Vera Tikhonova

Things are going very well for Curaleaf Holdings (OTCPK:Karf), the largest cannabis companies by revenue or market capitalization. The stock price has increased 37.7% since the beginning of the year, and is up 107.8% since the rumored closing price of August 29th. May be subject to schedule changes. I’ve been calling the stock a “sell” since the beginning of this year. Bad stocks for cannabis investors. In February, I wrote that investors were thinking: good chance to sell itthe stock is currently up 12.7%.

In this follow-up after the DEA rescheduled cannabis from Schedule 1 to Schedule 3, we review Curaleaf’s first quarter financials, discuss changes in outlook, look at charts, and evaluate valuations. I continue to believe that cannabis investors can find better opportunities.

Curaleaf’s first quarter wasn’t great

Curaleaf reported its first quarter on May 9th. Sales were expected to be $339 million and adjusted EBITDA of $80 million. His actual revenue was $338.9 million, an increase of just 2% year over year. This was as expected, but not very impressive. Adjusted EBITDA was $76.7 million, lower than expected, down 8% sequentially and up 4% year over year.

Gross profit margin decreased slightly year-over-year to 47.5%, but operating expenses increased. Operating income was just $12.7 million, down 37% from the same period last year. This was mainly due to the expansion of stock-based compensation.

Operating cash flow expanded quite dramatically from $7.9 million in Q1 2023 to $43.8 million. Accrued income taxes increased by $41.3 million, which is almost the entire cash flow, and was slightly higher than in the first quarter of 2023. The big changes included a significant improvement in inventory, which expanded but was much less wide than he was a year ago. This improved operating cash flow by $17.5 million. The company invested $13 million in capital expenditures, which was more than $10 million lower than the same period last year. Free cash flow at that time was $30.8 million.

Curaleaf’s balance sheet is in trouble and continues to be in far worse shape than its peers. The current ratio (current assets to current liabilities) is at a red flag level of just 0.7x. I believe that tangible book value is important, and the reported tangible book value was -$764.3 million. Adjusting this for in-the-money options brings it down to -$738.7 million. Net debt is a hefty $475.3 million, which excludes $239 million in unpaid income taxes and $75 million in uncertain tax position.

Therefore, Curaleaf is growing slowly and likely becoming less profitable. The company has a large amount of debt, much of which is due in 2026. According to the balance sheet, current assets, including cash of $105 million, are significantly lower than current liabilities, which account for unpaid income taxes. Perhaps Curaleaf will be lucky, but it won’t be alone. Many MSOs pay significant income taxes.

Curaleaf’s outlook is bleak

Sentio said analysts have lowered their expectations and are less excited about Curaleaf’s future. In early January, when I wrote this article, analysts were expecting 2024 revenue of $1.42 billion and adjusted EBITDA of $352 million. The company expected 2025 sales of $1.64 billion and adjusted EBITDA of $462 million. These were reduced from November in advance of his third quarter report.

Going into the first quarter report, analysts were expecting 2024 revenue of $1.41 billion and adjusted EBITDA of $350 million, slightly down from January. The company currently expects 2024 sales to increase 4% to $1.4 billion and adjusted EBITDA to increase 12% to $340 million. This results in a margin of 24.2%.

Ahead of its first-quarter financials, the company had expected sales of $1.54 billion and adjusted EBITDA of $409 million in 2025, ahead of Germany’s legalization. This was significantly lower than expected at the time of the month. The company is currently targeting revenue of $1.53 billion, an increase of 9%. Adjusted EBITDA is expected to be $396 million, an increase of 16%, with a margin of 26%.

Eliminating the 280E tax would improve net income and cash flow, but analysts have not yet projected profitability on a net income basis. The company will post a loss of $0.39 per share in 2023, with analysts currently predicting a loss of $0.21 per share in 2024 and -$0.12 in 2025.

Curaleaf chart shows upside resistance

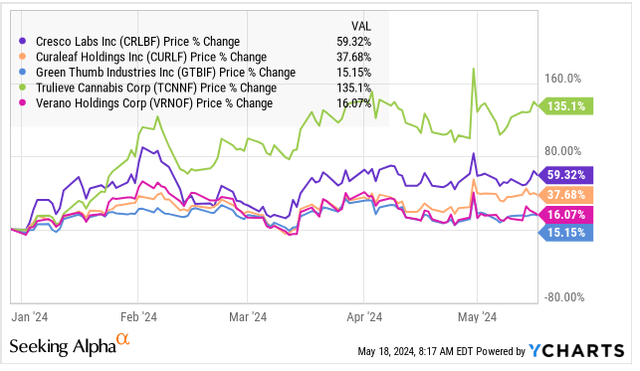

In 2024, Curaleaf is slightly up on the New Cannabis Ventures Global Cannabis Stock Index, which is up 33.5%, but ranks in the middle of its peer group.

Since my first article, the stock is up 20.0%, which is also in the middle of its peers, but behind the 24.0% return of the Global Cannabis Stock Index. Since our second article in March, the company is up 12.7%, outperforming its peers excluding Cresco Labs (OTCQX:CRLBF), increased by 14.3%. The Global Cannabis Stock Index outperformed all major MSOs, rising 20.0%.

Curaleaf recently hit a 52-week high on April 30, the day the DEA announced it was recommending a rescheduling. The stock closed the day at $6.24, down 10.4% since then. Its sideways movement over the past two years has been better than many cannabis stocks.

Most MSOs are unable to renew their highs from early December 2022, and Curaleaf is no different. This was at a time when the market was excited about what he called SAFE Banking (now known as SAFER Banking). Curaleaf hit an all-time low just over a year ago and is now up over 100%. I believe there is resistance in the 6 area ($5.75-6.50) and support near $4.

One of the concerns I expressed in a previous article is that the AdvisorShares Pure US Cannabis ETF (MSOS) There was a potential problem. The stock is currently the second largest holding at 21.9%. MSOS has seen significant inflows this year, buying over 13 million shares and boosting its position by 43.0%. That probably helps explain some of the strength. I’m no longer so concerned about the ETF’s outstanding shares decreasing and possibly leading to liquidations of its large holdings, but it could pose a problem for Curaleaf if the rescheduling doesn’t happen as expected. There is a possibility that

Curaleaf’s evaluation is high compared to other companies in the same industry.

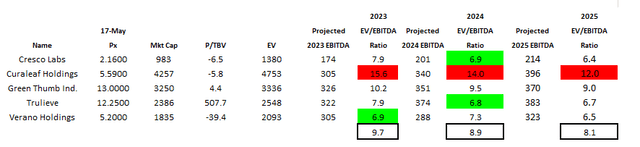

Rising prices and falling expectations are not helpful in valuing a stock. In an article two months ago, I reviewed Curaleaf’s rating compared to its peers. The company was trading at 12.0 times enterprise value to expected 2024 adjusted EBITDA at the time, and currently trades at 14.0 times.

Curaleaf stands out for its high price compared to its peers. I am Green Thumb Industries (OTCQX:GTBIF) makes more sense, and recently I have upgraded to neutral. I have written negatively about Trulieve since I have not been in the model portfolio of these stocks for a long time (OTCQX:TCNNF) and Verano (OTCQX:VRNOF) recently. Although it was long, I wrote favorably about Cresco Labs (OTCQX:CRLBF) During October.

Looking at valuation in 2025, Curaleaf trades at a 68% premium compared to its peer group’s 7.1x. It has the highest amount of debt and its current ratio is lower than these peers. For those who like a large he MSO, I recommend the GTI, which is much cheaper than Curaleaf and has a much better balance sheet. I think the Tier 2 name also makes sense, of which he owns two. The model portfolio for a member of my investment group is currently fairly fully invested, with his 42.5% exposure to MSO (4 stocks). This is higher than his 35.9% of the index’s exposure to that subsector. I’ve had two Canadian LPs for a long time, and three with ancillary names.

My goal for Curaleaf at the end of 2024 in March was $5.56 assuming 280E is gone. This is based on an enterprise value of 12 times projected 2025 adjusted EBITDA, which is roughly where it is currently trading. Can we go higher? Of course, but in my opinion other stocks have more potential to rise.

conclusion

My negative thoughts on this stock did not fare particularly well in 2024. While the stock has gone up, cannabis stocks as a whole have gone up, and Curaleaf has performed relatively poorly. My view remains that upside potential is low compared to peers, and I think investors should shift to other MSOs and other parts of the market.

Curaleaf has benefited from heavy buying by the MSOS ETF this year and rescheduling developments that have excited cannabis investors. Analysts cut sales and adjusted EBITDA forecasts even as legalization progresses in Germany, where Curaleaf operates. Its stock trades at an unwarranted premium compared to its peers. In my view, investors in Curaleaf are unnecessarily paying more money and taking on more risk compared to other MSOs and other cannabis names.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.