecast for FY2015 was lowered.

However, Cisco expects to raise capital and generate revenue of $53.6 billion to $53.8 billion, up from $51.5 billion to $52.5 billion previously. And while the expected revenue growth is impressive enough for the company to raise its guidance, this is still down from FY23 revenue of about $57 billion.

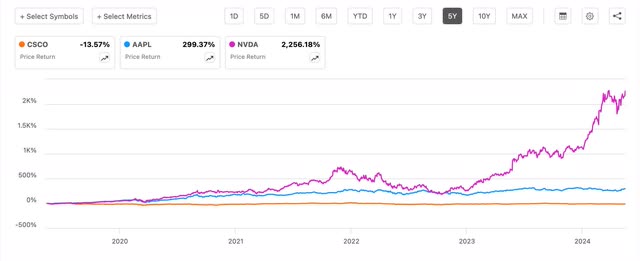

I think the market realized this and investors tempered their optimism. For companies like CSCO, share price growth is being held back by other tech giants like Apple slowing growth (AAPL) and Nvidia (NVDA) has shown strong growth recently. While Cisco has seen double-digit declines over the past five years, both companies have enjoyed high price returns of nearly 300% and nearly 2300%, respectively.

In search of alpha

Another reason for the price jump is that it was able to beat analysts’ expectations on both sales and bottom line. EPS was $0.88, above $0.06, and revenue was $12.7 billion, above consensus of $12.63 billion. EPS also increased by $0.01 from the previous quarter, but revenue decreased slightly from $12.79 billion.

Additionally, earnings and revenue both decreased from $100 million and $14.57 billion on an annualized basis. I usually start to become skeptical when a company records a year-over-year decline. But for reasons I’ll explain later, I expect his CSCO to see solid growth over the next few years.

Q3 2023 | Q3 2024 | |

EPS | $1.00 | $0.88 |

Revenue (billions) | $14.57 | $12.7 |

Decline in segment revenue is also a cause for concern

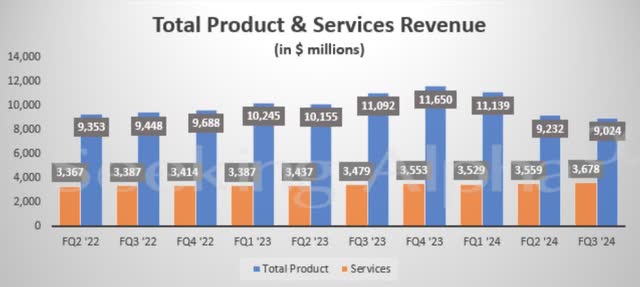

However, product revenue fell 19% in the third quarter, from approximately $9.2 billion to $9.0 billion. Services revenue was $3.7 billion, up slightly from $3.6 billion in the previous quarter. Networking, the largest product category, also fell by 27%. Management attributed this to inventory practices. However, over the long term, we expect these companies to show growth as they complete their largest acquisition to date, Splunk.

In search of alpha

CSCO just completed an acquisition in the recent quarter, so it will take some time for the company to move forward with acquisitions and show growth. This is definitely something we will keep an eye on in the future. Even on an annualized basis, product revenue decreased from approximately $11.1 billion, while services revenue increased over the same period.

Improved margins and geographic segmentation

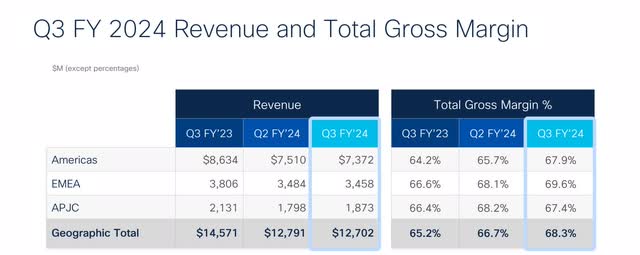

Overcoming product and services revenue declines, Cisco demonstrated margin improvement during the quarter. Product gross margin increased slightly to 66.9% from 66.5% in the first quarter of the year.

Non-GAAP gross margin also increased to 68.3% from 67.1% in the same period. For comparison, peer Arista Networks (ANET) Non-GAAP gross margin for the quarter was 64.2% and non-GAAP operating margin was 47.4%. Non-GAAP gross margin for the fourth quarter is expected to decline slightly to a range of 66.5% to 67.5%, while non-GAAP operating margin is expected to be 31.5% to 32.5%. ANET also expects second-quarter profit margins to fall to 64% and 44%, respectively.

Q1 2024 | CSCO | ANET |

Non-GAAP operating margin | 66.5% | 47.4% |

Product gross profit margin | 66.9% | 64.2% |

Additionally, on an annualized basis, non-GAAP services gross margin increased 340 basis points and non-GAAP operating margin increased 30 basis points to 34.2%. Geographically, CSCO’s segment also showed improvement year-on-year, with the Americas increasing by 6%. EMEA increased by 4%. APJC fell slightly by 1%.

All three companies have shown strong year-to-date growth, with Americas down 19% in the first quarter, while EMEA and APJC were down 13% and 38%, respectively. Combined gross margins also improved year over year in all three locations.

CSCO investor presentation

Possibilities of AI

It’s no secret that AI is the next big thing. And with his $28 billion acquisition of Splunk, Cisco aims to leverage this going forward. Management said earlier this year that the AI switching market is expected to exceed $10 billion in the next three years.

Regarding the timing of growth and AI, the company’s CEO said during the earnings call that it will start at a low level in early 2025 and ramp up in the second half of this year.However, 2026 is likely to be the year of strong growth for CSCO.

In addition, the company introduced Cisco Hypershield, an AI-native cybersecurity solution that will be integrated into the company’s fabric. This is expected to help defend AI-scale data centers and protect enterprises from constant security threats. This is expected to revolutionize security in both on-premises and cloud environments. First shipments are scheduled for August of this year.

CSCO

high return on capital

Another reason I decided to open a position in Cisco is that the company returns capital to shareholders with a well-covered dividend and frequent share buybacks. While we would expect a larger dividend increase than the $0.01 increases over the past few years, the share buybacks indicate the company’s strong financial position.

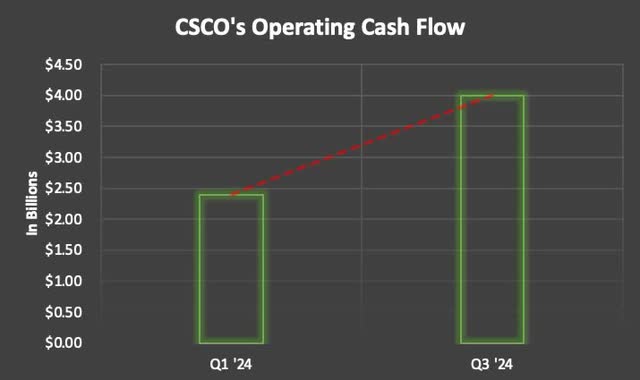

During the quarter, the company returned $2.9 billion through share buybacks and dividends. A total of $8.5 billion has been returned since the beginning of the year. And the $0.40 dividend was more than covered by $4 billion in operating cash flow. This was up from his $2.4 billion in the fiscal first quarter.

Create author

Management is taking advantage of the company’s depressed stock price to take advantage of the opportunity to buy back its own stock.Last year, they bought back 88 million shares, and over the past 10 years bought back Over 1 billion. Excluding share buybacks, CSCO’s free cash flow payout ratio is less than 50%.

This gives us plenty of room for even bigger increases, which I think is probably driven by the recent acquisitions and the expected growth over the next couple of years. CSCO has an excellent track record of increasing dividends, and I think it will return to larger dividend increases while delaying share buybacks. This should lead to higher stock prices in the future as well.

Additionally, the company had ample liquidity on its balance sheet at $18.8 billion. This is down from his $23.5 billion at the beginning of the year as a result of Splunk’s acquisition and capital allocation strategy. They also have more cash than current debt, which is minimal compared to their market capitalization of $195b.

Possibility of upside

With a forward P/E of around 13x, I think the stock is attractive at current levels, especially for long-term investors. It is also lower than CSCO’s five-year average of 14.37x and the sector median of nearly 24x. Additionally, this is much lower than his peer Arista Networks’ forward P/E ratio of approximately 41 times.

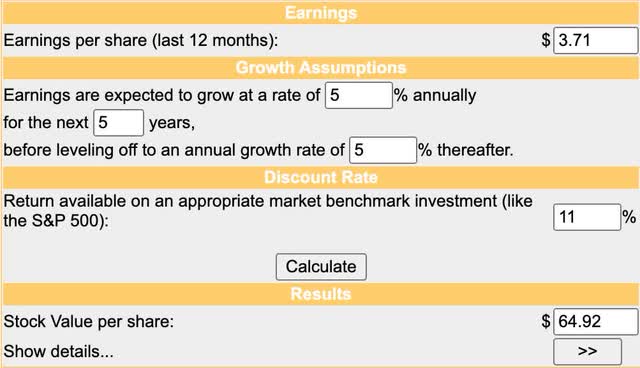

Due to slow growth and unstable financials, I think the market is pricing this tech giant much lower than its newer peer ANET. However, he believes in the company’s recent turnaround with the Splunk acquisition, which is a great entry price if he wants to enter the AI space. Using the discounted cash flow method, CSCO’s price target is approximately $65.

money chimpanzee

Of course, this is a long-term story. However, I expect his CSCO to return to growth over the next two years. When I look at them, Revenue forecastThe company forecasts growth of approximately 8.5% in 2026 and approximately 16.5% in 2028.

To manage expectations and temper enthusiasm, I decided to use a projected growth rate of 5%. We believe this could be achieved by CSCO if its recent acquisitions are successful. Additionally, this gives the patient investor double-digit upside room and a well-covered dividend while he waits. Additionally, Wall Street rates them a Buy with a high price target of $76.

risk and return

Cisco has been slow to decline more than 5% over the past five years. The company is making acquisitions to get back on track for growth, and I think this is the right move. However, if margins and segment revenues continue to decline and recent acquisitions do not provide some growth, this could lead to further price declines.

The company also faces increased competition from competitors like Arista Networks, which went public just a decade ago and already has more than 9,000 customers. But for now, I think the biggest risk to CSCO is the company itself. Growth is expected to occur during 2025, according to management, and the company’s stock price will be influenced by margin and revenue growth in the coming quarters.

If the decline continues, stock prices are likely to follow suit. And the company will continue to lag behind its competitors. However, as mentioned above, the company believes it can turn its fleet around for positive growth by the end of 2025 or early 2026. As a result, I’m bullish on the company and rate it a Buy.