Catherine Delahaye/Digital Vision, via Getty Images

Figures 1 to 4 (New York Stock Exchange:Figures 1-3) is a healthcare apparel retailer known for its high-quality, trendy scrubs.

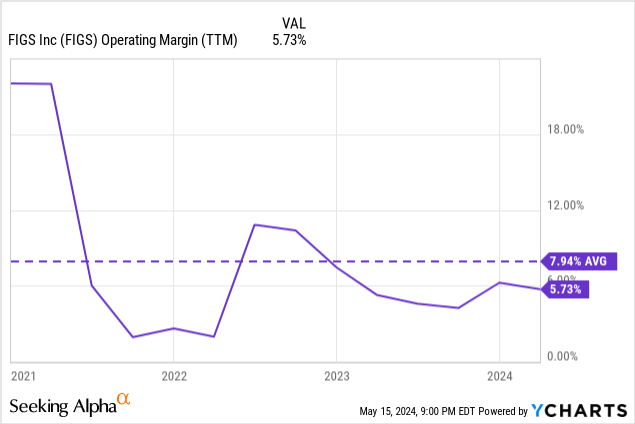

I started researching this company because March 2024 Comes with hold rating. This rating was based on the company’s low operating margins and dilution. Stock-based compensation, slowing growth trends, and increased competition. The company’s adjusted EV was too high compared to operating profit.

In this article, we will review the company. 2024 Q1 Results and financial statement. The results were not unexpected, with flat revenue and lower margins thanks to an investment program the company launched last year. But the stock reacted very favorably, soaring 20% in the days following the earnings release. Given that this rally was not justified by the company’s fundamentals, I think the stock has even less of an opportunity now than it did in March.

Unimpressive results

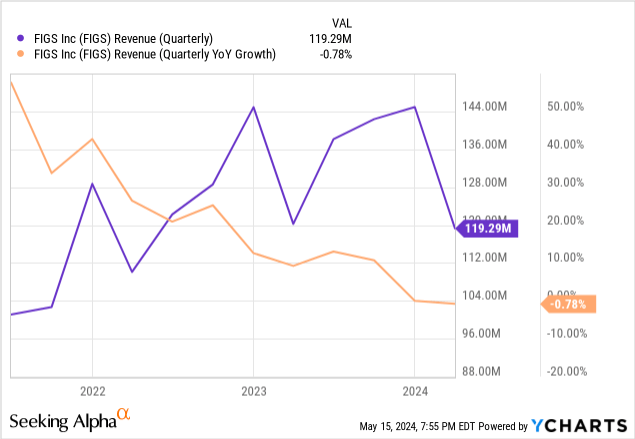

flat revenue:FIG’s sales decreased by 0.8%, resulting in slow or no growth for the second quarter. According to his MD&A for Q1 2024, the company’s customers grew by his 9%, but this was offset by a decline in purchase frequency (given flat AOV).

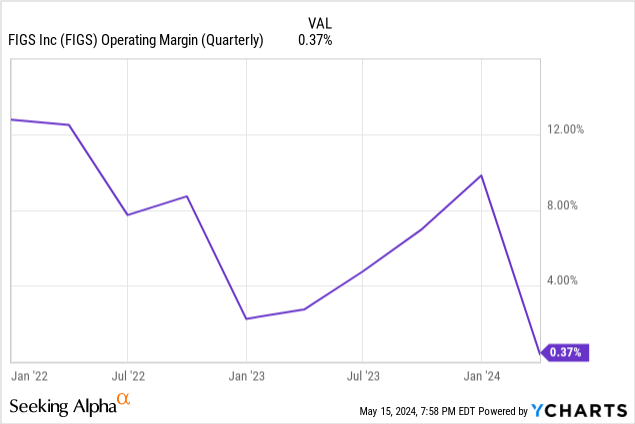

Investment eats up profits:FIGS’ operating margin was low and close to the break-even point for the quarter. A decline in margins is expected given that Q1 is the smallest quarter due to seasonality, but in this case the decline was exacerbated by increased investment.

Figure gross profit decreased due to changes in product and geographic mix. The company is selling more non-scrub products internationally and is focusing on newness in its scrub line. The international division is less than 10% of his revenue and the non-scrubbing division is about 20% of revenue, but the company does not operate at the same scale as its core markets, so profit margins in these categories are lower. In the chart, we expect margins to improve as we scale up over the medium term.

Selling expenses decreased thanks to accounting changes in the treatment of export tariffs, but are expected to increase in the next quarter as the company transitions fulfillment centers.

Finally, although marketing was flat, management commented on its efforts to maintain investment in brand marketing. The company is motion Conversations with wildlife veterinarians recorded in South Africa.We have recently launched another product. motion Before and after Nurses Week, nurses from all over the country gather to ring the New York Stock Exchange bell.

Therefore, most of the cost increases are due to growth investments such as new products, changes to the company’s fulfillment centers, and not marketing cuts.

One exception was general and administrative expenses, which increased 5% year over year. I hate this category of expenses. This is because most of a company’s excess costs are generally in this category. For example, general and administrative expenses include executive compensation (two of FIG’s executives earned $10 million in 2023) and corporate expenses.

“Strong” cash flow for management: The company’s management team spoke multiple times during the conference call about strong and robust cash flow generation. However, management was not completely honest about this. In fact, the company generated his FCF of $12 million in the first quarter of 2017, of which $11.6 million was in stock-based compensation. This is not a robust cash flow generation model. It simply pays its expenses with stock and dilutes shareholders. This reflects a lack of integrity, which is the basis of trust between shareholders and management. In my opinion, very bad.

Reconsidering valuation after increase

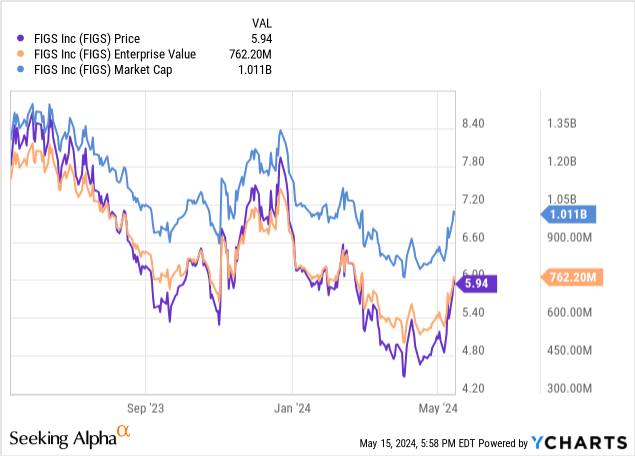

Some market participants may have been satisfied with the company’s results, as FIGS’ stock price rose 20% after the earnings announcement. Perhaps some investors are speculating that the company could return to growth, seeing flat sales as a sign of bottoming out.

The graph below shows that FIG’s EV is $760 million, but I think the company needs to adjust the stocks and options it uses to generate the “strong cash flow” mentioned above. Masu. The numbers below are based on 170 million shares, but the company may issue up to an additional 35 million shares in the form of RSUs and options. Adding this gives the company a market capitalization of $1.22 billion and an EV of $970 million.

What expectations are behind this valuation? For example, for a company to generate a 15x EV/NOPAT multiple ($65 million NOPAT or $92 million in operating income), the company’s operating margin must be 17%, or about the company’s historical average (and 12%). Must be 10 points higher. points above the current level).

Conversely, to get an 8% operating margin at the same EV/NOPAT multiple, FIG’s revenue would need to grow by $1.15 billion, or 110% from current levels.

Therefore, to provide a reasonable (in my opinion, still rising and in no way opportunistic) earnings multiple, the current stock price must have a very optimistic value, such as revenue overlap or historical margin overlap. assumptions need to be incorporated. Even if these amazing feats were to happen, the stock would simply have a reasonable value.

Therefore, we believe that FIGS stock is not an opportunity at this price.

What do you expect from future earnings?

We believe that two topics are essential for future FIG.

The first is international sales. Given the success of the product in the US, I believe this is one of the company’s major opportunities. I suspect that customer awareness of FIGS in the United States is already very high among doctors, nurses, dentists, etc. This leads me to believe that the company has probably already captured most of the market opportunity in the US. People who don’t buy FIG today probably have a reason for doing so (like the high price), rather than simply not knowing about the company. However, in Europe, Canada, Asia, and Australia, there are many potential customers who are professionals who have never tried FIG’s superior products.

The second is competition in the United States. In my introductory article, I mentioned several DTC brands operating in the field of high-quality scrubs. Given FIG’s extremely high gross margin of over 60%, these companies have plenty of room to undercut FIG in price. Signs of increased competition include increased promotional activity in the United States and a significant hit to gross margins that cannot be explained by changes in product mix.