Richard Drury

Over the past 24 months, my thought process regarding the home construction industry has changed significantly. From late 2022 to his early 2023, I was bearish on the industry in the short term due to high interest rates and inflationary pressures. but, In the long term, I recognized that continued population growth and a nationwide housing shortage would lead to attractive returns for investors. But by the middle of last year, I started to become much more bullish on the industry. Even though interest rates remained high and inflation had only recently fallen, we were beginning to see a recovery in new property orders.

This recovery leads me to believe that the pressures associated with the housing shortage will be enough to offset the downside facing the industry. And that made me pretty bullish.largely One of the companies in that space I considered and later decided to upgrade. But there was one company I didn’t do that with, but wish I had. Dream Finders Homes (New York Stock Exchange:DFH).See, the end article The article I wrote about this company was published at the end of January 2023. If I was still writing about this company 6 months from now, I’d be pretty bullish on it. However, time has passed and I have finally decided to revisit the company.

It’s unfortunate that I called the company and ended up missing out on a pretty big opportunity because I couldn’t update my thesis on the company. As you know, in that article, I rated the company a “hold.” But since then, the stock has risen 166.9% while the S&P 500 index has risen only 27.6%. Fast forward to today, net new orders are not as strong as I would like, but we continue to see improvement year over year. That said, the stock looks attractively priced. I think this is enough to earn a “buy” rating.

A long-awaited upgrade

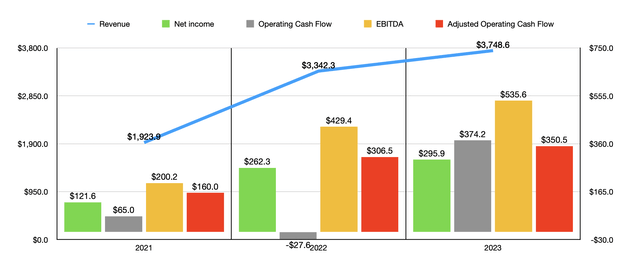

Basically speaking, Dream Finders Homes has done pretty well over the period so far. recent years. In 2021, his revenue was only $1.92 billion, but in 2022, his revenue increased to $3.34 billion. Revenue increased further in fiscal year 2023 to $3.75 billion. This increase in sales was driven by two main factors. First, the number of housing closures increased from 4,874 to 7,314. Second, the average closing price increased from $389,094 to $505,764.nevertheless recent prices Although not as high, it is still an increase year over year.

Such an increase will almost certainly result in increased profits and cash flow. And indeed, Dream Finders Homes is no exception. Over the past three years, net income has jumped from $121.6 million to $295.9 million. Other profitability metrics followed a similar trajectory. For example, operating cash flow increased nearly six times from $65 million to $374.2 million. Adjusting for changes in working capital, he more than doubled from $160 million to $350.5 million. And finally, the company’s EBITDA expanded from $202 million to $535.6 million.

On May 2nd, the Dream Finders Homes management team: present Financial results for the first quarter of fiscal year 2024. Revenue was $827.8 million, significantly higher than the $769.4 million reported in the same period last year, but still short of the $92.6 million expected by analysts. Net income managed to reach $54.5 million, up from $49.1 million in the year-ago period. However, the resulting $0.55 per share was $0.06 less than expected. As the graph above shows, cash flows are quite mixed, with only EBITDA showing year-over-year growth.

Digging deeper, there was both good news and bad news. For example, its backlog has actually declined in recent years. This is not surprising. After all, there is always a delay between placing your order and when your home is finally built. A temporary slump in demand due to continued construction activity is bound to have a negative impact on the backlog of orders. The final result was a decline from 6,381 units in 2021 to 3,978 units last year. The good news, however, is that sales in the first quarter partially recovered to his 4,524 units. This is still lower than his 5,479 cases a year ago, but at least it’s progress. Unfortunately, net new orders declined during this period, dropping from 6,808 units in 2021 to just 5,744 units last year. Another important data point is something called cancellation rate. The company has seen an increase in recent years. In 2021, the company’s cancellation rate was 12.2%. This figure increased by almost double to 21.5% in 2022. But here comes the first really good news. The cancellation rate for 2023 has dropped slightly to 18.3%.

When it comes to investing, it’s essential to look at the bigger picture as well as the finer details. If you look at the cancellation rate from one year to the next, the decline appears to be quite small. But when you break it down quarter-by-quarter, you can see some of the larger trends. As the chart below shows, each quarter of 2023 (except Q1) saw year-over-year improvement compared to 2022. Last year, it reached 22.9% in the final quarter, which is to be expected from a seasonal perspective. And 22.9% was actually a pretty significant improvement over 32.1% a year ago. It stands to reason that if it weren’t for last year’s tough first quarter, the overall cancellation rate for 2023 would have been significantly lower than the previous year. The cancellation rate for the first quarter of this year was slightly lower at 21%, compared to 20.9% in the first quarter of last year. This is a bit concerning, but in itself it’s not a big issue for me.

A similar trend can be seen for net new orders. Even though this metric was lower in 2023 than in his 2022, the results for the second and third quarters of last year showed a significant improvement compared to the same period a year ago. And even in the last quarter of last year, net new orders were about the same as his last quarter of 2022. This weakness usually makes me a little cautious. Because this could be the beginning of a recession. A new trend that is the opposite of what we want. However, we are encouraged by the fact that net new orders increased from 1,448 units in the first quarter of 2023 to 1,724 units in the same period this year.

The company expects 8,250 properties to close throughout 2024. If this happens, it would be about 12.8% higher than the company reported in 2023. Some of this is undoubtedly due to recent strong net new orders.However, in February this year, the company announced Acquisition of Crescent Homes, a home construction company with locations in Charleston and Greenville, South Carolina, and Nashville, Tennessee. The company is acquiring 457 residential lots that it says are in “various stages of construction” in exchange for $185 million. He also has a backlog of 460 homes worth a total of $265 million. In addition to that, he will have an additional 6,200 plots under his control.

At this point, it is too early to predict what 2024 will look like as a whole. We know that if the average price per home built matches last year’s prices, hitting our real estate goals should result in approximately $4.17 billion in sales. But everything beyond that is speculation. Even assuming no further growth occurs and earnings are in line with 2023 results, the stock still looks reasonably priced. In the chart above, you can see how the stock is valued using 2022 and his 2023 data. Also, in the table below, similar he compared with five companies. Dream Finders Homes became his second most expensive company in the group in terms of price-to-earnings ratio, but compared to 4 out of 5 companies in terms of his other two profitability metrics covered It was cheaper than

| company | price/revenue | Price/operating cash flow | EV/EBITDA |

| Dream Finders Homes | 9.9 | 8.4 | 7.2 |

| M/I Holmes (MHO) | 6.9 | 8.3 | 5.3 |

| Green Brick Partners (GRBK) | 9.0 | 12.0 | 7.7 |

| Century Community (CCS) | 8.7 | 74.7 | 8.6 |

| Beazer Homes USA (BZH) | 5.6 | 22.4 | 9.8 |

| Try Point Homes (TPH) | 10.1 | 18.2 | 8.5 |

remove

As it stands, I have to say that I regret not revisiting Dream Finders Homes sooner. The company itself seems to be doing quite well. Obviously, there was easy money to be made at this point. However, I would argue that there are some additional benefits. Although there are still signs of weakness, most evidence suggests the worst is yet to come. Given this, plus how the stock is priced, I believe it makes sense to be bullish.