Richard Drury

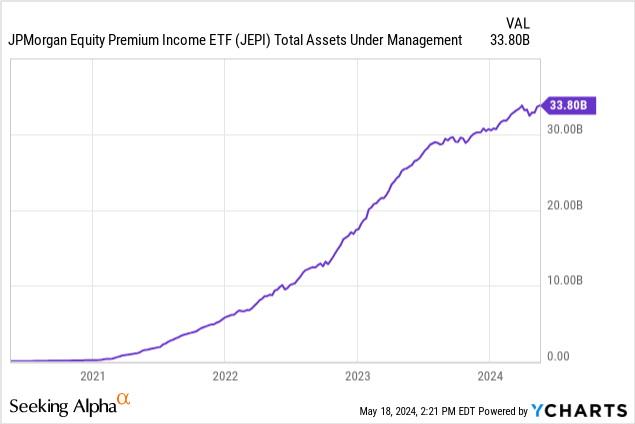

JP Morgan Equity Premium Income ETF (Knee search:Jepi) has grown rapidly since its inception primarily due to its value proposition to investors: offering attractive monthly distributions backed by broad diversification similar to S&P. 500 (spy).

In particular, it has nearly 20% exposure to technology stocks, including major “Magnificent Seven” companies such as Microsoft, Amazon.com, Meta Platforms, and Alphabet. However, there are several reasons why JEPI may not be an ideal investment proposition for long-term oriented income investors. In this article, I’ll explain in detail why, share the only reason I buy it, and also talk about the funds I pair with JEPI to maximize its strengths while offsetting many of its weaknesses. I will also explain.

Why not invest in JEPI ETF?

One The reason I don’t particularly like JEPI as an ETF for income investors is its expense ratio of 0.35%, which is similar to the Schwab U.S. Dividend Stock ETF (SCHD), Vanguard Dividend Appreciation Index Fund ETF (V.I.G.), and Vanguard High Dividend Yield Index Fund ETF (VYM), all fees are only 0.06%. Even the iShares Core Dividend Growth ETF (DGRO) has an expense ratio of only 0.08%. As a result, investors who choose JEPI are paying 4x to 6x more in fees each year by employing this strategy.

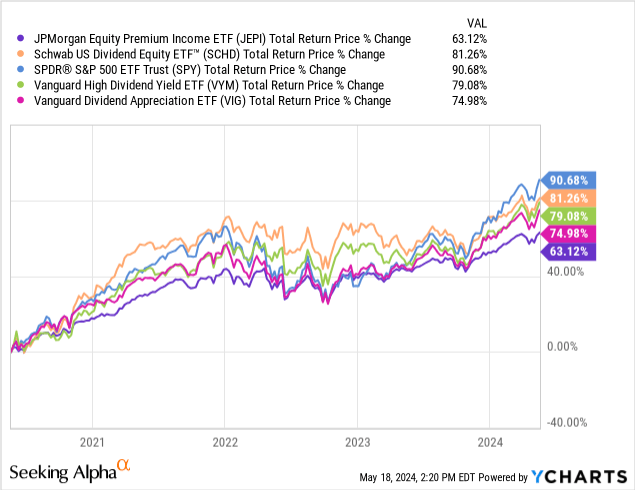

Another reason I don’t particularly like JEPI as a dividend ETF is that even though its portfolio structure somewhat mimics the S&P 500, its total return performance hasn’t been all that impressive. As the chart below shows, it has significantly underperformed the S&P 500 since its inception, as well as other dividend-focused ETFs. As a result, investors in JEPI may fall behind over time, especially during a bull market.

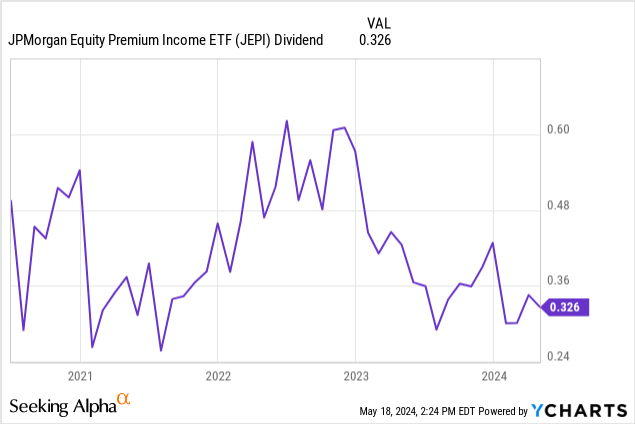

Another reason I don’t really like JEPI is that its distributions are funded by what is effectively a covered call strategy. Considering that the premium offered on option sales tends to fluctuate over time as volatility spikes and declines, JEPI’s monthly payouts are very insignificant, as the graph below shows. It’s stable.

Therefore, investors planning to live off JEPI’s dividends should take this into account and have a large margin of safety when planning their dividend payments relative to their cost of living. As a result, his 7.3% dividend yield after 12 months looks attractive, but to account for this uncertainty and implied volatility, it is important to consider 5%, or at most You should only expect a yield of 6%.

Another related reason why JEPI is relatively unattractive as a long-term income investment is the fund’s lack of measurable dividend growth. Therefore, as inflation erodes the dollar’s purchasing power, investors in JEPI’s purchasing power will also lose interest over time unless they reinvest the retained cash flow from these distributions to increase the number of shares outstanding to offset inflation. It is likely to decrease with the This further erodes the expected return from the fund over time.

How and why to invest in JEPI ETF

That being said, JEPI may still have a place in an income investor’s portfolio simply because it offers a diversified high yield from an equity portfolio that includes a significant percentage of giant technology stocks. This gives it some value as a component of a diversified portfolio, as it offers a unique value proposition that is not available in many other funds. In particular, JEPI could be worth owning when combined with a fund like SCHD, as they complement each other very well. SCHD offsets JEPI’s higher expense ratio with an expense ratio of just 0.06%, so in total, the total expense ratio is significantly lower than JEPI.

Additionally, SCHD’s total return performance has been very strong, with it only marginally underperforming the S&P 500 over the long term despite its very low exposure to technology, and technology has outperformed the S&P in recent years. It is the main driving force behind outstanding performance. Therefore, this improves overall performance compared to JEPI standalone. Furthermore, SCHD has a very impressive dividend growth track record, with its dividend growing at 10.87% CAGR over the past 10 years, 11.8% CAGR over the past 5 years, and 8.56% CAGR over the past 3 years. As a result, when combined with JEPI, the entire portfolio has the potential to generate above-inflation dividend growth over the long term.

As a final aside, JEPI has much lower exposure to financials, consumer defensive stocks, energy stocks, and consumer cyclical stocks than SCHD, while its exposure to technology is much greater than SCHD. A more balanced and well-diversified portfolio will also be constructed. S.H.D. Combining these two funds is not very expensive from a management fee perspective, JEPI’s call option strategy provides a partial hedge against economic downturns, and SCHD’s uncapped upside allows the combined portfolio to Attend more meetings. SCHD’s consistent dividend growth helps provide an income stream that increases over time, at least in line with inflation. Meanwhile, JEPI’s attractive monthly dividends provide a stable and lucrative source of income. His 12-month dividend yield for SCHD is 3.34%, and the combined dividend yield for the entire portfolio is still at a high enough level to likely cover a retiree’s current living expenses.

Key points for investors

As this article points out, JEPI has a number of flaws that prevent it from being an ideal sole or even majority ownership in a portfolio. But when combined with a low-cost, well-diversified dividend growth ETF like SCHD, it’s a valuable component of an overall attractive dividend snowball that combines attractive current yields with long-term dividend growth. There is a possibility that This combined approach is well diversified across sectors and includes sufficient exposure to mega-cap technology stocks along with other sectors that may perform better in different macroeconomic conditions. We don’t invest in ETFs, but for investors who want to take a more passive approach, picking individual stocks can generate long-term alpha yields like JEPI and dividend growth like SCHD. Because we believe that there will be better opportunities for You don’t have to actively manage your portfolio, you can own a small number of his ETFs, and still earn enough current income to meet inflation or outpace dividend growth over the long term. This isn’t a bad approach.